While progress is ultimately measured in both steps backwards as well as forward, those living in the day-to-day of crypto have an acute understanding of the pains of each step back. In the Web3, gaming is a microcosm of the broader markets and the embodiment of three steps forward, two steps back. While pundits nearly unanimously agree that blockchain built games will rule the roost in due course, getting there will not be without its growing pains.

There are complex difficulties in creating a sustainable token economy for a game. The current cris de coeur amongst experts is to shout the rather self-evident, “a game must be playable.” True, but there is much more to it.

We all know:

- Attracting users through inflation is unsustainable.

- Rewards easily earned are easily spent.

Typically, tokens can be earned through play, staking and LP’ing.

From first principles we can understand — a game is an attention economy. This is why the narrative “games need to be playable” is an important one. Should a DeFi protocol masquerade as a game, the attention required to drive sustainable ongoing growth is not there. Instead, participants merely work on “gaming” the protocol, rather than have the protocol serve the gaming experience.

Earning

The stain of an earning game that no longer has sustainable economic activity does not come out in the wash. Whilst Web3 games can be dynamic and create opportunities for a higher percentage of players to earn income—thanks to decentralized value distribution models—without ongoing revenue this model will fall flat. Dota2 famously generates more than 200M USD annually and puts about 40M of that revenue into tournaments. Were a Web3 game to attain similar success, by all accounts the tokenomics should be much more inclusive. This would equate to a much larger percentage of value being distributed via rewards, tournaments, tokenized incentives and the litany of possibilities that simply do not exist in Web2. However, the key differentiator here is that players return to Dota2 over the course of weeks, months and years. Utility (or attention) drives value, hence value needs to be driven into utility. Passive staking for example is not complementary to play and must be reconsidered. Game loops must be thought of as value loops, driven by the attention and enjoyment of the player.

A Word on Staking

Locking tokens to receive emissions is mildly worthwhile as it incentivizes vesting as a project matures but — it is not the utility of a token. Users receive more of a risky asset and can now mitigate some of the risk by selling it. This is a simple equation that often undermines inchoate game ecosystems.

Liquidity

Incentivizing liquidity is of value but should not be too heavily front-loaded or bloated, otherwise, users will depart when they see their outsized APYs dwindle. Teams should be willing to provide more liquidity than they often do for myriad reasons. Should a team not feel like their listing price is a worthy buy, why should anyone else?

Proper liquidity forces teams to reevaluate their diluted market cap as reliance on people showing up to provide liquidity for them in uncertain markets is a perilous prospect. Even in better conditions, the same scenario has played out ad nauseum — highly valuated, well capitalized projects experience a dramatic drop in volume, making it near impossible to enter or exit a position without massive slippage. While all markets have suffered greatly, these projects are going to have difficulty re-emerging as unlocks continue and every bounce gets sold. Teams that experience this become gun-shy and attempt to save every last dollar rather than defend their own token. The psychological impact is awful on early stage projects while private investors sit on the sidelines, saying nothing and waiting to sell. Early on, it is essential that a team understands their fragility as a new entrant into a highly volatile trading environment and must learn to balance their funding needs and liquidity.

Diluted Valuations

Battle For Giostone has a considerably lower diluted cap than most projects coming to market. And, as anyone can see, their distribution is a little different than what has become a standard but hugely flawed practice. Participants became worried that investors could own too much of a given supply and teams responded by raising their valuations in order to sell less tokens. This hugely limits upside potential and makes it extraordinarily expensive to provide liquidity, especially following unlocks. BFG as a project wishes for broad distribution of their token across their user base while conversely, keeping their cap table incredibly small. They have been remarkably efficient and believe that a lower starting point in terms of diluted value supports not only their prospective public but the future of the game economy itself.

This is inherent to preparing a worthwhile token economy — one in which the game tokens are prepared to grow in step with the growth of the game, not one where a newly released ecosystem sags under the weight of initial overvaluation.

In-Game Economy

The Battle For Giostone economy is a rethinking and gamification of the typical play-to-earn model. Sustainability should come from activity within the network and not be a slave to time-based emissions or investor demands. The borderline delusional hope that value can be shared and sustained through gratuitous emissions, without real underlying attention and activity will hopefully constitute a misguided footnote in Web3 gaming history. DeFi apps, which deployed similarly disastrous strategies, have woken up from the slumber of three-digit APYs to a rather stark reality. In recent months, the term “real yield” has become popularized. This simply means that APY is created by revenues derived from a given protocol. Gaming can be approached similarly even though the value of play is not something that can be perfectly quantified.

The dynamism of a token within a game is essential. While there is no game without capital contributions, players everywhere see these parties as prospective enemies. This largely adversarial relationship is problematic and was previously mitigated by very large community funds where players received free tokens, causing massive sell-offs. An improved appearance created a worse reality whereby the “cure” was worse than the “disease.” Tokens and their economy must be designed to serve both of these parties — the holder and the player — at the same time.

To better align incentives, the BFG economy has been designed to respect all types of token holders by introducing a looped economic system. After all, those who earn tokens bring activity and revenue to buyers while token holders can bring revenue to gamers, within the constructs of a mutually beneficial architecture.

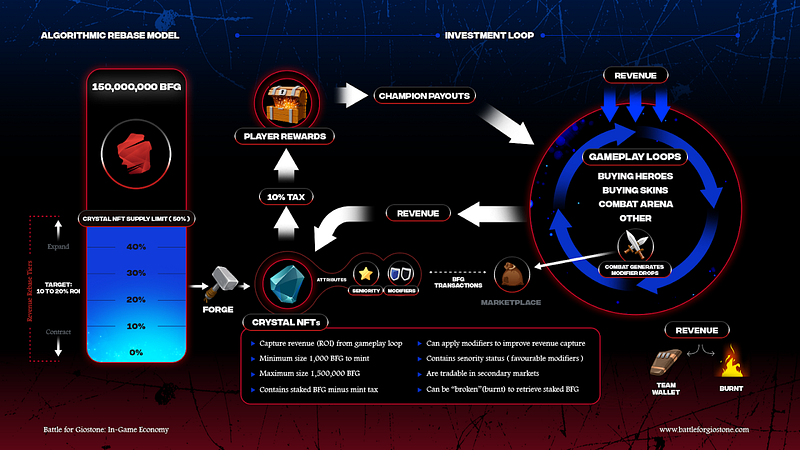

A schematic of the BFG in-game economy (some of these values may change)

The diagram above illustrates how a shared value economy can function within both a gameplay and holder loop.

For example:

- A capital contributor who supports the project will hope to earn additional tokens by staking their tokens.

- In order to do this, they must forge an NFT which will be taxed.

- In the diagram, the tax is 10% (as an example).

- This tax is then deposited into a player reward fund.

This is the beginning of a symbiotic relationship — holders are likely to lock up their tokens when they see future growth potential in the ecosystem while future growth potential must come in the form of new players.

- Network generated revenues offer BFG rewards to the NFT stakers.

A Tradable Asset

An overlooked element in all of this is the listed token which can live in a world that is separated from the game itself. Since the BFG token utilities is an acting currency among other utility, all game associated revenues will be converted to BFG. This allows for some token velocity and creates a direct relationship between APY, token price and emissions.

- When the APY is lower, the token price will respond in kind thus:

- Stabilizing the amount of BFG tokens to be distributed as revenue.

- When rewards increase, APY increases as will the token price, thus:

- Stabilizing the amount of BFG tokens to be distributed as revenue.

- Any inefficiency or lag creates opportunity for those who follow the game’s economy.

There are additional safeguards in place that further capitalize on the price to earning ratio:

- Not all locked BFG will have earning power — it will be capped by a percentage of the supply to incentivize early participants to gain earning seniority.

Naturally, economic activity will ebb and flow but the APY will be adjusted at the both high and low end to best support a burgeoning economy:

- Effectively rebasing to a lower APY when activity spikes around very bullish price activity balances value between the token and its return.

- Conversely, boosting APY during a lagging or developmentally intensive period will also impact price.

- The overall effect is stability both in BFG earning power as well as potential token price.

The ultimate aim is to create a popular game that has a sustainable economy with robust token utility. This requires thought surrounding the speculative nature of crypto in general as well as the seasonal aspects of gaming. Three digit APYs do not support the long-term growth and reward a minimum number of early entrants. APYs that offer very little do not attract users. Using a rebase function to create ceilings and floors provides economic sustainability. This is also the reason that not all BFG will have earning power from day one. The reasons are as follows:

- A new game needs time to grow and creating seniority incentivizes early adopters to forge NFTs (lock BFG) in anticipation of network activity.

- Increased economic activity will create more earning NFTs but — it must be sustainable.

- A user can lock in their earning power by being early to forge an NFT.

Modifiers

In order to create a sympathetic relationship between active players and token holders there must be a point of convergence. When there is zero overlap between these two parties, dissent can occur as gamers tend to see capital contributors as a necessary evil at best. The reality is far different but in gaming economies, there is something of a Chinese Wall between token holders and players. One never seems clear what the other incentives are and on occasion, they function independently of each other. There are examples of games with poor token utility with limited activity and vibrant gaming communities. This is a massive lost opportunity for genuine synergy as a vibrant Web3 game needs players and speculators alike.

To combat this, Battle For Giostone has introduced artifacts generated from in-game activity that are of benefit to token-holders, called modifiers.

- Modifiers are NFTs that boost earning power for a finite period of time.

- Modifiers can only be earned through gameplay via random or skill-based drops.

- Token holders purchase these from players on the BFG marketplace.

- Modifiers can have varied utility but can only be used with forged NFTs that have earning power.

Mutual support between gamers and passive token holders is an ideal for Battle For Giostone. This is achieved through the dispensation of earning modifiers that are dropped to gamers as a result of general gameplay activity. The range of modifier functions will be broad, not limited to but including — improved APY characteristics for the modifier holder, upgraded seniority position in the locking queue, time-based upgrades that provide powerful results for a limited period, and rare modifiers that will only ever exist on a very limited basis.

Recap

The BFG token economy is a significant departure from what has become a flawed standard play-to-earn economy. In fact, there are numerous differentiators across gaming economies on the whole that represent an important step forward.

Some key features of the BFG economic cycle:

- NFTs must be forged by BFG holders and staked in order to participate in the rewards schema.

- Saleable items, of value to holders, are generated through economic activity within the game.

- Forging NFTs exercises a tax, generating rewards for the players.

- Yield is non-inflationary and tied to actual in-game popularity.

- Player Rewards tend to be earned by highly skilled players.

Within this gameplay loop, there is a token flow to players that is bolstered by modifier drops (which boost the earning power of BFG locked NFTs), to be sold in the secondary marketplace. BFG producing NFTs are seniority based so longer-term users are always first to earn. Depending on the flow of rewards coming into the system, an NFTs earning power will vary.

As it stands, there is a second tokenized asset, GIOS, which lives off-chain where players can only earn GIOS through gameplay and which will not be tradable on exchanges. It acts as an in-game credit and its primary purpose is to forge new Heroes. While there may be a modest conversion rate to BFG, the rate will be purposefully high to stimulate players to forge new heroes.

The game itself will evolve rapidly as assets are created and seasonal play begins. There will be clear epochs that will stimulate economic activity and create favorable circumstances for entry. New entrants into the game will not feel behind in any capacity and the entree itself can be sped up through skilled play or subsidized by economic activity.

Conclusion

The BFG economy is designed for any and everyone to enjoy, however, participation trophies won’t come with monetary rewards. The promise of Web3 gaming and broader distribution of value is that more players are able to economically benefit from playing a game but more does not mean all. It is unrealistic to expect things to be any different and the performance of early play-to-earn models are proving this point in a painful way. Nonetheless, they are not to be maligned as progress is always marked by those who came first and dared to experiment.

Battle For Giostone has set out to improve upon the great experiments that have come before them, focusing on creating an economic loop that seeks to unite the passive and the active, the player and the invested holder if you will. It is not a DeFi protocol dressed up as a game. It is a well-balanced game, a long time in the making, where yield is non-inflationary and rewards benefit all parties. Economic activity and play are the drivers of this economy, not inflation and bloated APYs. Investors are incentivized to forge NFTs that add to the player reward fund, and invest in boosting modifiers via the secondary marketplace to improve their yields. The ultimate motivation behind this design is to enhance the existing gameplay experience for players into something that is uniquely Web3 oriented, financially rewarding, whilst at the same time provides for the familiar sense of enjoyment found in traditional gameplay experiences.