-

Fief Guild x Avalaunch: IDO Announcement

The rise of the guild is something that few saw coming. As “play to earn” evolved with “gamefi” and attendant innovations, we have quickly arrived at both milestones and inflection points.

At the highest level, the metaverse has begun to rethink the concept of work. There is widespread news on players of popular games supporting themselves through the pandemic via gameplay and more recently, social media has seen boasts of select players quitting their “normal” jobs. Additionally, the space, though rife with competition, has yielded somewhat to cooperation as roles in a larger economy have defined themselves and paid dividends.

Guilds have captured much attention through their collective earning power by aggregating and inserting the skills and specialties of individuals into decentralized autonomous organizations, bound through the singular purpose of optimizing earning power. With this have come anticipated challenges — who determines strategy? Is it a passive land grab group that is intent to sit on given assets or trading an NFT market, a hybrid of both, a static strategy or one that evolves — and on it goes. These growing pains are the signals of success though and not surprisingly, managing the humans has become the weak link in the chain.

To address these pain points, comes an ever evolving guild; one with its finger on the pulse of GameFi and wholly aware that the metaverse will not be about chain dominance but connectivity and interoperability. It is mobile, market savvy, having assembled some of the brightest minds in the space that are here to empower but here to empower through their human resources and tools…and Avalaunch is proud to announce them as our next IDO — Fief Guild.

Project Overview

Avalaunch has partnered with Fief Guild, to introduce the first Resource token for the guild’s upcoming economic strategy game: Blood and Coin.

Fief is the first economic guild of the metaverse with the primary objective to build decentralized protocols and game systems that plug into popular metaverse projects.

To kickstart Fief, the guild is creating its first game title: Fief: Blood and Coin, an economic strategy game that bridges on- and off-chain mechanics to deliver a highly rewarding user experience, built on top of the Fief protocols. In time, Fief will expand the utility of these protocols to plug directly into third-party project economies.

The Avalaunch IDO will signify the initial release of Fief Wood (WOOD), the first of five core resources that underpin Blood and Coin’s economic gameplay. Fief Wood will be heavily used in the crafting Game Action, allowing Guild Members to create a variety of functional Fief Item NFTs.

Fief Resources

Fief Resources are fungible tokens that facilitate the Game Actions performed across each Faction-based protocol in Blood and Coin.

Core Resources, such as Fief Wood, are acquired through Resource Gathering via the Farmer Faction. Fief Guild will also distribute these tokens via special drops to IGM holders and through special events, such as the Avalaunch sale or quests. Core Resources can then be used to do the following:

- Craft Earthy Items via the Craftsman Faction.

- Conjure Mystic Items via the Alchemist Faction.

- Add liquidity to the Fief Exchange or trade via the Bishop Faction.

Item Crafting/Conjuring will often require Guild Members to combine multiple Resources to create their desired output. The full list of Core Resources will be unveiled over the coming weeks, with planned distributions for IGM holders and more.

Fief Wood Economics

The Avalaunch sale represents the initial minting event for Fief Wood, affording Avalaunch participants the opportunity to be among the first holders of the unique Resource token.

Fief Wood, similar to the other core Resource tokens, is primarily produced via the Farmer Faction’s Resource Gathering system. This system, which leverages off-chain staking mechanisms, is ad hoc, meaning new supply is minted whenever a Guild Member Gathers Fief Wood instead of more traditional per-block mechanisms found in the industry.

As with all Fief Resource tokens, Fief Wood is totally consumed upon use in Crafting and related Game Actions. This provides a total sink for the token, which will also be freely traded on decentralized exchanges and eventually the Fief Resource Exchange (owned by the Bishops).

Following this initial minting event, Gathering Fief Wood will require staking with the Farmer Faction. This process will require specific Wood Gathering Items and the Fief Token (FIEF) to complete. With Gathering, the required FIEF will be consumed as a fee reward for the Faction and broader Guild.

To make up for the lost fee share from Avalaunch release, 10% of the proceeds from the launch (up to $150,000) will be used to re-purchase FIEF off the open market for future reward to the Farmer Faction in return for this initial demand for Fief Wood.

Fief Wood Utility

Prior to the commencement of the first season of Blood and Coin, which will pit all five Fief Factions against one another as they strive for economic dominance, Guild Members will be able to leverage Fief Wood to craft a variety of Items they can equip to advance within the City of Vitruvia.

The initial items available for Crafting will be:

- Common Wooden Axe — Wood Gathering (Farmer); Crafting Cost: 3000 WOOD

- Common Wooden Mallet — Wood Item Crafting (Craftsman); Crafting Cost: 3000 WOOD

- Common Wooden Cart — Wood Vesting (Farmer); Crafting Cost: 9000 WOOD

- Common Wooden Work Bench — Wood Item Vesting (Craftsman); Crafting Cost: 9000 WOOD

- Gathering Items determine how much of a Resource a Guild Member can harvest in a single Game Action.

- Crafting Items determine what rating of Item a Guild Member can build in a single Game Action.

- Vesting Items determine the cool down speed to claim and mint the output Resource/Item to the Avalanche network.

Therefore, these four items (in addition to others introduced shortly thereafter), will serve as the first steps towards the initial Faction-based economic systems — adding additional exclusivity to the Avalaunch release. Note, each of these items can be equipped by all Guild members, regardless of which Faction they join.

As an additional perk to initial WOOD holders, there will be no requirement to hold a Crafting Item to build the first 4 Wooden Items.

One Tree Planted

Fief Guild has partnered with One Tree Planted, a 501(c)(3) charity with a mission to help global reforestation efforts, to denote a portion of the Fief Wood sale proceeds to support the environment.

For each wallet that purchases WOOD in the Avalaunch sale, Fief will donate to have a tree planted via One Tree Planted’s reforestation program. You read that right…purchase digital WOOD and plant IRL trees.

Partners & Backers

Links & Team:

Website | Twitter | Medium | Discord |Docs

Galahad — Decade of software engineering leadership, focused on financial markets and crypto. Veteran of several startups and household name Big Tech goliaths. Currently leading operations and overseeing protocol development at Fief.

0xLongshanks — Decade of experience in early stage venture creation and investments. Held roles within NFT industry since early 2018 as both an operator and investor across multiple entities, primarily within the Ethereum ecosystem. Currently leading Guild and Game development at Fief.

Leo — Spent a decade in traditional software before moving into DeFi projects. Worked on multiple Avalanche projects throughout 2021, most notably as the COO of Pangolin Exchange. Currently focused on growing the GameFi and Metaverse ecosystem.

Coop — Over a decade in digital marketing, and an e-commerce entrepreneur. Started crypto in 2017, joined Pangolin on Avalanche in 2021.

Marvin — Self taught illustrator. Worked in communication and marketing until 2021. Started crypto journey in the Avalanche ecosystem. Learning everyday from the greatests minds out there (and from Twitter threads). Passionate about cinema.

Development — currently there are more than a dozen engineers dedicated to the project.

“It has been fantastic to work with Avalaunch on such a unique token launch,” said 0xLongshanks, Fief co-founder and Fief: Blood and Coin co-creator. “Their expertise and industry-leading platform has helped pave a new and exciting path for users to join our budding game economy.”

Closing Thoughts

We believe the future of GameFi resides in the power of cooperation more than competition. The ability for groups to convene and combine resources in order to extract, create and realize value is potent and the rise of the Guild is validating this premise. Fief is an organic project with an ever growing community, founded by savvy gaming and crypto veterans. Their Discord is chockful of human resources and their tool based approach is empowering to individuals and removes much of the difficulty in managing a large group of individuals who may have conflicting ideologies.

The Fief Wood IDO On Avalaunch

The Avalaunch sale represents the initial minting event for Fief Wood, affording Avalaunch participants the opportunity to be the first holders of the unique resource token. This is an exclusive offer to the Avalaunch community with 100% of the circulating supply (excluding liquidity) will be purchased and owned by the Avalaunch community.

- Initial Price — $0.01

- Initial Supply — 155,000,000

- IDO: 150M WOOD

- Sale Size: 1.5M USD

- Total Supply — Uncapped; minted ad hoc through Resource Gathering

- Initial Liquidity — 5,000,000 (added to WOOD-AVAX Trader Joe pool upon launch)

A pool will be opened on Trader Joe where trading will commence for the 45 days leading up to the crafting events. This is intended for all users to be able to craft items in Blood and Coin. To that end, participants in the IDO will also receive a FIEF airdrop in order to be able to craft an item. The process will be as follows:

Process

- User purchases Fief Wood (WOOD) allocation through Avalaunch and receive a complimentary drop of FIEF token upon completion of the sale.

- Fief Wood can be held by the user for 45 days prior to the launch of the Fief Crafting system where the user can spend their WOOD (and dropped FIEF) to craft 1 of 4 initial items:

- Common Wooden Axe — Wood Gathering (Farmer)

— Crafting Cost: 3000 WOOD - Common Wooden Mallet — Wood Item Crafting (Craftsman);

— Crafting Cost: 3000 WOOD - Common Wooden Cart — Wood Vesting (Farmer);

— Crafting Cost: 9000 WOOD - Common Wooden Work Bench — Wood Item Vesting (Craftsman)

— Crafting Cost: 9000 WOOD - The amount of FIEF dropped to each user will allow them to craft an item in 7 days. Users can purchase more FIEF off the open market to craft an item faster (up to 1 day).

- Users will not need a crafting item (Mallet) or vesting item (Bench) to complete the first crafting action — This is a perk to early wood holders.

- Users will be able to trade WOOD any time for AVAX via a dedicated pool on Trader Joe. Pool will be started at an $0.01/WOOD ratio.

- 10% of the proceeds from the launch will be used to re-purchase FIEF off the open market for future reward to the Farmer Faction in return for this initial demand for Fief Wood.

Registration Schedule:

Registration Opens: March 10th at 3:00 p.m. (UTC)

Registration Closes: March 12th at 6:00 a.m. (UTC)Sale Schedule:

Validator Round Begins: March 14th at 6:00 a.m. (UTC)

Validator Round Closes: March 14th at 3:00 p.m. (UTC)

Staking Round Begins: March 14th at 3:30 p.m. (UTC)

Staking Round Closes: March 15th at 6:00 a.m. (UTC)

IDO Recap:

Total WOOD for sale: 150M

Fief Airdrop: Per participant

Price: $.01

Size: 1,500,000 USD

Vesting — 100% unlocked

-

Degis AMA #2 — Technical Deep Dive with Eric (CTO) , Serlin (Chief Data Scientist) & Theo (Core…

On 3/4/2022 at 4:30 p.m. (PST), an AMA session was held on Avalaunch with special guests Eric, Serlin and Theo — Degis’ Chief Technology Officer, Chief Data Scientist and Core Smart Contract Developer, respectively. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

The first AMA with the Degis Project was so enlightening and inspired, we had to do it again. In keeping with “one good turn deserves another,” let us commence with part II, the sequel AMA with a focus on tech. Today, we are joined by @liyang_ust , the CTO from Degis and an ICPC gold medalist who is humbly known as THEO . Lastly, there is a surprise guest in Serllin and he will contribute where he sees fit. So let us dispense with the pleasantries and get into it with our all star cast. Thank you all for being here.

Can you please introduce yourselves: who you are and how did you get into your current positions?

Eric Lee| Degis

Hello everyone. Nice to be here! I am Eric, CTO from Degis.

I have 3 years of development experience in blockchain and previously a C++ developer.

I am in charge of product logic implementation and smart contact development.

I have been participating in Degis since its early time last year. Together with other founders and core members, we decided to start this project. At that time, I got to be in charge of technical part because of my developer experience.

THEO DING| Degis

Hi guys, I’m Theo, I used to be a computer vision algorithm researcher and now a core smart contract developer at DEGIS.

I got the ICPC Gold Medal in college and I have 5 years of work experience. I joined Degis last year through the recommendation of professor Chen.

Serllin| Degis

Hi guys, this is Serllin from Degis team, and I am in charge of data analysis & monitor behind protection products, also assist in front & back-end development.

I used to work in quantitative companies, doing long-short trading strategies in futures & options market, and we also traded crypto assets, just from that time, I started to know DeFi, it has been three years.

I am also one of the first members in Degis, and I was responsible for data analysis, back-end monitoring and docking from the very beginning.

Dave Donnenfeld | Avalaunch

Appreciate your respective backgrounds. It is quite an impressive team to be sure. Please describe for us the high-level organization of your team? How many are there in total, what their expertise lies in, and how does this orchestration work to hit all of the specific areas required for running the protection/insurance model that Degis proposes?

Eric Lee| Degis

We have 12 people in total and three main departments: development, marketing and product & operation.

Our development department consists of smart contract developers and web developers, focusing on smart contracts and the web interface.

Community management and business promotion are done by the marketing team.

The product&operation team is for designing products, tokenomics, and daily operations.We are closely working together to build our products!

Dave Donnenfeld | Avalaunch

Good deal. How many in-house developers are currently working on Degis, and are there any future plans for extending the team?

Eric Lee| Degis

Currently we have 4 developers in our team mainly for smart contract, web interface and data processing.

Definitely, we are trying to expand our development team. We welcome those developers with passion, talent and experience. If you are interested in joining us, feel free to contact us.

Dave Donnenfeld | Avalaunch

How long has the beta product been in development for? What were the most challenging aspects throughout the building phase, and how have these roadblocks been overcome?

Eric Lee| Degis

Actually, this version has been in development for over 6 months.

Our model for building protections is very different so we spent a lot of time designing the implementation logic.

Especially for flight delay protection: a product connecting real world event with on-chain protection.

Also, we spent much time implementing our lucky box & purchase incentive system to share the income with holders in a more interesting way.

Our products highly rely on the data from oracles so we had many communications with different oracles and build our own oracle node. Hopefully we overcome these difficulties and get the product now.

Dave Donnenfeld | Avalaunch

This has been a long time coming. In crypto, people tend not to bother gauging the maturity of a project and what has gone on behind the scenes. Even the difference between one working product vs. the next and how intensive it may or may not be. We’ve known you for many months now and the amount of progress you’ve made has been impressive.

As I understand, the testnet released earlier this month is a full simulation of the mainnet. What can you tell us about the testnet progress so far? Are there any outstanding figures you’d like to discuss i.e. the number of participants etc?

THEO DING| Degis

Degis successfully held the second phase of the testnet event last month, around 200,000 unique addresses participated in the test. Over 50,000 addresses hold DEG in the test.

We have received a lot of praise and suggestions from our participants.

Dave Donnenfeld | Avalaunch

Super impressive numbers for a testnet and 50,000 addresses is amazing.

The way in which Degis brings this new protocol infrastructure is via smart contract insurance and an alliance with several security providers. Who are these providers, and how will the structure from a technical perspective look like when translating it into a user-friendly environment?

THEO DING| Degis

Our smart contract insurance will not be built on a mutual with many users but come from several security providers and project teams.

We think that when a new project goes online, the team is responsible for the security protection for their users (if they are not planning for a rug&pull).

We will build an alliance that consists of several projects and security audit companies. Every new member who wants to join need to stake part of their native tokens. The joining needs approval from most of the previous members of this alliance together with an audit certification.

Once some security issues happen, the payoff will have 1) the project tokens 2) other project tokens in the alliance 3) DEG tokens. Of course, most of the payoff will be in the first form.

We want to move the security responsibility from users to projects and make it a new standard for users to choose good projects.

Dave Donnenfeld | Avalaunch

Thanks for that Theo and it’s great you’re building a consortium/alliance of security partners.

From the protocol protection standpoint, Degis goes beyond the typical token protection and introduces the model for NFTs. Can you tell us why you devised the NFT model and how do you see this play out in the long-term, what benefits might this present now and in the future?

THEO DING| Degis

NFTs behave like a unique certification and is very useful for representing a “right” for someone. So it is natural to bring NFT into this protection area because every policy you have bought is a “right” of you.

Currently NFT has few standards and is used for many different types of protocols. So in a long term, we want to expand the NFT usage in protection area and make a new standard/template. A special NFT standard would help more future projects to easily integrate with protection projects like us.

Dave Donnenfeld | Avalaunch

Are there plans for extending the full version of Degis into a mobile application, if so when would this be expected?

THEO DING| Degis

Yes, we know that more people are using mobile devices now and it definitely is on our to-do list.

Actually, Degis’s current website is mobile compatible, so users can operate on their mobile phones.Meanwhile, our priority is to make sure that Degis can run smoothly for some time and then make all of our designed products online. So it may need more time before you see a mobile app.

Finally, no matter you are using a browser from a desktop or mobile phone, keep your wallet safe!

Dave Donnenfeld | Avalaunch

Thanks again Theo. So Degis decided to take on the notion of user participation through liquidity incentives, purchase incentives and governance. Can you tell us how the interplay between these different areas are designed to keep the users at the core of the protocol, and what implications this may hold for future expansion?

Serllin| Degis

thanks for the question, as one next-generation all-in-all protection platform, we have adopted unique & novel ways to engage users.

As you can see, they can not only be rewarded for providing liquidity, but also for buying policies, to enjoy the various benefits offered by Degis. Our basic idea is that, to give every user a sense of engagement, ownership and belonging.

For the future, we would like to extend this design, through diversified measures, like, treasure box, to enrich our platform, so that users would like to play, and to stay here with Degis together.

Dave Donnenfeld | Avalaunch

What technical challenges do you see for the future expansion of the protocol into the different blockchains?

Serllin| Degis

Currently, most of public chains are designed on EVM, which means we don’t need to do too many code adjustments or changes upon our current work.

But indeed, there are few technical problems to face, for example, the claim for protection results needs to be built on the oracle service, and some public chains have not built strong oracle ecosystem.

Then, we need to implement that ourselves, like build it within Degis. This is one problem that we have to face and solve when doing the cross-chain.

Dave Donnenfeld | Avalaunch

What can you tell us about the upcoming milestones, and are there any major partnerships or announcements that the team is looking to onboard or add to the future plans of Degis?

Serllin| Degis

As we posted in the roadmap, after “Naughty Price” which has been designed already, we are now focusing on impermanent loss protection, which will be live in Q2 this year.

Also we will have smart contract protection and an all-in-one meta market this year, for meta market, it means we are going to aggregate all protection services from all chains.

And we have already reached an agreement for this with several protocols, like solace, Etherisc, we are strategic partnerships now and are aiming this goal together.

Dave Donnenfeld | Avalaunch

Final question from us — How has building in the Avalanche community been for the team? Were there any certain benefits that you feel would not have otherwise been available from a technical perspective?

Serllin| Degis

Sure, building on Avalanche is very exciting, whether from technical perspective or not.

The most outstanding things are, the high speed & low cost of transaction confirmation, which allows us to better design protection products, help users to settle down immediately at a relatively low price.

Avalanche achieves finality over 100 times faster than the current version of Ethereum, thanks to this, we design out more user-friendly products, to lighten the next-generation on-chain protection service.

Dave Donnenfeld | Avalaunch

Well done Team Degis

You have performed admirably and we are ready to move on to the twitter portion of our program

Twitter Questions

@metonyacoin1 — Will Degis have passive income mechanisms such as flexible or locked staking and farming on their listed tokens?

Eric Lee| Degis

Yes. Staking will be online soon after the product is online.

You can stake DEG with flexible or locked period for future reward.

@natadmay3422 — I would like to know who you consider to be ideal consumer for your product?

THEO DING| Degis

First of all Degis welcomes every on-chain user, we don’t own the platform, Degis belongs to everyone who participates.

In addition, we are aiming to build one next generation of all-in-one decentralized protection platform, so people with protection needs are more than welcome to come here.

@Ahmetogrtm who asks — What is your most distinctive feature as Degis and the one you are most excited to offer?

Serllin| Degis

Good question, and that would be our smart contract protection product. We are going to have a model totally different from existing things.

We will adopt a new way to integrate different protocols into one protection pool, to make us protect each other through this new kind of design. more details will be announced gradually in the coming days, please stay tuned!

@waybesuricata — The Degis project has received serious investment and attracted very strong partners. So, why doesn’t the team use their own ID, but the NFT ID? Can you explain this briefly?

Eric Lee| Degis

Thanks for the question.

We are serious for building products and not meant to be anonymous.

It’s just because we are more comfortable to use NFT as our IDs in this virtual world.As the question mentioned, we have many investors and partners and they are not cooperating with a team without knowing who they are.

Sure, thanks for this question, we have prepared official documentation, which you can find on our official website, or just visit https://docs.degis.io/

@Fiosandra1 — In terms of learning more about the project, are there videos or social media pages we can learn from?

THEO DING| Degis

We also have a variety of promotional videos that will be released in the near future, so please stay tuned!

Also we are regularly publishing some feature articles of our project from the medium channel( https://degis.medium.com/).

Telegram Questions

If $DEG is planned to be used as a governance token, could you elaborate in what decisions the governance power will be given to the holders which encourages them to hold $DEG for long term?

Eric Lee| Degis

There will be a governance system for DEG holders after our product runs smoothly for some time.

And we have designed another governance token generated from DEG.

The decisions may include: adding new tokens for token price insurance, adding a brand new protection product, changing some policy parameters in the smart contracts, and changing some tokenomics parameters.

“Where I can get the latest updates or more information about the project?”

Serllin| Degis

Firstly, thanks for the question. You may get the latest information about our project by following our official channels, including but not limited to Twitter, discord, etc.

Generally, we will post the latest news there, and, through our medium channel, you can get more specific descriptions of our projects.

Token Burn and Buyback program play an important role in increasing Token value Do you have a token burn or buyback program plan to attract investors?

Eric Lee| Degis

Yes we know many projects have a buy back and burn mechanism for their token price.

We also have some designs for keeping our token’s value.

That will be achieved by the lucky box part.

We will share the major part of the income of Degis to our token holders.

“What is the most ambitious goal of your project? Could share with us any Upcoming Updates?”

Serllin| Degis

Our most ambitious goal, is to build the all-in-one protection platform, i.e. the meta market we mentioned in our roadmap. Which means, We are going to aggregate all protection services from all chains.

And we have already reached an agreement for this with several protocols, like solace, Etherisc, we are strategic partnerships now and are aiming this goal together. We are planning to achieve that till the end of this year.

Do you allow suggestions and feedback from the community? Are we allowed in decision making, do you put community into consideration?

THEO DING| Degis

Yes, we welcome feedback from the community, in fact, we received a lot of suggestions from the community during the testnet.

Further, when our project is stable, we will give more power to the community(DEG holders) to directly participate in the governance. And finally, we will hand over the authority of Degis to community management.

Dave Donnenfeld | Avalaunch

Thank you Degis. You all were great. Very much appreciated having the opportunity to get to know all of you and I think you’re going to make some waves in the space. Look very much forward to your mainnet launch and all the good things that lie ahead. @liyang_ust Serllin and THEO you all have been rock stars here today. On behalf of the Avalaunch community, we thank you.

Eric Lee| Degis

Thanks everyone! Nice to be here with you.

Serllin| Degis

thanks you all guys, happy to be here

-

Degis AMA #1 — Project Overview with Andy (CEO) & Oliver (CFO) (Recap)

On 3/2/2022 at 4:30 p.m. (PST), an AMA session was held on Avalaunch with special guests Andy (CEO) & Oliver (CFO), from Degis. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Once again, it’s on. Today we are elated to host another outstanding AMA with the good people from the Degis Project. The Degis Project is one that Avalaunch has a long history with and to be candid, never have we seen an initiative gain so much momentum in a short period of time. This speaks to the importance of the initiative and the hard work of the team. To think of things like impermanent loss protection coming to Avalanche, it’s hard not to get goosebumps. At any rate, let us welcome @oliveryoung to kick things off and @AndyDegis will be joining later on as well. Welcome Oliver, how are you today?

Oliver Young | Degis

Hello everyone, really nice to meet you all!

Really excited today to see our project start registration!

Dave Donnenfeld | Avalaunch

Good to have you of course and registration is well underway. Much hype. To get everyone acquainted, could you give us an introduction about yourself, who you are, what’s your background, education, and how did you end up with this career?

Oliver Young | Degis

I studied in HKUST and leanred Mathematics and Physics.

Then I worked in tranditional fiance as an analysy, and started doing research on DeFi and blockchain since 2020.

In July 2021, I joined Degis team and became a builder in Web3.0

Dave Donnenfeld | Avalaunch

Thank you for that.

Given your background, you are well suited for the industry.

Let’s dig in to Degis a little — Degis is known as a DeFi protection protocol that encompasses a matrix of products. Can you expand on this matrix for us please?

Oliver Young | Degis

NP. In our whitepaper, we propose four types of protection in DeFi. Token model, NFT model, Meta model and DAO model, which describe different protection mechanisms.

Specifically, we have token price protection, impermanent loss and smart contract protection.

And will continue deveop more kinds of protection in the future.

Dave Donnenfeld | Avalaunch

That’s fascinating actually and a big departure from what you normally see in the realm of blockchain/crypto insurance.

To focus — One of the mechanisms called Token Price Insurance supposedly covers both upside and downside risk. Can you elaborate on this structure and how it may work to reduce this dual risk for crypto users?

Oliver Young | Degis

High volatility has always been one of the reasons that keeps users from getting in blockchain, DeFi and GameFi projects.

Users are facing many problems like: assets liquidated, price dropping sharply after attack, missing good investment opportunities.

Degis creates a token price protection. If the price of subject matter goes above or below a certain price, the protection will trigger payouts.

ake the assets liquidated problem as an example, Andy stakes $100 worth of Etherum to get 80 DAI. He is worried about 20% decreasing to cause assets liquidated. He can buy a ETH price protection whose trigger price is 20% lower than the current price.

If his assets are liquidated, he will get payout and keep some property at last.

Give another example, Andy likes GameFi a lot, and he buys many props in one project. But he is afraid that the project might be hacked and he lose all his money.

He can buy token price protection of this project at a low trigger price, since the token price of the project are very likely to decrease a lot after hacking. If that happens, it will trigger payout, and Andy can save his assets.

Dave Donnenfeld | Avalaunch

That’s pretty clear and the big takeaway is the ability to hedge your own positions with an insurance product. That’s very inventive.

And I also realized that Andy can be saved.

Being an agnostic token insurance provider which specifically targets Avalanches’ beaconing ecosystem, one may say that Degis has somewhat of a competitive advantage in this space alone. With a myriad of tokens available in the ecosystem, I’m curious about what factors are at play to determine which tokens you provide an insurance for?

Oliver Young | Degis

Of course we will do AVAX protection first :), then we will build our protection related to our partners. At last, the decison right will be given to our community.

Dave Donnenfeld | Avalaunch

Short and sweet. Thank you — As a native crypto insurance provider on the Avalanche blockchain, one has to ask at some point if there are any future plans to extend into different ecosystems, and if so how will you expect to be dealing with existing DeFi insurance protocols?

Oliver Young | Degis

Our goal is to be universal. But all starts from avalanche. We will focus on avalanche for a long period of time. After everything is mature, we may extend into different ecosystems.

Dave Donnenfeld | Avalaunch

Protecting peoples’ funds, inadvertently means that you as a provider yourself would have to have pretty tight regulatory as well as security system/s in place. What does this infrastructure look like?

Oliver Young | Degis

Just now I mentioned our 4 types of protection model. Token model, NFT model, Meta model and DAO model. We develop the token model and NFT model at first.

Token price protection is an example of the token model. Creators stake 1 USDC to mint one protection token which is a ERC20, they can sell it in the AMM pool, or be LP of the AMM pool. If the event corresponding to the protection happens, the staked USDC will be paid to protection holders. This mechanism makes sure that every protection is 100% backed by assets and both sellers and buyers can trade at a fair market price.

As for the NFT model, LP is acting as a seller here. They stake their USDC in the protection pool, and the pool will cover some similar events. Our actuarial model will pricing different protection and create profits for LPs. The pool will not sell protection when the potential total payout exceeds TVL. So every protection is also 100% backed.

Dave Donnenfeld | Avalaunch

I think so. The NFT of a pool payout not exceed 100% rings obvious otherwise you might need additional insurance 😀but the LP as seller is fascinating.

Can you describe to us the protection buying process? Other than having a range of crypto assets to choose from, are there any other factors relevant, and what are the requirements for taking out this insurance? How much of an upside/downside protection will this provide?

Oliver Young | Degis

For token price protection, you can choose the crypto asset, trigger price and above or below. Then you can buy the protection in the AMM pool.

All users can create, buy and sell protection in the AMM pool. Later, we will give more convenience to our token holders. They can mint at a lower mortgage rate if they hold DEG tokens.

The trigger price we officially set will be plus or minus 20%, but later users can use DEG to open protection at different trigger prices. Users are free to choose the trigger price and protection amount according to their needs.

Dave Donnenfeld | Avalaunch

Well stated. What are the use-cases of the native token that drives the Degis ecosystem?

Oliver Young | Degis

The basic utilities of DEG token are insurance income sharing & governance.

Regarding income sharing, the treasury box is specially designed for DEG holders to share profits from the insurance pools while having fun with the lottery.

For the governance part, DEG is not only used for simply voting but can also be staked to create veDEG tokens to decide insurance pool liquidity shares which will come soon. As the project develops, we will continue to empower DEG tokens.

Dave Donnenfeld | Avalaunch

Who are you looking next at to form collaboration or partnerships with, and how will these relationships help achieve the high-level goal that Degis is after?

Oliver Young | Degis

We will announce our partnership with trader joe soon. And will build collaboration or partnership with Pangolin and Benqi. As a protection provider in eco, we want to build strong partnership with all the projects and provide our services to all users.

Dave Donnenfeld | Avalaunch

Look forward to it as I know you’ve already gained some real traction inside Avalanche.

What was the reason behind providing this solution on the Avalanche blockchain? Were there any immediate advantages other than perhaps being the first of its kind at least on this chain?

Oliver Young | Degis

Special thanks to Avalaunch! You have always been one of our strongest partners and helpers.

Thanks to the unique 3 built-in blockchains, Avalanche is the most suitable chain to build a protection protocol.

For now, it has fast transaction speed, large capacity, and low gas. But I want to talk more about the future.

C chain is compatible with multiple virtual machines including EVM, which can support Degis to establish our Meta model protection. In the meta-model, we want to aggregate all protection protocols on multiple chains. Multiple virtual machines can help us to achieve our ambition.

X chain supports multiple assets including some real-world resources. This will help us develop diversified kinds of protection in the future, especially those related to the real world.

P chain supports activating subnets. This can help us to develop transactions between businesses, like cooperating with traditional insurance companies. Also, the subnet can help to cope with possible regulations.

So we firmly believe that we can grow together with Avalanche, and fully utilize its market and technical advantages!

Dave Donnenfeld | Avalaunch

Appreciate that and the compliments. You all have been great to work with. Final question before we move on to the Twitterverse…

How would you envision the next 2–3 years of Degis to be like? What would be the ideal milestones reached?

Oliver Young | Degis

The roadmap describe our goal in 2022.

For further time, we will build our meta market and protection aggregator in 2 years.

Our final goal is to integrate traditional insurance with blockchain in the future

Dave Donnenfeld | Avalaunch

Well done Oliver. Thank you for all this information and insight.

Oliver Young | Degis

Thanks! Really honor to chat here!

Twitter Questions

@mast__balak who asks — I tried your testnet but I think there is so much difference in working on testnet and mainnet? My question is when we see Degis on mainnet? Also what new features we expect from the team on the mainnet?

Oliver Young | Degis

Thanks for your question. Yup. The team is continuing to build our project. If you participate in Testnet both phase 1 and phase 2. You could already find much difference.

I think you will see a much more improvement in our mainnet. The launch time of mainnet will be around early April.

Dave Donnenfeld | Avalaunch

On a personal note, I’ve seen your testnet and think it’s pretty close to mainnet material. Not sure I’ve seen a project mature as quickly as Degis.

That’s pretty soon. Didn’t mean to ask the next question prematurely.

@AndikaA25245812 Do you plan to increase the utility of DEG?

Oliver Young | Degis

Of course. DEG token is critical to our ecosystem and we will do all our efforts to make it stronger. Not only simple profit sharing, DEG will also be cleverly used in each protection products. You can expect that.

Dave Donnenfeld | Avalaunch

Expectations are high as it is. Looking forward to that

@BoycaIsBack — Where do you see Degis go in the next 5 to 10 years

Oliver Young | Degis

I think in long term, we will provide more protection related to the real world. And become a true worldwide protection project with the growth of Web3.0

Dave Donnenfeld | Avalaunch

@AndyDegis in the building. He had to tear himself away in order to be here and certainly, better late than never. How are you Andy?

Andy | Degis

Doing good! Hey everyone, this is Andy, CEO of Degis. Pleasure to connect with all of you here

Dave Donnenfeld | Avalaunch

Good to have you — I’m sure @OliverYoung wouldn’t mind if you fielded a question or two and very much appreciate your time.

@waybesuricata asking — Looking at your roadmap, we see that the Impermanent Loss Protection feature is planned for March-May 2022. Can you give information about this feature?

Andy | Degis

Yeah thanks for the question from @waybesuricata! Impermanent loss protection is our major focus in Q2, serving as a powerful weapon to insure against the risk of IL loss for liquidity providers.

Basically you just need one click to buy insurance for your position on DEX!

@Lopyou54804819 You have an impressive set of advisors on your website, many of whom are team members on Avalanche. Can you explain the respective implications of these advisors?

Andy | Degis

Our advisors is consisted of DeFi OGs, legal and academic professionals. We take their advice from different aspects, which also leads to our innovation in products as well as efficiency in execution.

Also our investors are helping a lot. Special thanks to all our investors, advisors and partners!

Dave Donnenfeld | Avalaunch

Your advisors are an amazing group. Not just the gratuitous group you often see. I don’t know who all has been formally announced and who all is still to be announced but it is worth a look for sure.

This has been a confidence inspiring AMA. Don’t sleep on Degis.

Telegram Questions

How will your “incentive lending and Liquidity pools” different from all the others at the moment? What ideas do you have to make these pools more attractive than others?

⭕️ At the moment we see lots of Defi project why people choose Project DEGIS?

Andy | Degis

@Iqballeo08 Thanks for the question. Degis is an insurance protocol that servers to protect other protocols and bring safety for users in the DeFi space. Our buyer incentive is an amazing innovation on how we incentive insurance buyers to participate in the ecosystem. Also want to mention that we use AMM pools for liquidity aggregation!

Almost 80% investors have just focused on price of token in short term instead of understanding the real value of the project. Can you tell us on motivations and benefits for investors to hold your token in long term?

Andy | Degis

This is a critical one. When we on-board investors, we make sure they are bring value as long as they are long term holders. Also, we set the locking period to 12 month to make sure they are in the game for long.

hi @OliverYoung You mentioned on Medium Degis “Reward Most Loyal DEG Holders”, so Can you explain How will DEG Holders redeem their Rewards? Will the prize be sent automatically to the holder’s address? and is there a minimum and maximum limit for DEG holders to get this great Prize?

Andy | Degis

Also a good one @jlaudybell We make sure all DEG holders can share the insurance pool income by staking DEG tokens. Also, lucky tickets are the ones that can boost your APR and there are even surprises waiting for you!

On your website you don’t mention that you have done any internal or external audit of your smart contract, so can you give us details if you have done any audit before? And in case you haven’t, would you plan to perform any review of your smart contract in the near future?

Andy | Degis

You are very sharp on the auditing part. We have been collaborating with slowmist since Jan and auditing report will be ready soon.

Did you consider community feedback/requests during the creation of your product in order to expand on fresh ideas for your project? Many projects fail because the target audience and clients are not understood. So I’d like to know who your ideal consumer is for your product?

Andy | Degis

@Leola_fenner_2001 Community is the most important thing that we value. Degis is built by all of our community members and we will do listen to their opinion for sure. That’s also why we are keep making innovation. It’s all because of amazing communities and we will keep growing with them!

Yeah finally! again, thanks so much for the passion here!

Dave Donnenfeld | Avalaunch

Boom! You’ve done it. You ran the gauntlet. @AndyDegis thanks for coming on and tackling some questions.

Good to have you and @OliverYoung very much appreciate your time here today.

I am honored to see how quickly Degis has progressed and you two deserve to take a bow, along with the rest of the team. Honored to be hosting your IDO and look forward to our future together. Many thanks.

Andy | Degis

Yeah thanks a lot to Avalaunch team and the amazing community here!

-

Degis X Avalaunch: IDO Announcement

Few would disagree that navigating the landscape of crypto can be perilous. The mention of risk is more than commonplace and rightly so. An important word that is rarely uttered is protection. Avalanche, despite its historic advances at breakneck speed, is an ecosystem of projects that remain largely unprotected.

Though insurance on the blockchain is commonplace enough, existing protocols often lack needed liquidity concentration and truly automated claims processing. As pundits have pointed out, many blockchain insurers, despite conveying otherwise, essentially secure a brick in the building but not the building itself. The truly staggering spate of hacks and exploits that have plagued DeFi have continually slowed the path to adoption and the likelihood of costly human error being remedied is nil — especially given the speed of development. However, there is a simple solution and that would be the accessible provision of insurance. Cryptocurrencies are volatile, risk is inherent and protocols can get exploited. Risk appetite is individual but collectively, the need for adequate coverage remains a gaping hole in a growing asset class.

Given the proliferation of DeFi protocols and the billions in TVL that have been secured in recent months, a decentralized insurance market dedicated to Avalanche projects seems a given but thus far, has not arrived. Until now.

Though it is a familiar refrain for Avalaunch, we must state that yet another long rooted relationship is ready to bear fruit and we are proud to announce Project Degis as our next IDO.

Project Overview

Welcome to the first decentralized Insurance Market built on Avalanche. The traditional insurance industry seems obtuse almost by design given the cumbersome purchasing procedures and protracted claiming processes. As an effect, many would be users are left out in the cold, claiming that insurance is more trouble than its worth. Even the most optimistic might characterize it as a “necessary evil” but in the realm of finance, it is an absolute necessity. Still, it is not readily accessible to many individuals, particularly in poorer regions of the world and the de facto coverage for many is the belief and hope that the institutions they interact with have adequate coverage to keep them safe. While Europe, America and Hong Kong have well-developed insurance markets, insurance systems in Africa and Southeast Asia, for example, have no accessibility to insurance protections.

Enter the Blockchain

Our next generation infrastructure can provide a permissionless and trustworthy platform on which everyone can buy insurance products to protect themselves from associated risks.

Given the growth of DeFi and the attendant “smart” money that has begun dipping their proverbial toe in the water, it is incumbent upon developers to provide coverage for crypto assets. Degis sees the challenge and raises some appreciable improvements.

A few limitations:

- Insurable DeFi protocols are very limited.

- AAVE and Compound being the most covered.

- Users should not be limited to those protocols.

Insuring platforms tend to set several pools for different products which:

- Separates and fragments capital liquidity.

- Utilizes manual claiming processes, for most insurance protocols.

- Can be very cumbersome and time-consuming.

There are some obvious pain points in traditional insurance and in blockchain, these obstacles are more pronounced. For a deeper dive into these mentioned limitations, please refer to this article. The Degis Project has identified these shortcomings and aims to fill the gap of existing protection protocols with their next generation insurance platform.

Degis: A Next Gen Insurer

Degis comes from the word “egis” , meaning shield in Greek. Debuting and built on Avalanche, their mission is to become a comprehensive, universal blockchain protection platform with a broader mission to redefine existing blockchain protection ecosystems. The pillars for Degis are protecting, earning and playing while mitigating against risks and uncertainties.

Built on Avalanche, Degis is designed to keep assets free from every crypto risk, building a shield for the decentralized world.

As a new protection ecosystem, the Degis Protocol departs from traditional insurance in that it is inclusive — allowing anyone with blockchain access to purchase the product. Prima facie, this may not seem groundbreaking but for those who hail from countries where insurance markets are grossly underserved, it is a welcome arrival. Much like crypto in economies with unstable native currencies, the ability to protect assets can similarly represent a safe haven in challenged economies.

Product

- Every insurance product on Degis will be backed in the form of NFT.

- The NFT stores all the information of the policy and the user’s data.

- NFTs are minted and sent to the buyer’s wallet upon order submission.

- The NFT will be burnt when the insurance expires.

Users may opt to keep the unexpired NFT in exchange for:

- Future discounts for other Degis designs in the future.

The Naughty Price — Building an Avalanche Protection Ecosystem

The Naughty Price is the next generation of token price protection. The product will cover BTC, ETH, AVAX as well as major Avalanche project tokens to lower risk for the Avalanche ecosystem. Currently, most insurance protocols focus on covering smart contract flaws and protocol hacks. On Degis, the Naughty Price covers token price fluctuation, capable of reaching a much broader market.

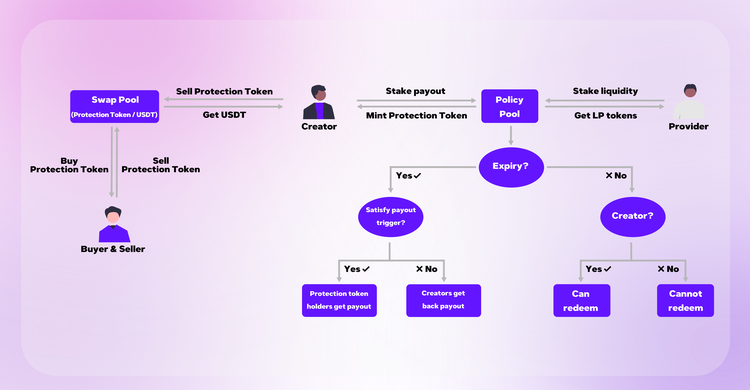

In the Naughty Price system, there are three main roles:

- Creator, provider as well as buyers and sellers.

- Creator deposits USDC into the right policy pool to receive naughty tokens.

- Provider deposits USDC into the policy pool to provide liquidity to receive:

—LP tokens as rewards.

—LP tokens can be staked for mining DEG (Degis token).

In the graph below, AVAX30L tokens are protection covering AVAX where the creator can sell naughty tokens to the left policy pool before the expiration date.

The left policy pool is an AMM-based capital aggregation pool where trades between buyers and sellers (naughty tokens and USDC) transpire. When the naughty token hits its expiry date, the payout is determined by the token price.

Providers can only deposit USDC into the right policy pool, and the protocol will mint fractional amounts of naughty tokens with 1:1 ratio. At any time, providers can redeem their capital based on the current exchange ratio. At the initial phase, Degis will cover BTC, ETH, AVAX and Avalanche major projects’ tokens with a goal towards covering the entire Avalanche ecosystem.

To further accommodate new entrants, Degis will develop:

- An innovative protection for Impermanent Loss.

- Smart Contract Protection — Protect user from smart contract hacks.

- Meta Market — A protection aggregator, all-in-one protection market.

Degis focus on wider coverage areas, capital liquidity aggregation, instant payouts and great inclusion portends a robust suite of products that reimagine traditional insurance. By establishing on-chain and off-chain protection upon launch, Degis will debut Naughty Price followed by broader community initiatives.

Degis — Links & Team

Announcements | Telegram (Discussion) | Twitter | Medium | Discord | Website

Partners & Backers:

“We are excited to back Andy and team as they build one of the leading protection platforms on Avalanche. As the ecosystem continues to expand, Degis fills a need to provide protection to the range of projects in the Avalanche space.” Leslie, Co-founder of GBV

Closing Thoughts

Like Degis, we believe that the future of insurance will be built on-chain. In terms of positioning, Avalaunch feels that the market is ripe for a comprehensive solution. There have been numerous projects that have attempted to insurance provision but have suffered from inexperienced teams, poor execution and frankly, thinner efforts. As more and more TVL enters the Avalaunch ecosystem, the need for a protection platform done right is great. Unlike existing protocols, both Degis and Avalaunch believe that the new form of protection should not only protect users for their on-chain assets, but also assets off-chain.

“Cooperating with Avalaunch has been an amazing journey. We were impressed with how professional the team is in launching new projects. They enable projects to smoothly move from very beginning to a successful launch. The launch preparation process is also very efficient. In the meantime, Avalaunch team brings a lot passionate contributors who are aligned with the long-term goal of degis development and the growth of avalanche ecosystem to the project. We are excited to work with avalaunch, a road to a successful launch.” Andrew, Head of BD, Degis.

Funding Numbers

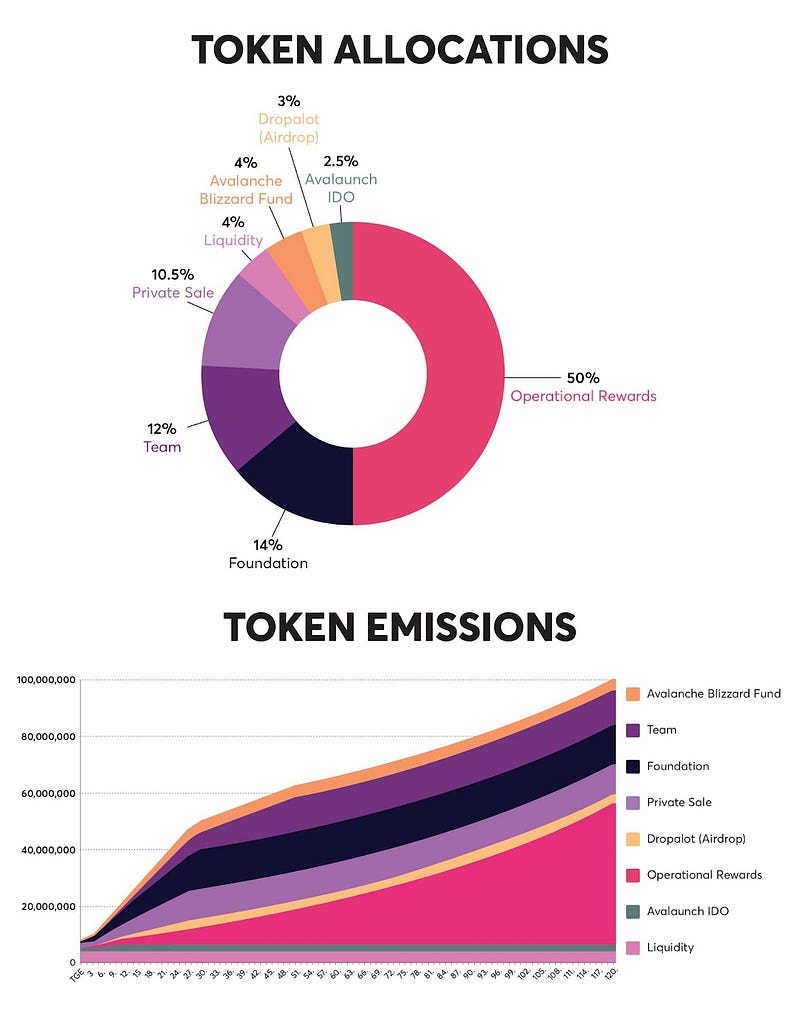

- Total Supply: 100M DEG

- Seed: 16M DEG — 3,200,000 USD

- *ECO Grant: 5M DEG — 500,000 USD

- Private: 3M DEG — 1,500,000 USD

- Public IDO: 2M DEG — 1,200,000 USD

- Raise: USD 6,400,000

*This ecosystem grant was funded by Avatar and Ava Labs to foster and expedite the development of the Degis Project.

Supply — Breakdown & Vesting:

Total Supply: 100,000,000 DEG

- User Incentives: 40M DEG (40%)

- Investors: 24M DEG (24%)

—Seed: 16M DEG

—ECO Grant: 5M DEG

—Strategic: 3M DEG

—IDO (Avalaunch only): 2M DEG (2%) - Team: 12M DEG (12%)

- Growth Fund: 12M DEG (12%)

- Reserves: 5M DEG (5%)

- Advisory: 3M DEG (3%)

- DEX Liquidity: 2M DEG (2%)

Vesting Following TGE:

- User Incentives: Contingent upon user participation on the Degis platform

- Investors:

—Seed: 10% at TGE, 12-month cliff post mainnet, quarterly release

—ECO Grant: 12-month cliff post mainnet, quarterly release

—Strategic: 12.5% at TGE, 12-month cliff post mainnet, quarterly release

—IDO: 50% at TGE, no cliff, 5% weekly release - Team: 15-month cliff following mainnet, quarterly release

- Growth Fund: 16.7% at TGE, released quarterly over 2 years

- Reserves: Community governed unlocks

- Advisory: 15-month cliff following mainnet, quarterly release

- DEX Liquidity: 100% unlocked

Other:

- Initial Circulating Supply: 4.975M DEG (excluding liquidity tokens)

- Initial Market Cap: US 2.985M USD (excluding liquidity tokens)

The Degis IDO on Avalaunch

- 2M DEG at USD 0.60 — USD 1,200,000 (Total Supply: 100M Degis)

- Sale Size: USD 1,200,000

Registration Schedule:

- Registration Opens: March 2nd at 3:00 p.m. (UTC)

- Registration Closes: March 5th at 6:00 a.m. (UTC)

Sale Schedule:

- Validator Round Begins: March 7th at 6:00 a.m. (UTC)

- Validator Round Closes: March 7th at 3:00 p.m. (UTC)

- Staking Round Begins: March 7th at 3:30 p.m. (UTC)

- Staking Round Closes: March 8th at 6:00 a.m. (UTC)

IDO Recap

- Total DEG for sale: 2M

- Price: $.60

- Size: 1,200,000 USD

- Vesting — 50% at TGE, no cliff, 5% weekly release

-

Dexalot AMA #2 — Technical Deep Dive with M. Nihat Gurmen (CEO) & Cengiz Dincoglu (CTO)(Recap)

On 2/21/2022 at 12:00 p.m. (PST), an AMA session was held on Avalaunch with special guests M. Nihat Gurmen (CEO) & Cengiz Dincoglu (CTO) , Team Dexalot. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Our first AMA with Dexalot was so darn good, we had to do it again. We…had….to. Had we not, I’d feel irresponsible for denying our information hungry community what they deserve. Alas, we are here and joined once more by the @the_axol0tl and our friendly neighborhood @hydrofoilracer. They are long time friends and workmates who have joined forces in creating their magnum opus that is Dexalot. Gentlemen, good to have you here again today and welcome.

How is everyone doing?

Quicksilver| Dexalot

Doing great, nice to be back 🙂

The Axolotl| Dexalot

Doing great!

Dave Donnenfeld | Avalaunch

Good to have you both back.

Let’s get it started — Given the exposure you’ve been getting, I’m sure you’ve done this numerous times already but once more, could you please introduce yourselves and how you got to be where you are today?

The Axolotl| Dexalot

We feel very energized with the interest we have seen so far!

Sure.. let me start.

Hello Everyone. Thanks for having us here again. I am one of the co-founders of the Dexalot project. I have a PhD in Chemical Engineering. I am coming from a corporate background in the Oil & Gas sector.

I always inclined to do projects that have programming, innovation and collaboration in my corporrate and academic life.

Crypto ended up combining all of that for me again. So, I jumped into Avalanche and Dexalot with both feet.

Quicksilver| Dexalot

I am the CTO and the other co-founder of this project.

I have worked in Wall Street for almost 20 years building electronic trading systems on the IT side and I have also held a quant position at JPMorgan’s Statistical Arbitrage Trading Desk.

This is my 5th trading system in the last 20 years.

I left WallStreet 3 years ago as I didn’t see the upside for myself and kitesurfed and hydrofoil raced for almost 2 years while keeping my entrepreneurial aspirations alive with a few non-crypto projects.

Dave Donnenfeld | Avalaunch

An introduction that never fails to impress. Thank you for that. Many people might be curious about the Dexalot team, how many people are behind it, and how many are developers dedicated to work on the exchange?

The Axolotl| Dexalot

We have about 16 people if we count all full-time and part-time people including visual designer, community admins, social media team.

4 out of the 16 are at the executive level. Including Cengiz and I, the core team has 6 developers.

and yes, co-founders code in this project.

Additionally, we work with a group for additional project-based engagements. They have built a monitoring application to detect malicious actors and behaviors on Dexalot.

We are very excited to introduce this montioring app in the near future…

Dave Donnenfeld | Avalaunch

How does having such a varied team provide you with the tool set required to run something as complicated as a DEX? Is the entire framework developed from the ground up, or is this based on a whitelabel solution structure?

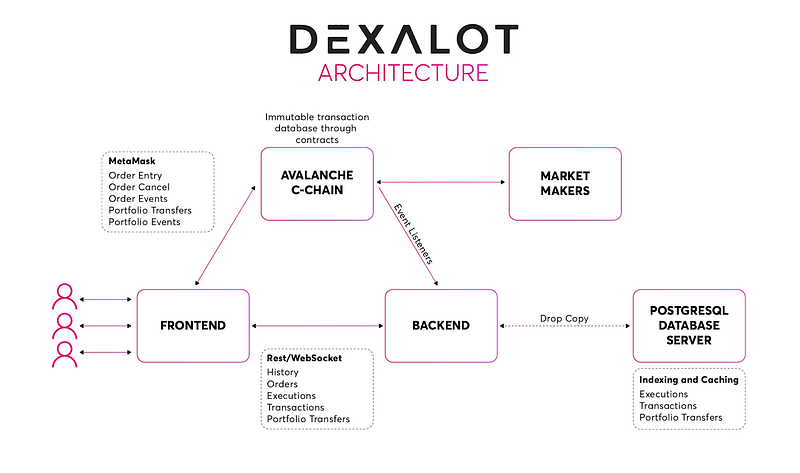

Quicksilver| Dexalot

We built everything from scratch.

They include smart contracts, frontend, backend, database and market makers.

Having personally built multiple custom trading systems in the past makes a tremendous difference in the end result. From the start, I pretty much had the end state architecture in my mind, but we got there gradually , re-confirming the architecture based on the needs at the time.

In a way we evolved into our current state. We are in a good state but we have a lot more in out plate to do…

Dave Donnenfeld | Avalaunch

An exchange that aims to change the game from the centralization perspective is quite a statement. What does the architecture look like?

Quicksilver| Dexalot

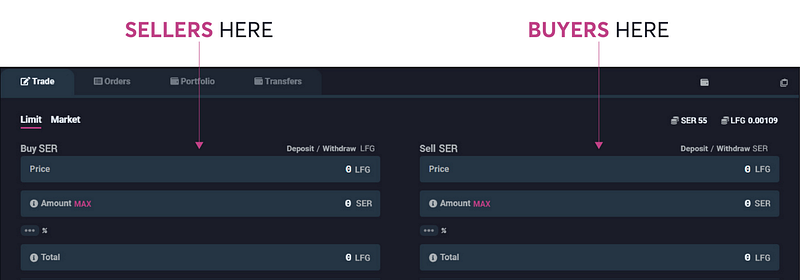

In a nutshell, because all trading activity is on chain, all you need is a frontend and our smart contracts.

But we have a very complex backend that supports all the bells and whistles needed to give the CEX experience in the frontend like candle charts, orderbook aggregation, historical transactions etc.

We have a relational database, a blockchain indexer, in-memory database with a pub-sub mechanism, web-socket and REST api endpoints to achieve the features we are providing.

Dave Donnenfeld | Avalaunch

Having looked at the anatomy of the exchange, market and limit order functionalities are available. Will futures be part of the architecture?

The Axolotl| Dexalot

In the near term, the answer is no. Derivatives are classified as securities in the US, we are staying away from regulated securities for the moment.

However, we have expertise in derivatives within the team and will keep all such products in mind for the future and depending on changes to regulations.

There are many other cool ideas that we’ve brainstormed on and we’ll reveal them over time.

Dave Donnenfeld | Avalaunch

How does Dexalot deal with privacy concerns? How is this system analogous to centralized exchanges but still maintaining the make-up of a decentralized platform?

Quicksilver| Dexalot

All the backend components are somewhat centralized BUT they serve complementary functions.

Even if the entire backend crashes, user funds are on chain under their own custody. They can technically withdraw their asset without even needing our frontend directly from snowtrace.

Dave Donnenfeld | Avalaunch

With over $15M in the total volume locked, safety and security must not be taken lightly. Have there been any smart-contract audits, what about penetrance tests? What are your plans for the continued due diligence?

The Axolotl| Dexalot

We fully agree that security is of paramount importance.

To this end we tried our best to use well-audited libraries of OpenZeppelin to build on at the smart contracts level.

We also did two private security audits and three public security audits by Hacken. We plan to trigger a security audit whenever an update is done for smart contracts.

Additionally, we did extensive hardening at the infrastructure level to increase the resilience of Dexalot in this age of distributed attacks and scanners, etc.

We will soon announce a bounty program as well to encourage community members skilled in security to contribute to the project.

Dave Donnenfeld | Avalaunch

In the lightpaper, the roadmap indicates that the next developmental milestone is a subnet on Avalanche. What were the core reasons for this, and how do you see this play an advantage in user adoption?

Quicksilver| Dexalot

2 words:

Gas & Speed

We will be focusing on the Subnet because we can control the gas cost better and will have tremendous speed improvement in addition to giving us much needed flexibility to deliver additional features.

Dave Donnenfeld | Avalaunch

Boom

Just like that

Is there a mobile app on the way? If so, will this be a full featured app or will these be added in phases?

Quicksilver| Dexalot

Our website is already compatible with mobile phones

Simply login through MetaMask and app.dexalot.com to start trading today.

But we don’t have a dedicated native mobile apps.Dave Donnenfeld | Avalaunch

final question for this section but save your denouement for later please. What does the support structure look like, and what’s the expected response time?

The Axolotl| Dexalot

We various ways for users to reach out for support. We have multiple channels: TG, Discord, email.

The turnaround time for TG and Discord should be in the order of minutes and email can take longer.

Our email support queue has automated acknowledgment for every email received. Then one of our staff picks up from the queue and tries to resolve it. If a legitimate bug has been reported then we may not be able to have a resolution quickly as it involves coding, testing, etc.

Certainly depending priority we fast track certain bugs as fast as possible.

Dave Donnenfeld | Avalaunch

Thank you for your resolve and determination in navigating the first leg of this journey. You are appreciated. Now, we must move on to where few dare to go (much like your journey as a DEX) and that of course is the Twitterverse.

Twitter Questions

@Sayangk34486540 who asks — Is your project only for elite investors, what about others with small funds, is it open to everyone?

The Axolotl| Dexalot

Absolutely not. The whole crypto experiment is about people taking control of their own assets and removing middle layers to do transactions more and more peer to peer.

From that perspective, Dexalot follows the same model. It is non-custodial, trustless and everything is transparently on-chain.

Moreover, the on-chain order book allows programmatic interaction for any builder so it is very inclusive.

@PiloT9804 inquires — I see you’re on Beta mode- is it safe to Trade on Dexalot? And when will more token pairs be available for trading?

Quicksilver| Dexalot

Fair concern. Our code was built from scratch.

Therefore, we wanted to make sure the project gives a heads up to the users via a beta designation. However, we did a lengthy fuji testnet period.

Currently, we have more than 0.5M transactions on it. The mainnet has been used to log 115k transactions with real assets.

We also have our contracts audited 5 times so far. Therefore, we believe it has a good track record. In the next few months we will gradually increase our pairs.

@alialicinar3 — Are you considering new features such as staking and lending other than swap?

The Axolotl| Dexalot

For our own token there will be a staking feature. We hope to bring it to the market shortly after our TGE.

However, we do not have any plans to introduce any staking and lending protocols for other assets in the short term.

@A9R8VI Within Dexalot, “All orders and canceled orders placed on Dexalot are recorded directly onto the blockchain and displayed on the central limit order book” So up to how many days of data & history will be Recorded on Dexalot?

Quicksilver| Dexalot

We index everything that happens on chain to our database for quick access and display.

A trader’s entire history can be retrieved from the frontend with a few clicks. We had our US customers in mind, when it is time to do their taxes along with other features that require historical data.(Like charts)

@AndikaA25245812 — The concept of Dexalot is an innovative one, providing a service which the community has been looking to get on DEX for quite some time. Do you have plans of integrating other chains in the future, like lets say, the BSC?

The Axolotl| Dexalot

Currently, we have no plans for that. But if our community prefers us to be multichain then we will put this in our list to do for sure.

Telegram Questions

What is the most ambitious goal of your project? Could share with us any Upcoming Updates?

Quicksilver| Dexalot

The whole project is quite ambitious 🙂 but I would say Dexalot Discovery is the next one coming into the mainnet with our own ALOT token this week where we will be providing a solution to the crypto world a safe & fair initial price discovery process removing the arbitrage bots’ speed out of the question that is an important factor in the current process.

Since NFT is popular nowadays, is there a plan for NFT integration?

Quicksilver| Dexalot

We don’t plan on integration for NFT because there are already a few good applications that are out there that serve this purpose. As we believe in decentralization, we also believe in the decentralization of responsibilities among different projects and yet keeping a tight partnership with them.

Do you have any plans to attract non-crypto investors to join your project? Because the success of a project attracts more investors who haven’t yet entered the crypto world. What are the plans to raise awareness about your project in the non-crypto space.

The Axolotl| Dexalot

Yes, actually we have plans for attracting non-crypto investors into the crypto world. We have included people in our a team seasoned in tradfi and we are using their expertise to achieve that.

A common problem is that nowadays most investors are only interested in initial profits and ignore long-term benefits! So can you give them some reasons why they should buy and hold your tokens in the long term?

Quicksilver| Dexalot

Well we are truly in this business to make our product to go to DEX. WE have a sound revenue model, very good technology and with the introduction of the subnets, we can truly deliver CEX experience (speed/cost) with the full security advantages of DEX

Do the token holders have right to participate in the governance of the project? On what kind of decisions can they vote on about the project?

The Axolotl| Dexalot

Yes, governance is central to our project’s goals. We will have an on-chain governance feature coming in Q2 later this year.

Dave Donnenfeld | Avalaunch

Once again, it’s been a pleasure having you both. Your presence is very much appreciated and your dedication to Daddy Avalanche and its denizens is laudable. We are proud of our integration and to be hosting your sale; having had a working relationship for some six months now. It has been a long time coming.

@the_axol0tl and @hydrofoilracer and @FireStorlvl are absolute rock stars. Your contributions are something we all look forward to.

The Axolotl| Dexalot

Thank you very much everyone.

Quicksilver| Dexalot

Thank you very much and has been a pleasure as always

-

Avalaunch & The Islander Launch Initial Community Education (ICE) Program

Dear project owners,

The Islander team knows full well how challenging it can be to build and educate a community in the early days. We also recognize its importance and that the onus of responsibility falls squarely on our shoulders. We can ill afford to falter or become frustrated when our community members are not informed enough to put their full trust in us for an extended period of time. Again, this is on us.

While it can be discouraging when your most commonly asked question is “Wen moon?” with “Wen lambo,” being a close second but we have been here before. We have built communities from the ground up and have always stayed the course. In short — been there, done that.

So hey, we want to help you. Just because we believe that our little support and companionship could make your ride less bumpy. After all, we are in this thing together.

To our beloved community of crypto enthusiasts,

We used to be just like you: losing money in projects that we never understood or particularly cared about. While trading with the trend makes sense, investing with the herd does not.

We know exactly how hard it is to find the best projects. It is a vast landscape full of tainted information. Making well-informed investment decisions is often beyond our reach, therefore, finding the needed conviction to be confident in supporting the most worthy of projects in such a volatile class is often the difference between success and failure. Nothing hurts more than not being able to withstand the volatility only to see a project go on a dream run…after you sold.

So hey, we want to help you. Why? Because Islander was built to solve that pain point; to build a bridge of aggregated knowledge that can take us to the proverbial promised land. Stable and mature markets means informed buyers which translates into mass adoption which would remain the endgame for all of us. This is the Islander Mission.

Dear Avalaunch,

Since our first day of this adventure in the Avalanche ecosystem, you have always been the best partner and role model. What you did to help Islander and other projects here was massive and amazing. Words can not express how grateful we are, and we normally don’t struggle to express ourselves. 🙂

From our first days, our mantra has always been to keep learning and growing so that one day we could work together with you. Hokey though it may sound, we wished to emulate and amplify the initiative we both share — to find and support the best projects out there with generosity and good faith in order to contribute to the holistic growth of the Avalanche ecosystem.

We know that gratitude without work does not signify much and so, in the name of action…Let us introduce to the community our mutual Initial Community Education (ICE) Program for IDO projects on Avalaunch. We believe there is no better time than the present and will begin with our good friends at Dexalot!

What is ICE?

Initial Community Education (ICE) is a cooperative, education program from Islander and Avalaunch aimed to offer support to IDO projects through the learn-to-earn mechanism pioneered by Theislander.io

What are the benefits of ICE for crypto projects?

- A no cost way to build an early community of loyal, informed users.

- Receive a double boosting campaign from Islander’s island and Avalaunch’s island on Theislander.io at no cost.

- Additional exposure through Islander and Avalaunch social media.

- Receive an exclusive island, customized by Islander Team.

- Learn-to-earn campaigns educate and boost community power.

What are the benefits of ICE for community members?

- Learn about IDO projects on Avalaunch and earn:

ISA, XAVA and IDO tokens. - Keep your fingers on the pulse of the Avalanche ecosystem.

- Identify emerging trends, source through aggregated data

What should one expect from a standard ICE?

- A learn-to-earn campaign with rewards in ISA (Islander) (https://theislander.io/project/4)

- A learn-to-earn campaign with rewards in XAVA (Avalaunch) (https://theislander.io/project/13)

- A learn-to-earn campaign with rewards in participating Avalaunch IDO token

Following these events are AMAs, educational content (infographics/blog posts) and social boosting from Islander & Avalaunch in order to maximize project exposure and knowledge transfer.

When will ICE start?

Sooner than you expect! The first ICE would be with one of the most anticipated projects — Dexalot — in the last week of this month. Get ready and stay tuned for more detailed information!

-

Dexalot AMA #1 — Project Overview with M. Nihat (Recap)

On 2/17/2022 at 12:00 p.m. (PST), an AMA session was held on Avalaunch with special guests M. Nihat Gurmen (CEO), Cengiz Dincoglu (CTO) & Firestorm (Advisor), Team Dexalot. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Hello and welcome everyone to another most excellent AMA brought to you by Avalaunch in association with the good people of Dexalot. It is a genuine pleasure to be finally launching this project; it has been a long time in the works for us and moreso, for them. It is indeed an all-star cast and we were fortunate enough to have enough connections to get not one, not two but three officers of Dexalot as guests here today. We are joined by @FireStorlvl @hydrofoilracer and none other than @the_axol0tl today and I’ll let them do the talking. We’ve already exchanged pleasantries in the proverbial war room so let us get right into it…

As you all can see…Today, we start our AMA with 3 members of the team. Thanks for being here. Can we start with a brief introduction about who you are, what your academic background looks like, and how your experience brought you to the crypto space?

The Axolotl| Dexalot

Hello again. Let me start it off introducing myself.

I am one of the co-founders of the Dexalot project.

I have a PhD in Chemical Engineering and I am coming from a corporate background in the Oil & Gas sector.

Before that I was in the academia at University of Michigan.

It seems every 7–10 years I make major change in my industry.

After Oil & Gas I did that change towards blockchain…

Crypto space was a natural fit for me as it epitomizes innovation and collaboration.

Dave Donnenfeld | Avalaunch

We’re of course glad you made a switch. I couldn’t have waited another 7–10 years for Dexalot. 😀

Quicksilver| Dexalot

I am the CTO and the other co-founder of this project.

I have worked in Wall Street for almost 20 years building electronic trading systems on the IT side and I have also held a quant position at JPMorgan’s Statistical Arbitrage Trading Desk

This is my 5th trading system in the last 20 years. I believe, having traded my own HF algorithms, using, in some cases, an electronic trading system that I had personally built gives me a distinct set of tool sets that will contribute to the success of Dexalot.