The Blockchain Evolution

Since the creation of Bitcoin in 2009, blockchain technology has evolved through three significant generations. Bitcoin first revolutionized financial transactions on a global ledger, eliminating the need for trusted intermediaries. Ethereum, the second generation, expanded blockchain’s scope with smart contracts, which allowed the creation of decentralized applications (DApps) and what we now know as DeFi. However, as the user base grew, so did the demand for improved scalability. Avalanche, a third generation blockchain, has dramatically redefined a blockchain’s fundamental capabilities, establishing the foundations for an interconnected global landscape, specifically engineered for sophisticated, impactful applications.

BTC.b – Unifying the Three Generations of Blockchain

To bring us full circle, we have BTC.b – a native representation of Bitcoin on the Avalanche network. BTC.b retains Satoshi’s foundational principle of being a decentralized value transfer, while simultaneously expanding its functionality to actively participate in Avalanche’s rich DeFi ecosystem. By unifying the three generations of blockchain development, BTC.b democratizes access to new opportunities for both individual investors and traditional institutions alike. Moving beyond the traditional perception of Bitcoin as merely ‘digital gold’, the integration of BTC.b into the DeFi ecosystem not only taps into its $500B market cap (at the time of writing) but also further revolutionizes its potential as an asset class.

Understanding BTC.b – What sets it apart from WBTC?

BTC.b is a native ERC-20 token on Avalanche that represents Bitcoin bridged from the Bitcoin network, which can then be used across the ecosystem in yield-generating strategies.

It provides a superior alternative to WBTC, by eliminating the inherent risk associated with its reliance on third party custodians. WBTC requires the user to submit a request to a merchant, who then interacts with a custodian – who is responsible for executing the minting and redeeming of the WBTC. Since this process doesn’t usually happen on-demand, WBTC holders are exposed to price volatility and a poor user experience.

In contrast, BTC.b is minted and redeemed on-demand. This is done using the Avalanche Bridge, a non-custodial bridge that leverages the new Intel SGX technology. Its design ensures that the bridge can securely execute transfers without any one party ever having access to the bridge’s secret keys. This is crucial because the Avalanche Bridge is secured by 8 Wardens who are in charge of indexing and verifying transactions.

Each BTC.b is fully backed by a Bitcoin locked in the Intel SGX-secured bridge application.

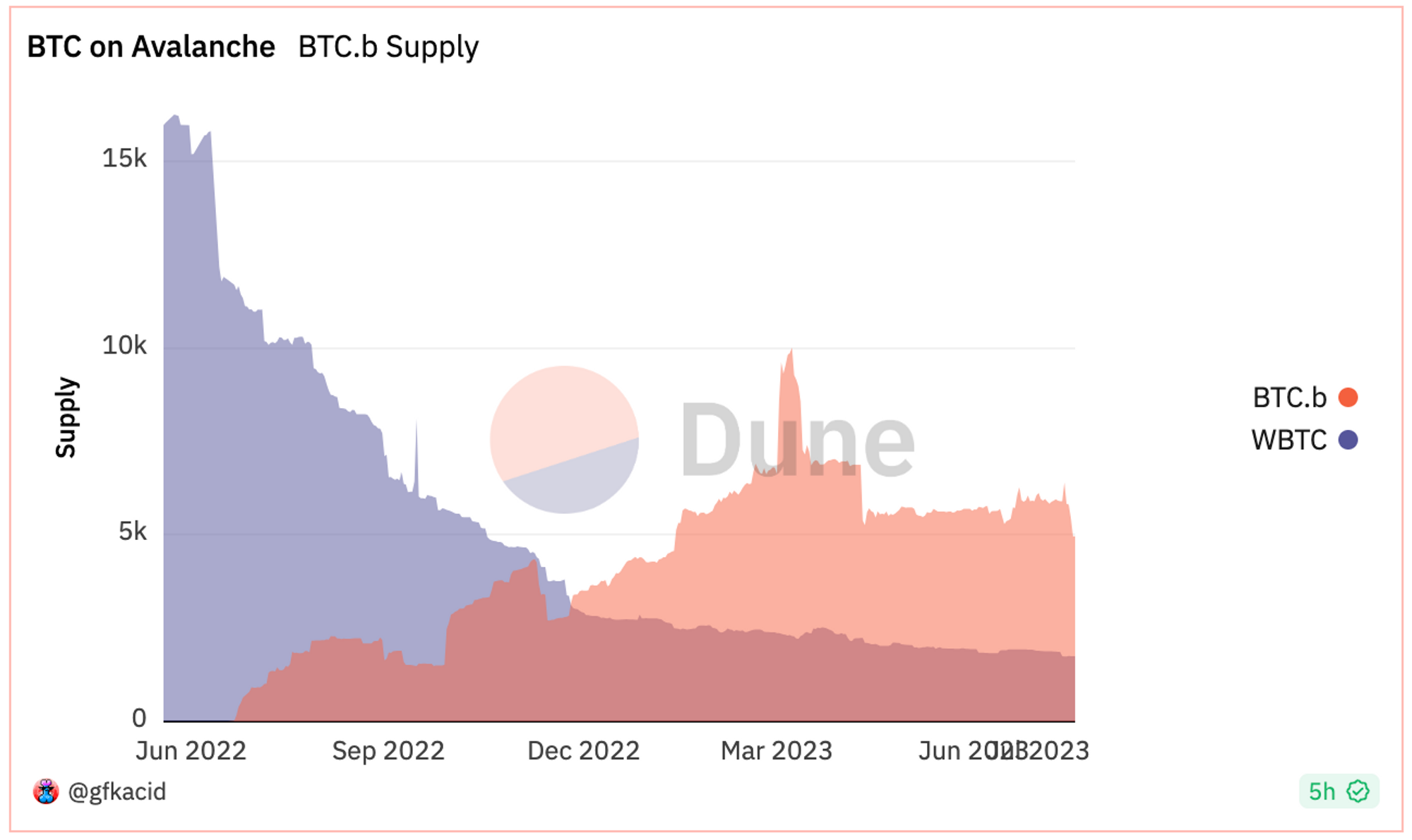

In the 12+ months since its launch, BTC.b has swiftly surpassed the supply of WBTC, with WBTC’s supply on a notable downturn, indicating a clear market preference for BTC.b.

BTC.b vs WBTC supply – gfkacid’s Dune Dashboard

In short, BTC.b allows users to:

- Mint and redeem their Bitcoin whenever they like

- Bridge at a low cost

- Be protected from price volatility & risk of depegging

- Participate in DeFi to earn yield on their Bitcoin

The previous risks associated with WBTC have now been replaced with a decentralized, borderless Bitcoin, marking the beginning of a new chapter in Bitcoin’s development.

A Borderless Bitcoin

In its evolution, BTC.b has become an Omnichain Fungible Token (OFT) built on top of the LayerZero protocol. This transforms BTC.b into a composable asset that can be used on Avalanche and all other major networks supported by LayerZero – including Ethereum, Polygon, Arbitrum and Aptos. OFTs function as native assets across all supported networks, which removes the need for reliance on centralized bridges.

The adoption of a universal token standard not only unifies liquidity but also enables seamless integration for protocols, thereby significantly enhancing the scope of yield-generating opportunities across the vast blockchain landscape.

A Look into BTC.b on Avalanche

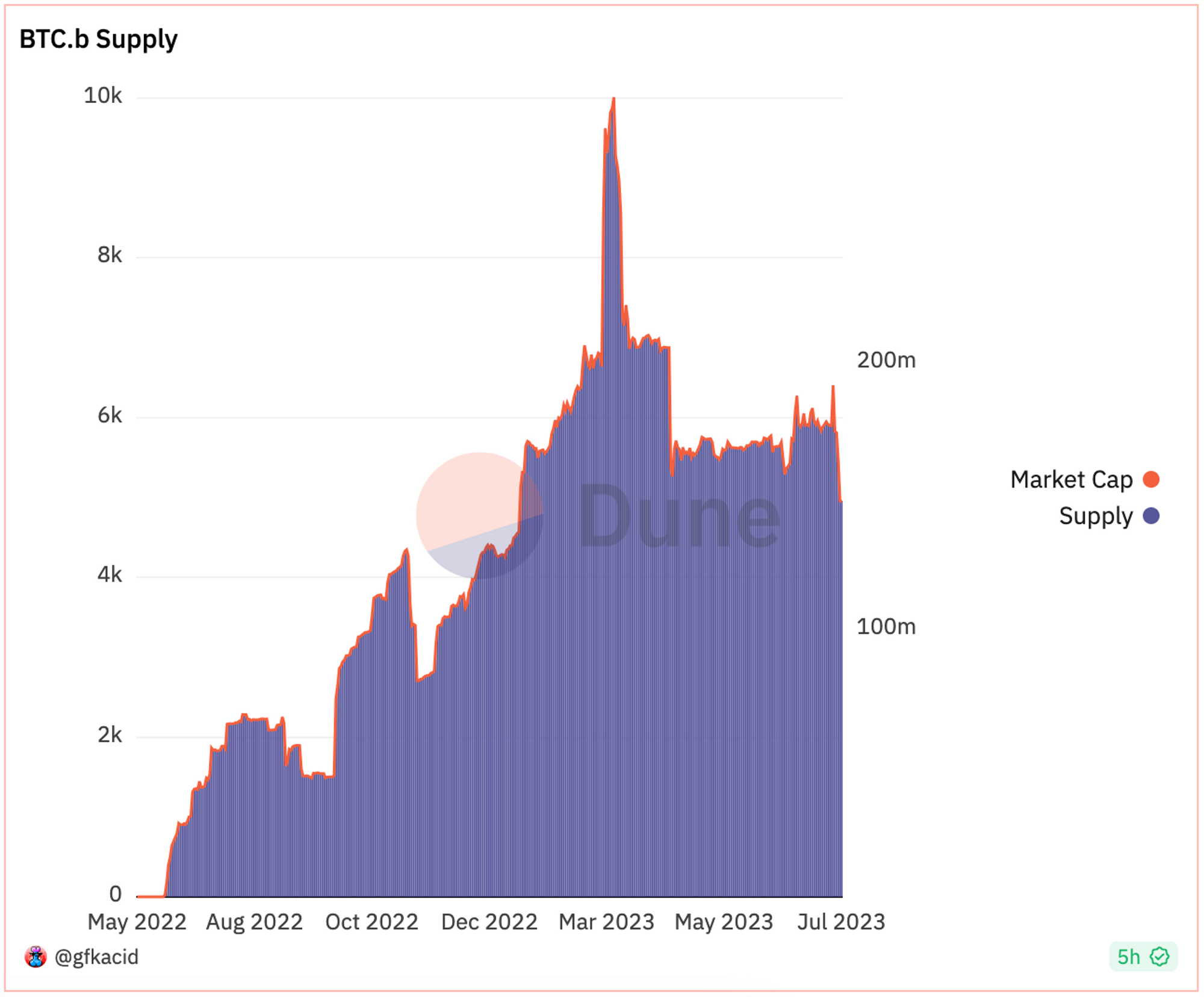

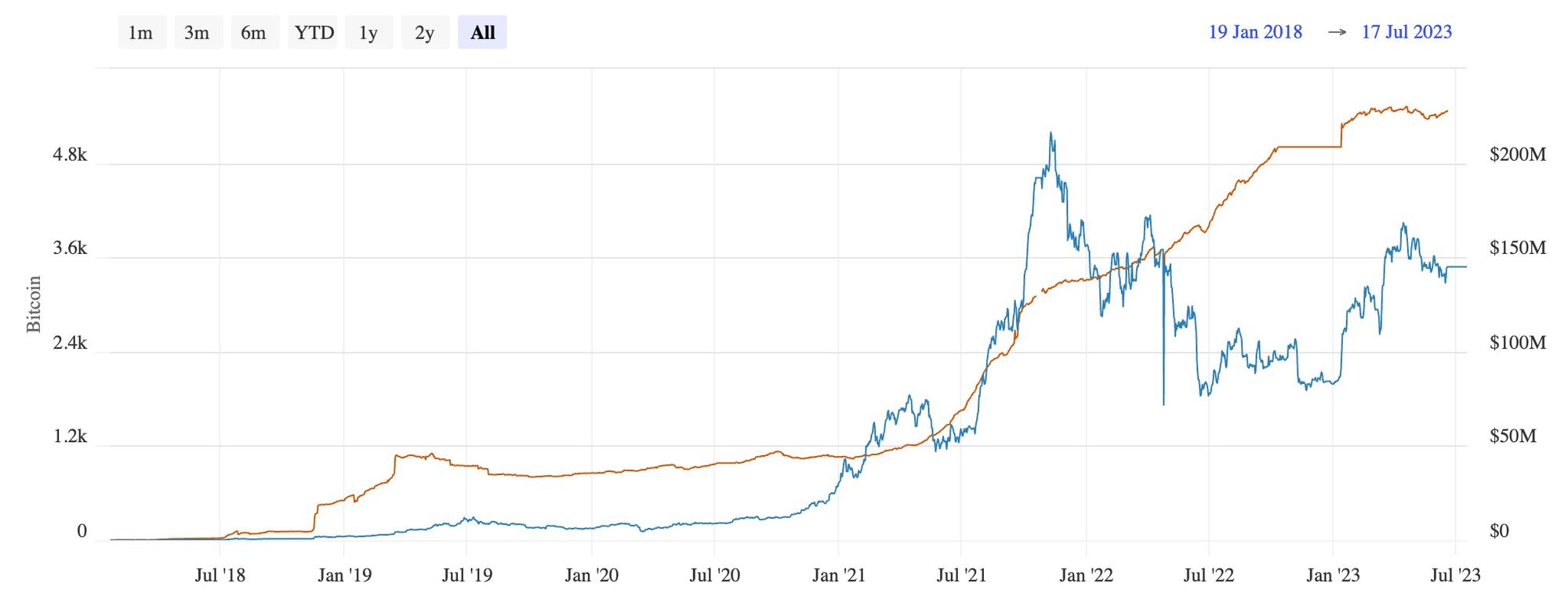

At the time of writing, there is a current supply of 4955 BTC.b with a market cap of $148M. The majority of BTC.b opportunities are on Avalanche, which holds a significant 98% of the total supply. BTC.b has effortlessly exceeded the capacity of Bitcoin on the Lightning Network, which is Bitcoin’s scaling solution. Earlier this year in March, it reached an all-time high supply of 10,000 BTC.b.

BTC.b’s journey so far not only provides a glimpse into its immense potential but also signals an inevitable growth in demand as more individuals and institutions discover the opportunities it presents.

Overview of BTC.b lifetime supply – gfkacid’s Dune Dashboard

Bitcoin capacity on the Lightning Network – txstats

BTC.b Opportunities on Avalanche

The landscape of yield-generating opportunities on Avalanche is diverse, accommodating a wide spectrum of risk tolerance levels. Here are some notable strategies:

- Fixed rate vaults on Struct Finance offering 10% on your BTC.b

- Leveraged borrowing to generate yield across integrated protocols on DeltaPrime

- Supply BTC.b or deposit as collateral and borrow on Benqi or Aave

- Customizable concentrated liquidity strategies using Trader Joe’s Liquidity Book

Where to Bridge BTC.b

To participate in these opportunities, users can bridge their native Bitcoin to Avalanche with the Core browser extension to mint BTC.b, which is facilitated by the Avalanche Bridge.

BTC.b can then be easily redeemed and bridged back to the Bitcoin network using the Core extension.

For those who wish to explore further strategies outside of Avalanche, transfer your BTC.b across multiple networks using Layerzero’s Bitcoin Bridge.

What the Future Holds for BTC.b

As we look to the future of BTC.b, it’s clear that we’re only at the beginning of exploring its tremendous potential. As the number of institutions adopting Bitcoin as a reserve asset continues to grow, it’s likely that we will see the development of on-chain financial products specifically tailored for institutional investors, with a strong focus on BTC.b-centered offerings. This would be enhanced by an expansion of opportunities across multiple networks – leveraging LayerZero’s OFT standard, which enables more complex and robust strategies across various chains without the need for intermediaries. This in turn will inevitably lead to a broader range of automated vaults, further diversifying opportunities for users to participate in, so they can benefit from the evolving DeFi ecosystem in Avalanche and beyond.

Conclusion

BTC.b represents a significant step forward in the evolution of Bitcoin and blockchain technology as a whole. By merging Bitcoin’s transformative vision with the rich DeFi ecosystem on Avalanche, BTC.b is already paving the way for a broader and more sophisticated range of financial products, thereby redefining Bitcoin’s versatility as an asset class. Given that the emergence of DeFi was enabled by Bitcoin’s original concept, it is therefore fitting that BTC.b will play a key role in driving forward a more accessible and inclusive financial system – as this deeply embodies and upholds the core principles Bitcoin was first built upon.