-

Heroes Chained AMA #2 — Technical Deep Dive with Ersin Taskin, CTO

Join us in the Avalaunch Telegram group for the second AMA with the Heroes Chained team.

We are joined again by Heroes Chained CTO, Ersin Taskin, where we will be covering the technical aspects of the project. The focus of this AMA will be the development, blockchain gaming and building on Avalanche.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 1/16/2021

- Time: 12:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

🐦 Follow: Avalaunch & Heroes Chained

✈️ Join: Avalaunch Telegram & Heroes Chained

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

Heroes Chained AMA #1 — Project Overview with Ersin Taskin, CTO

Join us in the Avalaunch Telegram group for the first of two AMAs with the Heroes Chained team.

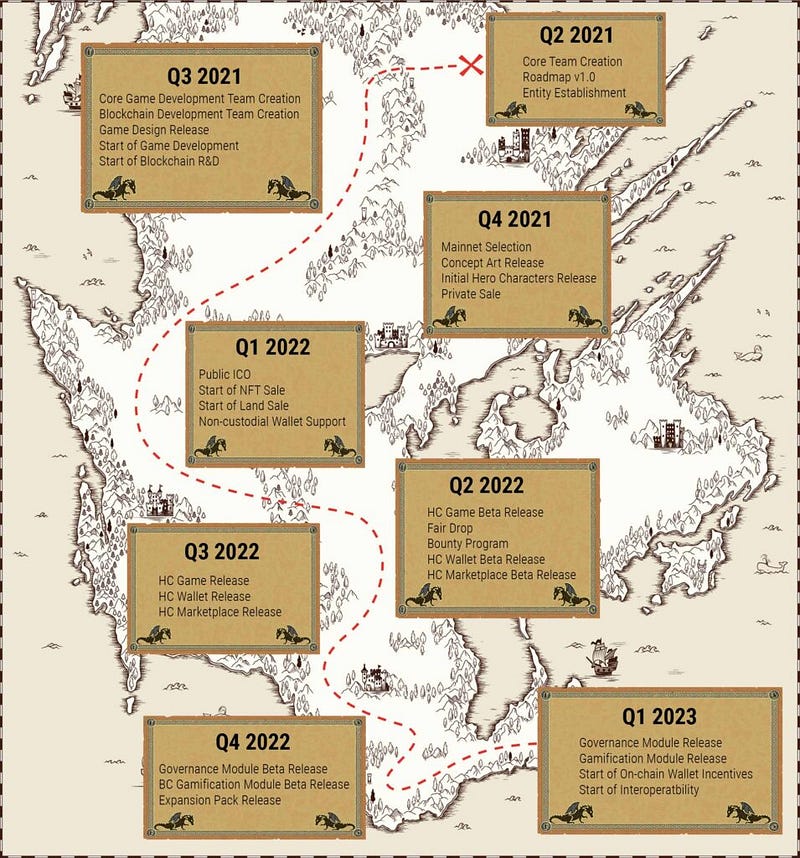

First up is Heroes Chained CTO, Ersin Taskin, where we will be covering the project at a high level. The focus of this AMA will be the business development, vision, road map, and post-IDO plans.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 1/14/2021

- Time: 12:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

🐦 Follow: Avalaunch & Heroes Chained

✈️ Join: Avalaunch Telegram & Heroes Chained

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

Heroes Chained x Avalaunch: IDO Announcement

In the annals of gaming history, there have been seminal moments and indeed epochs that came to define an era. From the 1980s until present day, we have seen many such defining moments. Now, another is upon us with the emergence of Fantasy RPG blockchain game Heroes Chained. Though blockchain gaming is indubitably seminal, the question as to whether play-to-earn is merely a heavily subsidized fad or something watershed rests squarely in the hands of developers.

What will be the zeitgeist that defines gaming in the early 2020s? A mass exodus to web3 and the emergence of a decentralized AAA experience replete with incentives that can fuel local economies? Or will it be relegated to something far more unremarkable. Time will tell of course but it appears that the proverbial deck is now getting pretty stacked.

Today, deep within the legacy world whose shoulders we stand upon, a legend has been awoken, a veritable paladin and an army of accomplished cohorts by his side. Their armamentarium is robust and they are looking to fill their warchest…and perhaps yours as well.

It is with great pleasure that Avalaunch announces its next IDO in Heroes Chained.

Overview

No one owns the future; someone’s got to take it and Heroes Chained is poised to break ground on tomorrow with their real-time fantasy action role playing game (RPG). It is an ensorcelling world of monsters and mayhem where players aspire to be Guild Masters as they gather heroes and embark on epic, perilous quests.

An execution play of the highest order, Heroes’ “Play And Earn” concept rethinks GameFi as it challenges the existing tenets of “play to earn” with a model that runs through the singular apex token, HeC.

Heroes Chained is all set to kick off a series of top game titles through a stellar fantasy metaverse project launching on the Avalanche network. Avalaunch is truly lucky and honored to have worked with this team and to be hosting their IDO.

The Fantasy RPG Game

“The fantasy world of Ventuna, which is home to many races and lands, has been ravaged by the Dark Lord Oblivion and his eternal champions. In a last stand to fight back, all the races gathered together and created the biggest city to be known in all history, ‘Last Hope’. Behind her walls, the city is able to sustain the many races and protect them from the Dark Lord Oblivion’s reach and influence. Outside the walls; the further you go, the more it takes.”

Were one to create a mantra around the Heroes Chained philosophy, “game before gamefi” may come to mind. The standard-issue low quality graphics and limited play of many blockchain games just don’t cut it.

However, these do not mean incentives are not key drivers. What jumped out at Avalaunch was HC eschewing the two-token economy and preferring to drive all value through the one and only HeC token.

Governance is certainly important but one has to look no further than a currency to see where the money flows. HeC identified this as a problem and took a stand. In the overarching sense, the problem Heroes Chained is here to solve is the issue of play-ability. Meaning, games that are simply not fun enough will have a built-in shelf life that hinges entirely on the rewards they are able to distribute.

Heroes Chained has assembled a group of bonafide all-stars as vanguards of this initiative. Their mission is to create a “sticky” game whose value proposition stands alone in terms of value; both monetarily and experientially.

Heroes Chained is a place where players own a ‘Guild’ and gather heroes, not expendables, to compete against others and complete missions en route to the ultimate guild in the city of Last Hope. Players can PvE by sending their heroes beyond the walls of the city, free to roam the terrain, fight enemies, track down nodes, buy land to claim them, discover dungeons, uncover artifacts and complete missions.

At the heart of this, remain their unique Heroes:

- Races: elves, humans, orcs, dwarves, half-beasts and lizards.

- Classes: assassins, warriors, archers, mages and healers.

- Traits: good or evil, both good and evil.

- Their respective stats relate to their individual function and utility within the game.

- Heroes are upgradeable through training, live battle and by conquering missions and quests.

- Sub-classes: All races and heroes can morph to include new subclasses in higher levels and special abilities.

Dynamic Game Play:

- PvP elements include Guild vs Guild or Team vs Team

- PvE — roam the terrain, take on enemies beyond the city.

- Alliances between guilds can be forged for Tournaments and Leagues.

The Guild

- Guild Owners — gather and train heroes

- Completing missions and battle other players

- Secure ranking in the city of Last Hope

- The home turf where resources e.g. land, resources and heroes reside.

- Upgradeable — acquire additional land and resources

Gaming Features

There will be a number of dynamic features that will further enhance the game and the overall user experience. The aforementioned land is fertile; able to produce crafting materials and in-game tokens to increase player clout and invest them deeper into the game.

To that end, there will be breeding where progeny will retain a mixture of the parental gene pool. Guild Spells act as an in-game super power which can produce shifts in momentum in the heat of battle. These examples speak to a thoughtful and immersive experience for the gamer. To tie this together, there are NFTS and a marketplace.

All game resources from cards to heroes to materials are represented by non-fungible tokens that create ownership and value aggregation for players. Naturally, where there is value, players have something they can leverage and may opt to represent them in the vibrant marketplace.

Heroes Chained — Links & Team

Website | Telegram (Discussion) | Twitter | Medium | Discord | Instagram | Facebook | Reddit | Twitch

Team: This team needs no introduction and can stand up against any leaders in the blockchain universe, or elsewhere for that matter. In fact, it is more than worth a visit to their litepaper to see the bios of the sixteen professionals dedicated to the project. Their Executive Producer Mev Dinc is known in gaming circles as “The Legend,” and has a published autobiography attesting to his life’s work and contributions to the gaming industry. Their Art Director, Onur Can Cayli has created for Game of Thrones, the Avengers, the Terminator, Stranger Things, Hunger Games, Marvel among other blockbuster films and TV series.

Their executive leadership is truly unrivaled from top to bottom and full of accolades. It is an honor to work with them.

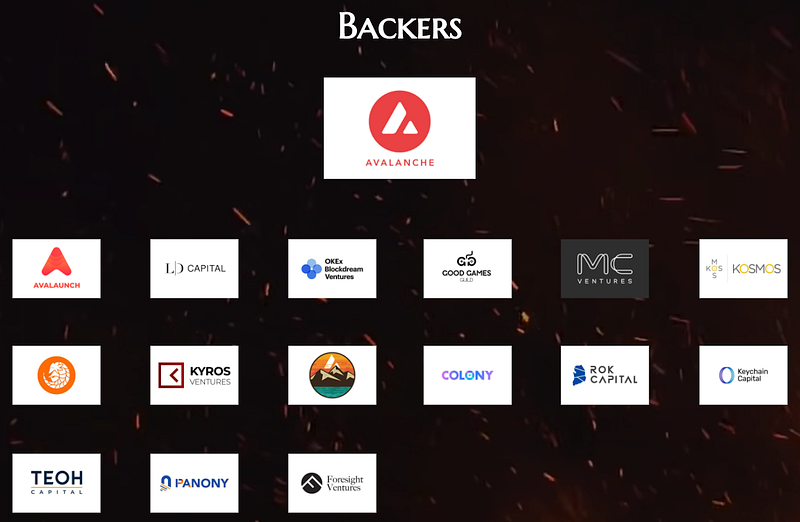

Partners and Backers:

This is a well-capitalized team who attracted many of true value-add “smart money” contributors in the space. Projects who have the luxury of selecting their earliest backers are provided a measure of support that is hard to come by in private equity.

Closing Thoughts

In the day and age of GameFi, it is easy to overlook the importance of artistry, storytelling and immersion of experience because in-game rewards currently rule the day. However, true adoption and sustainability remain contingent upon both and this would be the Heroes Chained difference.

They recognize the relationship between the “fi” and the game and are acutely aware of how the conspicuous absence of state-of-the-art games has been so effectively hidden in play view. This is perhaps shrouded by some short-term thinking as GameFi is a symbiosis and the link between the two is inextricable and non-negotiable. Their vision is simple:

Optimize a game that people love to play and incentivize them with rewards. Only when both pieces are in place will the cornerstone of something that can truly last generations be set.

The HeC token is similarly thoughtful as it combines both in-game and governance utilities into one, along with a deflationary mechanism. Moreover, it creates value through NFTs and a marketplace for good measure.

Rather than summate HeC into governance, DeFi, in-game, marketplace utility etc., we see it as the creation of a virtual island nation with a token that effectively dictates policy, provides fuel and a medium of exchange for crafted items, lands, assets, game power and trading.

How big that island nation becomes is what we all look forward to witnessing.

Funding Numbers:

- Pre-Seed: 6.75M HeC at .08 USD — $540,000 USD

- Seed: 5.5M HeC at .12 USD — $660,000 USD

- Private: 7.75M HeC at .25 USD — $1,937,500 USD

- Public Sales: 4M HeC at .35 USD — $1,400,000 USD

- Total Raise: $4,537,500 USD

Supply — Breakdown

Total Supply: 100,000,000 HeC

- Rewards & Staking: 40M HeC (40%)

- Team & Advisors: 20M HeC (20%)

- Community & Marketing: 8M HeC (8%)

- Private: 7.75M HeC (7.75%)

- Pre-Seed: 6.75M HeC (6.75%)

- Seed: 5.50M HeC (5.5%)

- Public Sales: 4M HeC (4%)

- Foundation: 4M HeC (4%)

- Liquidity Provision: 4M HeC (4%)

Vesting Following TGE:

- Rewards & Staking: 48 months daily linear vesting

- Team & Advisors: 9-month cliff, 24 months daily linear vesting

- Community & Marketing: 2% at TGE, 18 months daily linear vesting

- Private: 10% at TGE, 3-month cliff, 12 months daily linear vesting

- Pre-Seed: 9-month cliff, 24 months daily linear vesting

- Seed: 5% at TGE, 4.5 month cliff, 15 months daily linear vesting

- Public Sale: 20% at TGE, monthly vesting over 6 months

- Foundation: 1% at TGE, 18 months daily linear vesting

- Liquidity: 20% at TGE, 3 months daily linear vesting

Other:

- Initial Circulating Supply: ~2.05M HeC (excluding liquidity tokens)

- Initial Market Cap: ~717.5K USD (excluding liquidity tokens)

The Heroes Chained IDO on Avalaunch

- Total Supply: 100M HeC

- 2.857M HeC at .35 USD

- Sale Size: $1,000,000 USD

Registration Schedule:

- Registration Opens: January 13th at 3:00 p.m. (UTC)

- Registration Closes: January 16th at 6:00 a.m. (UTC)

Sale Schedule:

- Validator Round Begins: January 17th at 6:00 a.m. (UTC)

- Validator Round Closes: January 17th at 3:00 p.m. (UTC)

- Staking Round Begins: January 17th at 3:30 p.m. (UTC)

- Staking Round Closes: January 18th at 6:00 a.m. (UTC)

Avalaunch IDO Recap

- Total HeC for sale: 2.857M

- Price: $.35

- Size: $1,000,00

- Vesting — 20% at TGE, monthly vesting over 6 months

-

Islander AMA — Project Overview with Viet Anh Tran, CEO (Recap)

On 01/03/2022 at 9:00 p.m. (PST), an AMA session was held on Avalaunch with special guest Viet Anh Tran, CEO, Islander . Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Hello and welcome everyone to another AMA brought to you by Avalaunch. In the crosshairs today is our upcoming distribution event, a veritable first and our partnering project is none other than Islander. Here to tackle the tough questions and tell us more is Viet Anh Tran, one of the co-founders and the presiding CEO of this innovative earn-to-learn project. How are you today @vietanhtran2105 ?

Viet Anh Tran| Islander

I’m feeling very excited, especially with what we are currently doing with Avalaunch. So it’s more than a good day sir

Dave Donnenfeld | Avalaunch

Glad to hear that. So let’s get the party started…

To start off with, please introduce yourself. What did your career and education look like before joining the crypto landscape?

Viet Anh Tran| Islander

So I’m Viet Anh — Founder and CEO of Islander.

In Vietnam, most people know me as the Founder and CEO of Spiderum — a social media platform for youth to share opinions/knowledge with around 100.000 users and millions of visitors per month through many other channels such as: website, YouTube, Facebook…

I was a small investor in crypto for a few years as well, before this first effort to venture in this space with Islander. So far everything has been good because I personally learned a lot and made so many good friends along the way.

Dave Donnenfeld | Avalaunch

That background is going to serve you in crypto most certainly as aggregating marketing power in this space is probably akin to herding cats. 😀

It would be great to get an overview of the team, how everyone came together, and what the day-to-day operations of the project look like at this point.

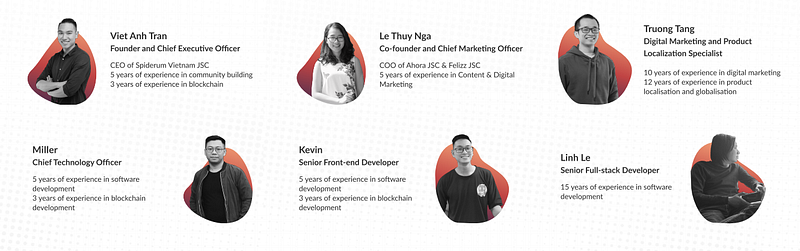

Viet Anh Tran| Islander

I think we have certain advantages when it comes to this part

We are a team that have been working together for years, through countless ups & downs, so our trust in each other’s capabilities is strong. Our CMO Nga has been working with me for 6 years now since our first startup Spiderum, other members also worked with me for a long time now, also in Spiderum.

We shared the same vision of building sustainable products because we found each other and worked together in Spiderum. In Vietnam, what we are proud of the most is that we have always been considered good community builders by our community, who have resilience and integrity. We would love to bring our philosophy to the crypto world as well.

Dave Donnenfeld | Avalaunch

Thank you for the comprehensive answer Ser…moving along

What is Islander at a high-level and what makes it important and relevant in today’s crypto landscape?

Viet Anh Tran| Islander

Islander is an online learn-to-earn and a decentralized platform to manage and market your own projects in a unique way. Project owners (crypto project managers, influencers, content creators) can quickly engage their audience’s attention and nurture them in the long term by giving out interesting and interactive quests as well as tradable NFT items, which are either pre-made by the platform or customized by its users.

Our main features & offerings:

- Innovative marketing services for crypto projects

– Permission less affiliate model for influencers

– Learn-to-earn activities for crypto enthusiasts

– Ranking Features & Tracking Dashboard

We all know that there have always been huge obstacles: the lack of tools and the lack of know-how, that held the adoption and promotion of Blockchain projects to the new-comer Investors. With Islander, we aim at making the adoption & promotion easier, Blockchain Projects will be able to apply many interesting game elements into the promotion of their projects, such as Game Visuals, narrations, quests, rewards, leaderboards and so much more. Our aim is not to create a game, but to make investing and marketing a game.

Dave Donnenfeld | Avalaunch

Boom. Just like that. The Imperium people stepped up with the bullets and you’re following suit here. The AMA game is tight.

Bringing together communities, learning and marketing in one unified platform is a very compelling use-case for crypto. How did the idea come about and why was it important for you to build this project?

Viet Anh Tran| Islander

I think it started from our own pain point as community builders in Spiderum. We have always wondered how we could leverage the power of the community and incentivize our users to support the platform growth. With Islander, we believe that we can leverage the power of blockchain technology to not only help us but also help others who face the same struggles. At the end of the day, community is the most important thing for us, and we would love to help others to engage and build their communities sustainably.

I believe Islander will attract a lot of attention from crypto projects as community building is really a pain point in the market right now. One of our missions is to create a solid target market and distribution method through a learn-to-earn and quest-based model. We believe that we can help newborn projects build solid communities by educating their members through our learn-to-earn model.

Dave Donnenfeld | Avalaunch

It is hugely needed in crypto, more of a gaping hole than a pain point.

I have to say that gamified marketing is very metaversal so the larger play here is apparent. Since we’re redefining the future of work here — Tell us about the “learn-to-earn” model and why this will be impactful for people globally.

Viet Anh Tran| Islander

With the learn-to-earn model, crypto projects can create quests to incentivize users to learn and market the product. For the crypto enthusiasts, they will save a lot of time and effort finding the right projects they would like to support, and even earn rewards by learning/sharing about them.

It’s a win-win situation in which crypto enthusiasts get rewards for acquiring knowledge and flattening the learning curve to join crypto, while projects can attract the right supporters who would be there for them in the long run. At the end of the day, we believe that quality will outweigh quantity when it comes to community building 🙂

Dave Donnenfeld | Avalaunch

What exactly is “an island” on Islander and how do they work? What are the various aspects of the project that come together to make this unique?

Viet Anh Tran| Islander

With Islander, we want to create a world with thousands of islands, each one is the representation of a crypto project. Islander will allow project owners (on our platform they are Island Lords) to create quests to attract, educate and engage with their community members. On Islander, everyone can also be influencers (Boat owners), who can get extra rewards by bringing residents to islands through affiliate marking activities.

Dave Donnenfeld | Avalaunch

Let’s populate some islands 😀

Within Islander there is a ranking system that allows users to grow reputation inside of the platform. What can you tell us about the system and why is this an important component to the Islander ecosystem?

Viet Anh Tran| Islander

Almost all games have a leaderboard, and Islander is no exception. With the help of transparent crypto transactions, the Islander Leaderboard will offer fair competition for everyone.

Islander will have different leaderboards for different parts of the platform, which we will introduce along the way in our development plan:

- Island Lord Leaderboard: For Islands (Crypto projects) that have the most residents/the highest rewards distribution/etc.

– Boat Owner Leaderboard: For Boat Owners (influencers) who bring the most residents to different islands

– Resident Leaderboard: For residents who complete the most quests on Islander

We will also introduce monthly, quarterly, and yearly leaderboards with different rewards introduced and developed further in the future.

Dave Donnenfeld | Avalaunch

Nicely laid out. At launch, the platform is integrated with your brainchild Spiderum. What is the significance of this integration and how did it come to be a part of the platform at launch?

Viet Anh Tran| Islander

To be clear here, the integration will happen later in our Roadmap, meaning later this year. But it will definitely be a big milestone that we all are looking forward to

Our intention is to develop a solution to plug in web 2.0 communities like Spiderum (and Spiderum would be the perfect test to customize, optimize). Islander is designed to fit perfectly in the use of intellectual property, such as content, where content creators from many other platforms as Spiderum can create and optimize their “conditions’’ for others to access their works, with not just cryptocurrency, but with NFTs ticket or trading with other content creators on the ground of blockchain technology. Our ambition is to empower existing web 2.0 communities and bring them to a web 3.0 environment.

Dave Donnenfeld | Avalaunch

That’s something to point to as it will tie things together nicely

Islander also utilizes NFTs to achieve a unique sense of ownership over the reputation on the platform, amongst other things. What roles do NFTs play within the Islander ecosystem and how do you expect people will use them?

First of all, we will offer cashflow NFTs (for example Boat NFTs for Boat Owners on Islander) that help people make more money while learning and helping crypto projects to grow. We also intend to expand the Islander World into a metaverse called The Island-verse. This is to push the idea of using NFTs in Affiliate Marketing further, making it available to other areas such as art and music, sport and sport betting, video games etc. We also want influencers and content creators on other platforms to have means to spread their works easier by selling access to their “crops” (knowledge/content) through NFT tickets.

Dave Donnenfeld | Avalaunch

Let’s talk about the iSA token and it’s utility. How does it drive the platform and encourage adoption?

Viet Anh Tran| Islander

So our token is ISA and here are its use cases:

1. Payment for platform services:

– Projects: user reports/analytics, marketing services (banner, ranking etc.)

– Influencers/ users: payment for affiliate & learn-to-earn activities

– Content creators: payment to mint NFTs tickets to sell access to exclusive content2. Staking: Tier up to earn interest and have higher platform benefits

3. Burn mechanism: part of platform fee will be converted to ISA are burned as a mechanism to reward all ISA holders community by reducing total supply

Dave Donnenfeld | Avalaunch

People loving on a deflationary mechanism Sir. What does the development roadmap look like and what has been accomplished so far?

Viet Anh Tran| Islander

This is our roadmap. So basically the next big milestone is that we will be launching on mainnet at the end of this month. There will be huge campaigns that we will work together with our partners to bring the concept of Islander to the community in the most convenient and rewarding way.

You might have joined our testnet event, in that event we attracted 100k+ participants in under a week and had to close earlier than expected because the reactions were much higher than we dared to expect. I hope the mainnet events will drive the same or even better results when it comes 🙂

Dave Donnenfeld | Avalaunch

Good on you for being so close to mainnet. How does Islander plan to drive adoption of both users and crypto communities?

Viet Anh Tran| Islander

In the case of Islander, the problem is a chicken-egg problem (which we have faced and solved before with Spiderum, so lucky for us haha): to acquire users to participate in the task, there must be quality projects; In contrast, to attract quality projects, a large enough user base is needed. Islander develops both in parallel through the following forms:

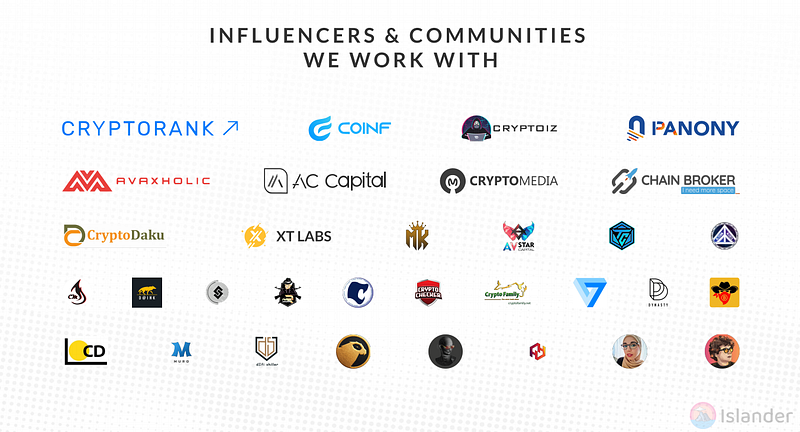

On one hand, we formed partnership with high potential and quality projects: Currently, Islander has been cooperating with Avalaunch, Pangolin, Kalao, YAY Games, Colony, RocoFinance, Talecraft, Avaxtars, Avaware, SupraOracles, DareNFT, Faraland,… and will continue to promote activities with other projects in the future.

On the other hand, we formed partnership with communities/KOLs to not only market the project but also encourage them to set up a profile on Islander and support possible campaigns on our platform later on. Till now, Islander has cooperated with many large communities/KOLs such as Coin68, TCVN, CoinF, CryptoFamily, AVStar, Cryptoiz, Moneyking, Avaxholic, Dynasty Korea, Maven Capital, Top 7 ICO, Crypto Differ…

In order to keep our users with us in the long run, Islander will continuously listen to feedback from the market and constantly develop products, features, and build more extensive cooperation to deliver a great product and solve each and every day challenges that projects and users are facing

Dave Donnenfeld | Avalaunch

You have been very active in this regard. One of the more integrated projects we’ve had coming into their token generation and I’d imagine the distribution with us is only going to help that.

What was it about Avalanche that compelled you to build here? What has been your impression of the community and its ecosystem so far?

Viet Anh Tran| Islander

For sure, and we are very grateful to have this opportunity to work closely with Avalaunch. You guys have always been the role model for projects like ours 🙂

Coming back to your question, the reason we chose Avalanche is, besides Avalanche being a blockchain with great UX and speed and impressively rapid growth, we are amazed by how the people behind Avalanche and also the builders in the Avalanche ecosystem created an ecosystem of knowledge and mutual support among blockchain projects built on it.

For example, we have learned a great deal from our partners, especially Avalaunch, or Kalao, Colony, Pangolin… This is not the case with other chains, where new projects might not be able to find the same amount of support at their earlier stage despite how hard they try. Many ecosystem, in our opinion, seem to be too crowded and chaotic for a new project to acquire the right mentorship and partnership that could help them build sustainably for a long time.

Dave Donnenfeld | Avalaunch

these are good points. Avalanche projects are generally pretty open and quite helpful to each other.

what is the Islander “grand vision”? What would the project look like in 5 years if the team was able to execute on it’s most ambitious version of the project?

Viet Anh Tran| Islander

The end goal in mind for us right now is to build a decentralized world facilitating knowledge transfer and accelerating mass crypto adoption.

In the long run, we would like to create an Island-Verse where every player, from crypto projects, influencers to individuals, can connect, exchange values and gain benefits in a gamified economy. Users can own and trade NFTs, build communities, and earn crypto rewards by playing and contributing to the development of this Island-Verse.

Twitter Questions

@KomKotha who asks — Can you get influencers and crypto market participants to evaluate the project?

Viet Anh Tran| Islander

In the Islander world, influencers and crypto market participants are the ones who directly evaluate and decide the success of the project. The better the project, the more appreciated it will be by influencers and crypto enthusiasts. And of course, if the project is good, that island will be more popular.

@muinlyreol wants to know — Given current market conditions, can you explain why users should participate in the long-term development of the Islander ecosystem?

Viet Anh Tran| Islander

I love the question and will be as straight as possible to you: We can’t control the market. We can’t tell/give you the advice on what to do with ISA. What we do best from day 1 of our entrepreneur journey till now is keeping ourselves honest to everyone — our partners, clients, users etc.

But you can be sure that, due to the nature of Islander, which is developed to support other projects and help Retail Investors connect with great investment opportunities, we can continuously develop our product and partnership to actually generate more and more revenues even when the market is bearish.

Besides all that, we have the experience of managing and developing platforms, with the contribution of the best people in Product Development, Marketing, 2D/3D Art, and Gamification… We succeeded in building Spiderum from scratches. I can promise you that we are eager to do it again, with Islander, for many years to come, with all of our passion. We’ve been through thick and thin, and this time we will be ready to face whatever comes towards us. So yes, please stay with us for our long-term vision if you have confidence in what I’m saying 🙂

@trinhcrypto1997 — Could you tell us some of the projects you’ve onboarded and the plans to attract more real crypto enthusiasts to Islander?

Viet Anh Tran| Islander

Till now, Islander has been cooperating with some prominent projects such as Avalaunch, Pangolin, Kalao, Colony,Talecraft, Avaware, Faraland… and we will do something interesting together later this month

We believe that by attracting the right projects and setting good learn-to-earn campaigns, we will attract more and more crypto enthusiasts into our platform

@ladyseorama — What were the reasons that motivated you to create the Islander project?

Viet Anh Tran| Islander

I think I already answered this question above 😀 it comes from our own pain points as community builders in the case of Spiderum

@billkillchill — what was the inspiration to use the “island” as a concept?

Viet Anh Tran| Islander

Because in Islander, each island will represent one project. And a good project will be an island with many residents, in which each resident represents one crypto enthusiast. Also, the concept of boat owners would also resonate with the whole idea. So in short, with this island concept, we will make the project development story more interesting and intuitive to every one to be engaged.

Telegram Questions

I’m curious … Will I be able in the future to buy an island as a special, rare and unique NFT on Islander?

Viet Anh Tran| Islander

If you are a project owner, then the answer is possibly (not now though, we are offering islands to some of our earlier partners for free). But as crypto enthusiasts, we will have other NFTs to offer soon, these NFTs would help you earn more in our learn-to-earn and share-to-earn activities. Please stay tuned and follow us for more updates in the coming months 🙂

Binance exchange is life changing for many crypto project. Have you ever dream that one days $ISA token will listed on Binance? If yes, What’s the core factors that motivated you to make it became realty?

Viet Anh Tran| Islander

Our focus is on building a really good product and other things would just come as a result of good work. So in order to answer this question of yours, I think exchange listing is cool because it works like a recognition of your work, but we in Islander don’t want to rush for anything and don’t want to put it as one of the achievements we have to reach no matter what. Instead, we want to focus on serving our partner projects & users to our fullest extent and we will see how it goes from there 🙂

I want to ask why did you choose to put Islander on the Avalaunch chain? And how does your team ensure the price of ISA won’t drop big after IDE because 100% of ISA sales will go to the stakeholders of the XAVA community.

Viet Anh Tran| Islander

I already answered the part about our choice to build on Avalanche ecosystem earlier. But I still choose this question because I want to answer the second part of your question.

There will surely be participants who take short-term profit in every IDO, but we are confident that we have been working closely with Avalaunch and other partners to prepare for the scenario you mentioned.

Your concern is really on point. However, unlike the common situation where projects have to solve the conflict between backers and supporters, Islander believes in giving prospects for both by growing the community with ISA distributed carefully.

After analyzing the situation, we realized that the chance is low, especially when we have our Mainnet event coming soon, which is considered a great leap in our product development and will positively affect the market. This scenario is also included in our Market Making plan, which covered such situations and also how the market condition will be.

Besides, it is Avalaunch we are talking about. Avalaunch has always been one of the best (if not to say the best) launchpads, and for a long time, the Avalaunch Community has been informed and familiar with our Islander project. I think we won’t see a big problem here at all 🙂

I have read that on the Islander platform that you provide customizable tasks, management applications, and payment gateway services. Can you tell me how the payment gateway works and in which area it will be used?

Viet Anh Tran| Islander

This is what we will develop to support content creators in the future. Basically what it means is that content creators can sell access to their exclusive content through the payment gateway supported by Islander & our ISA token and through our NFT-powered tickets.

Islander has collaborations with partners like Kalao, YAY Games, Colony, SupraOracles. Will your collaborations continue in the future? What kind of work do you do with your partners, what is the advantage?

Viet Anh Tran| Islander

Absolutely. Our partnerships are always built for long term and there are many things we could do together with each and every partner. For example, our partners can all organize learn-to-earn campaigns on Islander, and it will be long-lasting. At the same time, with specific partners there will be other things we could work together as well. For instance, let’s take Avalaunch into consideration: we both could work together to build a mutual plan to support new and promising projects by leveraging the power of both of our communities, and those kinds of partnerships are the things that we would keen on exploring for the development of the whole Avax ecosystem.

Dave Donnenfeld | Avalaunch

Very much appreciate your time here today and the thoughtful answers

It’s been impressive and a breeze to go through.

Viet Anh Tran| Islander

Thank you very much for listening to me today. I hope I was able to share some information about our project that could be helpful for the Avalaunch community

Dave Donnenfeld | Avalaunch

We very much look forward to the unprecedented distribution offering and inviting our community to hold and participate in the Islander Initiative.

On behalf of us all, many thanks.

Lovish Shahi| Avalaunch

If you want to learn more about Islander, please do not hesitate to follow our social channels here: https://flowcode.com/page/islander

Viet Anh Tran| Islander

My biggest thanks to the Avalaunch team for making this happen. We really appreciate it and as I said, you guys have always been our role model and I wish that our partnership would last forever 🙂

Dave Donnenfeld | Avalaunch

Thank you. Been great getting to know you and Islander and look forward to our continued work together.

- Innovative marketing services for crypto projects

-

Islander AMA — Project Overview with Viet Anh Tran, CEO

Join us in the Avalaunch Telegram group for the first of two AMAs with the Islander team.

We will be joined by Viet Anh Tran, CEO, where we will be covering the project at a high level. The focus of this AMA will be the business development, vision, road map, and post-IDO plans.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 01/03/2021

- Time 9:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

🐦 Follow: Avalaunch & Islander

✈️ Join: Avalaunch Telegram & Islander

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

Islander IDE x XAVA Airdrop: Initial Distribution Event

Despite the advantages and intrinsic fairness of life in a decentralized world, good information is fragmented and even the best projects can be passed over if they don’t get needed attention from jump.

As anyone who has attempted to navigate the landscape of crypto can attest, messaging is spread far and wide. For those seeking even the most basic knowledge, there are endless social media outlets espousing the virtues of their favorite chain, project or technology. Ordinary people can find it overwhelming and often resign themselves to being exposed to a mere glimpse of what is out there.

For marketers, it is similarly problematic. Even the most qualified are often siloed and entirely left to their own devices as they labor to reach an overwhelmed audience. There are just too many flags planted in the ground and not enough cooperation and cohesion in the message. Islander has set out to change this through the creation of the ISA token paired with a rather inventive “learn-to-earn” model.

The Reveal

This is a project that is a long time coming; having been forged over the course of many months through friendship and a basic desire to make the space better. For Avalaunch as a platform, we have noted the genuine strides Islander has made in recent months—from both a business and technical perspective. Their raise overall is modest as it is a grassroots projects so initially, despite our relationship and support, we wondered if an IDO would be possible.

Not wanting to raise more than what they need, a boutique style offering was created for the Avalaunch community totaling $300,000 USD worth of ISA. We thought it might be a great time to show appreciation and support for the community as well as the Islander initiative and purchase this allocation for our second IDE (Initial Distribution Event).

To that end, the Islander public sale has been purchased by Avalaunch and will be distributed at no cost to our devoted community through our second IDE (Initial Distribution Event). The IDE will operate similarly to our IDOs, minus any costs to the participant.

But wait…there’s more!

In addition to the Islander allocation, Avalaunch will be adding $300,000 USD worth of XAVA to the IDE, bringing the total up to $600,000 of pooled assets.

Overview

At its core, Islander is a decentralized affiliate marketing program that is powered by NFTs and intent upon revolutionizing the legacy affiliate model via its learn-to-earn mechanics. Central to this proposition is the native token Islander (“ISA”), which serves multiple purposes:

- To help projects discover, grow and maintain an audience of bonafide supporters.

- Allow key opinion leaders the opportunity to leverage their combined marketing power and earn.

- Create earning opportunities for content creators.

Additionally Islander provides:

- Intuitive toolkits for users to manage multiple projects

- Full support for developers

- Wallets, plugins and management apps

- A payment gateway platform

A permissionless, share and earn proposition that is powered by NFTs could represent a boon for crypto projects, content creators, marketers and enthusiasts alike. If there ever was a grassroots, community-driven project building on Avalanche, this may well be it. The Islander team is driven and spirited. Their raise is modest in size but their ambitions are by no means small.

Islander — Links & Team

Website| Telegram (Announcement)| Twitter |Medium

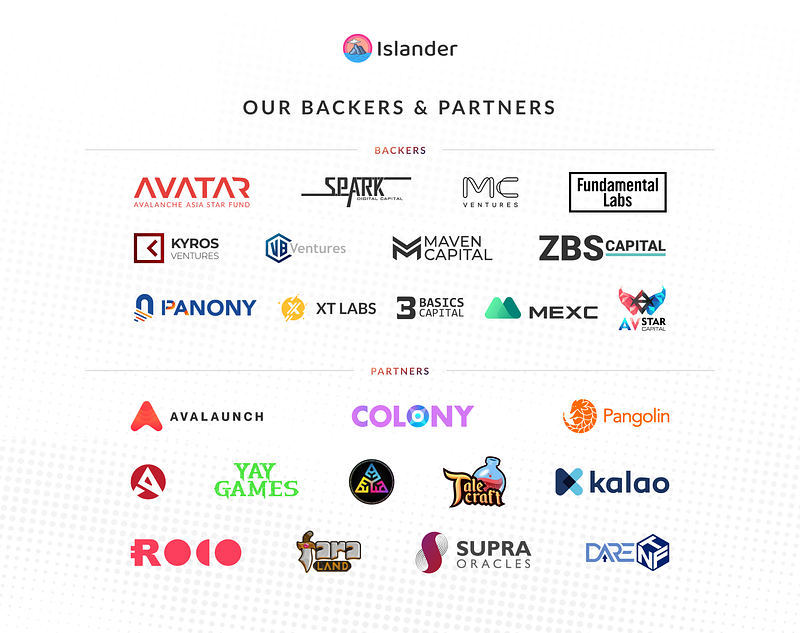

Partners and Backers:

Naturally, a project that aims to aggregate content creators, key opinion leaders and the litany of qualitative contributors to the crypto ecosystem, it stands to reason that those they are working with is a good indicator of their development.

Their list of Avalanche ecosystem partners and backers is also considerable:

“Avalaunch has always been our most trusted partner from Day 1 of this journey. We are very happy to finally work with Mark, Dave and the team not only in this IDO, but also in many other activities in the future. Islander and Avalaunch both value honesty and integrity and these shared values will undoubtedly ensure a long-term partnership between us,” states Viet Anh Tran, Founder and CEO of Islander.

Final Thoughts

The idea of aggregating marketing power and community is not lost on us—we are, after all, only as good as our community and the projects they embrace. Islander has come a long way in a relatively short period of time as evidenced by the inroads they have made in the Avalanche community along with some notable fundamental progress. Having had the fortune of knowing them for many months, they have matured to the point where we feel they are ready for launch.

Funding Numbers:

- Seed: 770M ISA at .0005 USD — $385,000 USD

- Private: 1.05B ISA at .001 USD — $1,050,000 USD

- Public Sale: 200M ISA at .0015 — $300,000 USD

Total Raise: $1,735,000 USD

Supply — Breakdown & Vesting:

Total Supply: 15,000,000,000 ISA

- Ecosystem: 4.5 B ISA (30%)

- Staking Rewards: 2.25B ISA (15%)

- Team and Advisory: 2.25B ISA (15%)

- Marketing & Partnerships: 1.715B ISA (11.43%)

- Liquidity Provision: 15,000,000 ISA (10%)

- Private Sale: 1.05B ISA (7%)

- Seed Sale: 770M ISA (5.13%)

- Content Creators: 750M ISA (5%)

- Avalaunch: 200M ISA (1.33%)

- Testnet Airdrop: 15M ISA (0.1%)

Total of 99.99% resulting from rounding

Vesting Following TGE:

- Ecosystem: 30-day cliff, monthly vesting for 60 months

- Staking Rewards: 30-day cliff, monthly vesting for 40 months

- Team and Advisory: 12-month cliff, monthly vesting for 20 months

- Marketing and Partnerships: 3% at TGE, monthly for 32 months

- Liquidity Provision: 600K at TGE (2-sided), discretionary Unlock*

- Private Sale: 10% at TGE, 60-day cliff, monthly for 18 months

- Seed: 5% at TGE, 3 month-cliff, 24 months vesting

- Content Creators: 3% at TGE, monthly for 32 months

- Avalaunch IDO: 50% Unlocked at TGE, weekly for 4 weeks

- Testnet Airdrop: 100% unlocked

*Following TGE, the liquidity unlocks are discretionary as their overall listing plans are not yet fully finalized.

Other:

- Initial Circulating Supply: 332.45M ISA (excluding liquidity tokens)

- Initial Market Cap: 498,675 USD (excluding liquidity tokens)

- Initial Liquidity: 600K total—300K ISA and 300K USD of AVAX

- 100% of the sale will go to community stakers of XAVA

Recap

- Total ISA: 200M ISA

- 100% will go to the community stakers of XAVA

- Size: $300,000 purchased by Avalaunch

- Vesting — 50% Unlocked, weekly distributions for 4 weeks

Islander IDE Instructions

As this sale is unique, the steps to participate will look slightly different than our regular IDOs.

1. Registration

You will register for the IDE as normal during the registration period. You will still need the 1 AVAX deposit, which will be returned to you during the claim process.

2. Sale

There will not be a validator or staking round where you purchase your allocation. To be eligible for your ISA and XAVA allocation, all you need to do is register with your stake or validator as normal.

3. Redemption

We will deploy a claim card on our airdrop page for you to claim your allocation, instead of you needing to purchase it during the sale. This means you don’t need AVAX to purchase or deal with gas fees during the IDE.

4. Redemption Details

When the claim card is live, you will be able to claim your allocated ISA, XAVA and 1 AVAX deposit in one single transaction.

The Islander IDE on Avalaunch

- 200M ISA (Total Supply: 15B ISA)

- Purchased and distributed by Avalaunch

Registration Schedule:

- Registration Opens: January 2nd at 3:00 p.m. (UTC)

- Registration Closes: January 5th at 6:00 a.m. (UTC)

Claiming Schedule:

- Claiming Goes Live: January 7th 6:00 a.m. (UTC)

The XAVA Airdrop on Avalaunch

Those who register and participate in the Islander IDE will also receive an equal dollar amount worth of XAVA.

- 300K USD worth of XAVA at market value

- Price to be determined after registration closes and prior to the beginning of the claiming round

-

Imperium Empires AMA #2 — Technical Deep-Dive with Cliff Yung, CEO (Recap)

On 12/19/2021 at 10:00 p.m. (PST), an AMA session was held on Avalaunch with special guest Cliff Yung , CEO. Imperium Empires. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Hello and welcome everyone to the sequel of our most epic AMA with Imperium Empires. This Part II will be more of a technical deep dive and we are fortunate to have Cliff Yung aka @darksoulrepo, one of the Co-Founders of Imperium with us here today. Cliff, before we get started, we appreciate you joining us today. How are you doing?

Cliff Yung | Imperium

Doing great! thanks for hosting me, and a big thanks for our supporters who registered for our IDO!

Dave Donnenfeld | Avalaunch

Indeed Sir. Let us not wait as our community is eager to know some more about Imperium.

To begin- Imperium Empire sets out for a new era of blockchain gaming — a challenging feat indeed, but let’s start from the beginning. To help everyone get a full picture, why don’t we start with you telling us about yourself. What did your education and experience look like before you transitioned into a full-time role on the blockchain?

Cliff Yung | Imperium

Sure, before I went into crypto, I used to be a corporate finance lawyer, and have worked with a few top tier international law firms. But I’ve always been interested in new technologies, so when I first heard about bitcoin, ethereum and smart contracts around 2016, I spent a lot of time looking into crypto, and was fascinated as to the impact that it can make!

I finally got into crypto in 2017 as a crypto lawyer, helping projects do ICOs, and also helping crypto funds with regulatory compliance when they trade cryptos.

Dave Donnenfeld | Avalaunch

Well personally, I’m glad to hear you got out of corporate finance and joined the movement

Next question — With such high-level mechanics and something as demanding as building a metaverse. How long has Imperium been in production for? What sets of technical difficulties did you encounter and have these challenges changed the direction of the project?

Cliff Yung | Imperium

Yes there’s a lot of work to do, and we’ve been working on it over the past 6 months — starting with the game design, which we are able to map out the most important parts early to ensure the execution is smooth.

I guess a lot of people will think that the biggest challenge will be the graphics, but that’s actually not the case. Since our team is highly experience in building high-quality games, AAA-quality graphics for blockchain games is pretty easy for us to do.

The most difficult part is in fact the backend infrastructure. Since Imperium is a MMO game that will potentially attract hundreds of thousands of players, we need to make sure that the game servers are robust enough to handle that traffic, while at the same time cater for the low-latency requirements needed for our players in South East Asia.

So far we’re sticking to the direction we originally envisaged!

Dave Donnenfeld | Avalaunch

The team is impressive to be sure. You have onboarded a genuine all-star cast. Global MMO backend sound a little scary. Kudos to sticking with the vision. With all the trends, it can be easy to stray.

Imperium Empire is built by pioneers with years of experience and vast pedigrees in blockchain and game development. How did a team as strong as this come together, and unify their vision into this metaverse project?

Cliff Yung | Imperium

Great question — to do a project of this scale and complexity, it’s rly about building a talented team.

We started to build the team since early this year. Having met with hundreds of people, I finally found the best devs and marketing team who are capable of doing a project like Imperium.

We currently have a team of 40, including an experienced in-house game development team led by our lead game developer and art director — he has 12+ years game development experience, having led the development of 8 games across PC/mobile/console with 7m+ total players.

As for our blockchain and back-end game server dev team, we have a few senior blockchain and full-stack developers — each of them used to work with Animoca Brands’ parent co. and has 15–20+ years experience building and maintaining game servers, and working with smart contracts.

One of our product managers also used to work as a business development and product manager with Tencent, the largest gaming company in the world, covering extremely popular titles such as League of Legends — he’s helping us to curate the go-to-market strategies for the different segments of our player base as well.

Dave Donnenfeld | Avalaunch

Yeah, the 40 number came up the last time. It’s a layer 1 size group so I’m now upgrading it to an all-star “ensemble” cast. It is well layered to across disciplines so kudos for that. Moving along — With integrations of NFTs and DeFi solutions, what set of challenges do you envision to encounter and what measures have you taken or you think will be required to take in order to tackle them?

Cliff Yung | Imperium

The biggest challenge we will probably encounter, is how we can make the DeFi integration into the Imperium metaverse seamless, from a UI/UX perspective.

The key to successful partnerships with top DeFi protocols like BENQI, is being able to let our gamers enjoy the benefits of DeFi without needing to learn concepts like TVL, liquidity mining, yield farming, etc.

So our game designer team and UI/UX team are working closely together to look at (i) games that feature a thriving in-game currencies economy; and (ii) how businesses in the non-crypto world are able to provide better UX for their customers through digital transformation. So we can put these together when we design the UI/UX of how players will be interacting with the DeFi protocols in game.

Dave Donnenfeld | Avalaunch

As a Metaverse project, how immersive will the experience be? In addition to land and spaceship sales, what other actions will gamers be able to perform? Can you talk to us about the guild tournaments and how these will power the ecosystem?

Cliff Yung | Imperium

So Imperium Empires is a 3rd person, real time strategy, massive multiplayer online space game. Every player controls a fleet of spaceships in a vast metaverse, mine resources, build and expand their empires, and compete with other guilds to take control of territories in the metaverse.

So we pioneered the Team-to-Earn mechanics that bonds players together in a guild. Playing Imperium Empires becomes a fun and social gameplay experience, which means players will be much more sticky with our game in the long term, because they have personal connections with other guild members.

The guild tournaments will work this — each guild will need to buy or lease a piece of land sector in the safe zone, build structures to support guild members (e.g. spaceship docs and hangers, material collection points, etc.). Guild members can also stake IME tokens to upgrade the guild technology level. Upgraded guilds can hold more guild members and have more powerful structures on their lands.

So guild members will venture out into the combat zone and war zone to take control of the territories there, as well as battling with other players.

Guilds will compete in seasons — top guilds will be rewarded with lucrative play-to-earn rewards based on a range of factors (e.g. the most regions and landmarks occupied, kill count, etc.).

Dave Donnenfeld | Avalaunch

That’s an @mleotan level answer. He must be proud. 😁 This is super informative and helpful as you can sense the layered quality to the game.

Very cool so anyone taking a closer look at the Imperium gamefy metaverse will realise that its core is rather complex. Can you give us a high-level overview of the core mechanics that define the Imperium Empire?

Cliff Yung | Imperium

Yes — the core mechanics evolve around two things — PvP battles and guilds.

For the PvP battle system, what is unique about it is that NFTs like spaceships and spaceship components can be destroyed in battles. This leads to natural deflationary tokenomics and NFT supply directly related to the Imperium gameplay.

Players who destroy other players’ spaceships or spaceship components in the combat zone and war zone, will also be able to loot the destroyed spaceships for components.

As for the guilds system — I’ve given a brief overview above, the key is to enable players to compete in teams which is way more exciting than 1-to-1 PvP gameplay!

Dave Donnenfeld | Avalaunch

The vision as the world’s first AAA GameFi 2.0 is solid with not many people daring to even dream of, but it is clear the team at Imperium took the time to devise features, rivalry to the most popular blockchain games of this time. Can you describe how these features enable Imperium Empire to become unique even among niche games like Axie Infinity or Illuvium?

Cliff Yung | Imperium

Yes, we are not just another AAA-quality blockchain game. In fact, Imperium is the world’s first metaverse that has the following features:

- Deflationary tokenomics: most GameFis have a hyperinflationary NFT mint mechanism, even Axie — the supply of NFTs scales exponentially with the number of players. So without a NFT burn mechanism to balance the supply growth, the supply always outgrows the number of new players coming in, reducing the rarity of the NFTs minted.

Therefore, to solve this problem and as explained above, core to our game design is a deflationary PvP battle system where NFTs owned by players (e.g. spaceships) can be damaged, disabled or destroyed, along with the looting mechanisms

2. Seamless DeFi integration by Gamifying DeFi: many GameFis fail to live up to their promise of the “Fi” part, with limited DeFi integration except for simple staking. We take a completely different approach by seamlessly integrating DeFi throughout our whole metaverse — whether as part of the core gameplay, or NFT drops. The partnership with BENQI we explained above is a good example of this.

3. Guild based gameplay: As explained before, gaming is now more like a social experience with your friends than playing the game itself. And given the huge number of players playing blockchain games (e.g. Axie Infinity has 2 million active players), it makes perfect sense for a blockchain game to be an MMO game like ours, so having a well calibrated guild system is a must. Guild based gameplay is also highly beneficial to the players, as the saying goes: team-to-earn, more returns!

Dave Donnenfeld | Avalaunch

I take back what I said earlier. This is a Leo level answer! Thank you for that. It’s enlightening.

Speaking of a unique position in the blockchain and gaming market, can you share any insights into where the deal flow for the gamers is coming from?

Cliff Yung | Imperium

Sure! Our main target market will be South East Asia, where many blockchain gamers are currently in. In fact, not just the blockchain gamers, but also the huge population of gamers in the SEA region.

So our marketing team is very experienced in SEA — I’m sure you all have met our CMO Leo — he’s a native Filipino who has a huge network of influencers in both the Philippines and Thailand (50%+ of Axie’s players are based in the Philippines). Many of his connections are well-known celebrities and will help us a lot in terms of hyper-localized marketing.

And since we are targeting non-crypto native gamers, we’re also in talks with one of the largest gaming and e-sports company in the SEA region to explore partnerships.

With these strategies, we’re very confident that we will be one of the blockchain games that can bridge the gap between non-crypto native gamers and blockchain games. After all, globally there are 3 billion gamers so the market size is much bigger than existing blockchain gamers!

Dave Donnenfeld | Avalaunch

This is cool stuff…Seeing that you’re building on arguably one of the most engaging communities, is there anything you can reveal at this time for the more savvy audience about the alpha testing programmed?

Cliff Yung | Imperium

We’re working very hard to build a gameplay demo, so that we can show the community some gameplay by the end of Q1 2022 — a lot of details are yet to be finalized, but stay tuned for our announcements!

Dave Donnenfeld | Avalaunch

We threw you a softball there. 😃 Let’s get back to it — Imperium Empire will essentially be the first metaverse project built on the avalanche network. How hard has it been for the Imperium team to build the first Metaverse project on Avalanche, and what helped the team decide to build on this chain as opposed to other chains?

Cliff Yung | Imperium

We’ve looked at many other protocols, and Avalanche is the only blockchain that fits our needs because of the following 3 reasons:

- Close and long term partnership: As one of the few AAA-quality blockchain games in the market, we’re here for the long term and looking to have a close and long-lasting relationship with the blockchain that we build Imperium upon. Out of all protocols that we’ve spoken to, we feel that the Avalanche Foundation offers us a lot of support other than investment, and the Avalanche eco also has a lot of high quality projects that we can partner with and build our community upon.

- EVM-compatible: One of our main target market will be South East Asia because a lot of blockchain gamers are based there, and they are so used to tools like Metamask — therefore from a UX perspective, it’s important that we can port blockchain gamers over from other EVM-compatible chains such as BSC to Imperium on Avalanche.

- Fast and stable blockchain: As we gradually move our game logic on-chain, there will be more on-chain transactions. Being an MMO game, transaction speed and stability of the protocol are super important for a smooth UX.

Dave Donnenfeld | Avalaunch

Thank you again. Value prop of Avalanche and Imperium in general is very clean.

What do the long-term goals look like for Imperium? What are your plans for expanding the metaverse, will there be a higher level integration with DeFi or will you focus more on expanding more on the game side?

Cliff Yung | Imperium

Most of our 2022 will be hyper-focused on building out the game — the most important thing for us to do for our community is to get our game ready so they can start playing.

The DeFi integration will probably come at a later stage after our game release, but of course this can be a moving piece and we’ll closely listen to feedback from our community.

Dave Donnenfeld | Avalaunch

Well done Cliff. To conclude this leg of your journey here…Thank you for this amazing interview, is there anything you would like to share with us today? Are there any specific look-outs you’d like the community to be aware of?

Cliff Yung | Imperium

Sure, you can find more about Imperium Empires in our website and socials, and do join our community below:

- Twitter: https://twitter.com/ImperiumEmpires

• Telegram group:

• Global 🌍 –https://t.me/ImperiumEmpiresofficial

• Announcement сhannel: https://t.me/ImperiumEmpires

• Philippines 🇵🇭- https://t.me/ImperiumEmpires_PH

• Turkey🇹🇷 — https://t.me/imperiumempiresTurkiye

• Vietnamese🇻🇳 — https://t.me/ImperiumEmpiresVN

• Website: https://imperiumempires.com/

• YouTube: youtube.com/ImperiumEmpires

• Medium: https://medium.com/@imperiumempires

• Instagram: http://instagram.com/ImperiumEmpires

• Facebook: https://www.facebook.com/Imperium-Empires-108799048229937

And of course, the next milestone in the short term will be our genesis NFT sales — stay tuned for our announcements!

Twitter Questions

@Tomie_chana who asks — What are your roadmap milestones that can retain investors prior to the game launch?

Cliff Yung | Imperium

As explained above, we aim to have a gameplay demo ready to show by Q1 2022. There will also be alpha testing and beta testing of our game staged between Q2 and Q3, prior to the official launch of the game in Q4.

@muinlyreol — People are worried about transaction speeds and transaction failures. With Imperium Empires does the number of users spike transactions and get congested?

Cliff Yung | Imperium

Great question — our back-end game server is structured in such a way that it can scale as the number of players increases, so we aren’t too worry about a spike in our player base. We also believe that the robustness of the Avalanche blockchain is able to handle any increase in traffic.

@komando911 asks — Is Imperium Empires planning to use subnet technology?

Cliff Yung | Imperium

We’re currently building on C-chain because we prioritize getting our game out to our community members to start playing. But we’ll also explore the use of subnet in the longer term!

@chimponzi_jam — Did you consider using any other chains or was Avalanche always in your plans?

Cliff Yung | Imperium

Multi-chain is not on our current roadmap, because we will to take the maximum advantage of the Avalanche community. But we’ll also listen to the community’s feedback to see if multi-chain is also the right fit for our strategies!

@hasantahsinler — When you designed and conceived of the game, did any other games or movies inspire or influence you?

Cliff Yung | Imperium

Yes, I’ve always been a big fan of RTS games and MMO games, so I’ve always been fascinated by games like EVE Online, World of Warcraft and Travian — where guilds play a vital part to the gameplay!

Telegram Questions

Metaverse is getting famous because of Facebook’s grand plan to create a great Metaverse. How do you view this? is this a threat or an opportunity? How do you turn this into an advantage for Imperium Empires? What will u do to attract more people to Imperium Empires?

Cliff Yung | Imperium

I think this is a great opportunity — it is quite clear to be that the metaverse that everyone will be in, wont be the closed one created by a centralized company like Facebook, but it will be one that listens and develops alongside with its community. So it’s great that they’ve ignited everyone’s interests in the term metaverse, and help us with onboarding players

What do you think about Asia market? Is your team planning to reach other countries with potential crypto markets, gaming, etc. do you interested to work and cash in on gaming industry in Asia?

Cliff Yung | Imperium

As explained before, Asia is one of our major market to focus on, because a large population of blockchain gamers are currently based in Asia. But of course, we’ll concurrently develop markets in other regions as well!

So many games said that they are Play to earn but they all ended with pay to win system because the game required gamers to buy more items to unlock more features and level in the game. What is your opinion about that Mr. @darksoulrepo ? What is the strategy that can ensure Imperium Empires will not ending like this?

Cliff Yung | Imperium

As a RTS game with a well designed guild system, it’s very unlikely that the game will ever be pay-to-win, since it depends on a lot of factors to play the game well — e.g. how to customize ur spaceships to suit what you wanna do in the metaverse, which guild member will be specialized for which roles, etc.

Is Imperium Empires functional for mobile devices? Or are you planning to design an app based on Android & iOS in the future?

Cliff Yung | Imperium

yes, Imperium Empires will be available both on PC and mobile, because we cater for the needs of the huge crypto and non-crypto gamer population in developing countries

Can players earn passive income while playing Imperium Empires?

Cliff Yung | Imperium

there will be a range of PvE and PvP gameplay where players can earn play to earn rewards — and of course the best part will be that you can earn with your friends in a guild — team-to-earn, more returns!

Dave Donnenfeld | Avalaunch

Congratulations and thank you.

On a final note — Cliff, both you and Leo have been exceptional guests. Highly thoughtful answers and cleanly shared information. We’re happy to be hosting your IDO and wish you all the success we imagine you having. Very much appreciate your time today and look forward to your launch and beyond!

Cliff Yung | Imperium

Thanks for hosting me too! We’re extremely grateful to everyone in the Avalaunch community who supports Imperium Empires — we’ll continue to do our best, and make sure that we deliver on our vision!

-

Imperium AMA #1 — Project Overview with Leo Tan, CMO(Recap)

On 12/16/2021 at 10:00 p.m. (PST), an AMA session was held on Avalaunch with special guest Leo Tan, CMO, Imperium Empires. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Hello and welcome to another riveting discussion on the Avalaunch Telegram. Today, we have an outstanding guest in Leo, one of the co-founders of Imperium Empires. We at Avalaunch are particularly excited about the prospects of AAA gamefi on the Avalanche chain so let’s get started but before I do…how are you doing?

Leo | Imperium

Hi everyone! Glad to be here — I’m pretty excited to get this ball rolling!

Dave Donnenfeld | Avalaunch

To kickstart the introductions, can you please tell us about your role and briefly touch on your previous experiences prior to joining the blockchain-gaming industry?

Leo | Imperium

Definitely! I’m the CMO & Co-Founder of Imperium Empires, but my previous roles were actually spearheading disruptive technology initiatives as a Product Manager; It all started with my stint with Uber as a Brand Ambassador in South East Asia during their first expansion in the region.

Seeing how this simple idea of “summoning” a vehicle on your command changed the way people move from point A to B sparked my love affair with disruptive technology — from providing last-mile transit solutions to blockchain-based authentication platforms; this life-long thirst for innovation keeps pushing me to go for what’s next, and with blockchain. and the metaverse taking over the space — Imperium Empires is really a no brainer!

Dave Donnenfeld | Avalaunch

Yeah the Metaverse has gotten some mention recently 😄

Let’s segue into #2 then — Since the public rebrand announcement of Facebook to Meta, the metaverse became an exciting topic, one that is set out to provide the pillars for the transition between the real world to the blockchain industry. Can you tell us more about the Imperium Empires — what it is, and how it fits in this rapidly expanding ecosystem?

Leo | Imperium

Imperium Empires is the world’s first AAA GameFi 2.0 space metaverse. When the world learned about the possibilities of blockchain gaming, NFT assets took the world by storm by introducing true in-game asset ownership — it opened doors to publishers and enthusiasts alike to have their own piece of the metaverse.

With Imperium Empires, we believe that the pioneer projects who help catapult this phenomenon have only opened doors for projects like us to realize the learnings from their journey and breathe life into what’s next — GameFi 2.0. By having deflationary tokenomics via NFT burns in PvP battles and seamlessly integrating DeFi with Gaming, we are able to unify two very different emerging categories in the blockchain space and provide an avenue to onboard more than 3 billion+ gamers worldwide.

More importantly, we’re putting a strong emphasis on the social experience of playing games through guild based-gameplay; allowing us to pave way for the new era of a social gaming experience on the blockchain.

Dave Donnenfeld | Avalaunch

Excellent. Thank you for that. “true in-game asset ownership” The potency of this can not be overstated. This is the transference of wealth that is going to change a bit of everything. Deflationary is going to matter in the years to come for sure but you need to onboard users first so….

By building the world’s first AAA GameFi 2.0 project, which challenges or market needs does Imperium Empire aim to address?

Leo | Imperium

We see four major problems in most blockchain games that Imperium Empires will address:

A. Low-quality graphics and limited gameplay — simply put, there’s no fun playing them;

B. Hyperinflationary and unsustainable tokenomics — no NFT burn mechanisms, and play-to-earn rewards drain fast as the number of players grows;

C. Lack of deep DeFi integration — most GameFi projects fail to live up to their promises of the “Fi” part, with limited DeFi use except for simple staking; and

D. Lack of guild-based gameplay that bonds guild members together and make gaming into a social experience.

Dave Donnenfeld | Avalaunch

As I understand, Imperium’s vision is to bring together key aspects of the blockchain under one umbrella term known as the Imperium metaverse. One that is able to integrate gaming with DeFi and NFTs. Can you give us a high-level overview of how this flow-model is going to be achieved?

Leo | Imperium

The recent rise of GameFi play-to-earn (P2E) games has catapulted DeFi integration into gaming through a gamified interface of DeFi. One reason why DeFi hasnt been able to reach non-crypto natives is because of the learning curve — it is often difficult for a layman to understand concepts like TVL, liquidity mining and yield farming. Therefore Imperium aims to become be a gamified hub of all major DeFi protocols on AVAX, bringing the benefits of DeFi to 3 billion+ gamers over the world. — through our gamified interface, DeFi is seamlessly integrated, so players no longer need to grind through the difficult DeFi concepts.

Dave Donnenfeld | Avalaunch

Gamified interface of DeFi sounds like a definite improvement over stablecoin arbing.

With the goal of presenting the first AAA GameFi 2.0 project as a disruptor in the blockchain-backed game industry, can you tell us about what the PvE mechanics look like? What about PvP?

Leo | Imperium

The Imperium metaverse features a wide variety of PvE and PvP gameplay, where players team-to-earn by joining a guild of friends to conquer the metaverse and build their empires.

PvE: asteroids mining, materials transport, cooperation missions and more — the majority of the rewards will be in IMC.

PvP: players compete for seasonal rewards in guild tournaments by taking control of various zones in the Imperium metaverse, destroying and looting other players’ ships — the majority of the rewards will be in IME.

Our PvP economics is vastly different from most blockchain games in the market. We’ve implemented a NFT burn mechanism that ensures NFT supply and demand is well balanced. What is truly unique about this burn mechanism is that we closely tie it with the thrill of high-stakes PvP battles in the Imperium metaverse — meaning that some NFTs like spaceships will be damaged or destroyed when players voluntarily leave the safe zone in the Imperium metaverse.

Dave Donnenfeld | Avalaunch

This is way more thoughtful than what we are used to seeing

but let’s name names for a moment and do a little compare and contrast — There are numerous billion dollar projects such as Axie Infinity and Bloktopia with PvE and PvP mechanics in place. What would you say are the key features that make the Imperium Empire unique? How does Imperium ensure a competitive edge over these already launched and established projects?

Leo | Imperium

We are happy that projects like them have paved the way for us to design better game mechanics and tokenomics. We believe we are better than any popular blockchain game in the market because of our following competitive advantages:

A. Deflationary tokenomics and NFT supply: most GameFis have a hyperinflationary NFT mint mechanism, even Axie — the supply of NFTs scales exponentially with the number of players. So without a NFT burn mechanism to balance the supply growth, the supply always outgrows the number of new players coming in, reducing the rarity of the NFTs minted.

To solve this problem, core to our game design is a deflationary PvP battle system where NFTs owned by players (e.g. spaceships) can be damaged, disabled or destroyed. The destroyed spaceships can be looted by other players for rewards, so they will earn lucrative play-to-earn rewards by winning the PvP battles (but the lootable value will always be less than the original value of the NFTs — thus deflationary).

B. Seamless DeFi integration by Gamifying DeFi: we already explained the details before — none of the popular blockchain games in the market know how to merge GameFi with DeFi.

C. Guild based gameplay: gaming is now more like a social experience with your friends than playing the game itself. And given the huge number of players playing blockchain games (e.g. Axie Infinity has 2 million active players), it makes perfect sense for a blockchain game to be an MMO game like ours, so having a well calibrated guild system is a must. Guild based gameplay is also highly beneficial to the players, because a well played team can earn more than playing alone. As the saying goes: team-to-earn, more returns!

Dave Donnenfeld | Avalaunch

Wow

Just taking that all in. We got an A, B and C. Kudos for that answer and all that typing.

I feel like we should give you a lunch break after that but we are a tireless community so — As a metaverse with a long-term vision, a sustainable ecosystem and implementation of DeFi elements, what partnerships are you looking to secure in the foreseeable future? Have any partnerships been agreed yet?

Leo | Imperium

Yes — We’ve already announced partnerships with leading AVAX projects like BENQI and Yield Yak, and of course we’ll explore more partnerships with other DeFi protocols — stay tuned for our announcements!

Since guilds are central to our gameplay, we’re also discussing partnerships with some of the largest guilds, and listen to their feedback as to how we can perfect our official guild management and scholar management systems.

Dave Donnenfeld | Avalaunch

Look forward to some guild partnership’s!

Following on from the previous question, what can you tell us about your business plan? Are you actively looking for collaborations with other projects and protocols?

Leo | Imperium

To onboard players into Imperium, one of our main target market will be South East Asia, where many blockchain gamers are currently in. In fact, not just the blockchain gamers, but also the huge population of gamers in the SEA region.

I’m actually a native Filipino and am fortunate to know a huge network of influencers in both the Philippines and Thailand, many of whom are well-known celebrities and will help us a lot in terms of hyper-localised marketing. We observed that 50%+ Axie players are based in the Philippines, and a lot of them have very high engagements on TikTok — in fact we began our TikTok marketing just a few days ago, and engagement is already super high with our contents having 250k+ views.