-

Imperium Empires AMA #1 — Project Overview with Leo Tan, CMO

Join us in the Avalaunch Telegram group for the first of two AMAs with the Imperium Empires team.

First up is Imperium Empires CMO, Leo Tan, where we will be covering the project at a high level. The focus of this AMA will be the business development, vision, road map, and post-IDO plans.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 12/16/2021

- Time: 10:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

🐦 Follow: Avalaunch & Imperium Empires

✈️ Join: Avalaunch Telegram & Imperium Empires

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

Imperium Empires x Avalaunch: IDO Announcement

There has been no shortage of NFT gaming and metaverse projects entering the market in recent months — the storied success of Axie Infinity and other play-to-earn propositions have grabbed headlines, along with the re-branding of Facebook as Meta — has brought the metaverse to new heights. Undeniably, the metaverse is a whole new way to earn income, and in a post-pandemic world, it is already transforming our views on work. The massive potential and jaw-dropping projections that the metaverse could generate upwards of one trillion USD a year in revenue is rooted in an existing stalwart, and that is gaming.

While gaming is a huge industry generating ~US$200B revenue per year, all players retain zero ownership in any game assets. Against this backdrop, Imperium Empires has a firm belief that blockchain and NFTs will return the value of players’ hard-earned assets to players, and take the gaming market to new heights. While many have tried to solve the same problems, as a rule, they often resort to building low-quality blockchain games with unsustainable tokenomics, and simply do not have the right personnel to deliver the solution.

Having worked closely with the Imperium Empires team for the past few months, Avalaunch believes it may well be hosting an exception to the aforementioned rule and is proud to offer “The World’s First AAA GameFi 2.0 Space Metaverse”, Imperium Empires, as our next IDO.

The Strekzans, one of the many spaceship NFTs that players can command in the Imperium Empires metaverse.

Overview

It has always been clear to the Imperium Empires team that a breathtaking high quality blockchain game is what the market has been waiting for. Imperium Empires is a 3rd person space RTS MMO game, and it addresses 4 major problems commonly seen in most blockchain games:

- Low-quality graphics and limited gameplay: simply put, there’s no fun playing these games;

- Hyperinflationary and unsustainable tokenomics: no NFT burn mechanisms, thus play-to-earn rewards drain fast and collapse as the number of players grows;

- Lack of deep DeFi integration: most GameFi projects fail to live up to their promises of the “Fi” part; and

- Lack of guild-based gameplay that bonds guild members together and makes gaming a social experience.

A closeup of the Strekzans NFT spaceship, with a Sporak standing in front of it.

Imperium Empires’ solutions to these include:

- Building a AAA-quality metaverse with an experienced team of in-house game developers, game designers and blockchain developers;

- Embedding a unique NFT burn mechanism where NFTs (e.g. spaceships) can be damaged or destroyed in PvP zones that players voluntarily enter;

- Gamifying DeFi and seamlessly connecting 3 billion+ gamers worldwide to DeFi through integrating top DeFi protocols on the Avalanche ecosystem into the Imperium metaverse; and

- Pioneering “Team-to-Earn” where players join and compete in guilds — guilds can also easily find, manage and train their guild members or scholars through Imperium’s official guild and scholars management system designed for guilds.

The Trident-M, another NFT spaceship that players can add to their fleets in the Imperium Empires metaverse.

Play To Earn Mechanics

- Dual Token Model: IME and IMC tokens. IME is the governance token with a fixed supply, while IMC is the in-game currency token with an uncapped supply.

- PvE: asteroids mining, materials transport, cooperation missions and more — the majority of the rewards will be in IMC.

- PvP: players compete for seasonal rewards in guild tournaments by taking control of various zones in the Imperium metaverse, destroying and looting other players’ ships -the majority of the rewards will be in IME.

The Sporak, one of the many NFT faction characters in the Imperium Empires metaverse.

Imperium is a thoughtfully crafted game — the result of the combined effort of an accomplished team of experienced game developers, blockchain developers and business development professionals. The core Imperium Empires team includes:

- Blockchain and Game Infrastructure: blockchain and full stack developers from Animoca Brands’ parent co, each with 15–20 years+ experience that includes building and maintaining low-latency MMO game servers, developing smart contracts, etc.

- Game Development: Experienced Unity developers, game designers, 2D and 3D artists with 12 years+ experience developing 8 games across all platforms (with a 7m+ total player base and US$6m+ peak monthly grossing).

- Marketing: Marketing team led by an Ex-Uber brand ambassador with a strong influencer network in Philippines and Thailand (where ~60% Axie Infinity players are based); along with an Ex-Tencent BD and PM with 10+ yrs experience in go-to-market strategies for popular games (such as League of Legends).

This level of talent and experience can not be easily duplicated and warrants standalone mention. Avalaunch believes that Imperium represents something of a breakthrough, as the gaming industry moves from for-profit Web2 endeavors that accrue value only to game publishers, to a new era that blends real ownership of game assets and play-to-earn in a high quality space metaverse.

Imperium — Links & Team

Website| Telegram (Discussion) | Twitter | Medium | YouTube | Instagram

Partners and Backers:

“We are happy to support Cliff and the Imperium Empires team to introduce their upcoming GameFi metaverse on AVAX. From our initial discussions, we were impressed with the team’s in-depth understanding of the existing pain points experienced in most GameFi projects.” — Christian Ng, Principal at GBV

Closing Thoughts

The proverbial AAA game is a sort of holy grail for blockchain. With an accomplished team of experienced game developers, blockchain developers and marketing professionals, Imperium comes with great expectations and promise — and is delivering what they envisioned through their work to date. Avalaunch feels fortunate to have met them so early and looks forward to contributing to their journey.

“We’re fortunate to have Avalaunch’s support in growing our community in the Avalanche ecosystem. Both Dave and Mark have been great partners — we appreciate their valuable feedback and expertise in connecting us to the right partners, so we can deliver the first grand scale AAA-quality space metaverse on Avalanche.” says Cliff Yung, Founder and CEO of Imperium Empires.

Funding Numbers:

- Seed: 208.33M IME at .0024 USD — $500,000 USD

- Strategic Round 1: 254.55M IME at .0033 USD — $840,000 USD

- Strategic Round 2: 210.00M IME at .0036 USD — $756,000 USD

- Public Sale: 222.22M IME at .0045 USD — $1,000,000 USD

Total Raise: $3,096,000 USD

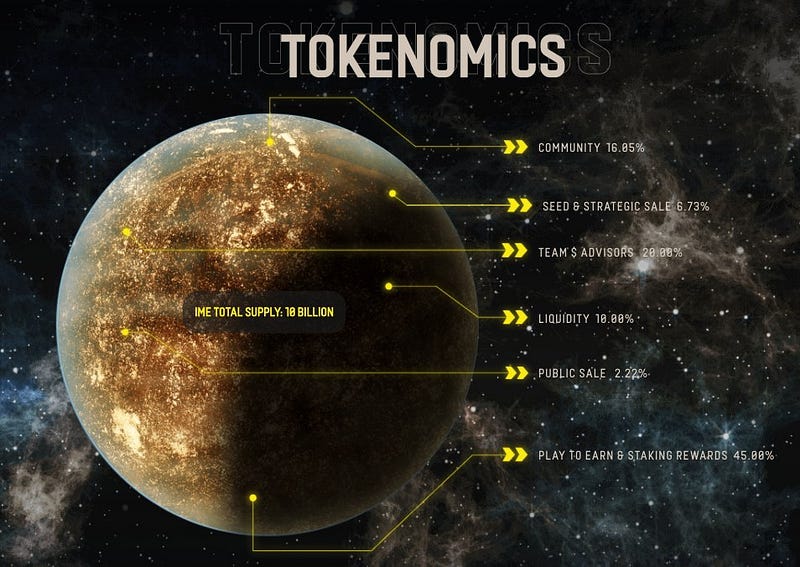

Supply — Breakdown & Vesting:

Total Supply: 10,000,000,000 IME

- Play-to-Earn and Staking Rewards: 4.5B IME (45%)

- Team & Advisors: 2.0B IME (20%)

- Community: 1.605B IME (16.05%)

- Liquidity Provision: 1B IME (10%)

- Token Sales (Seed, Strategic 1, 2 and Public): 0.895B IME (8.95%)

Vesting Following TGE:

- Seed: 6-month cliff, daily vesting for 15 months

- Strategic Round 1: 10% at TGE, 6-month cliff, daily vesting for 15 months

- Strategic Round 2: 10% at TGE, 6-month cliff, daily vesting for 15 months

- Public Sale: 35% at TGE, 1-month cliff, weekly vesting for 8 weeks

- Team & Advisors: 6-month cliff, daily vesting for 24 months

- Liquidity Provision: 10% upon listing, discretionary unlock based upon exchange listings

- Play-to-Earn and Staking Rewards: daily vesting for 36 months upon launch of game or staking

- Community: 5% at TGE, daily vesting for 36 months

Other:

- Initial Circulating Supply: ~203M IME (excluding liquidity tokens)

- Initial Market Cap: ~913K USD (excluding liquidity tokens)

The Imperium IDO on Avalaunch

- 222.22M IME at .0045 USD — $1,000,000 USD (Total Supply: 10B IME)

- Sale Size: $1,000,000 USD

Note: If you are a resident of one of the following countries, you will be prohibited from participating in the Imperium Empires sale: United States, Antigua and Barbuda, Algeria, Bangladesh, Bolivia, Belarus, Burundi, Burma (Myanmar), China, Cote D’Ivoire (Ivory Coast), Crimea and Sevastopol, Cuba, Democratic Republic of Congo, Ecuador, Hong Kong, Iran, Iraq, Liberia, Libya, Macau, Magnitsky, Mali, Morocco, Nepal, North Korea, Somalia, Sudan, Syria, Venezuela, Yemen and Zimbabwe.

Registration Schedule:

- Registration Opens: December 16th at 3:00 p.m. (UTC)

- Registration Closes: December 19th at 6:00 a.m. (UTC)

Sale Schedule:

- Validator Round Begins: December 20th at 6:00 a.m. (UTC)

- Validator Round Closes: December 20th at 3:00 p.m. (UTC)

- Staking Round Begins: December 20th at 3:30 p.m. (UTC)

- Staking Round Closes: December 21st at 6:00 a.m. (UTC)

IDO Recap

- Total IME for sale: 222.22M

- Price: $.0045

- Size: $1,000,000

- Vesting — 35% at TGE, 1-month cliff, weekly vesting for 8 weeks

-

Platypus AMA #2 — Technical Deep Dive with Mr.BeaverTail, Smart Contract Lead (Recap)

On 12/12/2021 at 12:00 p.m. (PST), an AMA session was held on Avalaunch with special guest Mr.BeaverTail ,Smart Contract Lead, at Platypus. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Hello and welcome honored viewers to our 2nd AMA with Platypus. Today we have Mr. BeaverTail with us to go into more detail on what is heralded to be a revolutionary project.

@MrBeaverTail is a visionary and we wanted to do something a little different today and ask some unpredictable questions. Sir, are you ready?

Mr. BeaverTail | Platypus

Hey guys 👋 glad to be here with you!

Yeah let’s do this

Dave Donnenfeld | Avalaunch

Let’s start off with a brief introduction about yourself. Can you tell us about your background, career path, and how you found yourself as the smart contract lead for Platypus?

Mr. BeaverTail | Platypus

I’m a software developer with a background in back-end applications, data and distributed systems.

I discovered cryptocurrencies back in 2014 when a professor at university told me he wanted me to find vulnerabilities in Bitcoin.I really wanted to prove it was bullshit, so I started researching everything about it.

The more I started getting into it, the more I got sucked into the Matrix… it then became my passion

Back in 2019–2020 I started getting really interested in DeFi and its applications. Again, I am a very skeptical person. So I like to do my own research, read white papers, analyze the math… And really got interested in how we can disrupt the current financial system.

My opinion is that our current financial system only serves the purposes of a few people, and not the general population. So I really became a matter of purpose to me and I decided to leave everything behind and focus solely on DeFi

DeFi still has a long way to go to become “Open Finance” but it is the best we got as mortals.

Dave Donnenfeld | Avalaunch

This is some high minded thinking and the world appreciates it. Serves the greater good.

Outside of yourself, how many developers are working on Platypus? Who is responsible for front end and back end development, and how closely does that team need to work together?

Mr. BeaverTail | Platypus

We started out as a team of 4 people.

Currently, I think we have around 10 people helping with development

FrontEnd development is handled by Shinji, our FrontEnd Lead (kudos to his great job behind the scenes btw)

We work very closely and are in constant communication.

Dave Donnenfeld | Avalaunch

I think people are going to learn how important a project this can really be and the work you’re putting into truly making finance “open.”

for us mortals, can you simply describe your role as smart contract lead? And for anyone interested in pursuing a similar path, how do you suggest one get started?

Mr. BeaverTail | Platypus

As smart contract engineer, you need to have a broad knolwedge of computer science as a whole.

I got into it because I realized this was the missing piece of technology to get rid of all intermediaries.

With smart contracts, people can interact with financial systems without the need of an expensive broker or a lousy bank.

Dave Donnenfeld | Avalaunch

Disintermediation is a beautiful thing. Death to the fee taking middleman!

Mr. BeaverTail | Platypus

My role as a smart contract engineer is designing, implementing and maintaining our codebase to make sure it achieves its purpose: bring a financial service to our users

In our case, we want to provide the greatest stableswap experience to our users: lower slippage, greater capital efficiency and best UX

Security is one of the main aspects involved in smart contracts. I’d really suggest you to start there. It is what makes this job so special and so stressful at the same time.

Dave Donnenfeld | Avalaunch

The efficiency this could create is hard to overstate.

At a high-level, could you describe the Platypus smart contracts, what they do, and how they come together to create the smart contract architecture?

Mr. BeaverTail | Platypus

Platypus smart contracts are actually more complex than any other protocol I’ve seen from the mathematical standpoint.

If you’ve read our Yellow Paper, you can see that math is truly our foundation and our research team is damn good at it.

Dave Donnenfeld | Avalaunch

My color palette is limited to white but I may have to try now

Mr. BeaverTail | Platypus

So our architecture tries to keep things as simple as possible while keeping gas costs at a minimum, taking into account that several math operations are need to a user to perform a simple swap.

It is truly an accomplishment for us to provide a such simple service because it requires so many hours of research and development.

Dave Donnenfeld | Avalaunch

This is the big question from us lay people that have peeked under the hood — Uniswap, Curve, and other AMMs, rely on the use of invariant curves to establish the relationship between tokens in a liquidity pool. Platypus takes a different approach. Could you explain what an invariant curve is, what its shortcomings are, and how Platypus achieves an improvement over this design?

Mr. BeaverTail | Platypus

We need to explain first what an invariant is: a property of a mathematical function which remains unchanged after operations or certain transformation.

Dave Donnenfeld | Avalaunch

So it sounds like a catalyst

Mr. BeaverTail | Platypus

Yes, in a way it allows Uniswap/Curve pools to maintain a certain property.

So, no matter what happens, Uniswap invariant curve will always be : x * y = k

with k being the invariant of course

This was a big breakthrough at the time but nowadays we see its limitations: impermanent loss, the need to provide liquidity in pairs, fees, etc.

In the context of Stableswap, this will mean that the liquidity provider may get back asset as a combination of tokens that are different from what he / she has original provided.

An additional shortcoming for stableswap like Curve or Saddle is that their stableswap invariant requires all tokens within the same pool to have the same amount of liquidity to reach its equilibrium state, making the least popular token the bottleneck for the growth of the pool.

Moreover, it is impossible to add new tokens into existing pool (particularly if the new token’s liquidity is not comparable to other existing tokens in the pool), which hindering the scalability of the protocol.

Dave Donnenfeld | Avalaunch

Right. You’re there thinking “this isn’t what I signed up for.” So, Platypus offers DeFi users a stableswap with higher scalability and greater capital efficiency. Could you touch on what these concepts are and what the implications of progress forward in these areas means for both Platypus and DeFi as a whole?

Mr. BeaverTail | Platypus

Sure, to illustrate what capital efficiency is, we can head over to Uniswap analytics.

We can see that there are over +100 pools that contain ETH asset.

These pools do not communicate with each other

They do not make use of each other’s capital

There is a big percentage of the pool’s liquidity that is dormant

This is just a limitation of the invariant curve model. Curve tries to get around this limitation by increasing the amount of assets in the pool… But as I said earlier the bottleneck is always the least abundant token in the pool!

Dave Donnenfeld | Avalaunch

So…Defi is supposed to be inclusive, shared economy and resources but these pools are siloed.

So it defaults to the lowest common denominator

Mr. BeaverTail | Platypus

Exactly

In contrast, Platypus uses a single-variant slippage curve.

Dave Donnenfeld | Avalaunch

Right so instead of invariant curves, Platypus is the first to leverage a single-variant slippage function. In your opinion, why is this alternative viable now, and not before? Did we need to start one place to end in another, or is it simply a solution that wasn’t considered previously?

Mr. BeaverTail | Platypus

So a single-variant slippage curve is just just a normal function f(x) where x is coverage ratio.

It varies in function of x, the coverage ratio

I really think this alternative was viable before, just as bitcoin was viable since computers were invented.

Dave Donnenfeld | Avalaunch

Understood. So to you it’s a self-evident evolution of where this should be going.

Mr. BeaverTail | Platypus

Banks and other financial institutions have used coverage ratio in risk management for years

why shouldn’t we use this for DeFi?

Dave Donnenfeld | Avalaunch

Right. So you define the range and cover it accordingly.

Mr. BeaverTail | Platypus

The missing link was using coverage ratio alongside single-variant curve to determine slippage

This allows the protocol to handle risk autonomously

But designing these types of protocols is not an easy task… It requires years of research to make sure the protocol is viable

Mr.Duckbill is truly a visionary I must say

Dave Donnenfeld | Avalaunch

Right. The defined function and range is intuitive enough but building it is another story haha. Yeah, Duckbill and Co are on point.

Could you introduce us to the concept of “asset liability management” and its place in Platypus?

Mr. BeaverTail | Platypus

Asset Liability Management is defined as the process of managing the use of assets and cash flows to reduce the firm’s risk of loss from not paying a liability

So as I said earlier this concept has been used for years in TradFi

Coverage Ratio is just one key indicator of risk of a certain firm

The higher, the better!

Coverage Ratio = Assets / Liabilities

Platypus leverages these concepts for the first time in DeFi

Dave Donnenfeld | Avalaunch

Let’s get into the token and pools for a minute — since you’re redefining DeFi and making it, well, smarter, I’m sure our users want to understand utility

The PLP token is staked to generate vePTP, an “asset” which is not transferable or tradable. Once generated, vePTP is used to boost a stakers APR on the provided liquidity. Could you help us to understand the necessity of this design, and what improvements it offers over simply staking vanilla PTP?

Mr. BeaverTail | Platypus

Stableswap tokenomics require special design.

We want to incentivize users to become long term supporters of the protocol

To understand this design, I need to explain what dialuting and non-dialuting emissions are

Dialuting emissions are token emissions that dialute the value of the token on the market. This is what most projects use to incentivize users to provide liquidity.

Dialuting emissions can make any token become a farm and dump token, because value is not being captured for the token holders

If I provide liquidity on sushiswap to farm Sushi, I don’t really need to hold the Sushi token

Non-dialuting emissions are emissions that do not dialute the value of the token in the eyes of the market.

We want to make 50% of emissions non dialuting

Dave Donnenfeld | Avalaunch

How does this happen? A token being put on the market is an inflationary event.

Mr. BeaverTail | Platypus

That is indeed true. But what about a token that is given only to those who ready to stake this token in the long term ?

Since the token is being held in a smart contract, it cannot be sold and therefore sell pressure is reduced

So by incentivizing users to stake $PTP for vePTP, we make sure that inflation is controlled

Dave Donnenfeld | Avalaunch

Apart from generating vePTP, how would you describe the utility of the PTP token?

Mr. BeaverTail | Platypus

PTP token is the gateway to all things platypus.

Initially, Platypus was going to be launched as a multi-vertical protocol. But we realized that the right path was to launch 1 vertical first, then expand to other verticals.

If you want to support the project, stake $PTP to obtain vePTP.

We’re going to make sure vePTP holders get well taken care of.

vePTP is the governance token of the protocol (ve stands for voting escrow)

Dave Donnenfeld | Avalaunch

Always nice to hear this

changing gears — Very simply, what is “withdrawal arbitrage” and how does the Platypus withdrawal fee mechanism combat this behavior?

Mr. BeaverTail | Platypus

In TradFi, Arbitrage describes the act of buying a security in one market and simultaneously selling it in another market at a higher price

In DeFi, it also means that, but the definition is widely extended to all operations that generate profit for the arbitrer

So withdrawal arbitrage in our protocol is basically a set of operations [deposit (given coverage is under 100%), swap then withdraw] taking advantage of the protocol’s design to generate profits for the arbitrer

This extracts economic value from the system

Many protocols have suffered from exploits like this

If you add flash loan to the equation, then you can really drain a pool

Dave Donnenfeld | Avalaunch

I’m not sure there’s been a flash loan protocol that hasn’t been exploited.

Mr. BeaverTail | Platypus

When designing platypus, we wanted to make sure that economic value is retained in the system and redistributed to liquidity providers.

That is why we have implemented a withdrawal fee, making withdrawal arbitrage unfeasible.

We even found a way of performing a deposit arbitrage ! So we had to implement a deposit fee

Rest assured, these fees are very very very low and will not affect the use of the protocol

You probably won’t even notice

Dave Donnenfeld | Avalaunch

The proverbial staking/unstaking fee for arbitrageurs. Very smart.

Mr. BeaverTail | Platypus

In my opinion any new protocol implementation needs a competent research team running mathematical analysis and simulations. It is not enough to have good devs. We have the chance to count with some really smart researchers

Dave Donnenfeld | Avalaunch

Moving onto security for a moment as you mentioned exploits before — we all know that everything is going to be audited by a proven 3rd party but….Seeing as how audits aren’t a “silver bullet,” how do you see them and their place in the development process? 2021 has been littered with high-profile DeFi exploits and hacks. As a smart contract developer, have there been any key takeaways for you with respect to your own process or code?

Mr. BeaverTail | Platypus

Security is indeed our biggest concern in Platypus

Dave Donnenfeld | Avalaunch

R&D is showing up more and more in the budgets of DeFi projects. it is just prudent and needs to be ongoing. I think too often people think of these contracts as “set it and forget it.” But please proceed re: security. Just couldn’t help myself here.

Mr. BeaverTail | Platypus

I think security should be any DeFi protocol biggest concern.

As DeFi gets more and more sophisticated, hackers get better at exploiting protocols

Coding smart contracts is nothing like coding a JavaScript/web application. Anyone who has worked in my development team knows I can be quite unfriendly if my directives are not respected.

Dave Donnenfeld | Avalaunch

Are they in fact getting better? I just thought there’s more money locked ergo more people chasing it. So the research of security is a discipline unto itself. Yesterday’s attack vector doesn’t equal what’s coming tomorrow. Hadn’t considered the evolution of hackers.

Mr. BeaverTail | Platypus

Hackers are getting better.

But so are we (DeFi builders and audit firms in preventing attacks)

For platypus we have very strict directives when it comes to our smart contracts.

We aim for 100% test coverage in our core smart contracts.

We use state-of-the-art security tools.

We don’t let our ego get in the way. I personally ask every new collaborator to go and tell me how code can be improved.Dave Donnenfeld | Avalaunch

That’s good stuff. Seems like a layered approach and of course the absence of ego goes a long way

So let us have a final question before we can move on to the Twitter portion of the program — on a higher level — What lies ahead for Platypus? Where do you see your efforts being focused in the next 3–6 months?

Mr. BeaverTail | Platypus

We have a lot on our plate.

We want to expand to other DeFi verticals, provide a fun and gamified experience for our users, develop partnerships with other teams in the ecosystem….

Things move fast in the cryptosphere, so I don’t really want to be too precise about these things, we want to maintain some flexibility as well

Dave Donnenfeld | Avalaunch

This is the evolution of the AMM. I hope it gets implemented everywhere but it’s forever a moving target. I think roadmaps are overrated in crypto; should be renamed “guidelines.”

Mr. BeaverTail | Platypus

Yeah, guidelines are better

I expect the smart contract team to deploy many contracts in the following months

I expect to serve users and our community

Twitter Questions

@totominhchi How can developers & technical people contribute to Platypus and how do you make plan to get them involved?

Mr. BeaverTail | Platypus

I’m looking for talent on the smart contract side.

If you’re a smart contract developer with experience in DeFi, please get in touch with me.We will be open sourcing our code in the following weeks

Whitehat hackers are very welcome to make suggestions on our code (up to 100k$ rewards). As I said before, ego is a killer.

@AkihisaMori45 asks — What achievements of Platypus do you feel are most important for your long-term plans?

Mr. BeaverTail | Platypus

We’re very pleased we got huge support from big names like Three Arrow Capital and Defiance in our private round, in a total of $3.3M.

The high interest exhibited by these strong names of the crypto industry speaks volumes on the relevance of Platypus for the crypto space and DeFi.

It’s also worth mentioning that the $10M LP pool cap of our alpha mainnet was filled within 15 mins, that was totally out of our expectations and I’d like to thank everyone who supported us all along.

@AndyToshi_cryp — How do you view other projects in the Avalanche ecosystem, is there a project that you see as a competitor or that you respect?

Mr. BeaverTail | Platypus

I honestly respect every DeFi builder our there.

It’s a very stressful job that requires a broad set of skills. While we make investors and supporters rich, we’re doing the hard stuff.But honestly, I think that there are great native projects on Avalanche

They have great teams and I can say working with some of them has been a pleasure so far

I can name a few: Benqi, Colony, Traderjoe, Pangolin, Yield Yak

@IvaniWu01 — what is the single biggest factor Platypus in removing impermanent loss risk for liquidity providers?

Mr. BeaverTail | Platypus

Impermanent loss is the result of using invariant curve’s (Uniswap, Curve). In these systems, you need to provide liquidity in pairs…. When you provide liquidity, you’re basically guaranteed that the product of the amount of 2 assets you provided will stay the same.

Liquidity provision in Platypus is single-sided, removing impermanent loss risk. Of course there are others risks that come with this paradigm shift, but impermanent loss is not one of them.

@Nirund14 — Does Platypus platform have future plans to go crosschain or do you think there is enough activity on Avalanche to sustain?

Mr. BeaverTail | Platypus

Our objective is to become the dominant stableswap on Avalanche.

We don’t have plans to go cross-chain for the moment. We actually believe this is not the right strategy!

And… we really think Avalanche is superior to other blockchains out there and we are quite happy to be an Avalanche native project.

Special thanks to the Avalanche foundation and Avalabs, you guys are the real Rockstar’s here.

Usually AMA’s are well prepared in advance. This one was quite improvised so I hope it wasn’t too hard to follow for everyone.

Dave Donnenfeld | Avalaunch

At this juncture, I’d like to pass the mic to @shahi297 and he’ll take over from here. This has been an enlightening experience and super informative. Our community, understandably, likes unlocked tokens and I can’t blame them but I think they will be very happy there is vesting for this project. It’s a game changer. Very much look forward to it and being a part of your journey.

Lovish Shahi | Avalaunch

Thanks Dave.

Mr. BeaverTail | Platypus

Thanks to Dave and Lovish for handling the AMA as well!

Lovish Shahi | Avalaunch

This was so far one of the best n most interesting AMAs we had so far.

This was really something Deep Dive.

Hope we can have some nice questions from community to add to this.

Telegram Questions

Currently, NFT is very hot, do you think you will apply NFT technology to your products in the future?

Mr. BeaverTail | Platypus

Yes, we’re currently working with a very special team on the Avalanche ecosystem to bring a very special experience on Platypus. Don’t want to spoil too much though.

How did you come up with the idea to create the “PLATYPUS” platform? Why did you choose the name? Does it have a special meaning and is there a story behind this name?

Mr. BeaverTail | Platypus

The original idea comes from research done by Mr.DuckBill where he envisions a paradigm shift for several DeFi verticals.

Platypus is a very special kind of animal, it lays eggs although it is a mammal, it is semi-aquatic.

We though it was the perfect animal to name a special (and a bit weird) protocol.

What are the steps to become a part of your community, and start getting revenues? Where do we buy, where do we sign up? This looks like an amazing project!

Mr. BeaverTail | Platypus

Thanks!

Well, first of all I’d recommend following our social networks (in particular twitter where we are the most active)@Platypusdefi @MrDuckbill @MrBeaverTail

To become a supporter of the project, you can:

– Deposit your stables into Platypus pool’s to farm $PTP token

– Stake your PTP to generate vePTP and participate in governance (while boosting your yield!).Also, keep in mind that stableswap is only the beginning. We want to expand to other verticals and add new features so make sure to stay tuned to our socials.

For Platypus being the first Stable Swap on Avalanche Network

Is your token swap program based on any existing platforms out there or did you have to build from scratch since you’re the first stablecoin swap on Avalanche Network?

Mr. BeaverTail | Platypus

We built Platypus from scratch, but we learned from the mistakes of other protocols and we’re are quite aware of the current innovations happening in DeFi till today.

We decided to build Platypus on Avalanche because we think it is truly the next generation blockchain the world needs: instant finality, decentralization, low fees, superior consensus mechanism…

We hope that more and more innovative and novel protocols will decide to build on Avalanche!

How does the community intervene in the construction of PLATYPUS? In other words, do you take into account the “feedbacks and demands” of the community as you continue to innovate your project?

Mr. BeaverTail | Platypus

We want to have a “Community first” approach. Open Finance (or DeFi) is all about that.

We did a testnet campaign with 1500 people testing and giving feedback. Also, we encourage everyone from the community to give feedback.

Our backlog is huge so please be patient as we are working long hours to improve our solution!

So far, we’re quite happy with the response from the community.

We hope to grow Platypus into a self-governing community of well educated participants.

Again, if you want to stay in touch and participate in our community, join our TG channel and follow us on social media:

@MrBeaverTail @MrDuckbill @Platypusdefi

Lovish Shahi | Avalaunch

I guess we are done with the community questions here

Thanks @MrBeaverTail for sharing such insightful tech deep dive with our wonderful community. Really appreciate you being here.

Mr. BeaverTail | Platypus

Allright guys, that is all for me.

Thank you for being here. Hope to see you soon on the cryptosphere.

-

Platypus AMA #1 — Project Overview with Mr.DuckBill, Founder (Recap)

On 12/10/2021 at 06:00 p.m. (PST), an AMA session was held on Avalaunch with special guest Mr.DuckBill, Founder, Platypus. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Hello and welcome to another AMA brought to you by the good folks here at Avalaunch. Today, we are fortunate to have none other than @MrDuckbill here to talk about Platypus Finance and offer us a glimpse on what’s coming to DeFi. How are you doing?

Mr.Duckbill | Platypus

My pleasure to be here to introduce Platypus to everyone! And thanks for the invite! 😊

Dave Donnenfeld | Avalaunch

Good to have you for sure as this is a heavily anticipated project. Without further ado, let’s get into it

To begin with, please give us a little bit of background about yourself. What did your education and career look like before joining DeFi?

Mr.Duckbill | Platypus

Sure! In the past I was like everyone, a university graduate that was confused about my future career. My first job was in a TradFi company as a small potato, handling boring and trivial tasks. After a few years, in 2017, I witnessed the ICO boom and got more and more interested in the crypto industry, and finally I have quitted my TradFi job and worked in a CEX in 2018. I have been working there since then, learnt a lot of crypto stuff, and finally left the company to create Platypus this year

And speaking of Platypus, it is also interesting because it was a modified version of my master thesis. Back when I first entered the crypto industry, I decided to further enhance my knowledge in crypto, so I applied for a master program in one of my local universities where they have courses specifically in cryptography and blockchain. And in the final semester I had to write a thesis. Then I decided, why not try to devise a new DeFi protocol? That’s how the very first version of Platypus was being created.

Dave Donnenfeld | Avalaunch

That’s a good story. From feeling the dread of a regular job to making your thesis your work today. Pretty inspired stuff I have to say. Prototypes aside, how did the idea of building a Stableswap on Avalanche come about? What is your unique value proposition?

Mr.Duckbill | Platypus

I had the idea for creating a single-sided AMM back in 2019 when I first learnt about Uniswap. When I was writing my thesis, I was further diving into how to create a single-sided AMM. At first I wanted to make it for general trading purposes, but eventually it became a Stableswap because it is easier in terms of risk management.

As an OG of Avalanche, I have been observing the ecosystem since day 1 after mainnet launch. Surprisingly, Avalanche lacks a good quality, native stableswap DEX with deep liquidity. And it also must be native because only by this it can support more native projects like algo-stablecoins and synthetic assets to access the liquidity they need.

Lastly, at the very core of our philosophy, the most unique value proposition Platypus have, is to bring innovation to the Avalanche ecosystem. Many projects so far are just forks from Ethereum. We want to show to the world that Avalanche is a great blockchain that can foster new innovation as well on its own. Stableswap is just the beginning for Platypus, we have many innovations ahead that we haven’t revealed yet.

Dave Donnenfeld | Avalaunch

Thorough and big ups for the Day 1 of mainnet AVAX person. That’s a straight up OG.

To build Platypus into a new generation single-sided Stableswap is definitely a challenge. Can you talk to us about what some of these challenges were and how you overcame them?

Mr.Duckbill | Platypus

While I have the idea and some rough protocol design, it was hard to get people to believe in me and follow me to join the project. Luckily I got the support from the Avalanche Foundation to offer me the X-grant, and also met Mr.Beavertail and Mr.Otterfoot and they trusted me from day one.

These are two most important things for a project to go from concept to early-stage, namely initial support from investors, and a small but passionate team. 🔥

Dave Donnenfeld | Avalaunch

Duckbill, Beavertail and Otterfoot are indeed a trio to trust. The Avalanche Foundation knew this. Congrats on that by the way, the support from them is quite a stamp of credibility.

How does the experience of each of the team members add up to help build the ecosystem and community needed for such a strong market ingression?

Mr.Duckbill | Platypus

Our team is definitely all rock-star! Mr.Beavertail, our smart contract lead, is an experienced engineer and worked on blockchain development since 2015. Mr.Otterfoot, our marketing lead, is a serial entrepreneur and worked in crypto media before. We also have a superb advisory board which will be revealed soon. 😉

Dave Donnenfeld | Avalaunch

You are rock stars for sure so let’s talk security — With DeFi being such a target for hackers, what security measures has Platypus taken to ensure the safety of the community?

Mr.Duckbill | Platypus

We have two auditors, Hacken and Omnisica, where the first audit was completed and the second audit is close to completion. So far, nothing major has been found.

We have also analyzed our system in vigorous mathematical proofs, and even self-identified a possible attack, called withdrawal arbitrage, and proposed the solution ourselves to mitigate this attack. You can find all these in our technical yellow paper. Besides, we are also running economics simulations to ensure the system is at least robust with certain given assumptions.

Lastly, we are currently running on the mainnet for alpha launch, where we have kept the TVL in the system to 10 million. It is important because it can let our system to be battled-tested in the real world while keeping the risk exposure manageable. The last thing we want is to have 1 billion injected into the system, then we are hacked, and everyone gets screwed up.

Dave Donnenfeld | Avalaunch

Yeah I saw your alpha launch got to 10M TVL in about 15 minutes. Maybe more than a “few” understand. 😃 So, how does Platypus fit in the current landscape of DeFi? What solutions does Platypus provide over its competitors?

Mr.Duckbill | Platypus

First of all, we are definitely a stableswap DEX, and we believe that stableswap is an essential building block of any DeFi ecosystem.

Let’s list some examples of why stableswap is important:

1, We know that native USDT and USDC are coming to Avalanche. They are going to create different representations (or addresses) of the same pegged token compared to the Avalanche Bridge token. You need a place to swap between these assets

2. Native algo-stablecoins, like TSD, AVAI and H2O, need a stableswap DEX to provide liquidity, support their price peg as well as allow people to trade

And why Platypus, but not our competitors? First of all, Platypus is single-sided, so when you try to farm on Platypus, our UI / UX is much simpler than others. Many DeFi new joiners tend to farm on stables first, so easy on-boarding is very important for stableswap.

Secondly, because we are innovative, and dedicated to Avalanche. Other native projects are just forks with no innovation, and outsiders are fence sitters: they are not here to help to grow the Avalanche ecosystem. We are the only stableswap DEX that fulfills BOTH criteria.

Dave Donnenfeld | Avalaunch

Yup. That all adds up. The amount of love Avalanche is being shown is impressive and this ranks high. Saving us from fragmentation which is becoming epidemic in crypto. Can you tell us about the utility of the Platypus token? What will token holders vs non-token holders be able to access on the platform?

Mr.Duckbill | Platypus

Well, PTP token is USELESS….

Except for generating vePTP

So if you have read our previous medium article, vePTP stands for voting escrowed PTP. You cannot buy vePTP from the market, the only way to get it is to stake your PTP, and wait for vePTP to be generated as time goes by. In essence, vePTP is equal to time.

I personally really love this idea, because it provides an easy way for us to differentiate who are the long term supporters and who are not. Some alpha leak here — we will play a lot of tricks on vePTP in the future, so make sure you stake your PTP now to get as much as vePTP as possible!

As for the use of vePTP token, first of all it will allow you to increase your liquidity mining yield. We have divided our liquidity mining pool into base pool and boosting pool, where only vePTP token holders are eligible for emission in the boosting pool. Besides, vePTP will also be used for voting in the future, expect you can see something like Curve — so you can use vePTP to change the emission allocation for different tokens. Lastly, just like all typical DeFi protocols, vePTP will allow you to share the revenue generated by the protocol.

But rest assured, even if you are not staking PTP, you can still enjoy the liquidity mining reward from our base pool.

Dave Donnenfeld | Avalaunch

A pretty complex problem with an elegant solution and clear cut rewards. Well engineered. Having glanced at the roadmap there seems to be few massive milestones on the way. Can you discuss with us just very briefly what these are, and what are the key developments token holders should look forward to?

Mr.Duckbill | Platypus

Well, we have achieved a lot of amazing milestones already! First, we got the Avalanche X-grant back in July, then we secured a 3M private round led by 3ac and DeFiance. We launched our alpha mainnet a few weeks ago and 10M was filled in 15 min. The system is still live and kicking as of today. And of course now, we are going to do our IDO on Avalaunch and launch our token soon.

Going forward, we have many things keeping behind the scenes and under development. One key development that our token holders should look forward to is definitely our beta launch! The beta launch will remove the cap limit as well as kick start liquidity mining. And hopefully, it is coming (real) soon!

Dave Donnenfeld | Avalaunch

That’s some of the smartest funding in the business. Congratulations on that.

What would you say excites you most about Platypus, is there a particular feature or milestone that you’re excited about and looking forward to?

Mr.Duckbill | Platypus

We intentionally keep our roadmap secret. If we have disclosed everything from day one, although we can make people excited about the project, but going forward all they will be asking is “wen-wen-wen” on when our roadmap will be delivered 😂

We want the community to “evolve” with us, we hope that every time when we drop something new, the community will be surprised by our innovation and regenerate the hype for the project. It is our marketing tactic, we don’t know if it works or not, but we hope it will.

What excites me the most about Platypus is, we are a super innovative team. Stableswap is just the beginning for us, and I am sure that our upcoming roadmap will bring innovation to Avalanche, and redefine how DeFi works beyond Ethereum.

Dave Donnenfeld | Avalaunch

We certainly know what “wen” is like. To date, you’ve made a lot of headway and I’m sure it will continue in good stead. Before we move on to the Twitter portion of the program — are there any last points you wish to discuss or share with the Avalaunch community?

Mr.Duckbill | Platypus

Being an Avalanche OG, I can just sit here and enjoy the success of AVAX. But ever since I have been working on Platypus, I found that the fulfillment and joyfulness for BUIDL is much larger than merely investing or farming. If you have the ability, come and build together. We will build the future of France together, here on Avalanche. 🚀

Dave Donnenfeld | Avalaunch

For sure. Good stuff. The future of France has never looked brighter 😀

Twitter Questions

@suryadi_uci

Platypus looks one of the most professional teams on Avalanche and I wonder what can we expect in the near future from Platypus except Stable swap? It’s obvious that your plan is way more than just being a stable swap platform. Can you give us some hint about future plans?Mr.Duckbill | Platypus

Thank you for your kind word! In fact we intentionally want to keep our roadmap secret, because we want to community to “evolve” together with us

Yes, very soon after IDO we are going for beta launch, where we will remove the cap limit and start liquidity mining. And afterwards we are targeting to have a big release in January, where we will bring some innovation that you have never seen in any other blockchain. (Hints: it is about gamification)

@MiMiCybe

who asks “I read Platypus website, I came across the term “LIQUIDITY Fragmentation, Can you explain a little about the Functions and how “Liquidity Fragmentation” works?”Mr.Duckbill | Platypus

Liquidity fragmentation means that liquidity is locked in separated pool, which reduce the capital efficiency as a whole. Imagine you have two pools USDT-USDC and USDT-DAI, the USDT in the two pools cannot be shared with each other which creates the “fragmentation”

If the liquidity can be shared, the capital utilization will be more efficient, and the protocol can provide lower slippage with the same amount of capital

Capital efficiency is a focal point in our system design, and we will have more innovation in this regard to be revealed in the future

@Ray230521 was not satisfied asking one question so he has three — What’s your long-term plan? What will #platypus look like in the future? How will #platypus ensure the sustainability of the project and its added value for the community?

Mr.Duckbill | Platypus

To make the project long-term sustainable, we have a long roadmap (we are already fully packed for at least 6 months), and we hope that as these initiatives reveal it will help regenerate the hype of the project

Again, vePTP is a very important design in our system. So if you want to enjoy the value add for our future releases, make sure you acquire them ASAP!

As for the future of Platypus, we believe that Avalanche will become a frictionless financial system that is open to anyone, and Platypus will become a backbone of this ecosystem. We will facilitate the swap of many different stablecoins, custodian or algorithmic, as well as pegged synthetic assets. May be even easy fiat on-ramp and off-ramp with central bank digital currencies.

In short, we have many great plans for Platypus, and we are also firm believer of Avalanche’s long term success. There is definitely a bright future ahead of us 😜

@andre_shifu why @Platypusdefi choose to build on avalanche network? and could you guaranteed your dapps is safe because all of your team are anonymous?

Mr.Duckbill | Platypus

Yes 😂 I choose to build on Avalanche because I am an Avalanche OG, and I love the Avalanche ecosystem.

Avalanche has the most solid technical foundation among all blockchain platforms. We have high hopes for Platypus and we want to make sure we are built on a platform that works best for the long term.

Anonymous founders are becoming increasingly popular in the DeFi space. We could have used our real world identity to launch the project, but we found that staying anonymous is even cooler. Anonymous founders have peculiar charisma for their idiosyncrasy and coherence for the underlying philosophy of cryptocurrencies and blockchain — decentralized, censorship-resistant, and privacy-by-default.

Oh, don’t worry about whether we will rug. We won’t. Being backed by 3ac and Defiance, launching IDO on Avalaunch, we have way much to lose if we rug instead of deliver. The upside for delivering is 100x, or even 1000x compared to rug. Just don’t worry about it.

@elif611_ How does $PTP attempt to address and mitigate temporary losses in LP pools?

Mr.Duckbill | Platypus

Nice question! Not sure how you define “temporary losses” though.

One way to think about this is that there are “temporary losses” in one of the tokens in the pool, say, the coverage ratio of USDT.e becomes 0.8 so there are less assets compared to liabilities for that particular token. In this case, we are using the “fractional reserve system” assumption in modern banking — not all LPs will withdraw their liquidity all at once. So as long as the distribution of the LPs are even enough, the system should always hold enough cash to prepare for withdrawals.

The second way to think about this is, will these “temporary losses” become “permanent”? The answer is NO. If one token becomes under-covered (i.e. coverage ratio < 1), it will always make another token over-covered (i.e. coverage ratio >1). In technical terms, the pool as a whole will always be SOLVENT. Token level insolvency is transient, and trust for the system will remain intact as long as the pool level insolvency is maintained.

That being said, we have provided options for users to “withdraw in other tokens” (i.e. the over-covered token) if they are holding an under-covered token. So in any situation you should be able to withdraw your LP token without problems.

Telegram Questions

Do you have any plans to attract non-crypto investors to #your project Because it is the success of a project to get more investors who are still not in the crypto world. What are the plans to increase awareness around your in non-crypto space?

Mr.Duckbill | Platypus

Yes we want to bring mass adoption with Platypus. Being a Stableswap DEX, we are able to attract many new users to DeFi that are risk adverse. Platypus simple and intuitive UX is going to help a lot in this regard.

Besides, we have a rock-star marketing team that are actively working in local penetrations in many countries. We will continue to work on this regard to spread awareness via localization.

Do you have any plan to expand your project in other chains like Polygon , polkadot in the future?

Mr.Duckbill | Platypus

Hard to say for very distinct future, but definitely not in the coming 1–2 years. Platypus is born in, and for Avalanche. Staying in Avalanche also help us to stay focused and maintain a loyal community. It is the optimal strategy for us.

How did you come up with the idea to create the “PLATYPUS” platform? Why did you choose the name? Does it have a special meaning and is there a story behind this name?

Mr.Duckbill | Platypus

There is a reason behind for sure! You will understand it as we reveal more of our roadmap 😆

And besides, Platypus is cute! And it is exotic animal along with Pangolin, Yak, Axalots, etc.

Can you briefly describe your PARTNERSHIP so far and upcoming partnerships?

Mr.Duckbill | Platypus

We are already working with many AVAX blue-chip projects like Traderjoe, Yield Yak, Benqi and Colony.

And up-coming we are going to work with native stablcoin projects as well, like Teddy Cash, OrcaDAO, Defrost, etc. 😉

What are the plans to educate and raise awareness and adoption among the community to make more people understand about the project easily?

Mr.Duckbill | Platypus

We know that our yellow paper is hard to understand! That’s why we have been writing many ELI5 articles in medium to educate our users

While our system design may seem complex if you look at the yellow paper, but when you look at the UX it is quite simple. So all the complex design from the backend is because we want to make the system easier to use for our users in the frontend 😀

Follow our social media and read our blogpost, this will help you to understand the project better for sure 😘

Dave Donnenfeld | Avalaunch

You’ve done it! Successfully run the gauntlet for us here today. Very much appreciated. The Avalaunch community is happy to have you and I personally would like to say thanks. This was super informative and we would look forward to hosting your IDO in a few short day. Thank you @MrDuckbill

Mr.Duckbill | Platypus

Thank you! Grateful to be hear and introduce Platypus to everyone ☺️

-

Platypus AMA #2— Technical Deep Dive with Mr.BeaverTail, Smart Contract Lead

Join us in the Avalaunch Telegram group for the second AMA with the Platypus team.

We will be joined by Platypus Smart Contract Lead, Mr.BeaverTail, where we will be covering the most technical aspects of the project.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 12/12/2021

- Time: 12:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

🐦 Follow: Avalaunch & Platypus

✈️ Join: Avalaunch Telegram & Platypus

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

Platypus AMA #1 — Project Overview with Mr.DuckBill, Founder

Join us in the Avalaunch Telegram group for the first of two AMAs with the Platypus team.

First up is Platypus Founder, Mr.DuckBill, where we will be covering the project at a high level. The focus of this AMA will be the business development, vision, road map, and post-IDO plans.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 12/10/2021

- Time: 6:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

🐦 Follow: Avalaunch & Platypus

✈️ Join: Avalaunch Telegram & Platypus

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

Avalaunch Joins Moralis Avalanche Hackathon as Partner

Avalaunch is officially teaming up with Moralis and Avalanche for the Moralis Avalanche Hackathon!

We are proud to announce that Avalaunch is a formal partner to the Moralis Avalanche Hackathon! The Moralis Avalanche Hackathon runs from the 6th of December, 2021, to the 31st of January, 2022. Anyone who wants to prove their development skills is free to join the hackathon at any time during its run.

“Avalaunch is an amazing partner to have for the Moralis Avalanche Hackathon,” said Ivan on Tech, Co-Founder of Moralis. ”We couldn’t be happier to have the definitive launchpad for Avalanche joining the Moralis Avalanche Hackathon. What’s more, knowing that Avalaunch is keeping their eyes on the hackathon will surely drive participants to go above and beyond with their projects.

“The whole point of Avalaunch, as a project and organization, is to support the growth of the Avalanche ecosystem,” said Mark Stanwyck, Co-Founder at Avalaunch. “Some of the most interesting and impactful ideas are often born from small bits of inspiration, which events like the Moralis Avalanche Hackathon are specifically designed to tease out. It’s a real privilege to support and promote alongside Moralis as they encourage fresh thinking around what’s coming next.”

Total Prize Pool

The total prize pool for the Moralis Avalanche Hackathon is already at $500,000 and can rise further. In fact, just the top three prizes, for which the only requirement to qualify is to build with Avalanche using Moralis, currently total $175,000. Specifically, the grand prize is currently worth $100,000 — while the runner-up prize is worth $50,000, and the third-place prize is worth $25,000.

As such, there has never been a better opportunity for you to test your development skills against others. Be sure to visit the official site for the Moralis Avalanche Hackathon and register, so you can take part in all the different-team building exercises and workshops. Let’s build!

Avalaunch Prize Pool

Avalaunch is providing a dedicated prize pool for the Moralis Avalanche Hackathon that totals $30,000. So, what will Avalaunch be looking for when judging projects? Specifically, Avalaunch is looking for a solution that can add utility and P2P OTC options for tokens vested on Avalaunch.

On the Avalaunch platform, Avalaunch offers projects the ability to vest public sale tokens, which are locked until the claim date. Avalaunch would like to allow users to farm a small reward pool with these vested tokens and/or offer a claim on them OTC to other users at a predefined rate.

If you’ve got a solution to solve this, be sure to build your solution and submit it during the Moralis Avalanche Hackathon!

About Moralis

Moralis is the leading Web3 development platform. Moralis enables developers to massively cut down their development time, by giving them access to a capable, plug-and-play blockchain backend infrastructure. In fact, Moralis offers a fully managed, infinitely scalable blockchain backend that cuts down the average development time by 87%.

In addition to this, Moralis is built from the ground-up to be fully cross-chain compatible. Additionally, Moralis’ different SDKs allow you to build a variety of Web3 projects with ease. As such, you can do everything from building Avalanche dApps to creating an NFT marketplace, learn how to build a DEX in minutes, create cross-chain dApps, or much more.

-

Platypus x Avalaunch—IDO Announcement

DeFi, despite its highly publicized setbacks, continues to march forward in a truly trailblazing fashion. The total value locked (“TVL”) across all decentralized finance platforms continues to eclipse previous highs at a blistering pace. According to analytics platform DeFi Llama, TVL first crossed the 200 billion USD mark in early October, and reached a most recent high of ~277B on November 9th. Perturbations in the market aside, we are bearing witness to the future unfolding before our eyes. The advent of automated market maker, borrowing and lending protocols and most recently, the algorithmic stable coin has set the table for the future of finance.

As capital remains slave to the contract in which it is locked, users are forced to contend with an outmoded model where liquidity pools seek the “lowest common denominator,” saddling users with high slippage costs and limited flexibility. The first generation of automated market makers (“AMM”) left much to be built upon. At the core of their limitations, is the current framework for StableSwaps.

StableSwaps are important not only for pegged assets, but also to solve the fragmented liquidity problem due to the existence of multiple bridges. It is also the building block for enabling more synthetic assets and algorithmic stablecoins.

Here to tackle this challenge comes a project that Avalaunch is truly honored to have for its next IDO: Platypus Finance

Overview

Platypus Finance’s design makes for a compelling StableSwap DEX that represents a bonafide innovation.

“Platypus has devised a whole new kind of StableSwap for enhanced capital efficiency, scalability and user experience. This pioneering protocol will be Platypus’ first major step in driving DeFi innovation in the Avalanche ecosystem.”

One only has to cursorily explore DeFi in order realize that, experientially, it is tantamount to being handed a new operating system for one’s computer every time a user goes to a new website. Even the most successful protocols such as Uniswap and Compound function independently of each other.

While their functions are different, the absence of shared liquidity forces users to choose or split their resources versus sharing them. Moreover, slippage remains a consistent issue and we are getting to a place where the literal costs can outweigh the benefits. The swapping of stable coins remains, well, unstable.

A Reimagined Automated Market Maker

Platypus removes existing StableSwap limitations, offering critical benefits to the Avalanche ecosystem:

1. Shared Liquidity

Closed liquidity pools are first-generation AMM—separated and not shared, giving rise to liquidity fragmentation.

Consider a typical stable coin pool:

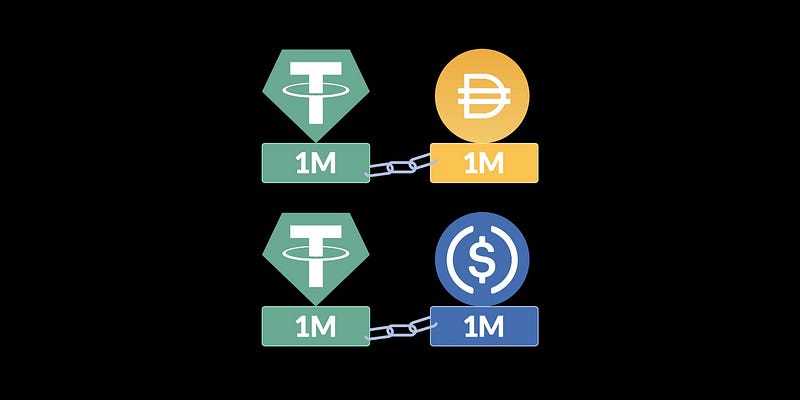

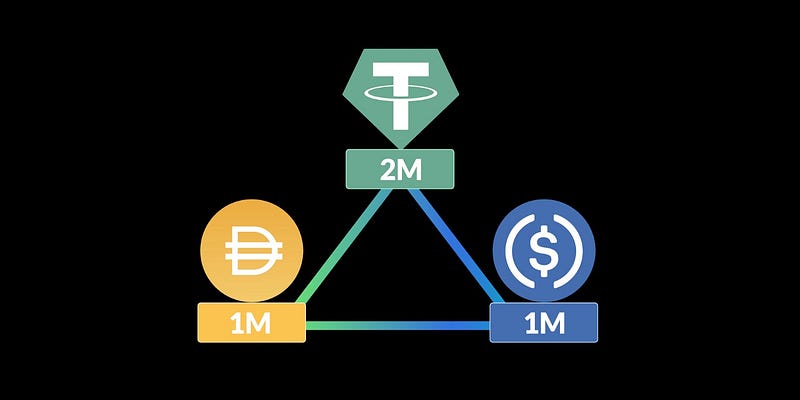

Users who swap USDT to DAI, for example, will experience slippage, calculated by holding the invariant between the liquidity in the USDT-DAI pool. Using a traditional StableSwap invariant and assuming A = 100 will create 0.05% slippage. By sharing the tokens, the pool in Platypus will look like:

With this mechanism in place, the slippage drops to 0.01%. Although handpicking parameters can make slippage look lower, the liquidity in Platypus between the two closed-pools is now shared, resulting in lower slippage.

2. Flexible Pool Composition

First-generation StableSwaps did not allow for the integration of multiple assets, e.g.—the base 3 CRV token cannot extend beyond USDT, USDC and DAI. The relative rigidity of these offerings requires the pools to have the same amount of liquidity. Should one lose size relative to the others, the entire pool’s equilibrium liquidity is pulled down with it.

This design is limited and makes it very difficult to add more tokens to the pools. Resultant to this, Curve has pool compositions comprised of pairing up the 3CRV LP tokens with the new token (e.g.: MIM), adding an additional layer of complexity.

The Platypus liquidity pool composition allows for flexibility.

“Our equilibrium state is defined by the same coverage ratio instead of the same liquidity. Assets in the pool are allowed to scale naturally based on its organic supply and demand.”

3. Single-Sided Token

In Platypus, users can deposit and withdraw tokens of the same kind without concern of pool compositions or size, or even the difference between token and LP token.

Platypus Value Proposition

Trading in Platypus means lower slippage, higher capital efficiency and greater asset scalability.

1. Lower Slippage—single-sided open liquidity pools promote capital efficiency, resulting in significantly lower slippage.

2. Higher Scalability—The Platypus liquidity pool composition gives room for flexibility and scalability.

3. User Experience— The simplified UX is easier without complicated pool compositions and users can deposit and withdraw tokens of the same kind without concern.

Conclusion

Without shared capital and as long as each protocol remains an island unto itself, existing stableswaps must continually rebalance in the isolated universe that they occupy, remaining inefficient. This fragmented liquidity is inefficient as dollars are “landlocked,” resulting in the higher costs and a compromised user experience.

Platypus Finance intends to usher in the next great innovation in DeFi by allowing for true capital efficiency. Platypus themselves have been bold enough to say they are here to “rewrite the rules of DeFi.” The Platypus mission calls for a merger of DeFi verticals into a single, unified system where locked capital can be shared across functions.

Platypus — Links

Website| Telegram (Discussion)| Twitter |Medium |Discord

Partners & Backers

The list above represents a pedigreed group of backers that is notably Avalanche-influenced in recognition of this “homegrown” protocol.

Final Thoughts

For supporters of Avalanche, it does not get much more exciting than this. Platypus has the makings to be something truly special—a seminal protocol that can propel DeFi forward. As a fee sharing protocol, the PTP token’s utility is straight-forward and potentially quite lucrative. For those lucky enough to witness the creation of Curve or the meteoric rise of Aave, we at Avalaunch feel that Platypus is similar in feel, scope, innovation and ambition.

Funding Numbers:

- Total Supply: 300,000,000 PTP

- Private: 42,000,000 PTP at .08 USD—3,360,000 USD

- Public: 10,500,000 PTP at .10 USD—1,050,000 USD

- Avalanche Foundation: Grant and funding totaling 114.8K USD

- Hard Cap: 4.5248M USD

Supply Breakdown

- Total Supply: 300,000,000 PTP

- Liquidity Incentives: 120,000,000 PTP (40%)

- Treasury: 60,000,000 PTP (20%)

- Sale (Private & Public): 52,500,000 PTP (17.5%)

- Team: 45,000,000 PTP (15%)

- Exchange Liquidity: 10,500,000 PTP (3.5%)

- Advisory: 6,000,000 PTP (2%)

- Avalanche Foundation: 6,000,000 PTP (2%)*

*Platypus received a grant from the Avalanche Foundation.

Vesting Following TGE:

- Liquidity Incentives: Reserved for liquidity mining*

- Treasury: 5% at TGE, 6-month cliff and subsequent 36 months linear vesting

- Private Sale: 10% at TGE, 3-month cliff and subsequent 18 months linear vesting

- Public: 10% at TGE, monthly vesting for 12 months (7.5% per month)

- Team: 12-month cliff and subsequent linear vesting for 30 months

- Exchange Liquidity: 50% at TGE, 6-month cliff and subsequent 6 months linear vesting

- Advisory: 12-month cliff and subsequent linear vesting for 30 months

- Avalanche Foundation: 10% at TGE, 3-month cliff and subsequent 18 months linear vesting

*The unlock is discretionary and contingent upon a number of factors that the team has identified. Any incentive unlocks will be announced.

Other:

· Initial Circulating Supply: 8,850,000 PTP (excluding liquidity tokens)

· Initial Market Cap: 885,000 USD (excluding liquidity tokens)

· Initial Liquidity: To be determined based upon yet to be finalized listing plans

The Platypus Finance IDO on Avalaunch

- 10,500,000 PTP at .10 USD (Total Supply: 300M PTP)

- Sale Size: $1,050,000 USD

Registration Schedule:

- Registration Opens: December 9th at 3:00 p.m. (UTC)

- Registration Closes: December 12th at 6:00 a.m. (UTC)

Sale Schedule:

- Validator Round Begins: December 13th at 6:00 a.m. (UTC)

- Validator Round Closes: December 13th at 3:00 p.m. (UTC)

- Staking Round Begins: December 13th at 3:30 p.m. (UTC)

- Staking Round Closes: December 14th at 6:00 a.m. (UTC)

Avalaunch Sale Distribution

- Stakers of the XAVA token will receive 95% or more of the sale.

- The allocation for validators of the Avalanche network is to be determined at the time of the sale.

IDO Recap

- Total PTP for sale: 10,500,000

- Price: .10 USD

- Size: $1,050,000

- Vesting — 10% at TGE, monthly vesting for 12 months

-

Colony AMA #2 — Technical Deep-Dive with Elie LE REST, CEO (Recap)

On 12/03/2021 at 9:00 a.m. (PST), an AMA session was held on Avalaunch with special guest Elie LE REST, CEO, at Colony. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Hello and welcome everyone to Part II of the Colony AMA. Call it the sequel. Last time, we had Wassel the Colony CMO here to set things up and now we have Elie LeRest, the CEO to knock things down.

Elie, good to have you here today Ser, how are you @Elie_LR?

Elie LeRest | Colony

Hey! It’s a pleasure to be here, I’m doing great! Thanks for having me 😉

Dave Donnenfeld | Avalaunch

Good to have to you…Let’s begin with a short introduction about yourself. How did your previous experience lead you to where you are today?

The abbreviated version of this story is fine. Maybe from age 7 onward 😀

Elie LeRest | Colony

Hey I’m Elie! Colony’s CEO, I’m leading a team to bring to life a true “Colony” that will empower the Avalanche community with access to early-stage deals and much more.

I’m also partner and Co-founder at ExoAlpha, a Hedge Fund with systematic quantitative strategies; long-short exposure to Bitcoin & Ethereum. I’ve been in the crypto space since 2013 and throughout the years, I’ve structured several digital assets deals, advised security/utility token projects and private corporate blockchain projects. My past traditional finance experiences include Asset and Wealth Management in Paris, New-York, at big firms like UBS and Credit Agricole. I’ve also built a crypto quantitative arbitrage trading algorithm in 2016. Last year I wanted to get more involved in the ecosystem and wanted to build a community driven initiative to empower Avalanche’s growth.

Why Avalanche? When I came across the Avalanche network a year ago, I felt that this was the right one. The technological breakthrough powering the consensus and the subnet customizability built on top was the perfect combo: being able to scale with high decentralization. This is where Colony comes in 😉

Dave Donnenfeld | Avalaunch

It’s a talented group for sure and I respect the hustle for having accomplished something of this magnitude. So, how many people are behind this sizable project?

Elie LeRest | Colony

Colony’s Team is composed of experts with decades of experience and pedigree in the blockchain, and traditional finance space. With the founding of ExoAlpha, a systematic crypto Hedge Fund that has amassed a trading volume of half a billion dollars per month and with over 150 published articles in well known publications, the team is more than ready to make Colony everything it means to be.

Not only has every member of the team been involved in finance or crypto for a long time, but members are active within the community today, and their insight into emerging markets and the latest trends is invaluable.

Right now the team is composed of 6 developers and growing. We have 3 solidity developers, 2 front end and a tech lead. On the marketing front we currently have 3 people and our CMO 🙂

Dave Donnenfeld | Avalaunch

I’m not sure what I’m more impressed with — the 500M a month or the 150 articles. That’s a lot of writing and an impressive assembling of a team.

How long did it take the team and how difficult was it to bring all of these different smart contracts together, and have it all under one development umbrella?

Elie LeRest | Colony

Thanks, we are a hardworking team 😉

So, building a DAO is not an easy task, it takes time. The developers started to work on the application in Q3 2021, and we expect that all the features of the application in its first version will be delivered in Q1 and Q2 2022. At the moment we have the front-end in place with initial features like staking & claiming tokens. By the end of the year, we’ll improve the airdrops functionality to process all the airdrops coming in late December 🤗

The development team is having so much fun developing the features of Colony as it’s a really different project than anything else in crypto right now and it’s a real challenge to achieve Colony’s vision alongside the best security, as it is our first priority.

Dave Donnenfeld | Avalaunch

Can you share any insights into the work around designing the flow of value of Colony, and how it translates into this decentralized smart contract architecture?

Elie LeRest | Colony

So the flow of value inside Colony is going to be segregated in 4 sections:

We’ll have:

– Early-Stage investments

– Liquidity Providing Program

– Index

– Staking ProgramEach of these sections have a dedicated flow of value. Colony aims at being transparent, naturally, everything will be on-chain. In addition to that, all the data related to Colony’s capital deployment will be available on the dashboard section of our application.

As of now, the entire architecture is not decentralized and it will take some time to have all the pieces together to build a secured, decentralized, capital efficient, community driven investment DAO. We want to build the DAO alongside our community feedback.

Once the entire system is decentralized, we’ll add new features like dedicated pools with locking mechanisms enabling capital investment in early-stage deals managed by Colony’s community.

Dave Donnenfeld | Avalaunch

This last part is notably exciting

Having looked at Colony, it is clear that one of its core missions is to drive development and bring value-adding tools to the Avalanche ecosystem. Can you briefly tell us what these different mechanisms are, and how does this work synergistically to support the Avalanche community?

Elie LeRest | Colony

Yes the team is really excited about it and looking forward to delivering it to the community 🙂

When you are staking Colony tokens, you have access to the entire dealflow of the Avalanche ecosystem. This will help the Colony’s community understand what are the market trends inside the Avalanche ecosystem. This is a powerful tool for the Avalanche community, to be able to engage with projects very early and contribute to their development and potentially bring funding through Colony (if the project successfully goes through the entire investment process => managed by the community).

Also, for projects, it’s also a golden opportunity because they will have access to a community very early and gain valuable feedback to move forward inside the avalanche ecosystem. In other words, if projects are funded by Colony, they have instant adoption with thousands of addresses holding their token (since Colony is airdropping almost all of its allocation to stakers).

Dave Donnenfeld | Avalaunch

Impressive stuff

Continuing…Setting up something of this scale, for sure, was not an easy task. What are the challenges of building such a complicated network of contracts that support this type of ecosystem, and how did the team solve them?

Elie LeRest | Colony

Colony is and always will be a work in progress, in the sense that we’ll always take the feedback of the community in consideration to build the structure that is right for the ecosystem we’re in. So far, Colony has developed mostly the tools that will give the users access to the primary functions of rewards receipt based on the staking (how many CLY are staked and for how long).