Introducing Stable Jack

Stable Jack is a DeFi protocol that creates structured financial products, allowing users to earn fixed returns, take leveraged positions without liquidation risks, and maximize rewards from airdrops or incentive programs—all while reducing the costs and uncertainties associated with traditional leverage. With $13M+ in TVL at ATH, over 500 users, and a 70% retention ratio, Stable Jack has already demonstrated strong adoption and user confidence.

By enabling users to trade exposure to yield, volatility, and points across any asset, Stable Jack enhances capital efficiency and offers a safer, more predictable alternative to high-risk trading strategies. With no liquidation risk on leveraged positions, protection from market manipulation, and a focus on sustainable yield, Stable Jack provides a practical solution for traders seeking stability and efficiency rather than chasing unsustainable returns.

Additionally, the ability to speculate on points and integrate seamlessly with major protocols ensures deeper market adoption, making Stable Jack a valuable tool for both experienced and new DeFi participants.

Key Features of Stable Jack

- Fixed Yield – Earn predictable, high-yield returns on stablecoins, no maturity date required.

- Leveraged Yield – Maximize returns on stablecoins and blue-chip assets with the highest market yield.

- Leveraged Airdrop Farming – Gain exposure to airdrops without risking principal.

- Leveraged Long Without Liquidation – Go long on your favorite assets with leverage, no liquidation risk.

- No Principal Risk – Secure high returns while protecting your capital.

- No Maturity Date – Set and forget—your positions remain active.

To achieve these features, Stable Jack uses three types of tokens, each designed to optimize capital efficiency and cater to different risk and reward preferences:

- Yield Tokens (YT) – Provide fixed and variable yield exposure, allowing holders to earn returns while retaining their principal. YT can also be used as collateral in DeFi protocols, enabling yield looping for enhanced returns.

- Volatility Tokens (VT) – Offer leveraged long exposure to collateral assets without liquidation risk or funding fees, making it a cost-effective way to gain upside exposure to price movements.

- Points Tokens (PT) – Enable leveraged farming of airdrops and rewards, allowing users to earn incentives while maintaining exposure to the underlying asset. PT can also be used as collateral for additional leverage.

By combining these tokenized strategies, Stable Jack transforms yield, volatility, and incentive trading into structured financial products, giving users more control over risk and returns in DeFi.

Stable Jack: Solving DeFi’s Biggest Challenges

DeFi lacks structured financial products that balance predictability and flexibility. Stable Jack addresses these major pain points:

- Unstable & Unpredictable Yields – Many DeFi platforms offer variable returns that fluctuate based on market conditions. Stable Jack provides fixed and leveraged yield options for greater control over returns.

- Leverage Without Safety Nets – Most leverage in DeFi comes with high liquidation risks. Stable Jack removes this risk, allowing users to take leveraged positions without the fear of sudden liquidations.

- Lack of Volatility Trading – Most DeFi products focus only on price appreciation, ignoring volatility as a tradeable asset. Stablejack lets users capitalize on market swings, enabling new trading strategies.

Stable Jack brings new ways to manage risk and deploy capital efficiently, making it an essential tool for users seeking structured, predictable, and scalable DeFi strategies.

Comparison Analysis

Stable Jack is based on a pool model (not AMM), preventing impermanent loss & price slippage, making it more efficient for both LPs and investors.

As the DeFi ecosystem matures, the yield market presents a significant opportunity for growth. Innovative protocols will drive the next phase of expansion, offering more structured and efficient solutions.

Stable Jack stands out among yield protocols with its unique ability to provide principal protection, no slippage, and no impermanent loss —a combination that is difficult to replicate. These advantages position Stablejack for strong, sustainable growth as demand for predictable and secure yield solutions increases.

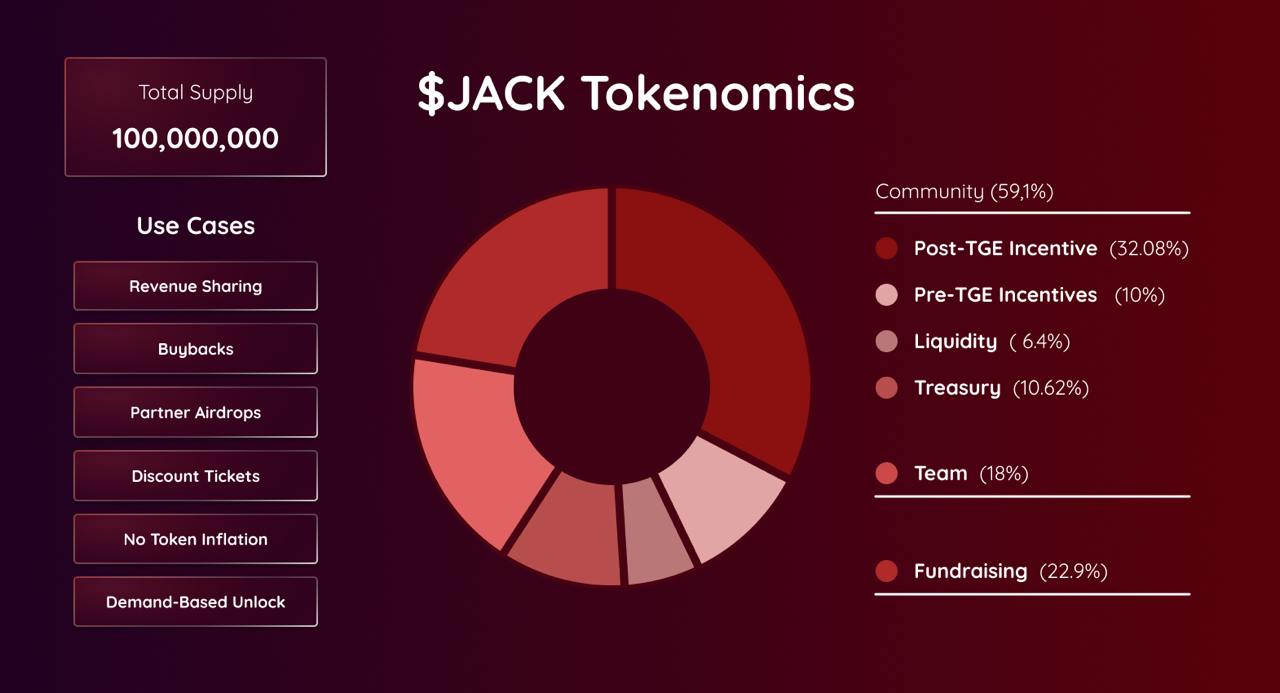

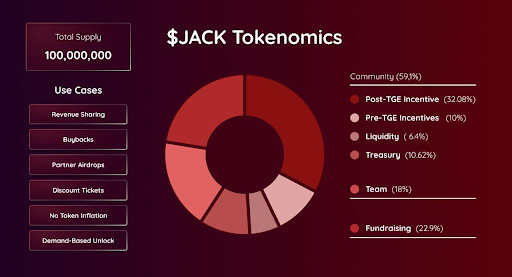

JACK Token Utility

Stable Jack innovates a new tokenomics model, called Discount Tickets. This community-first approach limits token inflation and sell pressure through demand-based unlocks, which benefits the long-term holders. Also, as part of $JACK tokenomics, the protocol will buy back $JACK from the market with the protocol revenues and share the revenue with $JACK holders.

✅ Demand-based unlocks – No inflationary token emissions, new JACK tokens only enter circulation when there’s a demand.

✅ No unnecessary sell pressure – Rewards long-term holders and users instead of mercenary capital.

✅ Protocol-Owned-Liquidity – enables Stable Jack to raise POL for buybacks, ensuring a sustainable token economy.

✅ Value Accrual to $JACK – Revenue-sharing, buybacks, & airdrops from partner protocols.

Users can buy JACK on the open market or at a discount via the Discount Tickets system. To unlock its full benefits, users stake JACK to receive sJACK, which grants access to the following utilities:

- Revenue Sharing – As Stable Jack grows, sJACK holders receive a share of protocol revenue.

- Fee Rebates – Reduces VT/YT minting and redemption fees based on the amount of $sJACK staked.

- Governance – sJACK holders vote on protocol decisions, community initiatives, and marketing strategies.

- Discounted JACK – Staked users can purchase JACK at a discount, with rates based on their stake amount and duration.

Stable Jack’s utility-driven model ensures that JACK retains long-term value, fueled by real demand rather than unsustainable emissions.

Catalysts For Future Growth

- Chain Expansion – Ethena Network and Hyperliquid

- RWA Exposure – Partnering with Misyon Bank to accept tokenized Turkish Money Market Fund as collateral, new RWA partnerships are coming soon!

- CeFi Integration – Collaborating with MENA & Turkish exchanges to integrate Stable Jack products

- DeFi Agent – A consumer AI product that automates and simplifies the DeFi user experience

- Mobile App – Aggregating DeFi products for retail users in the MENA region

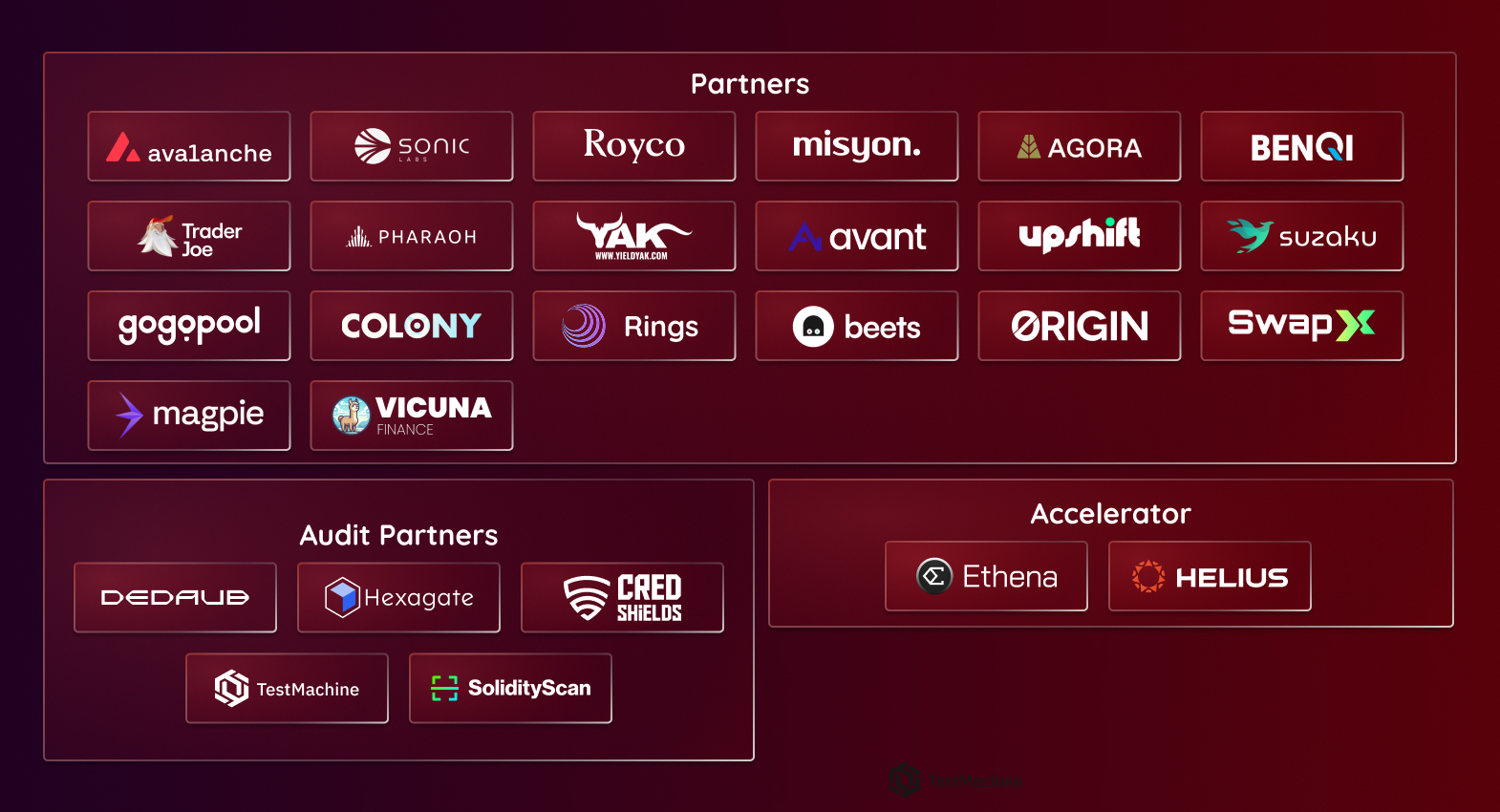

Achievements to Date

🏆 Winner of Avalanche DeFi QF by Gitcoin

🏆Ethena Accelerator 2nd Place – Launching on Ethena Network from Day 1

🏆 Helius Labs Startup Launcher

🏆 Sonic BOOM Winner – Eligible for significant Sonic Gems (points) & airdrops

Partners & Backers

“Stable Jack has the potential to revolutionize yield, volatility, and points markets across all assets on Avalanche. As a core building block of Avalanche’s DeFi ecosystem, we’re excited to support their growth and mission.”

— A representative of Blizzard Fund

Team

Official Links

Website | X | DeBank | Discord | Telegram | Docs | Mirror

Stable Jack: Avalaunch IDO

“Avalaunch is one of the most well-known protocols in the ecosystem as they supported OG protocol since the early days of Avalanche and we are super excited to work with the whole Avalaunch team, specifically David and Mark to make this raise a success for the whole community.”

From the Co-Founder of Stable Jack

Funding Numbers

- Angel Round: $1.25M – 8,606,000 (8.606%) at 0.125 USD – 12.5M FDV

- Seed Round: $642,772.00- 4,285,000 (4.285%) at 0.15 USD – 15M FDV

- Public Round:

- Avalaunch: $200k USD – 1.000.000 (1%) at 0.2 USD – 20M FDV

- Fjord: $1.25m USD – 6.250.000 (6.25%) % at 0.2 USD – 20M FDV

- Finceptor: $250k – 1.250.000 (1.25%) at 0.2 USD – 20M FDV

- Seedify: $300k – 1.500.000 (1.5%) at 0.2 USD – 20M FDV

Supply Breakdown

Total Supply: 100,000,000 JACK

- Team and Advisors – 18M JACK (18%)

- Post-TGE Discount Tickets – 32M JACK (32%) TGE

- Discount Tickets – 10M JACK (10%)

- Liquidity/MM/Exchanges – 6.4M JACK (6.4%)

- Treasury – 10.6M JACK (10.6%)

- Angel Round – 8.6M JACK (8.7%)

- Seed Round – 4.3M JACK (4.3%)

- Public Round – 10M JACK (10%)

Vesting Following TGE

- Team and Advisors – 180 days cliff, 730 days vesting

- Post-TGE Discount Tickets – 900 days vesting TGE

- Discount Tickets – 100% unlock at TGE Liquidity/MM/Exchanges – 60% unlock at TGE, 180 days vesting

- Treasury – 15% unlock at TGE, 365 days vesting

- Angel Round – 10% unlock at TGE, 365 days vesting

- Seed Round – 10% unlock at TGE, 365 days vesting

- Public Round – 100% unlock at TGE

ℹ️ The TGE for $JACK will take place in early April. Please await official announcements from the Stable Jack team regarding the exact TGE date and time.

Other Info

- Initial Liquidity: $500K worth of liquidity on Avalanche — (250k AVAX/250k JACK)

- Initial Circulating Supply (excl. liquidity): 23,945,600.00 JACK

- Initial Market Cap: $4,789,120.00

IDO Registration Schedule

Registration Opens: Wednesday, March 19 at 3:00 p.m. (UTC)

Registration Closes: Wednesday, March 26 at 6:00 p.m. (UTC)

IDO Sale Schedule

Validator Round Begins: Thursday, March 27 at 6:00 a.m. (UTC)

Validator Round Closes: Thursday, March 27 at 3:30 p.m. (UTC)

Staking Round Begins: Thursday, March 27 at 3:30 p.m. (UTC)

Staking Round Closes: Friday, March 28 at 6:00 a.m. (UTC)

Booster Round Begins: Friday, March 28 at 6:00 a.m. (UTC)

Booster Round Closes: Friday, March 28 at 10:30 a.m. (UTC)

How to Participate

To participate in Avalaunch sales, users will have to:

- Complete their KYC Registration | Tutorial

- Stake XAVA to secure their allocation | Tutorial

- Register for the sale when Registration opens | Tutorial

Claiming Your Allocation

Avalaunch IDO participants will be able to claim their $JACK allocation on the Avalaunch platform once the sale period ends.

Refund Policy

We’re offering a 24-hour unconditional refund policy on the Stable Jack IDO, available from the start of TGE. Please note that claiming your tokens during this period will make you ineligible for a refund.

If you do not take any action (neither claim nor refund) within 24 hours, it will be considered a claim, and the refund option will expire.

About Stable Jack

Stable Jack is a yield, volatility, and points market for any asset. Investors can access fixed and leveraged yield, farm airdrops with leverage, and long any asset without liquidation risk.

Since the launch, Stable Jack achieved an 80% retention rate, more than 5000 users and a 20% monthly growth rate.

Stable Jack innovates a new tokenomics model, called Discount Tickets. This community-first approach limits token inflation and sell pressure through demand-based unlocks, which benefits the long-term holders. Also, as part of $JACK tokenomics, the protocol will buy back $JACK from the market with the revenues and do revenue sharing.

About Avalaunch

Avalaunch is a launchpad powered by the Avalanche platform, allowing new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With its values deeply rooted in the early Avalanche community, we are able to offer projects confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem. Leveraging Avalanche’s scalable, high-throughput, and low-latency platform, Avalaunch is built by users, for teams, to help grow strong communities.