-

Nullshot: Where AI Meets Community Co-Creation

The Problem We’re Solving

Traditionally, there’s a team and there’s a community. Builders build. Users use. The wall between them is assumed, accepted, normal.

This wall has real consequences. Great ideas die because the person who has them can’t code. Communities want to contribute but have no mechanism to do so. Technical founders hold all the power while communities have none of the ownership. Value accrues to those who can deploy contracts, not to those who actually create value.

Nullshot breaks this wall.

The Vision: Co-Creation + Co-Ownership

Here’s the core insight: We’re creating something different. A space where everyone builds together, with AI bridging the gap between ideas and implementation.

What does this actually mean? Non-technical people can build technical products with AI assistance. Ideas transform into code faster than before. Complex concepts become accessible to everyone. Individual contributors gain the capabilities of entire teams. The quality bar stays high while barriers to entry drop low.

The result: More people can meaningfully contribute. More ideas become reality. Everyone who helps build owns what they create.

What Nullshot Actually Is

The technical architecture is built on Cloudflare’s infrastructure with TypeScript at its core. Think of it as a unified canvas where AI amplifies human potential.

There are three core components:

Brainstorm: Where Ideas Take Shape

This is where you can propose anything: AI agents, DeFi tools, agentic workflows. The AI helps translate ideas into technical specifications. Communities refine proposals together, with technical and non-technical contributors working side by side. The AI assists with prototyping through mockups, code snippets, and feasibility checks. Every contribution gets tracked—every suggestion, every improvement, all credited. Ideas get validated against real-world data from social media, code repositories, and Discord communities.

Builder Ecosystem: Where Ideas Become Real

This layer provides tools to develop and deploy AI agents and MCP tools. The interfaces are straightforward, allowing you to combine powerful AI capabilities without writing code. Performance runs at the edge with less than 50ms latency via Cloudflare Workers. Event streams, durable storage, and workflow orchestration are built in. Developers can write agents locally in TypeScript and deploy them anywhere.

Nullshot Launch Platform: Where Ideas Graduate

Products launch through a fair launch mechanism using Dutch auctions with no insider advantages. Tokens gain instant omnichain presence, launching everywhere at once. Revenue flows to contributors—you build together, you earn together.

How It Works: A Real Example

Let’s walk through what happens when someone actually uses Nullshot. We’ll call him Jake.

Jake can’t code, but he sees traders struggling to track positions across multiple chains. Here’s what happens:

Week 1: Ideation

Jake describes his idea for a Web3 MCP tool that aggregates DeFi positions. The platform’s coding and specification agents help him sketch out basic functionality. The feedback loop shows DeFi users on X and Discord desperately asking for exactly this tool.

Week 2: Development

A developer contributor sees Jake’s idea and builds the first integration for Uniswap. Another contributor adds Aave support. Someone suggests existing APIs to speed up development. A DeFi whale spots the project and points out critical security considerations.

Throughout: AI Amplification

The platform’s AI agents help Jake understand technical discussions he wouldn’t normally follow. Developers use the same agents to rapidly prototype features. Non-technical suggestions get translated into technical specifications. Technical implementations get explained in plain language so everyone understands what’s being built.

By Launch

A hundred people have shaped this tool. All hundred share in the protocol fees forever. The MCP works everywhere: trading bots, Telegram, Discord, wherever users need it.

The key difference: This isn’t crowdsourcing ideas for someone else to build. It’s crowd-building with crowd-ownership.

The Technology: What Makes This Possible

AI Agents (Not Just Tools)

These are autonomous collaborators that perceive, plan, and execute tasks. They’re built on the TypeScript Agent Framework with edge-native performance through Cloudflare Workers and Durable Objects. They run always-on, globally distributed, with tireless execution. The logic combines deterministic planning with LLM reasoning to stay human-aligned.

MCP Tools (Model Context Protocol)

MCP tools are structured actions for agent execution. They use plain JSON contracts that define capabilities in ways that are human-readable and machine-enforceable. They’re safe by design with validated inputs and observable calls. You can compose them, combining individual tools into higher-order behaviors.

Example tools available include notifications.send for real-time alerts, github.createIssue for filing bug reports, crypto.swap for DEX transactions, and calendar.schedule for time coordination.

The Infrastructure Advantage

Cloudflare’s global edge network provides the foundation. TypeScript is familiar to millions of developers. There’s no assembly required—event streams, storage, and secrets management are all built in. You write locally and deploy globally.

The Fair Launch Mechanism

Traditional launches have problems. Insiders can snipe good entry prices. Teams can bundle initial sales to create artificial scarcity. The process isn’t transparent. Communities get excluded from day-zero value capture.

Nullshot’s solution works in three phases:

Phase 1: Voting ($10,000 USDC threshold)

Community members lock USDC to vote for projects. Voters earn 1% of swap fees during the launch period. They can cancel their votes anytime with a 0% fee. Because voting isn’t incentivized beyond earning fees, you get honest signals about what people actually want to see built.

Phase 2: Live Launch (24-hour Dutch Auction)

The project must raise $10,000 USDC within 24 hours. The Dutch auction format prevents sniping because price discovers naturally as the auction runs. You can trade during the auction—buying and selling are both allowed. The glide curve mathematics ensure fair price discovery.

Phase 3: Graduation or Refund

If successful, the token gets distributed omnichain and becomes tradeable instantly. If the launch fails, holders get a 100% refund. Sellers during the auction get a partial refund. Everything remains transparent throughout.

Why this works: There are no hidden allocations. The community participates from day zero. Price discovery happens fairly. Participants have managed risk throughout.

The Contribution Tracking System

Nullshot values every type of contribution. “What if” suggestions count. Code commits count. Security audits count. Design feedback counts. Community moderation counts. Testing and bug reports count.

The platform tracks all contributions. AI helps weight the value of different contribution types. Contributors earn an ownership stake based on their inputs. Revenue shares get distributed automatically.

The principle is simple: Your contribution is your stake. Your stake is your share. Forever.

The Key Differentiators

Democratized AI Access

The experience is simple and intuitive. You don’t need to code to create agents. You point, click, and build. AI amplifies everyone’s capabilities, not just engineers.

Relevant, Timely Context

Ideas get fed data from social media, GitHub, and Discord. The platform performs real sentiment analysis. You see feature demand signals from actual users. Validation is data-driven, not based on gut feelings.

Universal Interface

Agents work from the website, WhatsApp, Discord, X, and Telegram. Your AI follows you everywhere. You’re not trapped in a single ecosystem. This is true omni-platform presence.

Cloud-Native Architecture

Cloudflare’s global infrastructure means the platform scales without effort. It’s cost-efficient at any scale. There’s no DevOps burden to manage.

Privacy First

Every user gets a private cloud. No one but the owner has access. Collaboration happens with encryption. Users own their data vaults.

Focused on Participation

Contribution equals stake. Ownership belongs to builders and participants. You co-create, so you co-own. Participation becomes partnership.

What This Enables That Wasn’t Possible Before

For non-technical contributors, you can turn ideas into functioning products. You contribute meaningfully to technical projects. You earn ownership from intellectual contributions. The gap between vision and implementation closes.

For developers, you accelerate development with AI assistance. You focus on creativity instead of boilerplate code. You collaborate with diverse skill sets. You build with communities, not for them.

For communities, you move from consumer to creator. You own what you help build. You earn from products you shape. You have direct influence over what gets built.

New types of products become feasible: AI agents with community governance, MCP tools tailored to specific needs, autonomous protocols co-owned by users, and products that weren’t viable for small teams before.

The Integration with XAVA Ecosystem

How XAVA powers Nullshot

You pay launch fees in USDC or XAVA, with a 10% discount when using XAVA. XAVA forms the primary trading pair for graduated tokens. XAVA stakers receive revenue sharing. XAVA grants access to premium features and governance participation.

How Nullshot expands XAVA

Nullshot creates new utility for XAVA as a launch platform, not just an investment platform. It brings new users who are builders, not just investors. It creates new demand because every launch needs XAVA pairing. It generates new revenue as platform fees feed back to XAVA stakers.

The Flywheel

More products get built on Nullshot. More launches use XAVA. Demand for XAVA increases. Value for holders grows.

Real-World Use Cases

AI Agent Builders can create specialized agents without managing infrastructure. They deploy globally with edge performance. They monetize through Nullshot’s launch mechanism. Community ownership comes from contribution.

DeFi Tool Builders can build cross-chain aggregators, create trading bots, develop risk management tools, and launch fairly with community backing.

Content Creators can build AI-powered content tools, create audience-owned products, monetize creative utilities, and share ownership with their supporters.

Web3 Infrastructure Builders can develop protocol tooling, create developer utilities, build community management tools, and co-own products with actual users.

Looking Forward: The Roadmap

Coming Soon (Near-term)

Community validation polls with one-click consensus. Cross-platform signal integration from social media, GitHub, and Discord. Usage analytics through public dashboards and adoption curves. Open source reasoning so you can see transparent Compass agent logic.

On the Horizon (Medium-term)

Language-agnostic runtime with support for Rust, Python, and Go. Plugin compatibility with ElizaOS, Arc, and AutoGen adapters. An expanded MCP tool library. Deeper social insights. Enhanced privacy controls.

The Vision (Long-term)

Even more powerful AI assistance. Specialized AI tools for Web3 covering token design and security audits. Seamless technical translation between contributors. AI-enhanced governance. New collaborative workflows we haven’t imagined yet.

Who Nullshot Is For

You should care about Nullshot if you have ideas but can’t code. If you’re a developer tired of building alone. If you want to own what you help create. If you believe communities should be stakeholders. If you’re excited about AI enabling creation. If you want to build products that matter.

You don’t need a technical degree. You don’t need a coding bootcamp. You don’t need a technical co-founder. You don’t need venture capital. You don’t need connections or credentials.

You do need a good idea. You need willingness to collaborate. You need openness to feedback. You need commitment to shipping.

The Broader Impact

What happens when barriers fall? More diversity in who builds. More perspectives in what gets built. More innovation from unexpected places. More equitable distribution of value.

The transformation looks like this: From “can you code?” to “can you contribute?” From “technical founder” to “community builder.” From “product team” to “product community.” From “users” to “co-owners.”

The Invitation

The next breakthrough won’t require a technical degree or coding bootcamp. It’ll require a good idea and a community ready to build it together.

Nullshot is the platform that makes this possible. AI as your co-pilot. Community as your team. Contribution as your stake.

The canvas is blank. The potential is unlimited. The tools are ready.

Come build the future with us.

-

The XAVA Token: Building Utility

The Philosophy

XAVA Labs operates on a core principle: “We’re not just building products; we’re architecting an economy.”

The XAVA token evolves through expansion rather than redesign or pivot. Every new application from XAVA Labs adds fresh utility layers without replacing existing functionality. This approach stems from studying what works and what fails in crypto tokenomics.

The Single-Utility Problem

The crypto industry learned an expensive lesson over the last several years: single-utility tokens face a fundamental economic problem called the velocity trap.

The equation is simple but brutal: MV = PQ (where M equals token value, V equals velocity, P equals price level, Q equals quantity of transactions). When tokens serve only one narrow purpose, especially payments, users hold them for seconds instead of days. Velocity rates hit 50 to 100 or higher, creating constant downward price pressure.

The data tells the full story. Nearly 2,000 projects raised $13 billion during the ICO era. Over 1,600 failed within two years. The pattern was consistent: single narrow use case leads to extreme velocity, which leads to inability to capture platform value, which leads to price collapse. The problem persists today.

Uniswap generated over $1 billion in annual protocol fees for years, yet UNI token holders captured none of it. Governance-only utility meant the token couldn’t reflect the protocol’s massive success, earning it the “useless governance token” label despite Uniswap’s dominance.

The portfolio theory evidence is equally stark. Research analyzing token performance from 2020 to 2024 reveals that multi-utility tokens achieve:

- 30 to 50 percent lower annual volatility than single-utility tokens

- 2 to 3 times better survival rates through market cycles

- 100 percent or higher Sharpe ratios (risk-adjusted returns)

- 50 percent faster recovery times from market drawdowns

Multi-utility tokens function like diversified portfolios. When one demand source weakens (say, trading volumes decline), others compensate (staking, governance, new product usage). Single-utility tokens inherently lack this resilience. When their one use case faces headwinds, there’s no floor.

XAVA’s expansion stems from a strategic reality: single-utility tokens face structural disadvantages. For XAVA to continue to thrive, a pathway to multi-utility design is required.

The Strategic Shift

XAVA Labs frames the approach directly: “Your XAVA tokens are becoming multi-utility assets that anchor a growing ecosystem of omni-chain protocols and capture the value generated across that entire landscape.”

Every project follows the same discipline:

- Identify genuine market needs

- Develop solutions that create new on-chain behavior

- Integrate XAVA token utility

This third point is key. Every product from XAVA Labs is built with XAVA into its DNA from inception.

Expanded Utility

XAVA will be a unified system for AI creation, tokenized ownership, and permissionless funding with the XAVA token being key to owning that convergence. The XAVA token anchors the ecosystem, streaming rewards from origination activity via newly tokenized components. Together, they lay the foundation for the new economy where AI, capital, and collaboration operate in unified alignment.

XAVA Utilities

- Gas – Powers transactions and contracts on the XAVA L1.

- Staking & Validation – secures the network and earns validator rewards.

- Launch Access & Allocation – grants entry to omnichain from Day Zero launches.

- Streams – delivers new tokens directly to stakers.

- Revenue Capture – accrues fees and AI-driven income back to holders/stakers.

- Governance & Treasury Rights – enables protocol voting and treasury influence.

- Ecosystem Access Layer – required for deploying, interacting with, and monetizing apps, agents, and tools built on the XAVA network.

The future economy will arise from the convergence of AI, internet-native collaboration, and open capital markets.

XAVA Labs is building an omnichain platform for the origination of tokens that reflect real, AI-driven value creation. The system integrates AI orchestration, collaborative build environments, and transparent capital formation. Designed to be deeply non-extractive, ensuring value flows correctly to contributors and participants.

Following Proven Patterns

XAVA’s expansion blueprint comes from studying successful precedents. This path has been validated by tokens that made the single to multi-utility shift work.

Pattern #1: Phased Rollouts Minimize Risk

Ethereum took five years to transition from Proof-of-Work to Proof-of-Stake (Beacon Chain 2020, Merge 2022, Shapella 2023). BNB expanded from exchange fee discounts to BSC gas token gradually. Chainlink grew staking caps progressively: 25M to 45M to 75M LINK.

The lesson: Major utility additions require time. Each phase validates assumptions before scaling further.

Pattern #2: Staking Reduces Velocity

Many of the most successful token transitions added staking mechanisms. The reason is straightforward: locking tokens removes them from circulation, directly attacking the velocity problem. Ethereum currently has 26 percent or more of supply staked (35.3 million ETH), fundamentally changing token dynamics.

XAVA’s staking addition follows this pattern, first for IDO access and now, ecosystem benefits.

Pattern #3: Fee Distribution Creates Sustainable Value

Tokens with direct revenue sharing dramatically outperform governance-only models. AAVE’s Safety Module distributes protocol fees to stakers. Curve sends 50 percent of fees to veCRV holders. Raydium uses 97 percent of fees for buybacks, resulting in $360 million in buy pressure during December 2024 alone.

Nullshot’s fee distribution to XAVA holders follows this highest-performing pattern.

Pattern #4: Governance Needs Economics

UNI generated over $1 billion annually in protocol fees for years while the governance-only token languished. When fee-sharing discussions resumed in 2024, UNI jumped 40 percent on speculation alone, validating that governance without economics is insufficient.

The Value Capture Hierarchy

Analysis of 2020 to 2024 token performance reveals which mechanisms work best:

Tier 1 (Most Effective):

- Fee Distribution (direct revenue share)

- Deflationary Burns (ETH burned $10B+ via EIP-1559)

Tier 2 (Sustainable):

- Buyback Programs (Raydium’s 97 percent model)

- Usage-Driven Yields (Chainlink staking for oracle security)

Tier 3 (Weakest):

- Governance-Only (UNI pre-fee switch)

The compounding effect works like this: More products using XAVA creates more reasons to hold. More holders creates more liquidity across chains. More liquidity creates better user experience. Better experience creates more users, which creates more demand.

Why They Outperform: The Data

The shift from single-use is backed by compelling performance data and behavioral research.

The Quantitative Evidence

Comparative analysis of token performance across multiple market cycles (2020 to 2024) reveals stark differences:

Metric Single-Utility Tokens Multi-Utility Tokens Improvement Annual Volatility 85 to 120% 55 to 75% 35% lower Maximum Drawdown -85% to -95% -60% to -75% 20% better Sharpe Ratio 0.3 to 0.6 0.7 to 1.2 100%+ higher Survival Rate (4 years) 20 to 30% 65 to 75% 3x better Recovery Time 18 to 24 months 8 to 12 months 50% faster These tokens are more stable, resilient, and likely to survive market cycles. The reason is diversified demand sources creating natural hedging.

The Portfolio Effect

Different utilities show imperfect correlation, meaning when one demand source weakens, others compensate, functioning like mini-portfolios.

Consider how BNB’s utilities correlate:

- Trading fee discounts: 0.40 correlation with exchange volumes

- Gas fees (BSC): Correlated with DApp usage (different cycle)

- Token burns: Inversely correlated with supply (automatic hedge)

- Launchpad participation: Event-driven (different trigger)

This creates natural stability. When trading volumes decline in bear markets, the use of truly useful applications may hold steady or even grow, preventing total value collapse.

The Velocity Management

The single-utility payment token problem produces velocity rates of 50 to 100 or higher, creating perpetual sell pressure.

Multi-utility tokens achieve dramatically lower composite velocity by balancing:

- High-velocity utilities (50 to 100+): Transaction fees, payments

- Medium-velocity utilities (15 to 50): Service access, short-term staking

- Low-velocity utilities (5 to 15): Governance, long-term staking, collateral

Target for healthy multi-utility token: composite velocity of 5 to 15.

What the Market Is Validating Right Now

The crypto market in 2024 to 2025 has decisively separated sustainable tokenomics from unsustainable. The patterns that have emerged are hard to miss.

Real Yield Is Winning

Projects using protocol revenue to create tangible value for holders dramatically outperform pure inflationary models:

- Raydium: 97 percent of fees fund buybacks, producing $360 million in buy pressure (December 2024) and 45 million RAY (10 percent of supply) repurchased

- Aerodrome: Vote-escrow model plus revenue distribution creates sustainable yields tied to real usage

- Bananagun: 40 percent fee distribution produces 218 percent return in 2024

The whole of the data confirms: Over 72 percent of top-performing crypto projects in 2024 credited strong tokenomics (real yield, buybacks, fee distribution) as the key driver of value retention.

What’s Being Abandoned

The market is actively rejecting:

- Low float, high FDV launches: Team/investor allocations over 50 percent face immediate community backlash

- Pure points farming: 15 of 30 major 2024 airdrops showed losses. Starknet (STRK) down 64 percent, Wormhole down 73 percent from ATH

- Governance-only tokens: Activists pushing Polygon to eliminate 2 percent inflation shows governance alone isn’t enough

- Inflationary yield farming: Unsustainable APYs that dilute faster than they create value

What This Means for Holders

Current state: XAVA operates on Avalanche (where Avalaunch operates).

As products like Nullshot are omnichain-native, XAVA utility expands across chains. This means deep liquidity across multiple chains where users can interact with the XAVA ecosystem from their preferred chain.

Your XAVA tokens are becoming more useful without changing fundamentally. To circle back to the aforementioned utilities:

- Gas – Powers transactions and contracts on the XAVA L1.

- Staking & Validation – secures the network and earns validator rewards.

- Launch Access & Allocation – grants entry to omnichain from Day Zero launches.

- Streams – delivers new tokens directly to stakers.

- Revenue Capture – accrues fees and AI-driven income back to holders/stakers.

- Governance & Treasury Rights – enables protocol voting and treasury influence.

- Ecosystem Access Layer – required for deploying, interacting with, and monetizing apps, agents, and tools built on the XAVA network.

Growing Together

“As we expand the XAVA ecosystem and attract new users, we’re not leaving our founding community behind. We’re bringing everyone forward together. Every new application we build serves dual purposes: attracting fresh participants to the XAVA economy while creating additional utility layers for existing holders.”

Your XAVA tokens aren’t changing. They’re growing. More products. More utility. More reasons to hold.

-

The XAVA Ecosystem: Avalaunch, XAVA Labs, and Nullshot

From Single Product to Ecosystem

The XAVA ecosystem is evolving from a single launchpad into a multi-product protocol. As this transformation accelerates, it’s essential to understand exactly how the pieces fit together.

Since we began expanding the XAVA ecosystem, thoughtful questions have emerged from the community about the relationships between Avalaunch, XAVA Labs, and Nullshot. These questions matter. Let’s walk through how everything connects, because there’s intentional design behind this growth. Here’s the architecture that connects everything.

The Three-Layer Structure

Layer 1: XAVA Token (The Foundation)

The XAVA token powers the entire ecosystem. Each addition is designed around it from the ground up. As a multi-utility asset that operates across all products, it gains new utility layers as the ecosystem expands. Everything builds on top of XAVA and all value accrues to it.

Layer 2: The Products (Where Users Interact)

This layer consists of Avalaunch, the proven launchpad operating since 2021; Nullshot, the AI-powered co-creation platform launching in 2025; and future products currently in active development.

Layer 3: XAVA Labs (The Engine)

XAVA Labs serves as the R&D initiative building the products. Through a research-driven development approach, its mission centers on transforming XAVA into a multi-application ecosystem with liquidity across multiple chains.

The key insight: these components don’t compete. They complement each other. Each layer creates new reasons to hold and use XAVA tokens.

Avalaunch: The Foundation That Proves the Model

Avalaunch launched as an Avalanche-native token launchpad focused on distribution without tier systems. The platform features validator and staking rounds, an innovative vesting marketplace, and several other mechanisms designed to prioritize community participation that are now standard features in the broader launchpad landscape.

The numbers tell the story. After operating for more than four years since 2021, Avalaunch has facilitated 30+ project launches, raised $23 million across those launches, and served over 400,000 IDO participants.Today, Avalaunch remains fully operational. All features continue working exactly as designed. XAVA staking for IDO access remains as does redistribution to stakers. This matters because Avalaunch isn’t legacy infrastructure; it is a proven product that validates everything that comes after.

XAVA Labs: The Strategic Pivot to Ecosystem Building

After many years of working with and launching other teams’ projects on Avalaunch, a realization emerged: why serve only as the gateway? Launches are fraught with challenges and the downturn in the market only amplified what a perilous road it can be. Given the obstacles, the thought became – what if we built the products ourselves, for our community?

In 2024 and 2025, this thinking formalized into XAVA Labs, representing our commitment to transforming XAVA from a launchpad token into the foundation of a thriving, multi-application ecosystem. The mission focuses on building applications that deliver expanded utility and tangible, long-term value to every XAVA token held.

The philosophy centers on what we call research-driven development. This means every product begins with research, not trend-chasing. Through deep exploration of emerging opportunities, we identify where actual demand exists, then develop products that expand the XAVA economy strategically and sustainably.

The methodology follows a clear path: identify genuine market needs, develop solutions that create new on-chain behavior, integrate XAVA token utility at the core, stress-test before launch, and ship.

The current XAVA Labs portfolio includes Avalaunch as an established product now under the XAVA Labs umbrella, the TypeScript Agent Framework as an infrastructure play, Nullshot as the flagship new product and an active research pipeline with projects currently in development.

XAVA Labs exists because the traditional approach of building one product and hoping it succeeds forever no longer represents the strongest strategy. The XAVA Labs approach builds multiple products, with each one expanding the ecosystem. This creates compounding utility: as more products launch, XAVA becomes increasingly essential across more use cases.

Nullshot: The First Major XAVA Labs Product

Nullshot represents an AI-powered collaborative platform where communities brainstorm, build, and launch products together, with contribution tracking built in for ownership distribution.

The differences from Avalaunch clarify the complementary nature of the ecosystem:

Avalaunch launches tokens for external projects, positions the community as investors, operates native to Avalanche, follows a traditional fundraising model, and helps fund other teams’ ideas.

Nullshot builds and launches products collectively, positions the community as builders, operates omnichain from day one, uses an AI-enhanced co-creation model, and helps you build your own ideas.

These platforms complement rather than compete. Avalaunch means “support promising projects by investing.” Nullshot means “build promising projects by contributing.” Both serve the XAVA ecosystem. Both create utility for XAVA tokens. Both attract different user behaviors and expand the addressable market.

Nullshot required design and development across multiple emerging technologies: channeling AI agent capabilities into measurable product outcomes, navigating the emerging field of MCP tooling, and building custom omnichain infrastructure.The research-driven approach meant stress-testing assumptions, building multiple prototypes and refinements, and focusing on lasting impact.

For the ecosystem, Nullshot brings new users who are builders and collaborators rather than just investors. It creates new utility for XAVA through launch fees, trading pairs, revenue share and several value flows yet to be fully articulated. It enables new products to be built on the platform, which can then launch through Nullshot itself.

The Twitter Account Transition: Strategic Communication

The Avalaunch Twitter account transitioned to become the Nullshot account. This decision emerged from practical strategic thinking.

Avalaunch spent four years building its audience and developing a significant following. Nullshot represents where innovation happens now. Starting fresh would mean rebuilding from zero, which would delay getting the message to our existing community.

This transition doesn’t signal that Avalaunch is dead. The platform remains very much alive and like you, we hope that Avalanche’s C-Chain becomes abuzz with activity. The switch simply recognizes that Nullshot is a new direction and we wanted to leverage our existing reach for maximum impact.

How the Pieces Work Together

The XAVA ecosystem creates a flywheel effect that strengthens with each rotation.

Avalaunch users need XAVA to stake for IDO access and are primed for deeper ecosystem engagement while XAVA Labs builds products with XAVA utility at the core. Each product attracts new user behaviors and expands the total addressable market.

Nullshot brings users who want to build projects. They need XAVA to launch and receive platform fees and revenue generated by the platform. They create products that can launch via Nullshot’s fair launch mechanism. They contribute to ecosystem growth organically through their creative work.

More products coming will bring even more user types. Each adds new utility to XAVA. Each attracts different audiences. All feed the same token economy.

The result: XAVA becomes layered across multiple use cases.

Why This Structure Works

For the token: Multiple demand sources mean the token isn’t dependent on a single product. Diversified utility creates resilience. Network effects compound as the ecosystem grows.

For the community: More ways to participate, whether through investing, building, trading, staking or governing. More products to use in daily practice. More reasons to hold XAVA for the long term.

For the ecosystem: The structure attracts diverse user types. It creates sustainable growth loops where each product feeds the others. It builds a defensible moat because multi-product ecosystems prove harder to replicate than single-product platforms.

The Evolution in Context

Avalaunch established a single product with a single utility, operating on a single chain, Avalanche. It proved the model could succeed but became outmoded.

The 2024 to 2025 period marked XAVA Labs’ formation. The strategic pivot to a multi-product vision emerged and going forward, this phase aims to deliver products that increase XAVA’s utility as a sustainable growth trajectory takes shape.

In the near term, expect Nullshot’s continued development and additional XAVA Labs products emerging from the research pipeline as well as omnichain integration to extend our reach from a liquidity and visibility perspective.

One Ecosystem, Multiple Entry Points

Whether you discovered XAVA through Avalaunch, are excited about Nullshot’s co-creation vision, or waiting to see what XAVA Labs builds next, you’re participating in the same ecosystem. The structure is straightforward: a proven foundation in Avalaunch, a strategic R&D engine in XAVA Labs, and ambitious new products like Nullshot, all working toward the same goal.

You’re not choosing between them. You’re participating in all of them with a single token.

-

Paradise Chain AMA: Project Overview (RECAP)

On 8/20/2025 at 05:00 p.m. (UTC), an AMA session was held on Avalaunch Telegram group with Timo Juuti, Co-Founder of Paradise Chain, to learn about the vision behind their new Avalanche L1.

Avalaunch

Hello everyone! Today we are joined by Timo for a very exciting AMA to dive into Paradise Chain! Hello Timo— how are you today?

Timo | Paradise Chain

Hey all, pleasure to be here! 👋 feeling great!

Avalaunch

Really great to have you, ok let’s dive right into our first question — can you share the story of how Paradise Tycoon came to life and how that journey ultimately led you to building Paradise Chain?

Timo | Paradise Chain

Absolutely, love to. It’s a long story, but I’ll try to make it short… 😁

Our games studio was founded in 2017, and we developed and published traditional games for about five years before pivoting to web3. The pivot was a big decision, we had to consider it from every possible angle and convince a lot of people. Digital ownership was discussed, but it didn’t feel like enough of an upside, especially from a game development perspective (continuing…)

Then we discovered Avalanche and Subnets, which offered the possibility to create our own chain. That’s when everything clicked. Instead of building just a single game, we could create a chain for games with interoperability extending beyond assets to actual features. This meant we could reuse parts of existing games and features in the same chain, leading to longer game lifespans and faster development. We initially focused on Paradise Tycoon because we needed to prove our game concept worked. Once established, it was time to introduce Paradise Chain!

Avalaunch

Wow that’s amazing. It has been a long journey to get to where you guys are today! Very cool to hear how subnets/Avalanche L1s just made sense for what you were building. We’d love to know more about the core team behind Paradise Tycoon. How did that all come together?

Timo | Paradise Chain

Feels like an eternity tbh! 😂

So I already mentioned we go way back… Our studio was found by me and Harri Karppinen (he’s here, lurking — I see you!). We share a passion for digital entertainment and creative arts, especially games, but also have a very data driven approach, and background too.

Our vision was to combine the creative side with data-driven development and user acquisition in gaming. We’re based in Finland, home to a very strong gaming industry with hits like Angry Birds and Clash of Clans. Back then, Harri already had over a decade of experience in the gaming industry and practically knew everyone, so we got started pretty quickly. That’s how it started, and we keep building still!

Avalaunch

Awesome! Hello Harri 😄 yes I think Paradise Tycoon’s metrics are a strong demonstration of your user acquisition expertise. So you’ve touched on it a little bit earlier but what made Web3 the right home for Paradise — and what does it unlock that traditional gaming can’t?

Timo | Paradise Chain

Yeah I covered some of that in the first question, but it’s a topic I’m more than happy to continue on 😁

Of course digital ownership remains a significant advantage, can’t deny that. We go beyond that though… the monetization of user-generated content is a major unlock. We couldn’t replicate what Roblox does without massive resources and infrastructure. With web3 tech, the infrastructure is pre-built.

Additionally, as I mentioned, there’s next-gen interoperability. For example, you can craft tools in Paradise Tycoon, then use the same crafting system to make weapons in Paradise Legends to defeat monsters. These even more on development side too, but I think these are the main ones for us.

Avalaunch

Nice, so building in web3 has really unlocked something that can’t be achieved in traditional gaming. There have been so many games who’ve tried to make it in this space, so it’s great to see how much success you’ve already had in proving the benefits of building on web3 tech.

How do you balance building for traditional gamers who want fun with crypto natives who want utility and rewards?

Timo | Paradise Chain

It’s not that different from traditional gaming tbh. Many of us have played games where we wished we could trade items or currency with other players. The key balance is providing enough rewards to keep gameplay interesting without giving away too much. I always say that for a sustainable economy, some players must earn more than they spend, while others must willingly spend more than they earn and enjoy doing so.

Avalaunch

So as with everything else, it’s all about balance! Why did you decide to build a dedicated Layer 1 instead of launching on an existing blockchain, and how does Paradise Chain enhance the player experience?

Timo | Paradise Chain

Exactly, all about the balance. No need to reinvent the wheel, just keep the wheel going! 😁

There are many reasons for this approach. Scalability is one key advantage. Another significant benefit is using our native token, MOANI, for gas fees. This allows us to determine which transactions should incur fees and which can happen in the background without players even realizing they’re interacting with the blockchain…

Also when we launch multiple Paradise IP games, players will be able to move seamlessly between them, creating an entirely new kind of gaming experience!

Avalaunch

Really interesting! I think many people aren’t fully aware of how you guys are leading the way in showing what’s possible with this tech. Very exciting to see how it’s all unfolding.

Your flagship game, Paradise Tycoon, has already gained strong traction. What has driven that success so far, and how does it connect back to the broader Paradise vision?

Timo | Paradise Chain

Thanks, I believe we have put more though into how to really utilize web3 tech in gaming than most.

and tbh our development process has been refined all the way since 2017…

Which is probably the main driver for the success. For example, before we start developing any game, we create mockup gameplay ads featuring various art styles, atmospheres, and gameplay elements. We then test these with potential audiences and select the approach that resonates with the audience best… (continuing…)

Throughout development, we continuously collect and analyze data both in-game and externally, iterating based on these insights. This creates a clear decision path: games either fail early and are discontinued before launch, or they demonstrate strong metrics and proceed to release.

The connection comes from applying this across all Paradise IP games, with the process becoming increasingly efficient thanks to feature interoperability!

Avalaunch

Your thoughtfulness really has come through and the metrics for Paradise Tycoon are extremely impressive: 1.2M+ installs, 250,000 monthly active players, over 5M in-game trades! Amazing.

Let’s dive into the MOANI token. What are the core utilities of MOANI across the Paradise Chain and Paradise Games ecosystem?

Timo | Paradise Chain

Thanks! 🫡

Let’s split the answer into two parts. First, Paradise Tycoon. Inside Paradise Tycoon, MOANI is the lifeblood of the economy!

Players earn and spend it on everything that gives the game its depth… like items, cosmetics, crafting, islands, boats, even player created events.

These are not some future utility either. It’s already in place, with off-chain version of the token. In beta we saw over 60% of airdropped MOANI immediately used in the game. Plus, we had over five million trades between players. For us, this proves real utility and sustainable token sinks.

Then the second part, Paradise Chain…

MOANI is the native token of Paradise Chain. It serves as gas for transactions, connects progression and assets across all Paradise IP titles, and powers a broader creator economy.

As we expand to consoles and new games like Paradise Legends, MOANI’s role grows from being a currency in a single game to becoming the foundation of an interoperable gaming ecosystem.

Avalaunch

Appreciate the insights! Sounds like MOANI has been very deeply integrated into the entire player experience. Beyond Paradise Tycoon, what other games can players look forward to in the Paradise world, and how will they fit together?

Timo | Paradise Chain

Yes. It really is the foundation for a real, player driven economy.

So our second game, Paradise Legends, already has a playable prototype and will enter Beta soon. It’s a top-down action RPG where players defeat waves of monsters, progressing as far as possible, with PVP elements in the future. The game incorporates items, tools, and crafting features from Paradise Tycoon (continuing…)

In Paradise Legends, inventory management is central to the core gameplay loop. Players must strategically choose which items to bring into battle, whether to carry healing potions or an additional weapon that can be switched to counter different monster types. Weapons serve different purposes across games; for example, a scythe deals AOE damage in Paradise Legends but is primarily used for cutting weeds in Paradise Tycoon. You can also visit Port Ohana to mint weapons or tools, granting them special abilities and improved stats. These are independent games, yet very much connected.

Avalaunch

Interoperability in action — nice! Love the whole new layer this brings in terms of giving weapons different purposes in each game experience. Well we can’t wait to see more of Paradise Legends, sounds quite epic.

What role has your community played in shaping Paradise so far, and how do you see that evolving as the ecosystem grows?

Timo | Paradise Chain

A big role, biggest! We’ve been building in public since day one, and I mean truly in public. Many claim this, but we’ve actually kept our game available throughout development.

We’ve listened carefully to our community and developed the game based on their feedback. It’s a significant advantage that web3 players want to be part of the journey from the beginning.

I don’t think this will always be the case, so fellow game developers should enjoy it while it lasts. 😁

Avalaunch

That’s actually very cool to hear — huge respect to you guys for committing to building in public. Not an easy task. I’m sure it’s been really rewarding for the team to see how the community has evolved alongside you.

So we’ve come to our final question before we move onto the community round! How do you envision Paradise Chain evolving over the long term, and what role could it play in defining the next era of Web3 gaming?

Timo | Paradise Chain

That’s a great question. We’ll expand with more games and deepen the interconnections. Players will shape the token’s future utility by creating their own events and content through user-generated content features.

I believe we’ll demonstrate to larger game studios the genuine possibilities that web3 technology offers for gaming!

Avalaunch

Most definitely. Can’t wait to see how Paradise Chain continues to grow and all the new player experiences that will be added along the way! Super excited.

We’ve come to the community questions and I’m going to jump right in. @Advocate_SS asks: In what ways is Paradise Tycoon planning to link up with other Web3 projects, marketplaces, or ecosystems? And how might this let players use their Paradise NFTs, tools, or passes beyond the game itself, adding extra value in the real world?

Timo | Paradise Chain

Great question @Advocate_SS

From the start we’ve built Paradise Chain for interoperability, so Paradise Tycoon assets aren’t locked into one game. In the past, we’ve worked with the likes of The Sandbox, Mon Protocol, and quest platforms such as Galxe and Dequest (to mention just some).

Players will see their NFTs, tools, and passes unlock quests, perks, and rewards across the wider Web3 ecosystem, adding value both inside Tycoon and beyond.

Avalaunch

@pradeep_kumar999 would like to know: Something related to the game, What makes the journey to becoming a ‘tycoon’ in Paradise Tycoon more than just stacking resources? How do the game’s unique mechanics around creativity, collaboration, and adventure keep players engaged while also rewarding them with Web3 incentives?

Timo | Paradise Chain

Also a great question! 👋

In Paradise Tycoon, the journey is not just about stacking resources, it’s about how creatively you use them and how you create value for others. We’ve already seen players giving boat rides or talking about doing the lawn for neighbors who are too lazy to equip a scythe lol (continuing…)

That mix of creativity, collaboration, and shared adventure keeps the world engaging, while Web3 ensures those efforts can be meaningfully

rewarded.Avalaunch

@harryyvv asks: How does community governance shape the future of Paradise Chain’s virtual world? In what ways can token holders or active players have a say in updates, new features, or in-game economic policies that impact the whole multiplayer ecosystem?

(Very funny about players being too lazy to equip the scythe..!)

Timo | Paradise Chain

Thanks for the question @harryyvv while we don’t have a formal voting system (at least yet), community governance in Paradise Chain happens through player actions… here’s what I mean…

Every time players spend or trade MOANI, they are effectively shaping which features and sinks thrive, and where the economy expands next. Our goal is to keep the world evolving in the direction its inhabitants want it to go. So instead of top-down decisions, it’s a joint effort where the community’s behavior directly guides the future of Paradise Tycoon and the wider ecosystem.

Avalaunch

From @Sanchez_Williams15 — What role will the upcoming MOANI token play, not just as the in-game currency, but also in driving interoperability and overall economic growth across the Paradise Chain ecosystem?

Timo | Paradise Chain

Hey @Sanchez_Williams15 thanks for the Q.

Inside Paradise Tycoon, MOANI works as the core in-game currency for crafting, upgrades, events, and trading.

But its role is much bigger: it’s also the gas token of Paradise Chain and the glue that connects all our games!

As we launch new titles like Paradise Legends and expand to consoles, MOANI ensures assets, progression, and player-driven content carry value across the whole ecosystem. This interoperability means every player action, whether buying an item, hosting an event, or trading, all contributes to broader economic growth, making MOANI the foundation of a sustainable, multi-game economy.

Avalaunch

Now we hear from @kieule0701— Given Paradise Tycoon’s beta success (1.2M+ installs, 5M+ trades), how will Paradise Chain scale to accommodate future games and larger player bases? What metrics demonstrate the chain’s readiness for mass adoption?

Timo | Paradise Chain

That’s an important point @kieule0701 … lets advertise the dorito chain a bit! 😏

What’s great about Avalanche Layer 1’s that they have already been proven at scale by others, handling millions of transactions daily. We’re building on top of that proven infrastructure, so as Paradise Tycoon grows and new games join, we know the chain can seamlessly support mass adoption.

Avalaunch

@sondeptrai5 asks: What is the core vision behind the creation of Paradise Chain as a new Avalanche L1, and how does it differentiate itself from existing L1 solutions in terms of scalability, decentralization, and real-world adoption potential?

Timo | Paradise Chain

Good question @sondeptrai5! The vision for Paradise Chain is to be a gaming-first L1 where assets and progression flow across titles. Unlike many chains that launch before adoption, we already have players and proven traction, so scalability and decentralization are paired with real-world use from day one.

Avalaunch

@MochaPoli wants to know: What kind of incentive structures or tokenomics does Paradise Chain envision to encourage validator participation, maintain network security, and also reward early adopters and community members who contribute to ecosystem growth?

Timo | Paradise Chain

Validator incentives are built directly into MOANI’s tokenomics: A dedicated allocation rewards validators and stakers, ensuring strong participation and network security from the start.

At the same time, players and early adopters benefit through staking programs, play-to-earn mechanics, and UGC monetization, so the ecosystem grows in a balanced way where both infrastructure providers and community members are rewarded for their contributions.

Avalaunch

@Rajanshee — Security is a major concern in Web3. Have your smart contracts gone through audits, and what were the findings? What steps are you taking to keep the platform secure and reliable?

Timo | Paradise Chain

Yes, security is a top priority. Another non-paid advertisement coming up… 😁

Our smart contracts have been thoroughly audited by Hashlock, a leading Web3 security firm. The full report will be published ahead of launch, but already confirms our contracts meet high standards of reliability. Beyond audits, we also follow strict internal testing, staged rollouts, and continuous monitoring to make sure the platform remains secure and trustworthy for our community.

Avalaunch

From @rubalsaluja — Can you share a bit about your marketing strategy — like ad campaigns, events, and promotions — and how the community will get involved across channels like Twitter, Discord, and more?

Timo | Paradise Chain

One of my fav topics @rubalsaluja 🫡 Our marketing is built around combining Web2 scale with Web3 community energy, so lets split this into two parts…

On the Web2 side, we’re running paid campaigns on Facebook, TikTok, and Google with proven low CAC, down to $0.12 per install.

That’s where our user acquisition experience from traditional gaming really comes useful

On the Web3 side, we activate through KOL networks, quests, and community campaigns on Twitter, Discord, and Telegram, often co-hosted with partners like Seedify, Avalanche, and Mon Protocol. The community isn’t just an audience, they get involved through creator programs, contests, game nights, and even in-game events that feed directly into our socials.

Avalaunch

We’ve come to our final community question! This one is from @deroo452 — For new users, do you provide user manuals, guides, or short tutorial videos to help them safely and easily navigate your platform?

Timo | Paradise Chain

Last but the least! Great question again

and may I say the questions has been absolute 🔥🔥🔥

Anyway, yes, we’ve made onboarding as smooth as possible. New players are guided through in-game tutorials that explain mechanics step by step, and we also provide short videos, FAQs, and community-made guides on Discord and YouTube. Because Paradise Tycoon is designed for mainstream accessibility, you don’t need prior Web3 knowledge, wallets and transactions are abstracted in the background, so players can just jump in and learn by playing!

Let’s go! 🌴 🔺

Avalaunch

Amazing! Well that’s a wrap and thank you so much Timo for your insights and sharing your thought process with us. I think we all learned a lot about Paradise Chain as well as the absolutely stacked team behind it all!

Just under 24h left to register for the MOANI IDO — you don’t want to miss this one!

Massive thanks to the Avalaunch community for tuning in as well!

Timo | Paradise Chain

Thank you so much, was great being here — you have a fantastic community, and like I said, the questions were absolute fire!

Avalaunch

Have a great rest of the day Timo!

Timo | Paradise Chain

-

Paradise Chain x Avalaunch: IDO Announcement

Introducing Paradise Chain

Paradise Chain is a dedicated Avalanche L1 for next-generation interoperable gaming — built by veteran game studio Empires Not Vampires (founded 2017), the team behind the hit title Paradise Tycoon.

Already a proven success, Paradise Tycoon has reached 1.2M+ installs, 250,000 monthly active players, over 5M in-game trades, and multiple positive netflow months in its thriving token economy.

Paradise Chain builds on this foundation to connect all future Paradise IP titles — including Paradise Legends (beta Q3 2025) and a 2026 release — through shared assets, gameplay features, and progression. With console launches on PS5, Xbox, and Nintendo Switch secured via Bonus Stage Publishing, the ecosystem is set to reach audiences across platforms.

With Paradise Chain, the team is able to deliver fast, cost-effective gameplay with deep interoperability between titles — where progress, items, and even events carry seamlessly from one game to the next. Backed by Ava Labs, Seedify, the Google Web3 Startup Program, and leading Web3 gaming partners, Paradise Chain combines proven product-market fit with sustainable token utility to scale to mainstream audiences.

The Power of a Dedicated L1

By launching its own Layer 1, Paradise Chain can:

- Accelerate development — shared features and assets reduce build time for new titles.

- Enable shared gameplay — not just cosmetic or asset transfers, but cross-game mechanics like crafting, events, and UGC.

- Enhance player experience — progression and value move with you between games, deepening immersion and retention.

- Optimize the economy — a single token, $MOANI, powers all in-game and on-chain activity.

This approach turns every new game release into an instant extension of the existing universe, with the network effect compounding over time.

The Paradise Games Lineup

Paradise Chain launches with a portfolio of games already in development:

- Paradise Tycoon (Live!) — MMO life simulation and building game with user-generated content, in development since 2022. With over 1.2M installs, 250k monthly active users, and an active in-game economy of 5M+ items traded, Paradise Tycoon has already proven product-market fit.

- Paradise Legends (Beta 2025) — a hybrid casual arcade action RPG with both PvE and PvP modes, launching as an in-game event within Paradise Tycoon before expanding as a standalone title.

- Unannounced Title (Alpha 2026) — part of a plan to launch new games annually, leveraging shared assets, codebase, and interoperable features to accelerate time-to-market.

Powered by $MOANI

$MOANI is the native token of Paradise Chain and the universal currency for all Paradise IP titles. Its utility spans the entire ecosystem:

- In-Game: Purchases, upgrades, cosmetics, NFT mints, crafting, events, island rentals, consumables.

- Protocol Layer: Gas for L1 transactions, asset transfers, shared progression across games.

- Creator Monetization: UGC and events monetized directly in $MOANI.

- Proven Usage: 60%+ of airdropped off-chain $MOANI spent in-game during beta; over 5M trades.

- Value Recirculation: All tokens spent return to game economy allocations; multiple positive netflow months achieved pre-launch.

Team

Partners & Backers

“We’re extremely bullish on Paradise Chain, Paradise Tycoon and the entire Empires Not Vampires team. The core team has worked together for many years and have shown a true knack for creating engaging games in what we believe is a great genre for web3 gaming, the midcore.”

— Yida Gao, The Founder and Managing General Partner at Shima Capital

Official Links

Website | X/Twitter | Telegram | Discord

Paradise Chain: Avalaunch IDO

“We first connected with Avalaunch in early 2023 and have been in close contact ever since. Over that time, we’ve seen first-hand how they operate, with transparency, professionalism, and a genuine commitment to building the Avalanche ecosystem. We’re excited to finally work together and bring Paradise Chain to the Avalaunch community, knowing we share the same vision of innovation in Web3.”

— Timo Juuti, Co-Founder, Paradise Chain

Funding Numbers

- Pre-seed Round – $1,040,000 – 650M MOANI at $0.0016 – 9.6M FDV

- Seed Round – $800,000 – 363M MOANI at $0.0022 – 13.2M FDV

- Seed Extension – $160,000 – 57M MOANI at $0.0028 – 16.8M FDV

- Private Pre-Sales – $500,000 – 300M MOANI at $0.0017 – 10M FDV

- Public (IDO) Round – $450,000 – 204M MOANI at $0.0022 – 13.2M FDV

- Avalaunch: $100,000 – 45 454 545 at $0.0022

- Seedify: $250,000 – 113 636 363 at $0.0022

- Eesee: $100,000 – 45 454 545 at $0.0022

Total Raise: $2,950,000

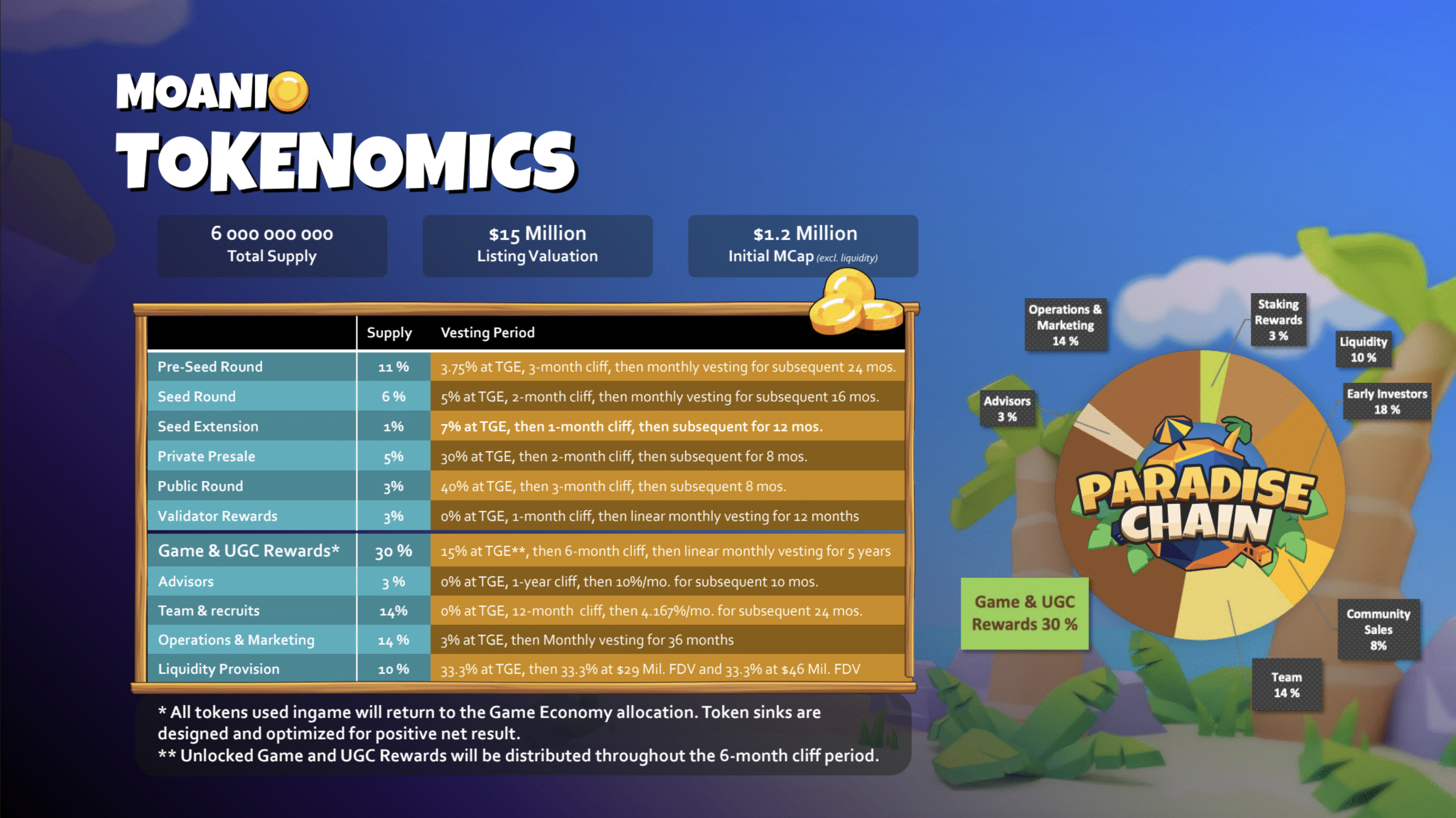

Supply Breakdown

Total supply: 6,000,000,000 MOANI

- Pre-seed Round – 650M MOANI (11%)

- Seed Round – 363M MOANI (6%)

- Seed Extension – 57M MOANI (1%)

- Private Pre-Sales – 300M MOANI (5%)

- Public (IDO) Round – 204M MOANI (3%)

- Validator & Staking Rewards – 200M MOANI (3%)

- Game & UGC Rewards – 1800M MOANI (30.00%)

- Operations & Marketing – 817M MOANI (14%)

- Team – 850M MOANI (14%)

- Liquidity Provision – 600M (10%)

- Advisors – 180M MOANI (3%)

Vesting Following TGE

- Pre-seed Round – 3.75% at TGE, 2-month cliff, then linear monthly vesting for 25 months

- Seed Round – 5% at TGE, 2-month cliff, then linear monthly vesting for 16 months

- Seed Extension – 7% at TGE, 1-month cliff, then linear monthly vesting for 12 months

- Private Pre-Sales – 30% at TGE, 2-month cliff, then linear monthly vesting for 8 months

- Public (IDO) Round – 40% at TGE, 3-month cliff, then linear monthly vesting for 8 months

- Validator & Staking Rewards – 1-month cliff, then linear monthly vesting for 12 months

- Game & UGC Rewards – 15% at TGE, 6-month cliff, then linear monthly vesting for 5 years

- Operations & Marketing – 3% at TGE, monthly vesting for 36 months

- Team – 12-month cliff, then linear monthly vesting for 24 months

- Liquidity Provision – 33.3% at TGE, 33.3% at $29M FDV, 33.3% at $46M FDV

- Advisors – 12-month cliff, then linear monthly vesting for 10 months

ℹ️ The TGE for $MOANI will take place shortly after the sale ends. Please await official announcements from the Paradise Chain team regarding the exact TGE date and time.

Other Info

- Initial Circulating Supply (excl. liquidity): 8.4%

- Initial Liquidity: $200,000

- Initial Market Cap: $1.76M

Registration Schedule

Registration Opens: Sunday, August 17 at 3:00 p.m. (UTC)

Registration Closes: Thursday, August 21 at 6:00 p.m. (UTC)Sale Schedule

Validator Round Begins: Friday, August 22 at 6:00 a.m. (UTC)

Validator Round Closes: Friday, August 22 at 3:30 p.m. (UTC)Staking Round Begins: Friday, August 22 at 3:30 p.m. (UTC)

Staking Round Closes: Saturday, August 23 at 6:00 a.m. (UTC)Booster Round Begins: Saturday, August 23 at 6:00 a.m. (UTC)

Booster Round Closes: Saturday, August 23 at 10:30 a.m. (UTC)How to Participate

To participate in Avalaunch sales, users will have to:

- Complete their KYC Registration | Tutorial

- Stake XAVA to secure their allocation | Tutorial

- Register for the sale when Registration opens | Tutorial

Claiming Your Allocation

Avalaunch IDO participants will be able to claim their $MOANI allocation on the Avalaunch platform once the sale period ends.

Refund Policy

We’re offering a 7 day unconditional refund policy on the Paradise Chain IDO, available from the start of TGE. Please note that claiming your tokens during this period will make you ineligible for a refund.

About Paradise Chain

Paradise Chain is an Avalanche Layer 1 dedicated to next-generation interoperable gaming. Built by veteran game studio Empires Not Vampires (founded 2017), it connects all Paradise IP titles through shared assets, gameplay features, and progression.

About Avalaunch

Avalaunch is a launchpad powered by the Avalanche platform, allowing new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With its values deeply rooted in the early Avalanche community, we are able to offer projects confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem. Leveraging Avalanche’s scalable, high-throughput, and low-latency platform, Avalaunch is built by users, for teams, to help grow strong communities.

-

Introducing XAVA Labs

Today marks a pivotal moment for the XAVA ecosystem. We’re excited to finally introduce XAVA Labs — our dedicated research and development initiative with one clear mission: building applications that deliver expanded utility and tangible, long-term value to every XAVA token you hold. XAVA Labs is a formalization of our commitment to transforming XAVA from a launchpad token into the foundation of a thriving, multi-application ecosystem with liquidity on every chain.

Research Driven Development Creates Real Demand

Every product coming out of XAVA Labs begins with research and a deep exploration into emerging opportunities, user behavior, and technical gaps. We try and shy away from chasing trends, and instead, back out from existing problem whose solution represents a strategic expansion of the XAVA token economy. This methodical approach ensures that every application we develop creates genuine utility rather than fragile momentum. The result is a portfolio of interconnected products and frameworks that compound value for XAVA holders over time.

Your XAVA tokens are becoming multi-utility assets that not only anchor a growing ecosystem of omni-chain protocols, but also capture the value generated across that entire landscape.

Backing Up

While we’re officially introducing XAVA Labs today, our work has been quietly underway for some time. For the past nine months, the research team has been deep in development on a flagship project that exemplifies everything XAVA Labs represents — meticulous investigation, strategic positioning, thoughtful user experience and transformative utility for XAVA token holders.

Taking this time to research, prototype, and refine has allowed us to stress-test key assumptions, explore multiple angles, and build something we believe addresses a real market need. While crypto moves fast, we want to make sure we are deploying something we believe will have lasting impact.

What we can tell you now: this project addresses a critical gap we identified in the market, creates entirely new demand patterns for XAVA tokens, and positions our community at the forefront of an emerging sector. The foundation for this particular platform is solid and launching soon, with an aggressive roadmap of enhancements designed to expand the product’s impact over the coming months.

More details coming very soon!

Strategic Product Development

Every project at XAVA Labs follows a disciplined process: identify genuine market needs, develop solutions that create new on-chain behavior, and integrate XAVA token utility at the core. We’re not building for the sake of building — we’re attempting to architect demand.

Current XAVA Labs Projects:

- Avalaunch: Our proven launchpad that has already established XAVA as the gateway to promising Web3 projects on Avalanche

- TypeScript Agent Framework: A cutting-edge infrastructure play positioning XAVA within the emerging agent economy

- Active Research Pipeline: Multiple projects in development, each designed to expand XAVA’s practical value

- Much more to be announced shortly

But we understand crypto moves fast and we intend to as well. The landscape shifts rapidly, new technologies emerge, and user expectations evolve. That’s exactly why XAVA Labs exists. Instead of struggling to keep pace we’ve organized XAVA Labs to anticipate it. Our research-first approach means we’re not just reacting to trends — we’re identifying the next wave of opportunities hopefully before they become obvious to everyone else.

Growing Together, Not Apart

As we expand the XAVA ecosystem and attract new users, we’re not leaving our founding community behind — we’re bringing everyone forward together. Every new application we build serves dual purposes: attracting fresh participants to the XAVA economy while creating additional utility layers for existing holders. More users mean more demand, more value accrual, more use cases, and more reasons for people to acquire and hold XAVA tokens. Your early support becomes the foundation for exponential community growth.

Sustainable Token Economics in Action

We’re not just building products; we’re standing up an economy. Each application creates new demand vectors for XAVA tokens, whether through direct utility, value accrual, governance participation, or access requirements. As we look forward toward the next few years, we aim to avoid short-term pumps or artificial scarcity. The goal here is to create genuine, sustainable reasons for an ever-growing user base to need, want, and hold XAVA tokens.

What’s Next

XAVA Labs represents our commitment to building for our community, honoring both our longtime supporters and future token holders. Our approach is simple: build tangible value. Every development effort, every strategic partnership, every product decision is designed to make XAVA more future proof.

The next chapter of XAVA is already being written — through strategic development and purposeful innovation.

Stay tuned for upcoming project announcements and have a look into our technical briefs to see exactly how we’re building the future of the XAVA ecosystem.

-

Stable Jack AMA: Project Overview (RECAP)

On 03/24/2025 at 7:00 p.m. (UTC), an AMA session was held on the Avalaunch Telegram group with Caesar Julius — CEO of Stable Jack, to learn about their unique approach to DeFi yield.

Below we present to you an excerpt from AMA with questions and answers.

Avalaunch

Hey everyone, welcome to another Avalaunch AMA! Today we’re joined by Caesar Julius from Stable Jack, where we’ll be diving into the protocol and learning more about what they’ve been building. Hi Caesar, thanks for being here, how are you doing today?

Caesar | StableJack

hey everyone! it is great to be here, as the whole team, we are pretty busy but can’t complain:)

Avalaunch

Amazing! We’re really excited to learn more. Why don’t we start at the beginning. What inspired the creation of Stable Jack, and how did the idea evolve into the product it is today?

Caesar | StableJack

Sextus and I had long discussed building a DeFi protocol. After witnessing the drama of the FTX, the USDC depeg, and the collapse of the LUNA, one thing became clear: people want yield, leverage, and stablecoins. However, the available options were neither sustainable nor truly competitive. The industry lacked efficient, accessible, and robust mechanisms to provide these financial tools at scale. It was when we decided to build Stable Jack.

Avalaunch

Yea, Stable Jack is a really important addition to the continued evolution of the DeFi ecosystem! We’d love to know more about the core team behind Stable Jack. What experiences have brought you all together to build the protocol?

Caesar | StableJack

Sextus and I are twin brothers. Our third co-founder Solomon is a friend of Sextus from college.

I have been in the ecosystem since 2017 and worked for Avalanche native protocols previously.

Sextus has worked for an Avalanche native VC, and a research company before Stable Jack. He is also an advisor to a Turkish bank for their DeFi and tokenization strategies.

Solomon has experience in audit companies previously.

Avalaunch

Wow that’s cool! Sounds like you have lots of native experience, as well as a convergence of experience from the tradfi sector. So Stable Jack is reshaping DeFi yields. Can you tell us more about the core features of the platform and what makes it so powerful?

Caesar | StableJack

Thanks!

Stable Jack allows what the user really needs.

- You can access leveraged or fixed yield on stablecoins and blue-chip assets like AVAX.

- You can farm airdrops/points program with leverage.

- You can long blue chip assets without liquidation.

Bear in mind that all of these opportunities are principal-protected. We believe this is what helps Stable Jack to excel in the market.

Avalaunch

Definitely see how Stable Jack is making DeFi more accessible and making it safer for users as well. To build on that, why is Stable Jack needed in the DeFi ecosystem?

Caesar | StableJack

DeFi isn’t safe, investments are too risky. Stable Jack makes DeFi simple and safer for investors with all types of risk appetite.

- No liquidation risk

- Principal protection

- Fixed yield for stablecoins

Avalaunch

Great to see that Stable Jack’s top priority is making DeFi safer so we can accelerate adoption too. Can you break down how Stable Jack works and how DeFi users can make the most of the platform?

Caesar | StableJack

Basically, each asset has three components. Yield, volatility, and points. What Stable Jack does is put all the collateral assets into a basket, and split these components depending on how the user wants.

- If you want the highest yield, you can buy Yield Token

- If you want to farm airdrops with leverage, you can buy Points Token

- If you want to long any asset without liquidation, you can buy Volatility Token.

Avalaunch

Very interesting, so it offers users a very flexible solution which they can customize to fit their risk strategies. How would you say Stable Jack compares to other DeFi yield protocols?

Caesar | StableJack

Compared to other protocols, there is no maturity date or principal risk on Stable Jack. Also, we allow volatility trading too.

Stable Jack’s model allows us to accept broader types of assets as collateral.

Avalaunch

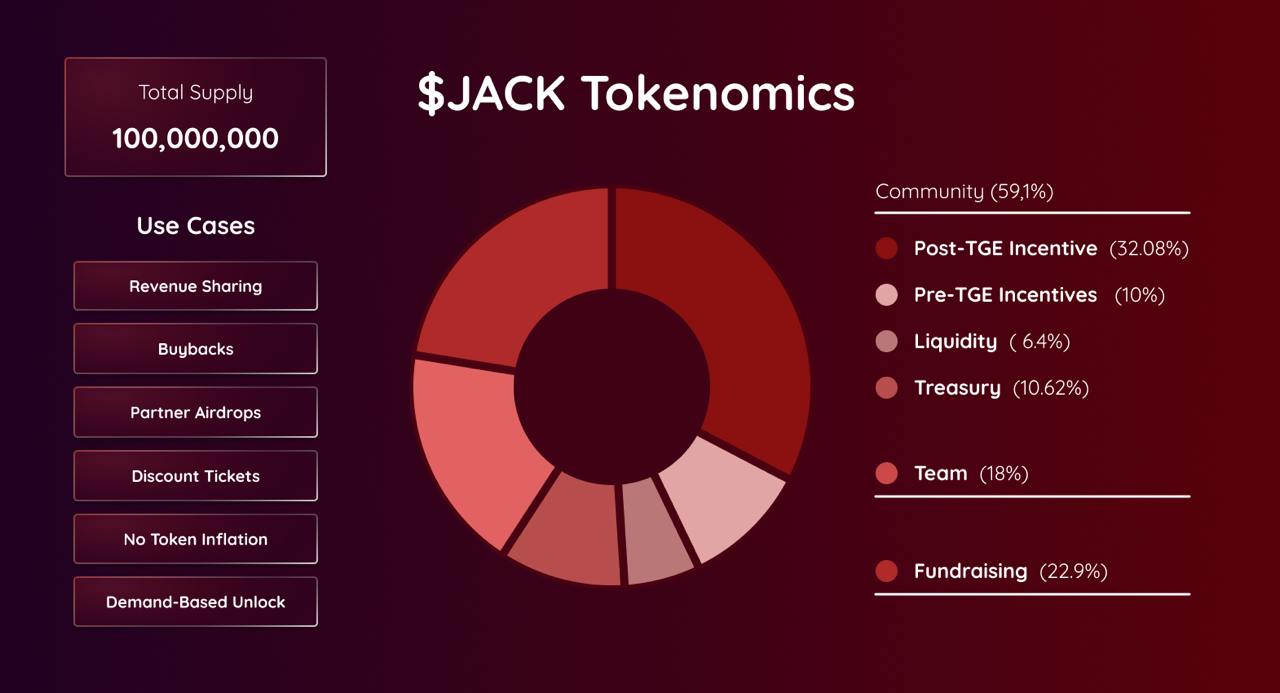

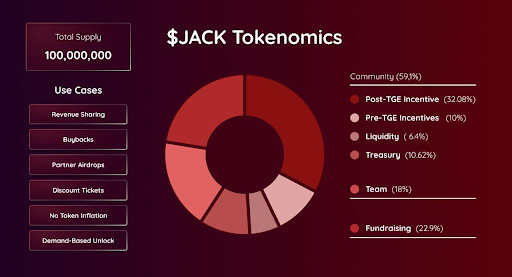

You’ve put a lot of thought into the JACK tokenomics. Can you dive into your approach and what you’ve implemented to position JACK for sustainable growth?

Caesar | StableJack

Instead of a vanilla airdrop and liquidity mining models, we developed the Discount Tickets model.

In simpler terms; investors are using the product and in return, they collect discount tickets at the end of an epoch, which will give them a JACK allocation and discount to buy JACK cheaper than its market price.

With this model, we prevent sybils and mercenary capital so that real users can earn more. Also, since there is no mercenary capital, the token is distributed to diamond hands which helps long-term holders and stakers because they are not going to be dumped on.

Avalaunch

It’s really great to see you taking such an active approach to designing more effective and sustainable tokenomics. Have seen a lot of people having an open conversation about it now, especially after your article, which I recommend everyone to take a read on! Definitely a step in the right direction.

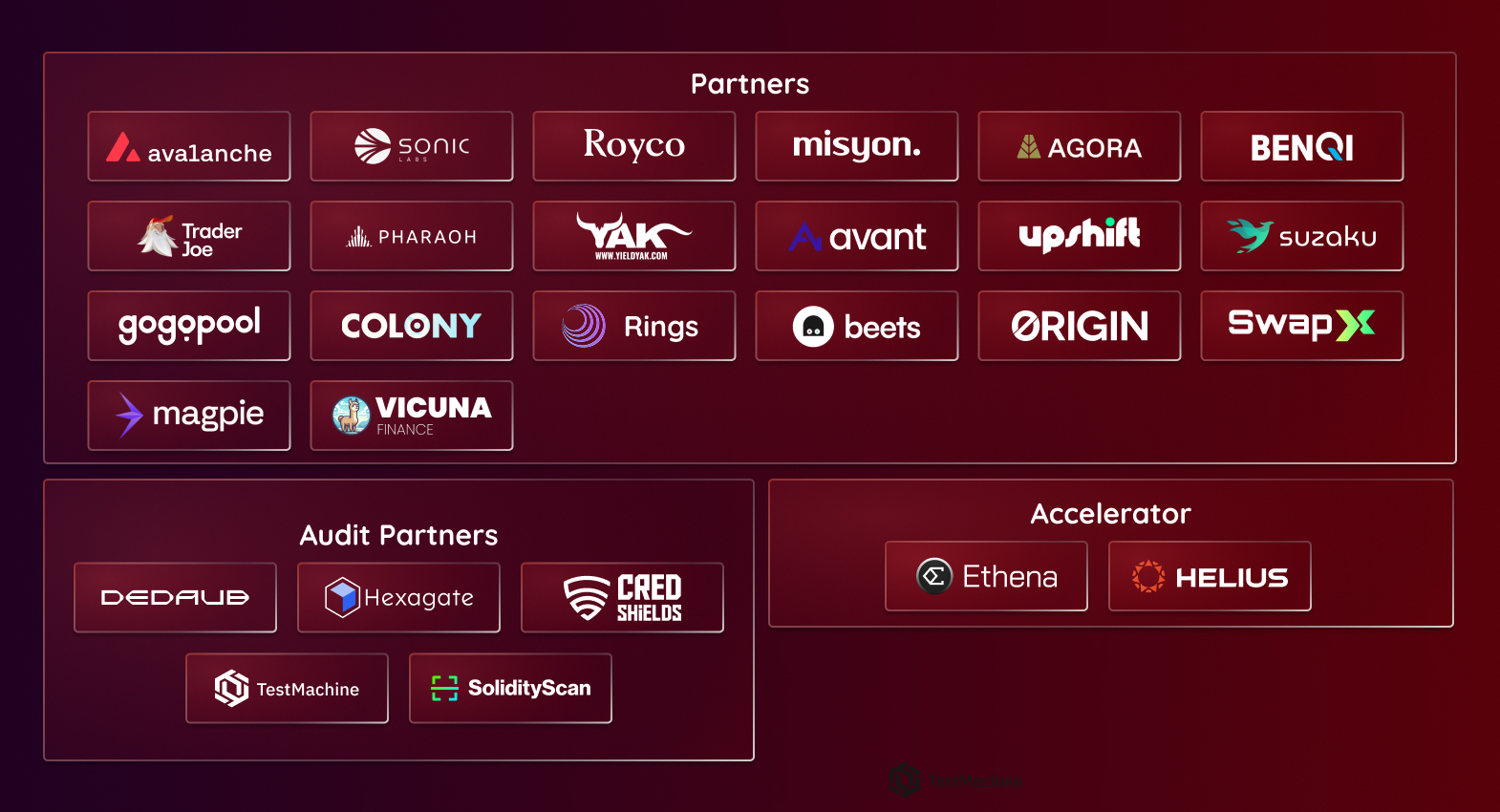

What upcoming features, partnerships, or integrations can we look forward to in the Stable Jack roadmap?

Caesar | StableJack

We will add new collaterals including BTC, and ETH. You will be able to long these assets without liquidation risk. On the other hand, we will add new stablecoin collaterals.

For new products, we are working on our own AI Agent that will offer a seamless DeFi experience with all of its difficulties being abstracted.

We have several partners. You can see the partner list attached in the photo below.

On the other hand, we will onboard banks and fintech institutions from emerging markets.

Avalaunch

That’s a lot of big updates for the community to look forward to. Excited to see your take on the DeFAI agent angle as well.

With the rise of RWAs and more sophisticated DeFi strategies, where do you see Stable Jack’s impact in the broader DeFi ecosystem?

Caesar | StableJack

RWAs couldn’t get a significant market share yet in DeFi. The reason for that is no real use case took place yet.

Stable Jack unlocks that, and institutions are aware. We are talking with TradFi from all over the world including the USA, Turkey, Brazil, and Hong Kong to tokenize their assets and use them on Stable Jack.

Avalaunch

Very exciting news. RWAs and stablecoins will be key in unlocking the next wave of adoption, can’t wait to see how Stable Jack will be positioned in all of this.

What is your long-term vision for Stable Jack, and how do you hope it will help shape the future of DeFi yield markets?

Caesar | StableJack

Our long-term vision is to make Stable Jack the yield hub of the ecosystem and also become the easiest way to onboard new people to crypto through our consumer app.

Avalaunch

Awesome, congrats on all your achievements so far! Sounds like there is a lot of developments going on in the background.

Ok so now we are moving onto the community part of the AMA! We have selected 10 questions and the first is from @TrinhHoangTC who asks: How does Stable Jack’s tokenized leverage model offer a more efficient and flexible alternative to traditional leverage trading in DeFi?

Caesar | StableJack

thanks a lot! excited to answer all the community questions

Stable Jack’s Volatility Token offers no liquidation, no funding fee, and no scam wicks, which makes it the most reliable and competitive way to long AVAX compared to existing models where the risk of liquidation is very dangerous.

Avalaunch

@Carl0709 would like to know: Can you explain how the Yield Token in Stable Jack provides a USD-pegged, yield-bearing asset and how it interacts with the underlying collateral asset to accrue yield?

Caesar | StableJack

As users exchange the yield and volatility or points of the collateral asset, when a user mints Volatility Token/Points Token, he/she gives up on yield of the asset, which is directed to Yield Token holders.

With this model, we can provide a USD-pegged yield-bearing asset.

Avalaunch

A question from @cryptodate — How does Stable Jack’s governance function? What role do token holders play in key decisions like fee adjustments, collateral expansions, and protocol upgrades?

Caesar | StableJack

There is no active governance on Stable Jack, but in the future, we will allow stakers to choose which assets to list.

Avalaunch

Now we hear from @nb0024 — As DeFi continues to evolve, what future innovations and product offerings can users expect from Stable Jack to strengthen its position in bridging traditional finance and decentralized finance?

Caesar | StableJack

We are planning to add new collaterals and offer new products like RWA assets. Moreover, we are working on our AI agent to simplify whole DeFi transactions.

Avalaunch

@haunguyens asks: How does the protocol ensure capital efficiency when allowing users to mint aUSD against AVAX LSTs, and what mechanisms prevent systemic risks such as under-collateralization?

Caesar | StableJack

The protocol is always collateralized at 1:1 which allows us to prevent under-collateralization. Stable Jack does not provide loans, so there is no undercollateralization risk.

Avalaunch

Question from @trgdoa — Stable Jack has identified Avalanche as its primary chain but has ambitious expansion plans. What factors will influence the selection of additional chains, and how does Stable Jack intend to position itself as a key player in the BTCFi ecosystem and emerging blockchain networks?