-

TaleCraft AMA #1 — Project Overview with Eren Gunaydin

Join us in the Avalaunch Telegram group for the first of two AMAs with the TaleCraft team.

First up is Director of Business Development, Eren Gunaydin, where we will be covering the project at a high level. The focus of this AMA will be the business development, vision, road map, and post-IDO plans.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 11/17/2021

- Time: 12:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

🐣 Follow: Avalaunch & TaleCraft

✈️ Join: Avalaunch Telegram & TaleCraft

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

TaleCraft x Avalaunch — IDO Announcement

As crypto pundits have mused, the migration of gaming onto the blockchain may barely be underway. The inherent transparency and immutability of the technology allows for a new type of player experience which is becoming more immersive in ways that aren’t always readily apparent. Not all games have to be a metaverse that blurs our definition of reality nor does it require breathtaking 3-D animation in order to make a massive impact.

Perhaps presaged by none other than CryptoKitties, value, be it perceived or real, is the driver. Digital collectibles as art to in-game assets are now being measured in dollars and cents — driven by active, growing markets full of impassioned traders, fanboys and even passive users.

Introducing TaleCraft

TaleCraft is touted as the first crafting game on Avalanche and is a player versus player board game. Along with minting NFTs, there is a very inventive play-to-earn mechanism where players gain power through a gamified NFT “alchemy.” In this medieval metaverse, skill reigns supreme over luck.

It is transporting, ever-evolving but this is not what made Avalaunch take true note. It is a subtle evolution in gaming by virtue of its economic model. The payoff is not more from the game itself or an ethereal value which may or may not be realized in the future. Rewards are payable in none other than AVAX via some innovative tokenomics. This is something that is sustainable for both player and CRAFT token alike.

Overview

“The Magical Metaverse of TaleCraft is a world where mystery and excitement conspire to ignite the competitive flames that burns deep within us all!

Talecraft is a universe where imaginations run wild and allow our most mythic qualities to take center stage. Rule over ancient lands and earn the amulets they contain. By leveraging the power of NFTs, the time is nigh to claim rightful ownership to what is yours as TaleCraft players emerge victorious in battle and advance!”

The TaleCraft team believes it is solving a problem that perhaps no one sees coming or is already thinly veiled in the marketplace.

- Classic NFT minting have limited use cases and may come to bore.

- Crafting Technology can be used instead of classical NFT minting.

- Users can play games and make profit with Crafting Technology as well as with classic NFTs within the same game.

- Crafting Technology is more engaging as players make money with strategy and through competition.

- The ERC-1155 standard can be integrated into games, used in the metaverse, thus having great potential for the Avalanche Ecosystem.

TaleCraft’s mission is to popularize this technology but it is the token mechanics which represent an additional departure from standard issue as they are liquid and gamified.

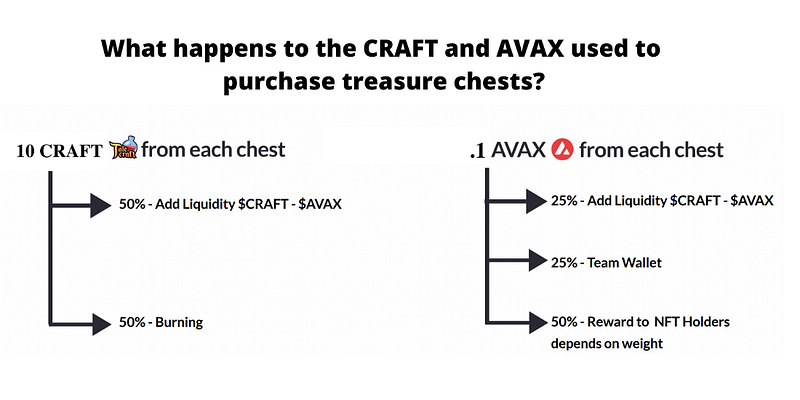

Players must deposit 10 CRAFT and .1 AVAX in order to unlock a treasure chest and receive an NFT card.

Once the 10 CRAFT enter the game, users are granted an NFT card, which is assigned a “weight,” which determines status within the game. Opening more chests, grants additional cards which can be combined in order to ascend levels.

Combined cards used to achieve a higher level will be burnt but where things get more compelling, is how the deposited CRAFT and AVAX are deployed.

As the diagram illustrates, the 10 CRAFT and .1 AVAX are put to work. There is a potentially massive deflationary component to this token. Moreover, the continual feeding of Avax into the ecosystem should also have an interesting effect as many earning models are often more of the token one already holds. This is effectively the opposite.

Partners and Backers

- Colony Labs

- Avalaunch

- Yay Games

- Roco Finance

- Chainlink

- Pangolin

- Trader Joe

Talecraft Links

Website | Telegram | Discord | Twitter | Medium

Eren Gunaydin, Head of Business Development at Talecraft states, “I didn’t anticipate such a partnership from a launchpad. It feels like a forming friendship with some genuine incubation. I believe Avalaunch has been instrumental to our success to this point and will remain an important part of what we do for the life of the project.”

Funding Numbers

Total Supply: 30M CRAFT

- Seed: 1,800,000 CRAFT at .20 USD — $360,000 USD

- Strategic: 1,800,000 CRAFT at .24 USD — $432,000

- Private: 2,850,000 CRAFT at .26 USD — $741,000

- Public: 3,750,000 CRAFT at .28 USD — $1,050,000

Hard Cap: $2,583,000 USD

Supply Breakdown & Vesting:

Total Supply: 30,000,000 CRAFT

Breakdown:

- Total Token Sales: 10.2M CRAFT (34%)

- Game Incentives: 3.69M CRAFT (12.3%)

- Staking: 3M CRAFT (10%)

- Team: 3M CRAFT (10%)

- Liquidity and Market Making: 3M CRAFT (10%)

- Operations & Development: 1.5M CRAFt (5%)

- Advisor: 1.5M CRAFT (5%)

- Marketing: 1.5M CRAFT (5%)

- Partnerships: 1.5M CRAFT (5%)

- Ecosystem: 1.05M CRAFT (3.5%)

- Airdrop: 60K CRAFT (0.2%)

Vesting

Token Sales:

- Seed: 30-day cliff, 5%, 90-day cliff, linear for 18 months

- Strategic: 30-day cliff, 5%, 90-day cliff, linear for 15 months

- Private: 5% TGE, 90-day cliff, linear for 15 months

- Public: 35% TGE, weekly for 3 months

Community & Player:

- Incentives: 6-month cliff, 10% monthly

- Staking: 5% TGE, linear for 20 months

- Ecosystem: 90-day cliff, 33.3% quarterly

- Airdrop: 60K CRAFT at TGE*

*A total of 60,000 CRAFT (16.8K USD) will be airdropped to a partnering community project.

Team, Advisory & Partnerships

- Advisor: 6-month cliff, 25% quarterly

- Team: 12-month cliff, 25% quarterly

- Partnerships: 5% TGE, 90-day cliff, 25% quarterly

Operations, Marketing & Liquidity

- Liquidity: 100% Unlocked — 1.66M CRAFT initially with the remainder reserved for additional listings

- Marketing: 180-day cliff, 25% quarterly

- Operations & Developments — 12-month cliff, 25% quarterly

*Initial liquidity—1.66M CRAFT and 500K USD upon listing.

IDOs:

- Avalaunch: 900K USD—3.21M CRAFT @ .28 (Details Below)

- Roco Finance: 150K USD—535.7K CRAFT @ .28 (Details here)

Other:

- Initial Circulating Supply: 1,739,500 CRAFT (excluding liquidity tokens)

- Initial Market Cap: 487,060 USD (excluding liquidity tokens)

- Initial Liquidity: 1.66M CRAFT and 500K USD in AVAX*

The Talecraft IDO on Avalaunch

- 3.21M CRAFT at .28 USD (Total Supply: 30M CRAFT)

- Sale Size: $900,000 USD

Registration Schedule:

- Registration Opens: 11/17/2021 at 3 p.m. (UTC)

- Registration Closes: 11/21/2021 at 6 a.m. (UTC)

Sale Schedule:

- Validator Round Begins: 11/22/2021 at 6:00 a.m. (UTC)

- Validator Round Closes: 11/22/2021 at 6:00 p.m. (UTC)

- Staking Round Begins: 11/22/2021 at 6:30 p.m. (UTC)

- Staking Round Closes: 11/23/2021 at 6:00 a.m. (UTC)

Avalaunch Sale Distribution:

- A minimum of 90% of the sale will go to the community stakers of XAVA.

- ~5-10% will be reserved for validators of the Avalanche network.

IDO Recap

- Total CRAFT for sale: 3.21M

- Price: .28 USD

- Size: 900,000 USD

- Vesting — 35% at TGE, weekly for 3 months

-

Avalaunch x Crabada — IDO Sale Purchase & Revised Breeding Coin Distribution

From the beginning, we knew Crabada would be a smaller sale than is customary on Avalaunch. Still, we felt it incumbent upon us to share what we could of a project we believe to be special. We have known the team for some time and have always appreciated their earnest commitment to the community and belief that games can not only bring people together, but also empower.

It takes a unique collection of individuals to hold space for this potential throughout the decision making process in a project’s earliest days, as the bewildering forces of crypto vie for supremacy. We have no doubt that the Crabada team possesses the character required to navigate this sometimes perilous terrain and our philosophy and approach mirror each other in many respects.

In that spirit, we are grateful to the Crabada team for entrusting us with this IDO and we were thankful to be able to bring it to our Avalaunch faithful. Many realities come to pass during the public sale process, not least of which is that any team utilizing our platform is relying on us to do justice to their vision and tireless efforts. It’s a tremendous responsibility and the success of it is realized through collaboration and a durable alignment of ethics.

As such, we are happy to outline some exciting announcements that both teams dreamed up over the last week.

The XAVA Red Tide & Crabada Invasion

We conducted some informal polling and asked the denizens of our telegram what they thought of this boutique offering. Overall, some 90% of users agreed that being afforded the opportunity to participate in Crabada, however small, was a worthy endeavor. We agree.

Over time, our staking numbers have been climbing steadily, having doubled in less than two months, but the Crabada announcement sparked unprecedented demand. We can rest assured that the Avalanche ecosystem is alive, well and growing by the day.

Though we have much larger sales coming and quite a bit in the works, we wanted to meet this surge in demand head on.

For this reason, the Avalaunch team has purchased the $400,000 IDO allocation from Crabada and will distribute it to the participants in the sale for free, via a refund of the AVAX paid to claim an allocation.

This IDO is on us.

As per usual, the allocations will be determined by stake and the distribution will not be linear. There will be lower than usual maximum allocations to most effectively distribute this to the record number of participants — some 15,000 strong.

Claim Logistics

Shortly after the IDO concludes, we will deploy a claim portal where registered users who purchased an allocation will be able to reclaim the AVAX used to purchase that allocation. It will require a bit of coordination across teams post-IDO, so we ask for just a bit of patience, but we aim to have this available to users ASAP.

True to form, the Crabada team also went back to the drawing board to determine how they could best meet the unanticipated demand, while still honoring the meticulously designed project and game tokenomics. The result being a revived Breeding Coin distribution for participants on Avalaunch.

At this point we’d like to give the Crabada team the floor so they can share their update to the community:

Crabda Revised Breeding Coin Distribution

Breeding Coins were previously arranged to be distributed in a 1:1 ratio to CRA allocation. This would have resulted in only 631 participants being able to successfully breed Origin Crabada in the Special Breeding Event.

To ensure that the Crabada NFTs would be better distributed, and that more players would be able to obtain Crabada NFTs, we have decided to revise the distribution of Breeding Coins based on the amount of XAVA staked by each participant.

This revision will now effectively allow 1,470 participants from Avalaunch to receive Breeding Coins and take part in the Special Breeding Event.

Distribution Details

Total Breeding Coins for Avalaunch participants:

- 22,218,000 Breeding Coins

- 1,470 Participants

Below is the breakdown of the revised distribution:

Power to the Player-Investor Class

We are extremely grateful for the overwhelming support by the community and we wholly believe in empowering our players.

With the new revision of our Breeding Coin distribution model set in place, we hope to be more inclusive in our reach to the participants to be a part of our growing community.

We want to be able to give more players a chance to own the NFT game assets and to start playing Crabada.

We chose to give game NFTs to participants of our token distribution event.

Players can start playing on game launch without needing to buy anything else.

Power to the investor-player class 💪

Own the game and play the game

👤🤝🕹We like the crabs 🦀

— brada Cra 🔺 (🦀, 🦀) (@oxtender) October 30, 2021

Special Breeding Event Updates

In-lieu of the new influx of new participants (more than 2x!) that will be eligible to take part in the Special Breeding Event, Crabada’s natively whitelisted participants will have a window of 2 hours to start breeding their Crabada first.

Breeding coins that are allocated to Avalaunch users will be airdropped on 13 Nov, 5 PM UTC.

Special Breeding Event Schedule:

- 13 Nov, 3 PM UTC — Breeding Begins (Crabada Native Whitelist Users)

- 13 Nov, 5 PM UTC — Breeding pauses. Airdrop for Avalaunch participants.

- 13 Nov, 5.15 PM UTC — Breeding resumes for all participants

The Special Breeding Event will be on a first-come-first-served basis. With only a limited number of Crabada available for both Pure/Genesis Chambers and Mixed-Breed Chambers, do be early to avoid disappointment of breeding your Crabada of choice!

Wishing everyone gc (good crabbing)!

From both teams, we want to thank you for recognizing the power of the Avalanche ecosystem and the quality of initiatives coming to our blossoming L1 ecosystem. We will always strive to do the right thing and our very best to service our passionate, occasionally raucous and always caring community.

About Crabada

Welcome to the world of Crabada. Rediscover the prosperous ancient Hermit-Crab Kingdom once ruled by Crustaco, King of the Crabada. Recruit loyal followers to your cause. Harvest precious resources from mines, and breed new warriors for your army. Loot enemies or humble miners unaware, claiming your rightful share of their riches.

Will you be the one to take the place as King of the Crabada? Or will you sow the seeds of discord across the land? The world is your oyster. Soon, they will tremble when they hear your name.

Website | Telegram |Discord | Twitter | Whitepaper | Medium

-

Crabada AMA #2 — Technical Deep Dive with Fuji102x (Recap)

On 11/05/2021 at 12:00 p.m (PST), an AMA session was held on Avalaunch with special guest Fuji102x, CTO of Crabada . Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Hello and welcome everyone to our 2nd epic discussion/AMA with Team Crabada. Today we will get down to the nitty gritty, the brass tacks, to where the still waters run deep by performing a more technically specific AMA with none other than @fuji102x Welcome, how are you today?

Fuji | Crabada

Hi everyone, it’s a good day, we’re working hard.

Very nice to be here today, thanks for hanging out.

Dave Donnenfeld | Avalaunch

I’ll bet. Appreciate you taking some time out to be here with us today.

Fuji | Crabada

Cheers. Let’s not make the people wait — getting right into it and to ease us in, why don’t we start by having you introduce yourself? Tell us a little bit about your background and what led you to be working in the explosive blockchain gaming industry?

Since I was a student, I was already farming in-game on some games. It was always quite difficult to cash out, and I mainly did it via p2p just like how bitcoin was in the early days.

I have been working in the blockchain space since 2016 including designing and implementing the very first backend system of a leading crypto wallet. In 2018, l wanted to make a game based on CryptoKittens because I couldn’t do anything with my collection.

Since then I have been trying out many blockchain games due to curiosity and following extra closely during the covid pandemic when we shifted to a remote-first world. I felt that the games out there were not really entertaining so that made me want to work on a game project to bring something new to gamers and players.

Dave Donnenfeld | Avalaunch

A solid background to be where you are — sounds like manifest destiny. Was Crabada always going to be built on the blockchain, or was this something that became obvious over time?

Fuji | Crabada

Actually, yes it was going to be built on the blockchain from the start. Working in the space since 2016, I saw how the space grew and it had a pretty big impact on the community around me. This laid the foundation for some of our plans.

Our team’s background was across working in various roles on blockchain applications. We wanted to apply what we knew was possible to something we were all passionate about which was gaming.

So we planned for it to be built on the blockchain from the start.

Dave Donnenfeld | Avalaunch

From the development point of view, what part of building Crabada was the most challenging and would this still have been a challenge at all, had you been building in the traditional game ecosystem as opposed to building on the blockchain?

Fuji | Crabada

It’s been pretty smooth so far, but I would say the top priority for us now in terms of development is growing the team.

We have really great talent currently, but we are still actively looking to grow our team in order to build out our roadmap. It could definitely go faster with more hands on deck. So that’s the key priority now. We need more blockchain developers.

Dave Donnenfeld | Avalaunch

Pretty smooth so far…you don’t hear that very often 😄

What about Avalanche’s architecture makes Crabada possible here, and not on other chains. What issues related to scalability have you faced and tackled?

Fuji | Crabada

We’re just very lucky, we have incredible team supporting us.

The Snowman consensus model allows blocks to be confirmed with finality and much quicker than most L1s.

It does not suffer from blockchain reorganization which can potentially lead to bad user experience.

It’s also highly scalable and it’s hard to foresee congestion issues happening as of yet, especially with Apricot Phase 4 Snowman ++ has improvements that address MEV issues that lead to congestion.

It’s overall a really good chain to build on.

Lovish Shahi | Avalaunch

Appreciate that. Here’s a question that users may not recognize the implications of just yet…Do you have any plans to develop on a subnet? What applications make sense for a blockchain-based game and gaming ecosystem?

Fuji | Crabada

Definitely, it’s already in the works. This was also one of the reasons why we wanted to build on Avalanche.

We plan to launch a zero-fees gaming blockchain — initially for our own use and later extend it to other games.

The first step would be to migrate the idle game in Q1 2022. Subsequently, we will launch the Battle Game on it, also planned for Q1 2022.

We think that a persistent game identity, like a player profile that can be brought across different games on our gaming blockchain is an area that we want to explore in the long run.

We believe that there is vast potential in the future for zero-gas gaming and foresee the opportunity to bring over other on-chain games or even port over traditional games that are not on the blockchain yet. So this is something that we are really excited to work towards.

Lovish Shahi | Avalaunch

That’s a Great plan!

What parts of Crabada live on-chain, and conversely, off-chain? Can you talk about the thinking around this and how the end result services the vision?

Fuji | Crabada

Important data will always be stored on-chain. For example, Crabada pets, other game assets, tokens, battle proof, etc. The other stuff like images, audio, game details are stored off-chain.

We use the hybrid model to reduce on-chain activities but still keep the game transparent.Lovish Shahi | Avalaunch

How big is the development team, and how many developers are dedicated to building Crabada?

Fuji | Crabada

Currently we’re at about 12 members, but we’re trying to grow to a team size of around 20 members. Current team consists of about 2 backend developers, 2 frontend developers, 2 smart contract developers. 2 game engineers, and 4 artists.

Lovish Shahi | Avalaunch

you guys are well diversified in each specific area.

Can you expand on the analytical tools available on the marketplace? Are there plans in the pipeline for building more?

Fuji | Crabada

Currently the marketplace provides simple data at both transaction-level and aggregated.

For transaction-level, we show recent listings, and recent sales.

For aggregated market data, we show the total number of sales, volume done, and average price over the past 24 hours, 7 days and 30 days.

Let me quickly show a screenshot of the marketplace from the test environment now

Depending on user feedback from their experience with it, we will improve it further.

Lovish Shahi | Avalaunch

looks interesting

How quickly do you expect these tools to be adopted? What metrics will you use to measure this success?

Fuji | Crabada

We really wanted to build something that is easy to use. We expect many users to pick it up really quickly. In terms of support, we have been putting out step-by-step user guides as well on our help portal, otherwise users can also ask in our telegram or discord chats, we have an awesome community that loves to help new users figure things out!

I think the most important metric for us would be the transaction volume of the marketplace. Aside from that we will be launching a portal for users to provide feedback directly to the team. We love to hear suggestions!

Lovish Shahi | Avalaunch

What approach to game security have you taken thus far? What are your biggest concerns related to vulnerabilities?

Fuji | Crabada

Security is our big concern, there are many ways to attack a game in general. We are building this project with security in mind, and all developers always apply OWASP principles in their daily work. For the blockchain part the smart contracts are undergoing audit by Verichains.

Lovish Shahi | Avalaunch

appreciate that

What has developing on Avalanche been like for you? What has been your impression of the developer community?

Fuji | Crabada

Avalanche C-Chain is like Ethereum in the development aspect so we are familiar with all development tools and environments.

We also have experience with customizing the Go-eth(Golang Ethereum fullnode) and working with coreth to build a new game subnet is not a big problem so far.

We really need to praise the developer support for Avalanche. There are many channels for community support such as discord, reddit , meetup and even their own forum.

It’s really easy to talk to the Avalanche team and community of other developers when we have any questions. It’s been great so far.

Lovish Shahi | Avalaunch

Final question before we move on to the twitter portion of our program — What part of the Crabada ecosystem are you particularly excited about? Which feature do you think has the most potential?

Fuji | Crabada

I’m really excited about bringing new features to players and introducing more modes of play to players. We have many ideas that we have planned, and we hope our players will enjoy growing together with us as we improve the game.

Besides this, building out the private chain and growing the Crabada ecosystem to support many games is another big goal. It’s less work on smart contracts and more on the blockchain layer, but it’s critical infrastructure that we need in order to scale.

Personally, I am very blown away by how much support we have received so far. We’re just really excited to wake up and build every single day.

Lovish Shahi | Avalaunch

We are excited too

Now let’s go ahead with the Twitter questions.

Twitter questions

@trinhcrypto1997 — Traditional gaming industry are inconvenient for game management. How will blockchain technology in combination with Crabada Play-and-earn model solve this issues?

Fuji | Crabada

Just to cover the technical implementation part, in our first implementation that is more or less fully on-chain, there’s less development tasks and infrastructure that needs to be built.

Instead of building a login flow, you can do an integration with metamask. Instead of payment integration, you can rely on the blockchain to track transactions.

You also don’t require complicated architecture for database solutions to track game assets and transactions since blockchain will handle that for you. And of course, the blockchain handles the infrastructure and security as well.

Dave Donnenfeld | Avalaunch

I’d like to thank @shahi297 for his interim hosting. I’ll be taking the reins from here. So, infrastructure, security and simplicity…can’t ask for more from the blockchain. Next up is from @LukasDuong1 — How can you ensure that gamers and Crabada have a long-term relationship? Do you have any tax or staking system?

Fuji | Crabada

We have our own native marketplace that charges a small transaction fee. Within the game, renting Crabada from the Tavern from other players also incurs a small fee. These fees will go to the treasury for CRA holders to manage. This approach would be sustainable long term to us as game makers as well as game players without suffering from power creep seen in traditional games.

We will implement staking about two weeks after launch. Staking initially provides benefits for investors to get involved with the game. Eg, lucky draw for rare Crabada, increasing team size.

There are staking rewards set aside for CRA stakers as well.

Dave Donnenfeld | Avalaunch

Sorry to pause your roll here but what is “power creep?”

Fuji | Crabada

power creep is when a game continually introduces new skills and abilities that makes older ones seem weaker. it’s not fun for players

it also devalues older skills and abilities as a result

Dave Donnenfeld | Avalaunch

Interesting. Thanks for that. From @Elnazvera1 — What was the biggest technical challenge Crabada faced when starting to develop your project?

Fuji | Crabada

One challenge that we faced is with the parser (we are using The Graph). It does not provide enough features that we need for complicated data aggregation so we have to take additional steps to process the data before it’s ready for the database.

@jamesch8825 “Idle Crabada that are not mining or looting can still earn rewards by being deployed to the Tavern as mercenaries” Can you explain this concept?

Fuji | Crabada

We want to provide many ways to win for players. Maybe some players do not get involved directly in gameplay, and we built the Tavern for them to lend out their Crabada to miners or looters as reinforcements.

@SarahMurtaza3 — Wen lambo

Fuji | Crabada

Wen Crabada Island

Telegram Questions

CAN you tell us about the security measures adopted by your platform? what is your project status regarding AUDIT? Are your smart contracts audited already?

Fuji | Crabada

we have cleared audit for our sales, breeding, time lock contracts. we will release the public audit soon

the game contract audit is currently underwayAlmost 80% investors have just focused on price of token in short term instead of understanding the real value of the project. Can you tell us on motivations and benefits for investors to hold your token in long term?

Fuji | Crabada

We really want to create an investor-player class where you own the game and play the game. So we have planned many benefits for CRA stakers who play the game in addition to investing in it

NFT ecosystem is huge and there is fierce competition in the DeFi+NFT space Which NFT project do you see as your competitors? And how do you plan to compete with them?

Fuji | Crabada

Yep I think we will see this space continue to grow. It’s really positive when we hear about large game publishers taking an interest in blockchain gaming. Also in the play-and-earn space, I think many great projects are also in the building phase. We will stay focussed on our own mission to build a fun and sustainable game that anybody can join. Rather than see it as competition, we see it as potential partners for our zero-gas gaming chain.

What is PROJECT’s revenue model? In which ways do you generate revenue/profit?

Fuji | Crabada

Crabada generates revenue through economic transactions that happen on the platform, for example through marketplace trades, and lending and borrowing.

As we know that every AMA program in a project, we all always talk about the advantages/pros of the features of the project. It’s rare for projects to notify about their project’s lack of features. So can you honestly tell us what your project lacks/cons in features?

Fuji | Crabada

So currently it’s a little hard for us to support guilds due to lack of scholarships. We plan to offer more support for guilds with new features in 2022. Maybe not exactly scholarships, but we believe in the value of mentorship and want to support play-together features.

On the flip side, this is an opportunity for early players!

Dave Donnenfeld | Avalaunch

A big thanks and maybe a hug (can’t speak for everyone) from the Avalaunch community. We appreciate @fuji102x taking time out from what I’m sure is a rigorous schedule and spending time with us today. Look forward to Crabada’s launch, the tavern if I haven’t mentioned, and an overall successful launch.

Fuji | Crabada

Thanks everyone for joining, it was really fun to do this. This community has so much energy and we love the questions that were asked!

About Crabada

Welcome to the world of Crabada. Rediscover the prosperous ancient Hermit-Crab Kingdom once ruled by Crustaco, King of the Crabada. Recruit loyal followers to your cause. Harvest precious resources from mines, and breed new warriors for your army. Loot enemies or humble miners unaware, claiming your rightful share of their riches.

Will you be the one to take the place as King of the Crabada? Or will you sow the seeds of discord across the land? The world is your oyster. Soon, they will tremble when they hear your name.

Website | Telegram |Discord | Twitter | Whitepaper | Medium

-

Crabada AMA #2 — Technical Deep Dive with Fuji102x

Join us in the Avalaunch Telegram group for the second AMA with the Crabada team.

In this AMA, we are joined by CTO, Fuji102x, where we will be covering the project from a technical perspective.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 11/05/2021

- Time: 12:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

✈️ Join: Avalaunch Telegram & Crabada

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

Crabada AMA #1 — Project Overview with 0xTender (Recap)

On 11/01/2021 at 12:00 p.m (PST), an AMA session was held on Avalaunch with special guest 0xTender, Co-Founder of Crabada . Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld| Avalaunch

Welcome everyone to the Crabada AMA. Today, we’re going to do an overview of this promising project. Our esteemed guest and colleague is none other than @Oxtender an instrumental part of the Crabada team. Welcome. Are you ready to lock horns with our vibrant community?

Tender | Crabada

Hi everyone! Thanks for taking the time to participate, and very excited to be here today

Dave Donnenfeld| Avalaunch

Our pleasure. Let’s jump right in — To begin with, please give us a bit of background on yourself. What did your career and education look like before crypto, and how did you end up focusing on blockchain gaming?

Tender | Crabada

For sure. So a quick summary is that I went down a more “traditional” route, having gone to business school and starting as a business analyst as my first job. However, as I grew in my career, I became more exposed to crypto and blockchain, having worked in product roles across both traditional and blockchain products, such as digital exchanges and cloud backup providers

As my exposure and experience in crypto grew, I became increasingly interested and passionate in the future of the space. This eventually led to my decision to start a small team to provide consultation on product and architecture for blockchain products.

As for blockchain gaming, it came about from my team’s shared passion for playing games. We were all avid gamers in our youth and these experiences stuck with us even as we began to delve into the crypto space. From this background, Crabada came about due to our desire to marry our passion for gaming with our strong conviction in the future of blockchain.

Dave Donnenfeld| Avalaunch

Awesome. Thank you for that. So from humble beginnings to Crabs. I like it — How did this strong technologically-minded team come together, and what was the turning point to building this Play-and-Earn game?

Tender | Crabada

We conceptualised and started working on Crabada in 2021, so there were already various role models and inspirations of what gaming on the blockchain could look like. So really we were just standing on the shoulder of giants.

Each of us were already working with EVM-based applications in different capacities, and as gamers ourselves, it seemed an interesting thing to explore.

I don’t think there is anything wrong with gaming as it is now, but using blockchain for games allows us to explore new models like play-and-earn just because of how tightly knit you can make the game and financial layer. Game assets could easily transform into financial assets frictionlessly and it opens up new modes of play that’s sustainable for game makers and players.

Dave Donnenfeld| Avalaunch

Play and earn is compelling…the GameFi thing is really taking.

At what point did you decide on developing on the blockchain, and how many iterations did it take before arriving at Crabada and its theme?

Tender | Crabada

For sure, it’s a really exciting space and we feel very blessed to be working on interesting problems

Right from the start, we were already planning to have our game built on the blockchain, as we were all believers in the future potential for web 3 and crypto to revolutionise the gaming industry.

We could see how the rise of decentralised applications and the growing acceptance of crypto in institutionalised settings would only continue to grow and therefore we wanted to ensure that our project would be built on the platform of the future.

Regarding the theme of Crabada, we definitely went through many iterations before eventually settling on our current concept.

We chose to use hermit crabs as game pets because they are originally creatures that were somewhat modular, they change their shells when they need to grow, and we believe that this represents our vision for a game and community that also continually evolves as they grow. While shells are the most distinguishing feature, we have expanded the concept to make all parts of Crabada modular.

Dave Donnenfeld| Avalaunch

Nice. Hermit crabs can live more than 30 years and I expect you all to have a long life span. 😄

From what I’ve seen there are a few unique features that sets Crabada apart from the myriad Play-and-Earn games out there. Can you talk about Crabada’s economy? How the integration of the NFTs, the native token (CRA), and the in-game currency (TUS) come together to serve the Crabada universe?

Tender | Crabada

For sure, sustainable economy is key problem we work hard on. It’s really awesome for players to play a game which you can make long-term bets on

Treasure Under Sea (or TUS) is our in-game currency and it’s used in our native marketplace from the start. Players and collectors will be able to buy and sell Crabada using TUS, and subsequently in-game items and resources will be introduced as well.

CRA, our governance token, has some innovative designs. We see potential for it to accrue value from platform use via ‘Marketplace’ and ‘Lending’ fees in the future. Most immediately it’s being planned as a membership model that makes playing Crabada more convenient and benefits players. For example, increasing the maximum team size, speeding up battles, participating in lucky draws for genesis Crabada.

It’s really about giving power to the investor-player class where you own the game and play the game!

Dave Donnenfeld| Avalaunch

Why focus on an “idle game” and how does this serve the vision of the project?

Tender | Crabada

We chose an idle game concept because it’s a game mode that most people are familiar with. Time is a scarce experience and we want to create a game that can be easily picked up and learnt, but still very replayable and players feel good to invest their time in it.

We want Crabada to be played by anyone, anytime and anywhere. Learning how to play is relatively easy, and it’s not disruptive to everyday activities. Heck, we want players to play Crabada alongside other games as well

For our next game, ‘Battle Game’, we still retain idle game elements and also bring in more complex battle dynamics, and nation-building concepts into the game. Still want to keep the barrier to entry low, but also give players interesting problems to solve and provide many ways to win.

Dave Donnenfeld| Avalaunch

Props to Crabada for some really sophisticated art and game design. I am curious what the process of creating such a unique world looks like.

Tender | Crabada

We’re really glad that you enjoy them!

Regarding how this all came about, it was definitely a team effort, with everyone pitching in to help ideate, refine, and then challenge the various themes that would influence the art and game design. Through this iterative process, we slowly built up the game’s visual aspect to what it is today. Special thanks has to go to our lead artist Min, who sacrificed many nights of sleep to build out Crabada visually, through his amazing talent to translate our ideas into art.

We explored various themes around the different classes of Crabada. We really just wanted to have fun with it, and I think this energy was transmuted into some interesting ideas, for example, there’s a class that consists of blockchain networks crabs, which is really distinct and people really seem to love.

Dave Donnenfeld| Avalaunch

Ha. Having looked at the Roadmap, I noticed that there are quite a few features that unlock after the launch. Can you cover some of these briefly, and what the token holders should be expecting within the first 6 months or so?

Tender | Crabada

After the token distribution events, it will be followed by our special breeding event for IDO participants and early supporters, where we reward them with the special opportunity to breed the original supply of crabs in Crabada!

After that, the next major milestone for us will be the launch of our idle game on the 15th November, supported on web browsers. Once the launch has successfully stabilised, we plan to release support for mobile browsers, in order to allow our players to enjoy Crabada on their mobile devices.

Subsequent to the launching of our idle game, we will continually roll out more exciting events and features for players, such as mining zones where players can mine faction resources that will be a key part of our eventual battle game mode.

We are also preparing to introduce staking in a few weeks after the launch, which will allow players to access staking benefits and further support the development and growth of the Crabada community.

Lastly, looking ahead to 2022, we are preparing for the launch of our cross-platform battle game mode sometime around March. I think players can look forward to more complex battle mechanics, great in-game battles where Crabs display their amazing array of skills, and exploration of the ancient Kingdom of Crabada via PvE

Dave Donnenfeld| Avalaunch

Wow. That is packed roadmap and a lot in the near term. Very impressive. The space has come a long way since raising money for a mainnet to be named later. I’ll put November 15th in my calendar and have an eye out for staking.

Is there anything that you can reveal at this time, about the long-term vision of the Crabada kingdom, does it expand beyond minting, breeding, looting and battling features?

Tender | Crabada

At the present, we have planned out our roadmap with a 1.5 year runway. We have already made plans to introduce more competitive features to the game such as PVP tournaments, as well as social elements such as in-game guilds, claims and play-together with friends

While it is still early days, in the future we plan to expand the Crabada universe by branching out to other genres, like Tower Defence, or by allowing our crabs to be used in other games that cater to a wider variety of gamers.

We believe that there is vast potential in the future for zero-gas gaming and foresee the opportunity to bring over other on-chain games or even port over traditional games that are not on the blockchain yet. So this is something that we are really excited to work towards.

Lastly, while these are still early days we see great value in the potential of creating a metaverse for the fans and players in our Crabada ecosystem. With the growing adoption of technology across every aspect of our lives, we hope that one day we will be able to provide members of our community with an ecosystem where people can potentially use their Crabada avatars to explore virtual worlds and interact with their friends, trade NFTs, and enjoy a multitude of services all from one single unified Crabada platform

Dave Donnenfeld| Avalaunch

There’s that word…Metaverse

This is indeed a very exciting time to be building on Avalanche. Since Crabada will be the first (hopefully of many) Play-and-Earn games building on this blockchain, I wonder what were the critical factors that determined building the project in this community?

Tender | Crabada

One of the really key factors that drew the team toward building on Avalanche was the overwhelming community support that we were receiving. When the project idea was first conceptualized, our team did extensive research on which ecosystem would be best to launch the game on. We were quite blown away by how warm and welcoming the Avalanche community was. Shoutout to Avalaunch (of course), Ava Labs, TraderJoe, Avaxholic and everyone’s favourite — CederNets

Another key factor for consideration were the transaction speeds and gas fees of L1 chains. With Crabada being a play-and-earn game, our main priority was to provide players with the best on-chain gaming experience possible, especially for our initial idle-game phase where we were going to be pretty reliant on on-chain transactions for game actions.

The transactions needed to be quick and affordable. Avalanche is — quote-unquote “Blazingly Fast and Low Cost” which was exactly what we needed. Additionally, the Apricot Phase Three upgrade couldn’t have come at a better time for us, where C-Chain fees were essentially being reduced by up to a whooping 66%. That was just really great news for us, and the Avalanche community itself. 😍

So I think from there, we were kinda fixated on the idea of having Avalanche as the home-base for the Crabada-verse.

Dave Donnenfeld| Avalaunch

The old Apricot Phase Three upgrade in the nick of time.

That’s something you don’t hear every day

Tender | Crabada

We like the Apricot

Dave Donnenfeld| Avalaunch

Finally, before we move on to the twitter section of the program- are there any last points you’d like to discuss, or share with the Avalaunch community?

Tender | Crabada

Our vision is simply to create a game that can be enjoyed by anyone, anywhere, at any time. We are extremely excited to build towards a game that will not only be enjoyed by crypto natives, but also by the masses. We hope that everyone here is as excited as we are, and to work claw-in-claw towards bringing the GameFi revolution to new heights.

Remember, wake up and like the crabs. Are you ready for the Crabalanche? 🦀🦀🦀🦀

Twitter questions

Dave Donnenfeld| Avalaunch

I am ready. My body is also ready. NGL, that was a pretty epic Q&A. Great stuff. First up from our supporter over on the twitter comes from @cryptoyaos who asks — we can only buy Crabada from other players after the breeding event, is that true? Will there be any other NFT sales from the team?

Tender | Crabada

Thanks for everyone who contributed questions! So many nice ones, and really feel the warmth and excitement of the Avalaunch community

So besides the initial breeding event, there’s also a lucky draw format for CRA stakers to win some Crabada. We have prepared 64 genesis Crabada in total, 10 of which will be distributed via the Special Breeding Event, and the remaining 54 will be distributed in a lucky draw format for CRA stakers.

We don’t intend to sell NFTs to players directly but instead, let players craft them. There are plans for more NFTs for the game including equipment, skill books after Battle Game is launched in Q1 2022. These will be craftable by players!

Dave Donnenfeld| Avalaunch

They are not always so warm but they are awesome and seem to be quiet and listening to you. Muting the channel helps as well with this. Question 2 from Twitter — @dydd2020 The project slogan is “Play with Earn,” i want to know how do you keep the balance between the play and earn?

Tender | Crabada

Good question — we chose the term “play-and-earn” instead of “play-to-earn” to further embody our vision for Crabada to allow users to have a gaming experience first, and a crypto experience second. It’s really an ethos for us

We want to make an inclusive game that welcomes people from all walks of life, even those who are not invested in crypto full time but are interested in an enjoyable game experience with the added potential of monetizing their effort.

Dave Donnenfeld| Avalaunch

You had me at “Crafted by players.” @AdcDavidtai1999 You are Planning to Launch the BETA VERSION

of the Crabada So that Many players Like me Can test and Overview this Exciting Platform?Tender | Crabada

Ok short answer — Currently, yes, we will consider open beta for the Battle game in Q1 2022, but currently no fixed date for it yet. We’re really excited to get it into the hands of players!

Dave Donnenfeld| Avalaunch

@M31Em In explaining it you mention it as an idle game.. which in game currency would you be earning while idle.. or is it both?

Tender | Crabada

Players will be earning primarily TUS from the games. Also when we launch a new game mode, we set aside some CRA incentives for it, so players will be earning both CRA and TUS when we launch the idle game. We always want to reward players for trying new things! 😇😇

Dave Donnenfeld| Avalaunch

Final question from Twitter before we release the Kraken and let you pick 5 magical questions from our enchanting community. @IvaniWu01 What characteristics differentiates Crabada from other P2Eearn project & what is the strategy to follow in order to position itself in the market and offer confidence, solidity & profitability in an innovative and creative way & not disappear sooner than desired?

Tender | Crabada

Will preface this by saying that building gaming with a blockchain layer is still a very new and interesting problem. There’s not really a playbook here. While we can come in with our hypothesis and models, we are prepared for iterations and experiments alongside our players. Shoutout to 0xRyze from Cryptoraiders for being a true fren of Crabada and helping us along the way

One interesting problem we give players to solve is around nation building / community building. We start to introduce factions early on after launch, as a taster for more faction mechanics in the Battle Game (Q1 2022). We want to give players the option to align themselves with certain factions and contribute to the overall faction, while not overly restricting modes of play. So I think factions have potential to become a core mechanic, let’s see.

Economy is also an interesting topic. How to create an economy that does not overly rely on new players coming in to support it. On one hand, we have to compete with other games that promise endless rewards, but we believe in building a sustainable game that can stand the test of time.

With the battle game, we will implement a trifecta of inflation-reducing mechanics including fusing NFTs, using game NFTs as ingredients, and battle injuries with the aim of creating sustainable emissions. We want to push the boundaries a little, and hopefully take the blockchain gaming space a little further.

Telegram questions

What main reason that make Crabada chosen play and earn models instead click to earn, free to earn, play to earn and etc. How are the difference of play and earn that Crabada brought.

Tender | Crabada

For traditional mobile games, there are limited business models, the most popular being play-to-win, where it’s not really a great experience for players who have to spend to keep up with the game. Unfortunately, the reality is that this is required for operating cost for game developers. With blockchain, we can tap into the financial layer easily, and create new and sustainable business models where players can have a good experience and at the same time, developers can cover operating costs to keep building great game features.

Ambassadors play a very important role in every project, Do you have an ambassador program? If yes, how can I be one ?

Tender | Crabada

For sure, we are planning ambassador programs. We want to empower players that do well to impart their knowledge to the community, and teach others as well. This is still in the works, but hopefully we can announce it soon!

CAN you tell us about the security measures adopted by your platform? what is your project status regarding AUDIT? Are your smart contracts audited already?

Tender | Crabada

We’re currently in audit by Verichains for our sales, breeding chamber and timelock contract. We’ve had good feedback so far from them, and once the audit results are out, we will publish them

Earning the trust of investors is extremely important in a project. How do you manage to gain their trust and make them stay in the long term?

Tender | Crabada

I’m staying up till 5am to do this interview because I really want to spend time with you guys 😊😊

Most of the priority of the cryptocurrency community & investors is the symbolic price. When the price of $CRA token soars/pumps, the community rejoices and grows. When the price of $CRA your token drops/dumps, many people are fear, uncertainty and doubt (FUD) of Crabada.

So, How do you deal with this or how do you deal with your investors panic if $CRA token price drops/dumps?

What are your plans to strengthen and grow your community & investors so that they don’t just value Crabada in terms of the price of $CRA tokens only?Tender | Crabada

Last question! We built our economy for resilience. Currently in idle game we want early adopters to earn tokens easily. With battle game, we introduce many more ways to play, and this means many more ways to win!

We really care about our players, and alot of hours have gone into designing economy to survive ‘demand shocks’, such as allowing Crabada to become ingredients like Crab soup? 🤔

I hope players will look forward to them!

Dave Donnenfeld| Avalaunch

A big thank you @Oxtender This has been great.

Tender | Crabada

Thanks Avalaunch, and thanks everyone for taking the time to join!

-

XAVA Locking & XAVA Points

What are XAVA Points?

XAVA Points (XP) are a representational unit of XAVA that can be allocated toward your stake for any IDO. Unlike normal XAVA, they cannot be purchased or traded, but are earned across the platform by staking XAVA and through various actions like locking XAVA and community-driven tasks.

Avalaunch Tutorial Quick Links:

Staking XAVA:

For every XAVA staked in the allocation staking pool, you will receive 1 XAVA Point. These points don’t represent any additional benefit beyond your normal XAVA, but are simply grouped with earned points for ease of use during IDOs.

How to Earn Additional Points:

Currently, the only way to earn extra XAVA Points beyond your stake is by locking your XAVA, however, there will be more ways to earn in the near future centered around continued participation and community engagement.

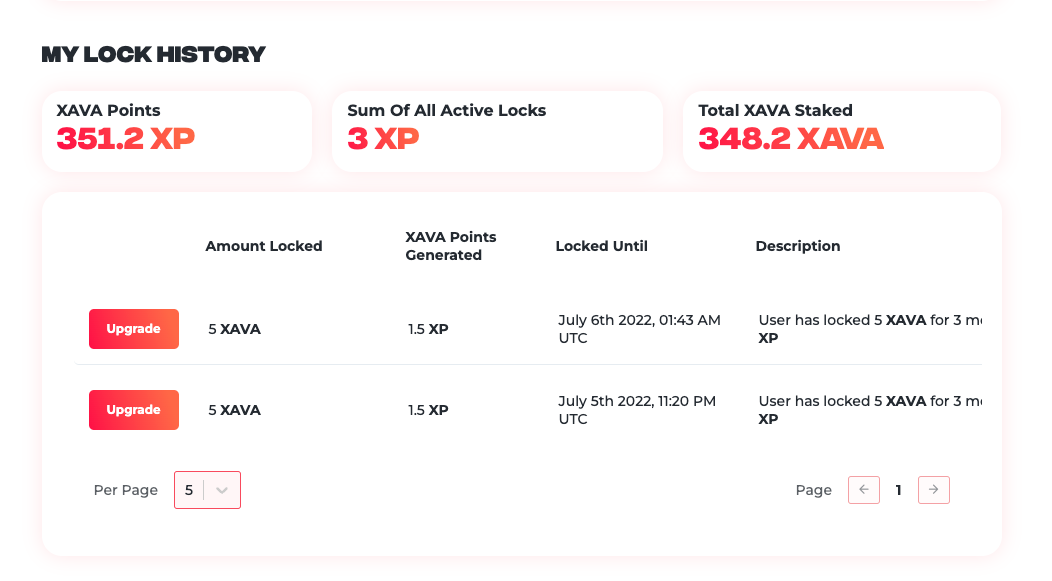

You can alway check your current XAVA points and history under the XAVA Points tab.

Video Tutorial:

How to Lock XAVA:

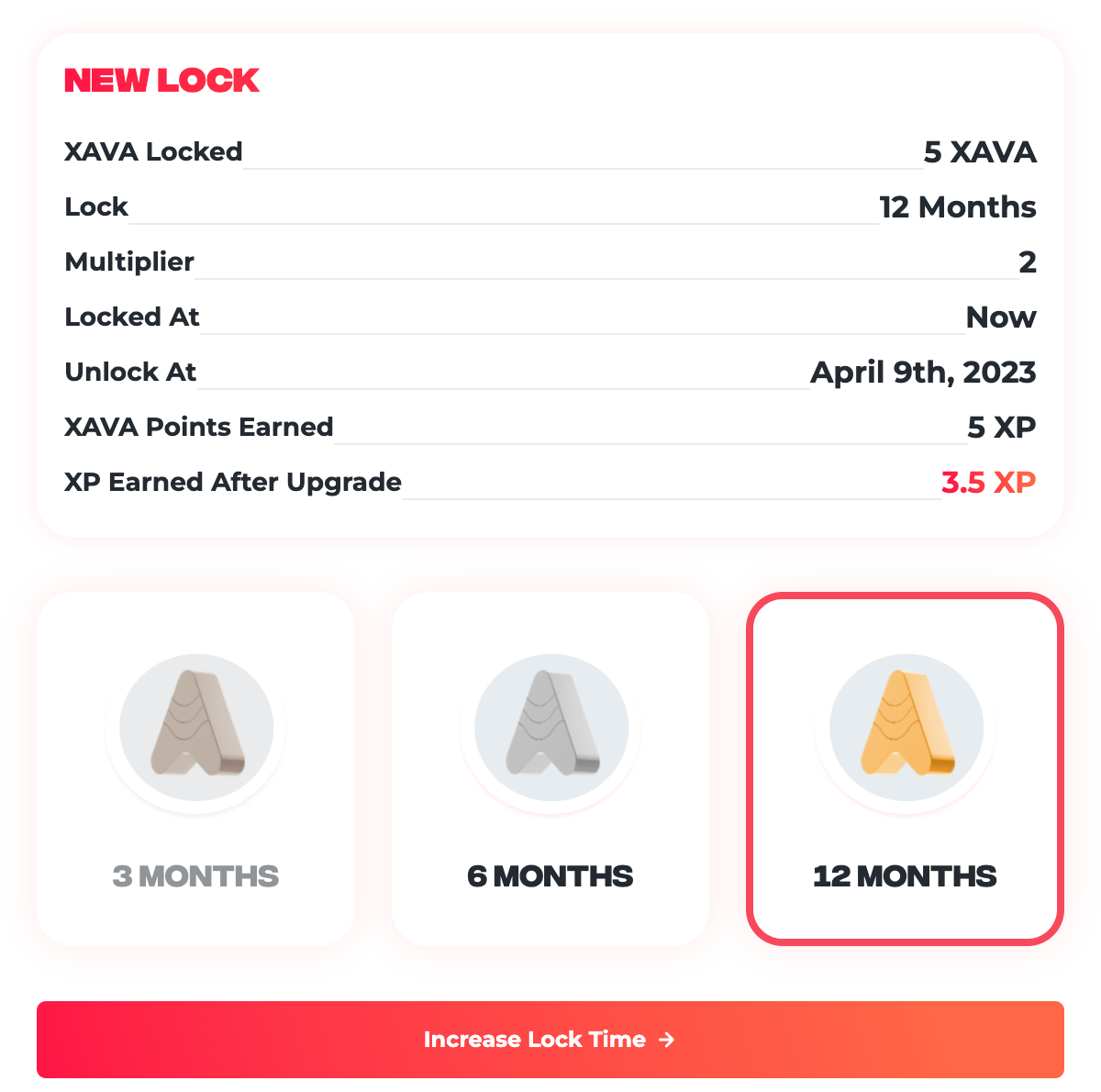

A user will now be able to lock their XAVA for a predefined term (3,6, and 12 months), for a multiplier on that XAVA, in the form of XAVA Points.

Important: You cannot unlock your XAVA until your selected lock term ends.

You can alway check your current XAVA points and history under the XAVA Points tab.

How does XAVA locking work?

When you lock your XAVA for a predefined term, you’ll receive additional allocation power in the form of XAVA Points that can be used toward any IDO.

There are 3 locking terms you can participate in, each with a set multiplier:

- 3 months → Receive 1.3x XP Multiplier

- 6 months → Receive 1.5x XP Multiplier

- 12 months → Receive 2x XP Multiplier

Example Scenario:

- You lock 1,000 XAVA for 3 months.

- When locked: You will have 1,300 XAVA Points which you can allocate toward IDOs. The additional 300 XP in this case are the XAVA Points you earned via the multiplier.

- When unlocked: You will receive your 1,000 XAVA back, and the 300 XAVA Points will expire.

How to Upgrade Your Lock:

If you want to upgrade your locked XAVA to a longer term without purchasing and locking more, you can do that under My Lock History under the XAVA Points tab.

To re-lock XAVA for a stronger multiplier, click on the Upgrade button:

Once you click on the Upgrade button, a module will appear where you can upgrade your lock to a longer term.

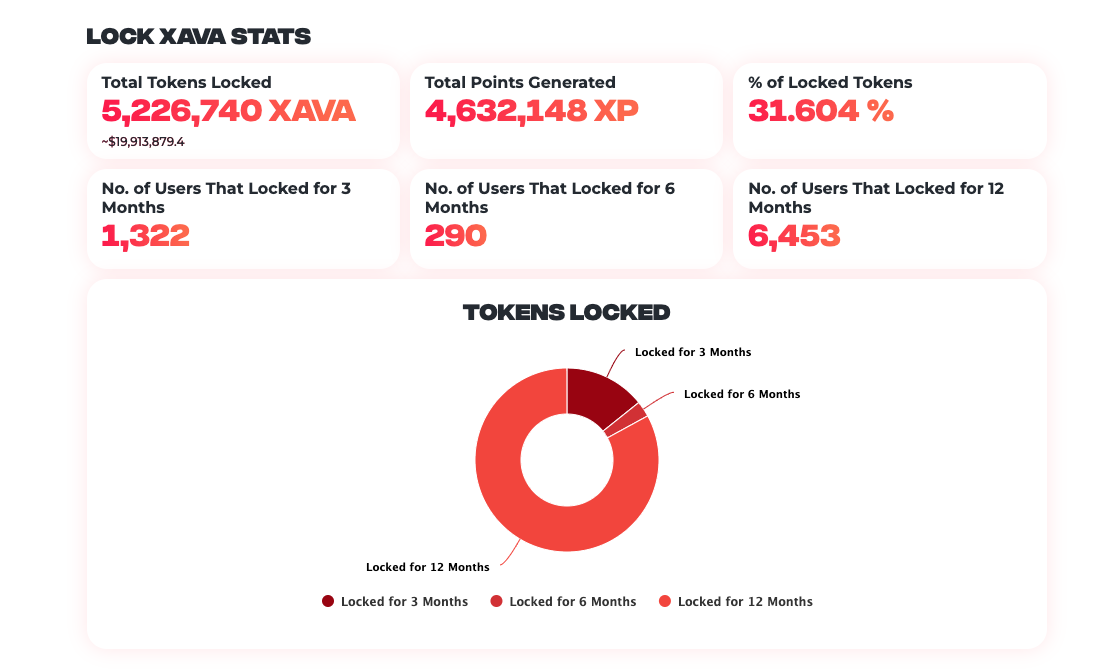

Lock Analytics:

Global analytics – what has been locked up and for how long – are available on the XAVA Points tab.

-

Setting Up Sale Automation

Video Tutorial:

Sale Automation Features:

Avalaunch IDOs now include two automations (Auto-Buy & the Booster Round) that require a deposit of AVAX to execute successfully. This guide provides steps to set up those features.

Avalaunch Tutorial Quick Links:

Deposit AVAX Collateral:

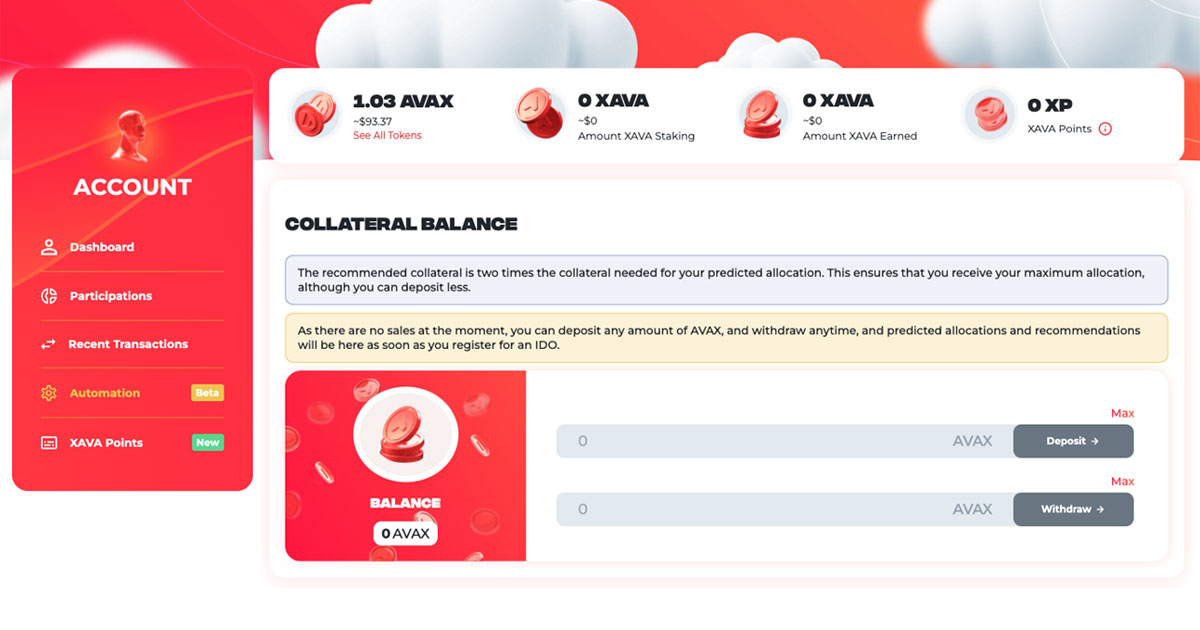

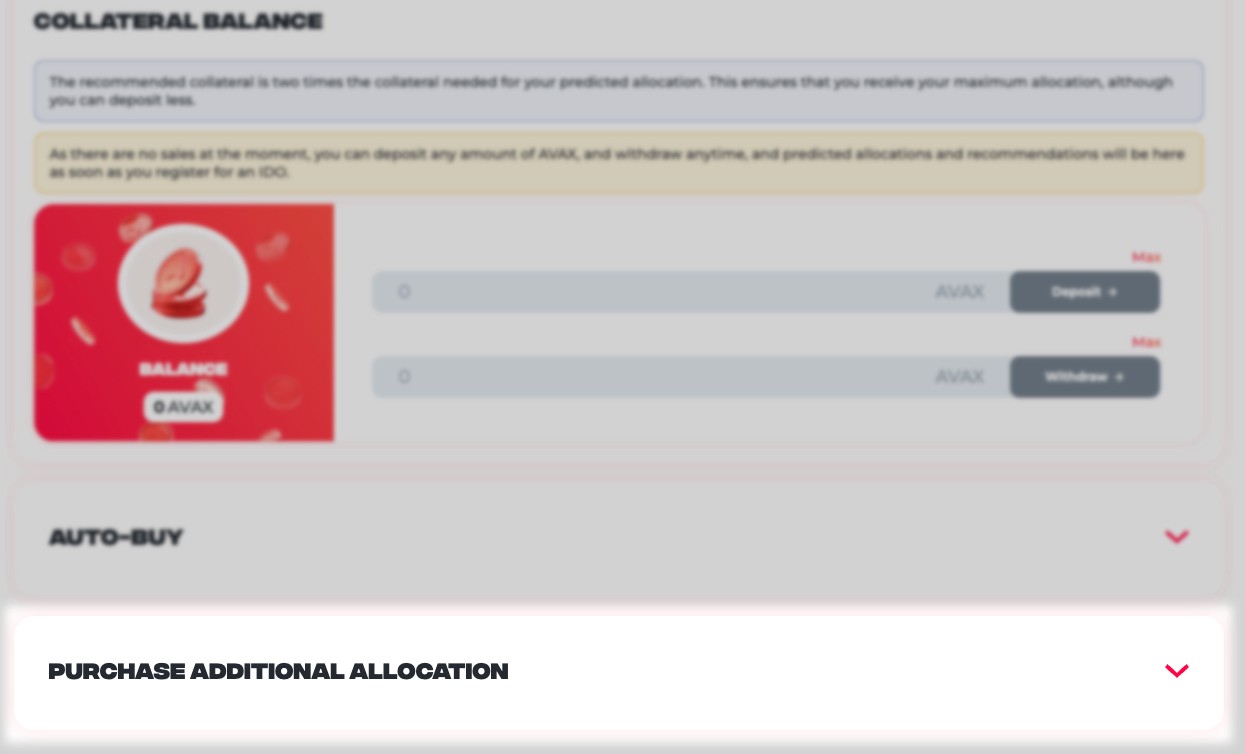

The deposit modal can be accessed through the Automations tab under the Accounts page.

Users will also be prompted to deposit collateral with predictive amount recommendations during registration as well.

During an active sale, you can check the automations tab to make sure that you have met the recommended collateral, which will be based on your current stake and predicted allocation.

Set Up Auto-Buy:

Auto-Buy is an Avalaunch automation that will allow a user’s allocation to be automatically purchased during the IDO sale window. When enabled, a user will no longer be required to be present during the sale to purchase their guaranteed allocation, as long as they have deposited the recommended collateral.

Right now, the recommended collateral will be 2x your predicted IDO allocation. In order to ensure you receive your full available allocation, please deposit the recommended amount.

Deposit AVAX Based on Your Predicted Allocation:

The recommended collateral is two times the collateral needed for your predicted allocation, which includes gas fees. This ensures that you receive your maximum allocation, although you can deposit less.

How Does Auto-Buy Work?

Auto-Buy can will become active during an IDO period and can be enabled at any time up to the beginning of a sale, including after you have registered. Once the sale begins, you cannot disable the Auto-Buy automation.

You can locate the Auto-Buy modal under your Automations tab.

In addition to no minimums and guaranteed allocations, Avalaunch is the first launchpad to offer the type of stress-free user experience which allows for passive participation in an IDOs.

Your participation in an Avalaunch sale can start and end with registration. With our new set of automations, our IDOs are now not only guaranteed, but can be entirely “hands off.”

Opt Into Booster Round:

Historically, there have always been unsold tokens in our IDOs as a function of our guaranteed allocations. If a user’s allocation is guaranteed to be waiting for them during the sale, there is always a chance that they don’t show up, leaving a remainder.

For our past 19 IDOs, we have purchased these unsold tokens at our cost and airdropped them to sale participants. While we felt this was a reasonable and generous solution, there has always been demand for a “last chance” offering of the leftovers.

The Booster Round is our response to this request.

How Does it Work?

The Booster Round is an opt-in final round which will allow stakers to pick up additional allocation after their guaranteed allocation in the Staking Round. Enabling will become active during an IDO period and can be enabled at any time up to the beginning of a sale, including after you have registered.

This round, like auto-buy, is automated and there is no need for a user to be present during it.

You can locate the Booster Round modal under your Automations tab.

In order to be eligible for the Booster Round, a user must first opt-in before and deposit the recommended collateral before the IDO begins. In addition to the collateral, you will be required to deposit AVAX for gas fees. This is to ensure that the transaction executes and the automation is 100% reliable.

Once the Staking Round has concluded, the application will begin to automatically scan the list of participants that have opted-in, sorted by stake, with the highest stake first.

If a user has opted in and deposited collateral, it will automatically purchase up to 1/2 their allocation in the staking round, with a hard cap of $300. No user will receive more than this, regardless of their stake.

If a staker has not enabled this feature or not deposited collateral, they will be skipped. If the user has not deposited enough collateral to receive the maximum Booster Round allocation available to them, whatever collateral is available will be used, and the application will move down the list.

Why Not “First Come First Serve?

The Avalaunch application was designed to remove the stress, confusion and need to be first from the IDO process. A round where the person who was the fastest or cranked their gas the highest “wins” would be antithetical to all of the design choices we have made to date. While we understand the desire, we simply prefer a more orderly solution.

With the collateral requirements and hard caps in place, we anticipate that the the Booster Round will allow for hundreds of participants to receive additional sale allocation, without sacrificing any of our core design principles.

-

Crabada AMA #1— Project Overview with 0xTender

Join us in the Avalaunch Telegram group for the first of two AMAs with the Crabada team.

First up is Co-Founder, 0xTender, where we will be covering the project at a high level. The focus of this AMA will be the business development, vision, road map, and post-IDO plans.

In addition to Avalaunch’s questions, we will be giving the community two opportunities to ask theirs, and we will be rewarding the 10 selected questions with $25 USDT each, for a total of $250 in prizes

Date & Time

- Date: 11/01/2021

- Time: 12:00 p.m. (PST)

- Where: Avalaunch Telegram

AMA Contest Rules

To be eligible to have your question selected, you must:

✈️ Join: Avalaunch Telegram & Crabada

♻️ Retweet: Tweet & Tag 3 Friends

There will be two ways to submit questions:

- Commenting on the Twitter post announcing this AMA

- Live during the AMA

Shortly before the AMA, we will select the 5 best questions from the Twitter thread and those will be asked during the session.

During the AMA, we will open up the chat for community questions. The 5 best questions will be selected by the guest for answering.

If your Twitter or community question was chosen, you will be contacted to receive your prize.

-

How to Acquire XAVA

In order to participate in Avalaunch IDOs, you will need to acquire the XAVA token.

Step 1: Purchasing AVAX from Coinbase

Step 2: Connecting to MetaMask

Step 3: Send AVAX from Coinbase to MetaMask

Step 4: Exchange AVAX for XAVA

Step 5: Connecting MetaMask to Avalaunch