-

KuCoin and Avalaunch Partner to Help Accelerate the Avalanche Ecosystem Through Early-Stage Funding…

With the listing of our platform token (XAVA) now complete, we are excited to announce the next phase of our collaboration with KuCoin, a world-wide industry leader and premier cryptocurrency exchange. On the surface, this partnership is two forces coming together to accelerate a new technology toward more users and adoption. Looking deeper, though, we see two organizations who are willing to sidestep convention, look for promising new trends, and bet on their success.

This is a journey we are honored to take alongside one of the largest and most influential players in the industry today and believe it will help secure Avalaunch and the Avalanche platform firmly in the center of the next generation of decentralized architecture and applications.

Avalaunch & KuCoin Partner

Avalaunch, as launchpad powered by the Avalanche platform, allows new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With our values deeply rooted in the early Avalanche community, Avalaunch is able to offer teams confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem. As such, we have gained valuable visibility into what might be coming next, needs that we can help service, and relationships with builders seeking long-lasting, meaningful support.

KuCoin, as a forward-thinking exchange that supports innovation, will work closely with us to accelerate these individuals who we hope will come to represent the best and the brightest projects being built on the Avalanche platform. In addition to the listing of XAVA, the native token of the Avaluanch platform on KuCoin, this partnership will ensure that exceptional Avalanche-based teams receive strong exposure and support while working to build out foundational applications. Through a joint effort designed to offer essential liquidity to new projects during their most critical stage of development, all projects launching on Avalaunch will receive a direct line of consideration for listing on KuCoin. These projects stand to benefit from KuCoin’s first-in-class marketing services, liquidity, expertise and user base.

In addition to centralized exchange support, Kucoin and Avalaunch will also work together to offer early stage funding and incubation for promising native Avalanche projects and teams. Leveraging Avalanche’s grassroots community and KuCoin’s worldwide network, this synergy will expose millions of new users to the potential of the Avalanche platform.

As a leader in the blockchain space, KuCoin, along with Avalaunch, plan to do our part in helping guide the ecosystem into a competitive layer one blockchain.

Brick by Brick

The first step in this partnership was the integration with the Avalanche C-Chain, demonstrating that KuCoin is an early supporter of this groundbreaking platform and invested in its growth. This native integration will allow for more users to flow onto the Avalanche platform, while removing some of the friction we see moving from chain-to-chain. This integration represents KuCoin’s continued commitment in helping solidify Avalanche as one of the most secure, scalable, truly decentralized technologies the blockchain industry has seen to date.

As such, Avalaunch values the opportunity to align with such an essential ally in the path to broader adoption, and with the new C-Chain integration, sees no better time to do it. Avalaunch’s primary directive is to help grow the Avalanche application ecosystem while fostering strong, healthy communities who are interested in supporting projects long-term as they continue to advance our new decentralized world. KuCoin was early in identifying the immense potential of the Avalanche platform, betting big on its future through its integration and marketing support before many others.

Avalaunch very much respects the initiative taken by KuCoin and looks forward to working closely with them to make sure that Avalaunch projects gain a strong presence and market share in an increasingly competitive space.

About KuCoin

Launched in September 2017, KuCoin is a global cryptocurrency exchange for over 350 digital assets. It currently provides Spot trading, Margin trading, P2P fiat trading, Futures trading, Staking, and Lending to its 8 million users in 207 countries and regions around the world. In 2018, KuCoin secured $20 million in Round A funding from IDG Capital and Matrix Partners. According to CoinMarketCap, KuCoin is currently the fifth biggest crypto exchange. In 2021, Forbes named KuCoin as one of the Best Crypto Exchanges for 2021.

-

Avalaunch Joins the Yield Yak Board of Friends

The most gratifying aspect of the Avalanche community, without a doubt, is the sense of camaraderie shared by the teams currently building out what will be remembered as the ecosystem’s earliest days. This is a special moment in time for the people and users here now and an opportunity we suspect many of us will be forever grateful for. There are some amazing teams laying the foundation for what’s to come and Avalaunch considers itself privileged to watch it all come together. While impossible to succinctly characterize, this is the lifeblood of our project. Everything we will ever do is designed to strengthen and support this intangible, yet persistent force.

Right now, the resulting landscape is relatively easy to traverse. For the most part, all of the teams are known quantities and many of them even communicate regularly. However, we suspect that this will not be the case forever. There’s a unique vibration that links together the current application ecosystem, and as we see Avalanche grow, we think it’s important to preserve it as best we can.

This is one of the many reasons we are happy to be joining the Yield Yak Board of Friends. There have been few more committed to collectively driving Avalanche DeFi forward than the Yield Yak team and their expertise and guidance is something many users have already benefited from, likely without even knowing it. Even in a short amount of time, our work with the Yak team and community has been rewarding and amplified our own efforts. Both Avalaunch and Yield Yak possess a shared vision for an Avalanche ecosystem befitting of the groundbreaking technology that underpins it, and the Board of Friends is simply one mechanism to drive us all there faster.

The Board of Friends

The inclusion in the Board of Friends will be formalized by two working criteria:

- Avalaunch will be appointed as a multi-sig signer for the Yield Yak platform, informing important product and strategy decisions that will help shape the project via governance over the coming months and years. This is a responsibility the Avalaunch team takes quite seriously and it’s an honor to play even a small role in the future of this promising project.

- Avalaunch will leverage the experience and expertise of the Yield Yak team, building upon the good will already extended by the team to many within the ecosystem. We have been consistently impressed with the generosity displayed by the Yak team and are confident that any new project entering the ecosystem will benefit somehow from their technical guidance.

In addition to the above, Avalaunch will receive 0.5% of the total Yield Yak supply.

Looking Ahead

As we approach the launch of our first product, it’s difficult to not look back and reflect on where we came from. Without even being live, Avalaunch has already very much been molded by the feedback of the early Avalanche community, and in some ways, this partnership codifies the spirit of collaboration that’s guided us since day one. We very much look forward to finding out what, or who, inspires us next, and the new ways which we will undoubtedly discover to service the community more completely.

About Yield Yak

Yield Yak is an easy-to-use tool to earn more yield from DeFi farming on the Avalanche network.

Website | Twitter | Telegram | Medium | Docs

-

Introducing: The Avalaunch Farm

After announcing last week that we had allocated the first 1 million XAVA for distribution to our early community through upcoming rewards, we are pleased to finally announce the details of our first program: The Avalaunch Farm.

The farm program, and the reward programs to come, are very much in-line with the Avalaunch ethos that is baked right into the platform. That is, our active users should be rewarded, and smaller players should be provided a means to grow larger over time. Our reward programs mirror this philosophy and act as a stepping stone toward this larger vision. When the allocation staking contracts go live, our reward programs won’t just stop, but will coalesce with the broader platform, to create a dynamic system that rewards the right users at the right time. These contracts are the first piece of the puzzle and you should expect the full picture to come into focus over time.

The Avalaunch Farm, and consequently XAVA seeping out to the early and involved, represent the very first signs of life for our platform — the rumblings of new system designed to challenge our current understanding of launchpads and beyond. In many ways, Avalaunch is an ongoing experiment dedicated to homing in on a sustainable, more resilient community-driven fundraising framework. The XAVA token is the monetary charge that runs through the circuitry of the system, and this early stage of its distribution is an incredibly exciting milestone.

The Avalaunch Farm

Our farming and rewards will go live tomorrow, 5/29/2021, at 12:00 p.m. (PST).

Two pools will be available, and users will be able to stake both their Pangolin XAVA-AVAX LP tokens and/or XAVA tokens, depending on their preference.

The URL is: farm.avalaunch.app (not live until tomorrow)

The website will go live a few hours prior to rewards beginning, and you are welcome to move tokens there, but they will not receive rewards until 12:00 p.m. (PST).

These two pools will be rewarded at different rates, with the LP token pool receiving a higher rate of rewards due to the cost of securing a liquidity position and the risk of impermanence loss. For a more simple, risk-free option, we suggest participating in our XAVA single-sided staking pool, where you can stake just XAVA to earn more XAVA.

Farm Rewards Details

- Rewards Start Time: 5/29/2021 @ 12:00 p.m. (PST)

- Rewards End Time: TBD (No Set End Date)

- Total XAVA Tokens Distributed Per Day: 7,513

Pool Reward Split

- XAVA (Single-Side): 33.33%

- XAVA-AVAX LP: 66.67%

We designed the token emission to be as attractive as possible to early participants, without also being dilutive to current and future holders.

It’s important to note that these rates are subject to change over time as we are able to observe what kind of user activity the farm experiences. These changes will always be communicated publicly and with as much notice as possible.

As always, thank you so much for being a part of our early community and supporting the vision for a more equitable and enjoyable fundraising space. It means the world to us. We know everyone is anxious to learn more about the platform and we have some details coming very soon!

-

XAVA LP Farming & Single-Sided Staking Coming Soon!

XAVA Farming & Single-Side Staking to Begin Saturday, May 29, 2021.

Our full update can be found here, but we did want to take this opportunity to announce that XAVA farming and single-sided staking will begin next week. We are excited to get more XAVA tokens out into the hands of the community and we don’t think our farming program will disappoint!

One-Sided Staking

XAVA is a token with earning power — you stake XAVA and earn XAVA, which has market value and powers sale allocations. This is a risk-free way to earn without having to worry about impermanent loss. If you currently hold the XAVA token, there aren’t many good reasons not to jump in! The single-sided staking effectively allows users to grow their holdings and power-up their future allocations as we lead up to our first sale.

XAVA Farming

Incentivized rewards are critical to bootstrap liquidity, engage and attract contributors to the platform. With a vibrant and growing community, Avalaunch wants to provide supporters the opportunity to earn through as many streams as possible. As Avalanche comes to the fore, decentralized exchanges like Pangolin offer a great opportunity to interact with the network and earn XAVA along with LP fees.

A comment on staking and farming competitiveness:

We chose our earliest supporters carefully and this will always prove to be an advantage.

Though we can not offer technical assurance, we can say with confidence that the majority of these supporters will not be staking or farming, thereby increasing the community participation.

We invite you to look and see how the numbers bear out once we go live!

-

Community Update: Allocations, Distributions & Rewards

Our commitment to the Avalanche community is to always try and take the next right step. To listen, with open ears, to the feedback about our project and how we can best serve the community. While it might not always be possible, as there are many moving parts behind the scenes, we resolve to continue to mold Avalaunch into the image of the people that use it wherever possible. This isn’t for just us, it is for you, too. Yes, this is an independent project and we have our own vision for what this should be, but that vision involves always seeking the overlap between you and us, and it’s something we won’t ever lose sight of.

Platform Pillars

Large players should not be able to dominate the sales, no matter who they are. This needs to be solved at the product level, for it to be truly impactful. When someone accumulates large amounts of XAVA on the open market, they should not have unfair advantages on the platform. This is something we have been building for.

The Avalaunch platform will feature a maximum allocation for each sale, in conjunction with a sybil resistance mechanism (in this case, account verification) to prevent any one single party from gaining large shares of the total amount available. In other words, this platform is designed to be whale-proof. In addition to these safeguards, there are planned mechanics to level the playing field in-between sales, and redistribute wealth back toward smaller players. There is likely nothing else like it in the space. We are engineering an entirely new type of launchpad from the ground up, blending some of the most potent elements of DeFi, with an ethos of fair and broad.

This is a complex product, and the specification has evolved rapidly. We are not only keeping pace with current market trends, but attempting to innovate beyond them. This means that it has been challenging to release anything but fragmented specifics, as we don’t want to pull the curtains back on the big picture too soon.

That being said, the full launchpad overview will be coming very soon, and we can’t wait to share some of what we’ve been working on.

Key Takeaways:

- A maximum allocation for each sale.

- Account verification (KYC) to prevent multiple accounts or bots.

- Planned mechanics in place to reward smaller players.

- Vested tokens cannot be staked.

Incentives and Redistribution

Farming

As we begin implementing the user interface and finalize backend development, the mechanics on how incentivized rewards programs function is critical. There are numerous considerations and chief among them is the distribution of tokens into the hands of active Avalaunch users as well as additional plans to increase the visibility and utility of the XAVA token.

Incentivized liquidity pools are an excellent first step.

Our next unlock involves ecosystem tokens which is 6.4mm XAVA. This is by design and assigning tokens to bootstrap liquidity serves multiple purposes — to offer deeper support, engage the community and get users earning XAVA.

One-Sided Staking

XAVA is a token with earning power — you stake XAVA and earn XAVA, which has market value and powers sales allocations. Staking also serves to mobilize tokens and signal support for given projects. It is innate to our tokenomics and as the platform matures, it is yet another avenue through which the ecosystem tokens are dispensed.

As we move closer to Avalaunch sales, this is integral to our analytics and distribution.

Extended Vesting

While the Avalaunch platform is resilient against large holders dominating the system, there are some extra measures we’d like to take to ensure that community is at the center of the sales. The sales we host are for the future community of the projects launching on Avalaunch platform — plain and simple.

As we examined the ongoing distribution of the XAVA tokens, it became apparent that in order to optimize our offering, holistically, some additional measures needed to be taken. We will of course continue to iterate on this and course correct as needed.

To detail this information and put a clear focus on the re-weighting of the ecosystem and what it means for XAVA holders.

Effective immediately:

1. Team and advisory tokens (19% of the total supply) are prohibited from participating in sales or rewards programs.*

2. All seed tokens (14% of the total supply) will be vested for an additional six months.

3. To begin incentivizing the community, we will dedicate 1 million XAVA (a current market value of ~2mm USD) to our upcoming series of rewards programs.

*Once sold in the open market, these tokens will realize full utility.

We’d personally like to thank the seed investors and our advisors for being so flexible and willing to do whatever best serves the project. As we move forward, we are considering publishing transparency reports to illustrate how our distribution model is coming along and to demonstrate the efficacy through the increased participation of the publicly staked tokens.

Key Takeaways:

- Team & Advisory tokens are prohibited from sale participation and rewards

- All vested tokens are ineligible for sales and rewards

- Seed vesting has been extended for 6 months

- Ecosystem rewards to begin next week

- Single-sided Staking — Stake XAVA to earn XAVA

- Incentivized liquidity pools (farming)

Supply and Unlocks

Currently, 76.86% of tokens eligible for rewards and sale participation are publicly owned. As unlocks continue and tokens are claimed, we will monitor and apprise in order to ensure that all parties are fairly and equitably represented.

Potential Circulating supply: 10.8m*

*On Coingecko, our API shows the current circulating supply. Tokens residing in the vesting contracts are considered locked until claimed hence the word “potential.”

At the time of this writing, there are 6.7m XAVA in circulation. To work with this dynamic figure before moving to the potential amount, here is the distribution as of today:

- 5.15m tokens from initial liquidity and the sale airdrop

- 1.55m tokens claimed from seed and private round distribution

Again, 76.86% of XAVA are publicly held while 23.14% come from seed and private round distributions. We expect this gap to close, although not entirely, as we always represented to our supporters that Avalaunch is a long-term hold. We encouraged them to “set and forget” their contributions and reiterated this point upon launch. We anticipate that any number of tokens will remain dormant for some time. Nonetheless, to look ahead and consider a fully claimed environment:

- 4.8m released from seed and private rounds

- 6m provided for liquidity and first distribution of public airdrop

This represents a more even split where 55.5% would be publicly held and 44.5% from pre-sale distributions. As we eye our first sale in June, we will continue to track this number.

Unlocks

The next unlock is from Ecosystem totaling 6.4M XAVA. This was done by design as these tokens are earmarked entirely for expansion of the XAVA offering and will be seeded strategically. These are allocated to anything that helps our users and supporters — from exchange listings to incentivized rewards programs to community airdrops, etc. This will be instrumental in the distribution of sale weight within our ecosystem.

As the ecosystem supply is released, a notable shift in earning power ensues. Further consider that ecosystem tokens are able to be earned by supporting our initiative. By disqualifying these tokens, the earning power of XAVA increases appreciably.

Stated earlier, ecosystem rewards make up a full 32% of the total supply and are earmarked for those that participate and support XAVA and the greater Avalanche ecosystem — staking, farming, incentives, rewards, contests, exchange liquidity, delegators, validators etc. Essentially, initiatives that increase the distribution and visibility of the XAVA token. Thus far, we have committed 2% of the supply to validators and delegators of Avalanche. It is significant and naturally, a fair amount of these tokens will be earned via liquidity provisions and any incentivized programs we may offer.

The equity increase given to active participants creates a supply that rewards more loyal users and is bolstered by the fact that these tokens are rewarded/earned but not purchased. In addition to allocations, users who interact with XAVA by staking and/or incentive programs can effectively lower the adjusted cost basis of their token purchases.

Key Takeaways:

- Currently, allocations and rewards are heavily weighted in favor of the community (76.86%). This, combined with maximum allocations for each sale, should ensure fair participation.

- We expect this gap to close as tokens are claimed

- Ecosystem (6.4m unlocking May 28th) to jump-start rewards/incentives

On Our Pangolin Listing

After our listing on Pangolin saw unprecedented demand, there was, understandably, some frustration around bot activity that took place in the first minutes of the sale. While extremely frustrating, this is also, unfortunately, extremely common.

Ironically enough, this is a big part of why Avaluanch is here in the first place. To create a better experience for teams and communities so they can focus on what matters: building their product. Projects shouldn’t have to navigate the endless maze of constantly-evolving threats simply to get their token into the hands of the community. It’s a severe distraction at best and many teams simply don’t have the resources to manage it successfully at what is often the earliest stages of their evolution. Having now been through this ourselves, we believe our experience in this area provides a unique motivation to carve a different path.

When it comes to a decentralized application like Pangolin and bots specifically, one of the developers working on Pangolin summarizes his thoughts on the issue in this thread:

Should we ban bots on Pangolin?

After the XAVA token sale, community members have had enough of bots pushing out human traders. Many have suggested we add a captcha to our website and only allow real people to take part.

Here's why that won't work.

— Connor Daly 🐈(4x)🔺 (@das_connor) May 15, 2021

In summary, most “solutions” to the problems present an entirely new set of problems, so they aren’t really solutions at all. Additionally, if you value the decentralized principles Pangolin is built on, you really wouldn’t want them to work, anyway. Ultimately, it’s a nuanced discussion that traverses very subjective topics mired in semantics. Rather than circle the drain on this forever, we are going to turn our attention back toward building what we feel is a product better suited for launches. Avalanche desperately needs a launch-specific platform more resilient to bots and whales, and that’s what we intend to deliver.

Vesting Contract Parameter

One last point of transparency is regarding our token vesting contract for seed investors specifically, and an incorrect parameter that was discovered after the contract’s deployment.

The contract address is: 0xB53E0fa6898C97A477F9c05733bdc10B78e10d6A

Our developer mistakenly set that time between vesting portions to 1 minute, (60 seconds) instead of 1 week (604800 seconds). The incorrect parameter was used for testing the contract and was unintentionally left in place.

This resulted in an accelerated vesting schedule, causing the tokens to be fully unlocked by Monday, June 14, 2021 at 00:35:00 GMT+0000.

All seed investors, who contractually bound to the vesting terms have been notified of the issue, and will immediately move their unlocked tokens to a new vesting contract with the correct vesting schedule on June 14, 2021.

Furthermore, the updated vesting schedule will include the extended 6-month lock-up.

The wallets affected are:

0xe90950A1B7Ad930d2dfBb3A4cDFD54669dE06B3e

0x2821E2DEcE4150649096644686baac3A73607f46

0x5e08bf95DcDd45B17963DbB7F9271Bb4a8A49194

0xf019675Ce68fe13089EeA5DABDC743c1a1155C0e

0x1D893D40d13254F86becC73ba3f15cA21e9F1A76

0x7B17a951B040644318AD2FFF3F47C9348fF854Cd

0x3A9103378E96CD9179c5fD226044d1e2936d7A59

0x205ecb4dbEf2eC61D6F1B92c4276Cdd7929F503d

0x99D1d7890bfC58Df34eaCA892dFde98Fa6118c44

0x8233484c7648f59086CeEA05f0A8D6a976CdAa75

0xa97e743fC09861a4AB3b38cB7a8F64BDF24EbeaC

0x6167FF49E5F873a5Aeae485dbc1B6f03d8F82bFC

0x773a1FD0f9D8048B0fd24e234feD69495C0fa15b

0x737dE5e58835A7CEfBE3de73f443c885cD245BCb

0x54b5f900014Ed1B842cDb79672b732A21f134fa8

0xe1bAf2857197C89CF7E2738E90beFe2FbB838Ce7

Wrapping Up

As we move into the next few weeks, we are excited to start introducing some utility to the XAVA token and offering ways to start earning it, allowing for larger allocations in Avalaunch sales. Look out next week for a full platform overview and more details about how the platform works!

-

Pangolin Listing & Private Sale Distribution

The Avalaunch team is excited to formally announce the details of our Pangolin listing and provide more information about the distribution of the community portion of our private sale.

The response and encouragement we have received from the Avalanche community, as well as from people outside of our direct ecosystem, has been staggering. There is an organic groundswell of far-reaching support for what the platform offers, and more people than ever are excited about Avalanche. The future is bright, indeed.

To be candid, having worked on this product we believed in for so long, the validation has been extremely gratifying — but that’s far from the complete picture. There is, without a doubt, something happening around here that is much bigger than Avalaunch.

The last two months have been incredibly transformative for our application and team, and a reminder of how a vibrant community can shape, augment and improve a very personal vision. This intangible interplay between a project, and the people that rally around it, is exactly why we are so excited about Avalanche. This “special sauce” benefits not only us, but also the projects that will be coming through Avalaunch. We look forward to seeing how you all impact those, too.

For your constant feedback, interest and passion, we simply cannot thank you enough.

Pangolin Listing

We will be opening our XAVA/AVAX pair on Friday, 5/14/2021, at 12:00 a.m. UTC on Pangolin. Please take the time to double check your local timezone against the listing time here.

As part of our rollout plan, Avalaunch will supply $180,000 of liquidity, at the private sale price of $.035.

The XAVA token address is: 0xd1c3f94DE7e5B45fa4eDBBA472491a9f4B166FC4

We will announce the listing immediately after the pool is created and post the link on our Twitter and in our Telegram. We would recommend staying away from anything other than links posted from our official channels.

Avalanche Tutorials

If you haven’t already, please play around with Pangolin prior to listing, get a feel for how it works, and maybe even make a swap. If you don’t have funds available on Avalanche yet, please see this video, which covers getting Your AVAX tokens from Binance into your MetaMask wallet. The same process would apply to any exchange that lists AVAX. This transfer requires an Avalanche web wallet. If you don’t have one yet, please see this video.

For any specific questions, please feel free to join us in our Telegram community and get answers there.

Private Sale Distribution/Redepmtion

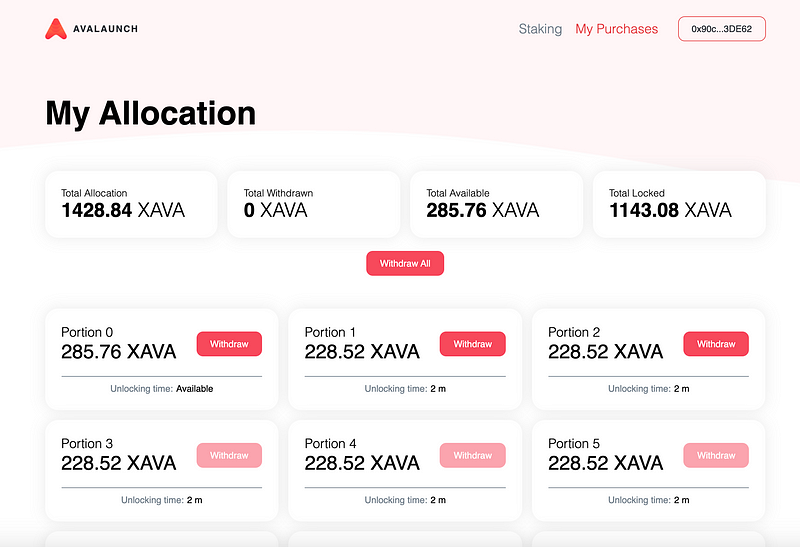

For those of you that received a private sale allocation email, and successfully completed the form in time, we will be launching a dashboard for you to claim your allocation shortly after listing. All you need to do is connect with the C-chain wallet (via MetaMask) that you submitted through the “winners” form and your allocation will be displayed. From there, the unlocked portion will be available for claiming. To connect you Avalance web wallet to MetaMask, please see this video.

Redemption Dasboard A few reminders:

- You do not need to pay for this allocation. This was gifted to you, as a thank you for your support.

- These will not be airdropped tokens. You need to come claim them, just as any private sale investor would.

- These tokens vest against the private sale schedule. Only 20% of your $50 allocation will be available initially. Please refer to our Tokenomics for full vesting details.

- There is no time limit to claim this allocation. You can claim your allocation whenever you’d like (provided it has unlocked), and the dashboard will be available to you forever.

- The URL to the dashboard will be shared shortly after listing.

Again, thank you everyone for your love and support. It has been nothing short of inspiring. Everyday we are reminded why we are here, and why we decided to go “all in” on supporting Avalanche growth in every way that possibly we can.

Over the next week, we will have some product updates coming and a few surprises along the way, so please keep your eyes peeled. And thanks to the amazing Kuen Shahi for her excellent tutorial videos.

-

Private Sale Distribution & XAVA Airdrop

As we watched the Avalaunch community grow over the last few weeks, two things became clear. The first being that the extraordinary potential of this new technology is resonating, deeply, amongst individuals concerned with a truly scalable and decentralized network. While we certainly could have told you this prior, we achieved a stronger appreciation for just how unique, and quite frankly rare, this community is.

You could argue that the cryptosphere, over time, has strayed from its ideals. Real decentralization somehow matters less than it once did, and the centralized end of the spectrum is bloated. Avalanche, we feel, represents a meaningful return to those principles.

The second point worth mentioning is that when it comes to user interest, the Avalanche community is alive and well in this regard, too. There is simply no shortage of individuals who are anxious to be a part of it, and want to contribute with their time, money and passion to its continued growth. As a result of this enthusiasm, the response to the public portion of our private sale inquiry was overwhelming, and simply stated, we severely underestimated the potential demand.

The unanticipated response presented a few hurdles, but we believe we have found a workable solution. However, before moving forward, let’s take a minute to look back.

The Avalaunch Fundraise

By crypto standards, the entire raise for Avalaunch, from seed to private, is small — less than a million dollars total ($944,625, to be exact). The vast majority of this was filled by friends, family, close community members and a few others who have helped immensely along the way. There was zero VC or institutional involvement at any point. This statement is not pejorative. We simply had the privilege of being surrounded by people that believed in what we were doing and were happy to help. This approach may be somewhat unorthodox, but it does offer us a finer degree of control as we navigate through the earliest days. This distinct advantage, we believe, also extends to future XAVA token holders.

When it comes to our overall launch strategy, our thinking is simple: take in a responsible amount of capital from people we know personally, execute like our lives depend on it, and list directly on Pangolin, with liquidity ($175,000.00, or 5% of the total supply) provided at our private sale price. No hectic IDO, whitelists or confusing sale mechanics. Additionally, with no suitable launchpad platforms already available on Avalanche, this feels like a somewhat obvious choice.

All in all, pretty straight forward.

Our Public, Private Round

With all that being said, we did allocate 10% ($66,412.50) of the private sale for the community we knew was still to come — our future supporters who simply hadn’t had the chance to support us yet. While a public portion of the private round is, in our experience, unconventional, this was an attempt to be inclusive of our, at the time, very small community.

For context, this public allocation of our private sale represents 36% of our initial market cap of $181,913.

The Winners, at Random

The form for our public private round had 4,902 submissions, far outpacing our original estimates. When looking at the amount available, and the number of individuals willing to contribute, the math immediately becomes problematic. There’s simply no good way to slice it and end up with a distribution that even remotely resembles fair.

So instead of deciding who is in, and who is out, we are just going to give it away, and distribute it evenly to as many people as possible. We won’t be taking any money for it. More specifically, we will be giving out 1,328 allocations, of $50 each, at the private sale price of $.035. The recipients have been chosen randomly from the private sale response form. Like all other private sale contributions, these allocations will be vested according to the private sale schedule, and distributed after our Pangolin listing.

From where we sit, this is the fairest approach, while also allowing the most amount of people to participate. It’s very hard to be preferential with 1,300+ allocations, and we plan to see a very broad distribution as a result. Instead of a public sale or similar where a very limited number of individuals end up gaining access, what we have here is over a thousand community members participating in our private round, with no financial obligation.

To be clear, we are giving this money away, and are asking for nothing in return outside of your continued support and enthusiasm.

How & When?

If your entry was selected, you will receive an email from hello@avalaunch.app, tomorrow, 5/4/2021, at approximately 9:00 a.m. (PST), with a link to a private submission form. We will announce through our social channels when these emails have been sent out. Through this form, you will confirm your email, and your C-Chain address for the XAVA token distribution. This email must be the same email you provided in your private sale application. No exceptions. Any email submitted which is not on our list of selected recipients will be discarded. If for some reason you need to use a different email, you will unfortunately become ineligible.

Once the emails go out, recipients will have 48 hours to reply to the form with the information needed for distribution. After the 48-hour period, the form will close, and any unclaimed allocations will be added to the initial Pangolin liquidity when XAVA is listed there.

XAVA Validator & Delegator Airdrop

Avalaunch also appreciates the valuable service that the validators provide in securing the network. Let’s face it, if it weren’t for them, Avalaunch wouldn’t be possible. This is the rationale behind our guaranteed allocation for validators in our sales, and also why we have decided to perform a XAVA airdrop to all Avalanche validators and delegators. The total airdrop will be 2,000,000 XAVA tokens which constitutes 2% of the total supply. The airdropped XAVA will come from our Ecosystem allocation, which is 30% of our total supply, and will be used to incentivize and reward token holders and the Avalanche community in the coming months and years.

Airdrop Details

The team at Baguette Exchange has established the gold standard in this type of distribution, successfully executing a similar snapshot and airdrop this month. They were gracious enough to share their process and code with us, and we plan to utilize it, while adjusting it slightly for our specific purposes.

The details are as follows:

- Snapshot Date & Time: 5/3/2021–12:00 p.m. (PST)

- Eligibility: Avalanche network validators and delegators

- Total Distribution: 2,000,000 XAVA (2% of the total supply)

- Weighting: The tokens will be evenly distributed amongst all eligible addresses

- Vesting: The airdrop will be vested for 1 year, at which point there will be a daily distribution, occurring over the course of 12 months.

What’s Next for Avalaunch?

As a team, we are looking forward to completing this phase of our rollout and moving toward our own launch. Helping the application ecosystem on Avalanche grow stronger is our primary focus, and until we are live, it will be impossible to fully execute on that vision.

In the coming days and weeks we will have some announcements about our Pangolin listing, as well as more detailed posts about how Avalaunch actually works, and how we think we are different. We have thought long and hard about how Avalaunch can best serve Avalanche, and as we move closer to our first sale, we can not wait to tell you all about it.

As a project, Avalaunch is here for the long-haul. What we are today is only a fraction of what we will become. In the grand scheme, our launchpad is a big first step, but far from the last one. We will always be here to grow alongside Avalanche as it inevitably evolves and matures.

To the future!

-

Community Update: Pangolin and the Path Forward

Avalaunch is a community-oriented project with one primary directive: help foster and grow the Avalanche ecosystem. While there are a number of complex considerations contained within this seemingly simple mission, at the end of the day, this is what we set out to do, and what orients our vision and direction day-to-day.

To this end, we are excited to announce that Avalaunch will be launching all of our smart contracts on the Avalanche C-Chain, and our token listing and liquidity provision will occur exclusively on the Pangolin AMM. The exact listing date will be announced soon.

After receiving feedback from the community about a few potential launch strategies (namely a dual listing on both Pangolin or Uniswap, or just Uniswap), it became clear that Avalanche exclusivity was not only the strongest path forward, but also the one most in alignment with the values of the project — especially as it relates to our growing future user base. We are strong believers in the immense potential of the Avalanche platform, and existing alongside the expanding list of applications built on the C-Chain is something we are very excited about. We received an incredible amount of support and guidance from the broader Avalanche community on this topic, which only helped reinforce what we already knew: we are building for a passionate, principled group of people eager to help develop something both special and important.

This really is a very unique moment in time, and a rare opportunity for everyone involved. Without our community, there really is no point in Avalaunch. We will always remain open to the input of our users and adjust course accordingly.

From Ethereum to Avalanche

One question that naturally presents itself is, “Why was Uniswap ever considered at all?” For an Avalanche launchpad, launching on Avalanche and listing on Pangolin seems like the obvious choice? Well, long story short, it is. However, our original thinking on the topic is worth highlighting. To summarize, the decision to explore an Ethereum AMM was a downstream result of other architecture choices, rather than a fundamental desire to list there first.

Originally, our Avalaunch sales were going to take place via an Ethereum-based smart contract, the results of which would be signed, sent to Avalanche, and the redemption of native assets would take place on the C-Chain — all from within the Avalaunch application. The intention was to leverage the user activity, liquidity, and familiarity that currently exists within Ethereum, and our application could act as a pseudo-bridge between the two ecosystems. We felt this set-up could help smooth the transition from Ethereum to Avalanche by going to the user, instead of asking the user to come to us. Everyone wins.

While we still think the logic is sound, it did present a few issues, mainly around the XAVA token. The Avalaunch sale allocations are determined by users staking the platform token in our smart contracts, and when these contracts lived on Ethereum, it fragmented the distribution of XAVA in ways that were difficult to manage across both chains. Considerations around the right bridge to use (including one we considered building), being linked to that particular bridge’s representation of the asset on Avalanche, split liquidity, and even a potentially segmented token supply simply became too onerous.

Additionally, it stirred some debate about which trade-offs were best for Avalanche, or if any tradeoff was appropriate at all. These are important conversations, and ones we hope to continue having, but for now, considering that Avalanche as a platform is more than capable of handling our needs, we are best served there. Whatever challenges around users and liquidity we might encounter will be short-lived, if we encounter them at all.

The simplicity of returning to Avalanche represented a solution to all our problems and more. Equally as important, it offers us a clarity of purpose that will aid in guiding our future decision making process as we move into listing, launch and beyond.

Looking Ahead

As an Avalanche native application, we look forward to supporting other builders and teams committed to developing the ecosystem and community. We are currently in the final phases of development, with our smart contracts being prepared for audit. We are aiming for a launch in early to mid-May, with a listing of the XAVA token on Pangolin a few weeks prior. Before a single sale takes place on Avalaunch, the audit will be publicly available, in addition to our code. This level of transparency is important to us.

We have received a lot of interest from teams looking to launch through the platform and have begun conversations with some very strong projects who we are certain will add value to the Avalanche platform. It goes without saying that we believe deeply in this technology and what it will offer the space going forward. We can’t wait to find out what Avalanche looks like in a year, two years, or ten years. When we reach that future, what we will see when we look back is anyone’s guess, but what we do know, for sure, is that we haven’t even begun to glimpse it.

-

$XAVA: Token Supply, Distribution & Listing

For a cursory introduction to Avalaunch, please have a look here or feel free to visit our website. For the TL;DR version, please scroll to the bottom.

UPDATE — 4/14/2021: Since the publishing of this article, Avalaunch has decided on a Pangolin exclusive listing and our contracts will be deployed to the Avalanche C-Chain. Please see here for more information.

Introduction

Avalaunch has set out to raise the bar in fundraising. In spirit, we are wholly supportive of decentralized crowdfunding and subscribe to the ethos of inclusiveness. We believe that IDOs, whilst revolutionary, leave much to be desired. Avalaunch’s aim is to rectify identified inefficiencies while remaining a work-in-progress — continually improving and refining our offerings and technology.

Tokenomics

Despite the fact that XAVA has a relatively straightforward, if not traditional supply and distribution, there were considerations:

The Avalaunch Token, $XAVA

- Apportioning the correct number of tokens for our forthcoming proprietary staking mechanism

- Anticipating market demand

- Sustaining market demand

- The date and rate at which tokens may migrate from exchanges to our platform

- Additional token utilities

- Eventual transition to governance contracts

- Ratio of liquidity to circulating supply to buyback capability

- Industry — comparables, projected CAGR, penetration, scalability

- How to incentivize seed, strategic investors, and respect retail buyers

While this abbreviated list offers a glimpse into our process, we are aware that ultimately, market forces will exert themselves and play a factor.

Initial Listing

As a launchpad, we have decided against the IDO route. While we consider our fellow launchpads to be essential agents of growth for the ecosystem and believe there will be future opportunity for collaboration, Avalaunch feels best served by an initial launch on Pangolin. The current backlog of projects, bottleneck of demand coupled with our desire to remain nonpartisan were contributors, but we believe this approach is also the fairest as it allows for a healthier allocation of tokens for the public.

Avalaunch Metrics

Supply

- Total Supply: 100,000,000

Distribution

- Token Sale: 33M

- Ecosystem: 32M

- Foundation: 21M

- Advisors/Partners: 9M

- Liquidity: 5M

Sale Metrics

Seed Round

Approximately fourteen percent of the supply was dedicated to our earliest supporters who provided seed capital and a willingness to stake their reputation in order for us to forge important alliances. We consider this an extended team and all of them remain involved and are continuously helping us drive the project forward.

- Seed Round: 14.025M tokens @ $0.02

Private Round

Slightly larger allocation of XAVA was dedicated to the private rounds. Given current conditions, this was not an easy decision. The rationale came down to what will, in the long run, most benefit supporters of our project. To be candid, a larger public round would have been our preferred but not our best route. The space is still nascent and the presence of value-add investors will best ensure our future.

- Private Round: 18.975M tokens @ $0.035

Total Hard Cap

$944,625 USD

Day One

- Initial Circulating Supply: 5.1975M

- Initial Market Cap: $181,913 USD

Liquidity

Avalaunch will provide 5% of the total token supply in liquidity at an opening price of .035 on Pangolin— the same as our private round.

Vesting

Foundation: 6 month cliff, 8.33% released monthly for 12 months

Ecosystem: 2 week cliff, then 20% released monthly for 5 months

Advisory: 6 month cliff, 8.33% released monthly for 12 months

Liquidity Provision: 100% locked for 12 months

Seed: 10%, then a weekly release for 5 months starting 12 months after TGE

Private: 20%, then a weekly release for 5 months starting 1 month after TGE

Conclusion

We look forward to our launch and very much appreciate the interest and support we’ve been shown to date. We understand that there are crypto enthusiasts who appreciate very abbreviated versions of articles. So, with you all in mind:

TL;DR

- Our supply and distribution schedule is anything but arbitrary and weighed myriad factors

- No IDO — Rather, we will launch on Pangolin at a date TBD

- Total Hard Cap: $944,625 USD

- Initial Market Cap: $181,913 USD

-

Introducing Avalaunch

Avalaunch seeks to be the first protocol, built exclusively for the Avalanche ecosystem, to offer promising and innovative projects a fast, secure and efficient platform for fundraising in a decentralized and permissionless fashion.

The Problem

Initial Decentralized Exchange Offerings (IDOs) saw great interest from inception during the DeFi boom of Q2, mirroring the ICO mania of 2017. While the hyper-speculative ICO phenomena was followed by a commensurate crash and burn, the IDO has risen once more. Largely gone are the costly entries to the centralized parties; replaced by a permissionless issuance with low barriers to entry. Projects arrive more mature, hard caps are in the stratosphere and though token generating events are trending, emergent market like DeFi are here to stay. Still, IDOs are not void of challenges nor impervious to problems.

The current IDO model is broken and is stifling true innovation. We’d like to fix that.

- Front-running new listings which creates gas wars and the same whale games IDOs were meant to subvert.

- Confusing exchange mechanics which isolate newer participants.

- Extremely volatile price action leaving most investors at a disadvantage.

- Users can have negative experiences and are less likely to return which: Discourages new listings, robbing the space of future potential.

There are additional difficulties including, but not limited to: prohibitively expensive gas fees, automated market makers dictating price, gamified distributions and incomplete fundamentals. Morever, despite future promises, IDOs are currently restricted to the Ethereum network, placing a relative stranglehold on innovation.

The Avalaunch Solution

Though complex and far-reaching as the aforementioned problems are, the remedy to what ails fundraising is quite simple. Avalaunch will endeavor to offer the following functionalities:

- Low volatility

- Secure applications

- Faster Finality

- Intuitive design

- Less expensive transactions with higher throughputs

- The ability to move assets between blockchains

While the solution is actually quite elegant on paper, it has been hamstrung by the available technology, until Avalanche.

Avalaunch is a decentralized protocol which will offer token pools and auctions, allowing teams to raise funds for their projects in a permissionless and interoperable environment using the Avalanche Blockchain.

We will allow the creation and ownership of swap pools, based on both and stable and fluid token prices. Our “Stable Pools” offer projects several advantages over the current models like:

- Stable price

- Predictable outcomes

- More informed investors

- Secure and compliant

- Fair distribution of tokens

- Positive community sentiment

- Beyond tokens sales — OTC, auctions, whitelist sales

Conclusion

Ultimately, secure, fast, transparent fundraising, empowering the right teams, will help drive the space forward. Avalaunch is an investor-centric platform that supports, not confuses, participants by offering an environment in which everyone wins. Our culture is built around fostering innovation and talented teams, which brings real value through useful applications and forward-thinking development. Welcome to the future of fundraising.