-

GoGoPool AMA #1 — Project Overview (Recap)

On 4/19/2023 at 2:00 p.m. (PST), an AMA session was held in the Avalaunch Telegram Group with GoGoPool co-founders, Steven Gates and Johnny Gault, to cover the project at a high level. The focus of this AMA is business development, vision, road map, and post-IDO plans.

Below we present to you an excerpt from AMA with questions and answers.

Dave | Avalaunch

Hello and welcome everyone to an AMA with GoGoPool. Today we have founder and CEO extraordinaire @ggp_steven ready to talk subnet, scalability and how his project is ready to take Avalanche to the next level.

How are you doing Steve?

Steve is in dispose and will be here shortly.

Steven Gates | GoGoPool

HELLO!!!!!

Dave | Avalaunch

How are you?, Ready to dive in?

Steven Gates | GoGoPool

Yessssssssssssssssss

Dave | Avalaunch

Where do you want to get started? Perhaps give us a brief intro on yourself.

Steven Gates | GoGoPool

Sure thing !

I’m Steven — cofounder of GoGoPool. Our mission is to help builders bring blockchain technology to the world, by making Subnets easy!

I have been an entrepreneur since University; my cofounder Johnny started programming on the VIC-20. Both of us have operated multiple startups in the past, and have always been interested in crypto. Johnny was probably the first 3000 readers of the BTC whitepaper!

We met before the AVAX Summit 1 last year, and swapped ideas on how we thought the ecosystem could grow.

Then, we met up at the Summit — and the rest is history! On the last day of the Summit, I showed him my prototypes, he showed me his, and that’s when we decided to start GoGoPool together in order to help builders bring blockchain to the world through Subnets.

Dave | Avalaunch

Excellent. Thanks. Can you give us the quick description of GoGoPool for our community?

Steven Gates | GoGoPool

Sure — —

GoGoPool is a decentralized and permissionless staking protocol built for Avalanche Subnets, allowing validators to launch for 1000 AVAX via the GGP tokens and liquid staking.

Basically, we make Subnets easy.

Dave | Avalaunch

Good stuff. Let’s get right into it — Can you please share the tokenomics of $GGP? When is the token launch scheduled?

Steven Gates | GoGoPool

The token launch is currently scheduled for April 28th, and registration for the IDO is opening on April 17th. Follow our Twitter @GoGoPool_ to keep updated!

The proceeds of this public sale is going towards providing liquidity for the protocol, in order to help it grow in its early stages, and also to bootstrap the initial GoGoPool Foundation so that we can provide grants and governance opportunities to the Avalanche community.

To support sane price discovery, the only day 1 circulating tokens, excluding liquidity, will belong to public sale participants.

Check out the Avalaunch page to read more.

Dave | Avalaunch

Can you tell us about the tokenomics?

Steven Gates | GoGoPool

Validator node operators use $GGP to launch new Avalanche validator nodes for cheaper. A node operator stakes 1000 AVAX and 10% of that in GGP tokens, and gets matched with 1000 AVAX from liquid stakers and launches a new validator node.

Because the operator is staking AVAX and GGP, they earn AVAX and GGP rewards from the protocol (on top of the normal validator rewards they earn). The more GGP you have staked, the more AVAX is staked onto it, and the more AVAX and GGP rewards you earn.

Dave | Avalaunch

What are the details for the $GGP token launch?

Steven Gates | GoGoPool

Do you mean the schedule?

Registration opened yesterday — and are open for a few more days!

Dave | Avalaunch

It closes on the 23rd and I know you have an additional round with validators at a higher price than the IDO — how is that going?

Steven Gates | GoGoPool

It’s going well! Partners are very excited, we will be deciding the final composition soon. The round is oversubscribed, so it’s really about choosing the right partners. Subnets are a diamond hands play, very different than what the ecosystem is used to right now!

Dave | Avalaunch

That’s great to hear. Well done. Validators are some diamond handed folks. Can you say more on the launch in terms of liquidity — I think projects strongly overlook the importance of this. It’s one thing to release a token but ideally the market should be a tradable one.

Steven Gates | GoGoPool

Sure — the intent of the public sale is to create deep liquidity on day 1. The plan is to have 500k of liquidity on Trader Joe live moments at TGE, which we think is a strong foundation to build the protocol off of and make it decentralized + permissionless.

Dave | Avalaunch

Agreed. Thanks for this. Wish more projects paid attention.

What do you think are the benefits of Avalanche subnets? Any areas for improvement?

Steven Gates | GoGoPool

Web3 is currently built for thousands of users, not millions. The first generation of blockchains (Ethereum etc) are not built to handle millions of users, and custom blockchains are required for scale.

Subnets are the best way to create a custom blockchain. They allow any developer to launch their custom blockchain for any usecase in a scalable, fast and cheap way. Web3 games especially find Subnets extremely valuable, as they allow their games to run fast and cheap for their users. Large financial institutions see it as a way to upgrade their current software systems (which was built in the early 2000’s).

Games are bringing the users, and institutions are bringing the dollars. Subnets are the only infrastructure they can use if they want to scale their blockchain to handle millions of users.

A big improvement will be permissionless Subnets — once you can stake a Subnet’s token and become a validator node, any builder will be able to bootstrap their Subnet using GoGoPool and immediately start working with the Avalanche Community.

Dave | Avalaunch

How do ordinary users and node operators benefit from GoGoPool?

Steven Gates | GoGoPool

Node Operators benefit from GoGoPool by being able to launch new validator nodes for only 1000 AVAX, while earning much more rewards than they normally would when running it solo.

Ordinary users benefit by being able to use ggAVAX liquid staking and earn more yield from any AVAX that they currently hold. In the future, I expect that ordinary users will even more yield by using the ggAVAX token to support Subnets, and move liquidity to the Subnet.

Dave | Avalaunch

Let’s talk about competitors or similar product — How is GoGoPool different from Lido or any liquid staking product?

Steven Gates | GoGoPool

Sure!

Up until now, people have been thinking about liquid staking only as a DeFi tool.

The current liquid staking products are no different — they are fine protocols, but really cater to the DeFi power user.

We think liquid staking will be much more important than just DeFi — we see liquid staking as an important layer for infrastructure, and as a way for Subnets to start going permissionless.

If you want to help builders bring blockchain to the world with Subnets, use ggAVAX — every AVAX staked goes directly towards helping a new validator launch, which helps Subnets launch faster.

Dave | Avalaunch

Sounds really good- that kind of support and increased inclusion is essential. Tell us about your next steps, partnerships, and exciting features you plan to add in the future.

Steven Gates | GoGoPool

At launch, our requirement for a node is 1000 AVAX so that we can make sure the protocol is operating safely and securely. I expect that requirement to change pretty quickly, depending on community feedback

In parallel, we are focused on helping Subnets launch faster via developer tooling. Stay tuned for more announcements on this.

As for partnerships, stay tuned for the Avalanche Summit!! Will be having some great announcements 🙂

Dave | Avalaunch

Nice caps usage on the DONE. Makes it very clear. Thank you. What difference do you expect GoGoPool to make to the Avalanche ecosystem?

Steven Gates | GoGoPool

I expect us to increase the decentralization and security of the Avalanche ecosystem greatly. Our goal is to increase the number of validator nodes, and ultimately support new Subnets that launch. We want to create the Subnet Economy, and have it be accessible to the ordinary person. Launching this staking protocol is the first step.

Dave | Avalaunch

Before we move on to the community questions, let’s do one more. Right now I’m just blown away with your caps usage on DONE and just taking it in. It’s great. So…

Avalanche is big business in every way while GGP seems grassroots and accessible to players, large and small. Do you think there are gaps that a project like GoGoPool can fill or is there some ideal target for your business?

Steven Gates | GoGoPool

Helping builders launch Subnets faster is a tough problem, and requires many different skills and capabilities. We think that a diverse ecosystem is a good ecosystem, so that the community can help both big and small projects. One thing we know for sure: all builders are interested in Subnets, and they are looking for partners. It’s up to us to help!

Dave | Avalaunch

The increased accessibility to early entrants that may not be large enterprises is important and I’m glad you’re here for that.

Steven Gates | GoGoPool

A B S O L U T E L Y

COMMUNITY QUESTIONS

Dave | Avalaunch

Now the community portion of the program…First up comes from the truly irreverent @Capcosmos who asks — How does GoGoPool compare to other staking protocols that have emerged in the Avalanche ecosystem?

Steven Gates | GoGoPool

Ok!!!!!!! I’ve thought a lot about this, and it’s an important question

GoGoPool differentiates in several ways:

Focus on Subnets; Our mission is to help builders bring blockchain to the world through Avalanche Subnets, making it easy for developers to launch and scale their custom blockchains. Other staking protocols focus more on DeFi or general-purpose staking.

Creating a community of node operators: Node operators launch new validators for only 1000 AVAX, and has multiple rewards. This incentives operators to join the protocol, and start coordinating towards helping Subnets launch faster.

Different rewards: Validators on GoGoPool earn rewards in three ways — AVAX staking rewards, a node operator commission, and monthly GGP rewards.

Unlike Lido and Benqi, which are DeFi-focused, GoGoPool sees liquid staking as an essential layer for infrastructure and a way for Subnets to become permissionless.

Dave | Avalaunch

Next up comes from our very own @sunsun77 Could you explain how the minipools in GoGoPool work and how they are matched from the ggAVAX deposit pool to launch as full AVAX validator nodes?

Steven Gates | GoGoPool

Yesss!

When liquid stakers swap AVAX for ggAVAX, the AVAX is held in a smart contract deposit pool.

Node operators bring their own hardware and stake 1000 AVAX and 100 AVAX worth of GGP tokens to register into a minipool queue. Minipools wait to get matched from funds from the deposit pool.

Once funds are matched to the minipool via the deposit pool, the minipool is launched as a full Avalanche validator node.

We have an autocompounder feature which cycles these minipools every 2 weeks, to maximize rewards.

Dave | Avalaunch

Now we have @Algojali a grizzled veteran of the ecosystem who wants to know the following: What specific open-source tooling and services does the GoGoPool DAO plan to provide to Subnet teams to help them design, build, and manage their Subnets more easily and efficiently?

Steven Gates | GoGoPool

Here is the first tool!

https://github.com/multisig-labs/GoGoTools

It is a way for a Subnet-EVM developer to develop and test out their precompiles extremely quickly, with minimal setup.

We’ll also have a big announcement at the Avalanche Summit that we’ll be sharing about our next bit of tooling 🙂

Dave | Avalaunch

Next up — @AshishPathakn — What are your own plans for building a Subnet and how important do you think that would be for GoGoPool?

Steven Gates | GoGoPool

I think an underexplored area on Avalanche is the idea of “Utility Subnets”. These are Subnets that are smaller, maybe have a custom VM, and are tightly focused on providing a function or feature to Subnets. An example of this is an Oracle Subnet — it can provide a Subnet-native version of Chainlink, as right now Subnets can’t use Chainlink feeds.

We are very interested in exploring Utility Subnets — stay tuned for more announcements. If you have an idea, DM me !! Looking for partners to collab with on this.

Dave | Avalaunch

Last one is always a softball so here goes — @Heylay3 — What is the story behind the name GoGoPool and how long did it take you to come up with it?

Steven Gates | GoGoPool

Haha this is a funny question .. When starting new projects, I always end up spending a ton of time trying to think of the name.

Like, for several days — it is all I can think about. It got to the point where I would set up codenames, first — and they would always start with “GoGo”. For several years I named my projects “GoGo…X”!

So with GoGoPool, I was already working on the original prototypes and investors were scheduling calls with me to learn more.

I was still using the codename everywhere, so I decided to go with it and started explaining the concept as “GoGoPool”. The name stuck!

Dave | Avalaunch

Alright. I ask this question all the time and that is best origin story I’ve heard to date. Well done!

Steven Gates | GoGoPool

Wow really?

Dave | Avalaunch

I’d say so.

Steven Gates | GoGoPool

We should have a community vote about it

Dave | Avalaunch

I don’t dole out such compliments too often. It’s meaningful and we’ve done a load of AMAs

Steven Gates | GoGoPool

You know, originally I was going to let people vote on changing the name

Maybe we still should do that!

Dave | Avalaunch

Avalaunch appreciates how vocal and visible you are in the Avalanche Community, and I can attest to your behind the scenes work as well. It’s nice to see even Avalabs recognizing you as an authority of sorts of subnets.

Steven Gates | GoGoPool

For sure, it’s hard work out there!

Hopefully the talks at the Summit are livestreamed for those at home

But I’ll be giving two different talks about Subnets at the Summit!

Dave | Avalaunch

GoGoPool is one of those projects that is needed and you’re team is always around the socials injecting life into this growing ecosystem.

Steven Gates | GoGoPool

We are sponsoring the Summit too 🙂

Right next to Avalaunch!

Dave | Avalaunch

Thanks for coming here today and we can continue this on Friday.

Indeed. Look forward to that.

Steven Gates | GoGoPool

Absolutely 🙂 Thank you for the hosting!!

Plus

It is said that he will do a similar job on the Benq platform in the future.

Where do you think this will take you in this business?

Where do you see yourself in the future? Do you have a specific goal in staking 6 million avax benq?

are there already applications or projects for subnetsSteven Gates | GoGoPool

Good questions!!

I think going forward, I view us as a very infrastructure focused team building mission critical software for Subnets.

That will naturally take us down a very different path than DeFi protocols!

-

GoGoPool X Avalaunch: IDO Announcement

Introduction

The demand for Web3 technology is growing exponentially, and will result in the onboarding of millions of new users in the coming years. In its current form, Web3 is built for thousands of users and can not meet the scaling demands of these anticipated millions. One truly popular app could completely break any layer 1 chain. The only way to scale Web3 and meet this demand is through appchains—and GoGoPool thinks Subnets are the best (and only) option to create this safe and scalable solution.

Subnets partition blockchain networks into smaller, more manageable parts, each with their own set of validators and levels of security. Basically, Subnets are their own sandboxes that are customizable, flexible, and scalable. It’s a private blockchain with batteries included.

Avalanche is unlike any other network in that it was specifically designed to support the creation and management of Subnets. The blockchain’s consensus mechanism is unique because it allows for fast and efficient validation of transactions across the network. This makes creating Subnets with their own features, consensus mechanisms, and governance models easier.

Avalanche is uniquely positioned to engineer a future where Subnets are responsible for network scalability, flexibility, and interoperability cross-network for Web3.

GoGoPool is working to advance the adoption of Subnets by making it simple for builders to create and manage them.

In their own words, “we make Subnets easy.”

About GoGoPool

GoGoPool is keenly aware of the challenges arising for builders as the Subnet ecosystem begins to grow. In particular, there are three noted obstacles: high validation costs, inefficient tooling, and a lack of community onboarding.

Every validator node of a Subnet must also be a validator of the Primary Network, which costs 2000 AVAX. That means to get started, a Subnet which requires 5 nodes will force a project to source 10,000 AVAX. This prohibitive cost makes experimentation with a Subnet untenable. Projects need a way to quickly source hardware and AVAX easily.

The first release is GoGoPool; a permissionless staking protocol designed specifically for Avalanche Subnets to make sourcing validator nodes easy. At launch, GoGoPool reduces the AVAX requirement to launch a new validator node by about 50% via liquid staking.

When using GoGoPool to liquid-stake, users swap AVAX for ggAVAX token, a new staking token which represents their staked AVAX plus any rewards it has accrued in real-time. Users can sell, hold, or spend ggAVAX. Effectively, they can use ggAVAX in the same way they use AVAX. No technical knowledge or hardware is required, and there is a 0.1 AVAX staking minimum.

You use ggAVAX to grow the Subnet Ecosystem while liquid staking.

Once a liquid staker swaps AVAX for ggAVAX, they start earning rewards automatically. The AVAX is held in the Deposit Pool smart contract where it gets matched to node operators.

To launch a new validator node through GoGoPool, users supply their own hardware and register minipools by staking only 1000 AVAX (instead of the normal 2000) and stake 10% of that value via the GGP token. Because node operators stake AVAX and GGP, they earn rewards in both AVAX and GGP. New minipools are placed in a queue to get matched from the ggAVAX deposit pool.

Once matched, minipools are launched as full AVAX validator nodes.

Minipools are non-custodial and were designed for maximum safety and freedom for node operators and liquid stakers. Operators retain full ownership of their node and may use it to validate Subnets, and it is this commitment to maintaining a permissionless protocol that makes it easier for participants to launch a Subnet!

Benefits to Users

The primary users are liquid stakers, node operators, and subnet operators.

Liquid stakers now have a direct way to support the Subnet Economy, as every AVAX they stake gets matched directly to a minipool. This lowers the cost of hardware and sourcing AVAX for a Subnet; helping Subnets launch faster. Liquid stakers still earn AVAX staking rewards, while not needing any technical knowledge. Avalanche Network penalties and rewards are socialized across the pool, creating a safer and more stable experience than solo delegation. If a node operator’s rewards are slashed, their GGP collateral is also slashed to help make stakers whole. The ggAVAX token can be used in DeFi the same way AVAX can.

Node operators are able to launch more validators at a cheaper cost, while earning more. They earn in 3 ways: staking rewards, monthly GGP rewards, and an operator commission from the matched liquid staking funds. Minipools are permissionless and noncustodial, giving full ownership to operators. Operators are also able to participate in the GoGoPool DAO, giving them access to Subnets who are looking to test their technology and find product market fit.

Subnet operators can launch their own nodes through the protocol, and tap into the community as they need to scale and decentralize. Projects that partner with the GoGoPool DAO will also get access to Subnet tooling (more details on this coming soon!) to help them launch faster with less engineering costs.

Token and Utility

ggAVAX

When a user deposits AVAX into the deposit pool, they receive a synthetic derivative token called ggAVAX.

ggAVAX represents a staker’s deposit plus the rewards it gains over time. This token is considered liquid and can be used like AVAX whereby users can:

- Hold it to accrue staking rewards

- Sell it, or

- Use it to earn additional yield.

If there is floating AVAX in the deposit pool, users will be able to exchange ggAVAX back for AVAX (which burns the ggAVAX, and draws AVAX from the deposit pool). Alternatively, they will have the option to exchange it for any token they would like on exchanges that list the token.

GGP

GGP is an ERC20 token and serves as the protocol token for GoGoPool. The GGP tokens allow Node Operators to launch minipools i.e. full Avalanche Validator nodes matched with user funds for 1000 AVAX.

Node Operators have to stake a minimum amount of GGP tokens to secure their assigned staking funds as insurance for good behavior. At genesis the minimum will be 10% of their AVAX staked amount, but the operator can choose to stake as much as 150%. The higher their GGP stake, the higher their monthly GGP rewards will be. Node Operators can use these GGP rewards to launch new validator nodes, increasing their overall yield. In the future, Node Operators may restake their monthly GGP rewards to request AVAX delegation from liquid stakers onto existing minipools.

If a node operator has excessively low uptime and causes a loss of rewards for the protocol, stakers can be compensated from the GGP insurance put up by the Node Operator. This socializes the risk of being matched with a bad operator, and minimizes any potential losses. Slashed GGP can be sold to token holders at a discounted rate, with AVAX proceeds awarded to Liquid Stakers.

GGP token holders will have the ability to participate in the GoGoPool Protocol DAO, which allows members to propose and vote on a range of governance issues including inflation schedule of GGP, removing/replacing bad actors, smart contract upgrades, payment of community developers for future work, and rewarding outstanding members of the community (as well as other configuring the settings of the protocol).

GoGoPool DAO

GGP’s goal is to have every component of the protocol be configurable by the ProtocolDAO. Anyone with a GGP token has the ability to partake in the ProtocolDAO, proposing and voting on new items. Members of this DAO will be responsible for pushing the limits on what DAO members can and will do, and set the standard for other web3 projects.

The ProtocolDAO will maintain a treasury to pay for security audits and reward community/developer contributions.

Some of the governance factors the ProtocolDAO members will have influence over are listed below:

- Depositing funds into the treasury wallet.

- The GGP token inflation schedule and rate.

- At genesis, there will be 0% inflation for 4 years, at which point the DAO can contemplate adding a 2-5% inflation rate to be used as rewards.

- GGP reward distribution between Node Operators and DAOs.

- Configure protocol settings like min/max staking amounts, enabling/disabling registration, etc.

- Deciding on liquidity mining and bootstrapping reward programs.

- Blacklisting / whitelisting Subnets.

Snapshot voting will be used to gauge sentiment, and outcomes will be executed on by the GoGoPool Foundation. The Foundation is a Cayman entity which has an independent Director, and is in charge of executing DAO proposals and guiding the progressive decentralization process for the protocol.

There is a second DAO which is responsible for maintaining the health of the protocol in its earlier days. The RialtoDAO is initially made up of the core developer team, and will be decentralized over time. This DAO operates Rialto (MPC software) and maintains a few important functions for the GoGoPool protocol (distribution of Avalanche staking rewards, initial price oracle to the protocol). See docs for more information.

Traction

- @stvngts and @JohnnyGault met at Avalanche Summit and were redpilled on the idea of “making Subnets easy.” March 22nd

- Proof of Concept Demo completed June 14, 2022

- Announced $5M Seed Round on August 31, 2022

- Audit 1- Kudelski Security, October 31, 2022:

Kudelski_multisig_labs_report - Audit 2- Zellic.io, February 22, 2003:

GoGoPool – Zellic Audit Report - First Subnet Partnership, Hunting Party, released February 23, 2023

- Launched to Testnet on March 1, 2023

- Second Subnet Partnership released March 4 with [redacted].

- Audit 3- Code4rena, March 21, 2023 GoGoPool contest

GoGoPool – Links and Team

Website | Discord | Medium | YouTube | Twitter

Partners and Backers

“GoGoPool isn’t just another Liquid Staking Protocol, it’s an LSP and a coordination mechanism that allows subnets to be deployed easier and cheaper. With their innovation, we believe GoGoPool could become a core infrastructure component for the Avalanche ecosystem, which is at the forefront of blockchain technology. Disclaimer necessary: This testimonial does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product.”

– Brian Johnson, Republic Capital“We believe GoGoPool is on the forefront of innovation in Avalanche scaling and growth by addressing the two most critical points: reducing the friction of launching and operating a subnet, and lowering the barrier to entry for staking participants who seek to reinforce the network. If you’re a supporter of Avalanche, you should be very excited by the important tech that the GoGoPool team continues to roll out for the ecosystem.”

– Brandon Potts, Framework Ventures“I have been an Avalanche validator since day 1 and believe subnets are key to truly scaling blockchains. The GoGoPool team has the potential to help achieve that dream, by creating a rich platform connecting validators like me to web3 builders eager to launch their own subnets. The team has strong technical expertise, a community-focused vision, close ties with Ava Labs, and no obvious competitor. I can envision a future where the GGP token plays a crucial, bedrock role in a dynamic subnet economy.“

– B_Tanyeri, Avalanche ValidatorConclusion

GoGoPool aims to make the adoption of Subnets in Web3 seamless and efficient. By addressing the challenges of high project costs, inefficient tooling, and lack of community onboarding, it is empowering builders, node operators, and users to participate in the rapidly growing Subnet ecosystem. The permissionless staking protocol reduces the AVAX requirement for launching validator nodes, making it more accessible for a broader range of participants while giving liquid stakers a way to directly help the Subnet ecosystem.

The mission is to drive the future of blockchain technology through network scalability, flexibility, and interoperability, as envisioned by Avalanche. By offering benefits to liquid stakers, node operators, and subnet operators, it fosters a more collaborative and interconnected blockchain landscape.

The introduction of the ggAVAX and GGP tokens further enhances the functionality of the platform, providing a way for node operators and liquid stakers to work together to grow Subnets. The GoGoPool DAO ensures that the platform’s future is shaped by its community, giving GGP token holders the power to influence governance decisions and drive the platform’s direction.

GoGoPool is a crucial step toward the realization of a truly interconnected Web3 world. By streamlining the creation and management of Subnets on Avalanche, we are making this cutting-edge technology accessible to a wider audience and helping to build a future where blockchain networks can seamlessly communicate and collaborate with each other while handling a Web2 level of scale.

Join in the journey to revolutionize the blockchain landscape and advance the adoption of Subnets for a more connected and decentralized world.

“It’s been great working with Avalaunch, and it’s awesome to be a part of this whole thing. We are all-in on making Subnets easy, reducing launch times for projects, and creating an ecosystem in order to scale Web3 and bring blockchain to the world. If we as a community play our cards right, I believe that in 3 years 80% of appchains will be powered by Avalanche Subnets.”

– Steven Gates, GoGoPool Co-FounderThe GoGoPool launch on Avalanche represents a truly community-centric, cooperative piece of infrastructure that will go a long way in moving Subnets forward.

Funding Numbers

To ensure fairness, transparency and community support the original private sale and public sales are at the same price. Public participants will note that the private sale is subject to a significant lock as are the pre-IDO partners whom are also buying at a premium over the public round. GGP feels this is important to make sure that all parties are correctly aligned at launch – there are no pricing differences between what is paid by private investors (VCs, angels, etc) and the Avalanche community. This way, everyone is sharing the same risk and rewards at genesis and fosters equality and fairness.

GGP believes that every person involved in both sales will directly help the protocol decentralize and scale for the years to come.

Total Supply: 22.5M GGP Tokens

- Seed Round—5M USD at $1.33 per GGP

- Pre-IDO Partner Sale: up to 1.35M USD at $2 per GGP*

- Avalaunch Validator IDO: 50K offered to validators at $1.33 per GGP

- Avalaunch Stakers IDO: guaranteed 250K USD at $1.33 per GGP**

*The pre-IDO partner sale is ongoing and GoGoPool will not accept more than 1.35M although interest may exceed this number. GGP reserves the right to sell less and any remainder will roll over to the foundation.

**Total IDO allocation is up to 1% of the total supply. Any remainder after 90 days rolls over to Foundation.

SUPPLY BREAKDOWN & VESTING

Total Supply: 22,500,000 GGP

- GoGoPool Foundation: 41.42% | The below allocations are subject to change according to DAO voting. Snapshot voting will be used to gauge sentiment, with recommendations executed by the Foundation.

- DAO Fund: 16.42% | allocated as per the DAO — eg. growth capital, additional grants, liquidity incentives, airdrop schemes, strategic alliances, advisors, etc.

- Ecosystem Development Grants: 15% | To fund engineering, business development, and marketing.

- Liquidity Incentives: 10% | To be deployed as the DAO sees fit.

- Original Team: 20%

- Seed Round: 15.58%

- GGP Staking Rewards: 15%***

- Advisors: 3%

- Pre-IDO Partner Sale: up to 3%

- Liquidity: 1%

- IDO: up to 1%. Any remainder rolls over to Foundation

***GGP Staking Rewards are split between 3 parties, and unlocked when issued:

- 70% to node operators

- 15% to Rialto DAO

- 15% to Protocol DAO Treasury

Vesting Following TGE:

- GoGoPool Foundation: Locked for 3 months, to be deployed under DAO snapshot voting over the following 48 months.

- Original Team: 12-month lock up, 36-month with quarterly vesting.

- Seed Round: 12-month lock, 36-month with quarterly vesting.

- GGP Staking Rewards: 48 months, monthly vesting.

- Advisors: 12-month lock, 36-month with quarterly vesting.

- Pre-IDO Partner Sale:

- Tickets under 100k USD: minimum 12-month lock with 12-month quarterly vesting.

- Tickets over 100k USD: 12-month lock, 36 month quarterly vesting.

- Liquidity: Fully unlocked at TGE.

- Avalaunch IDO: Fully unlocked at TGE.

Initial Supply: 187,970 GGP

- Liquidity pool—500K ($250K AVAX + ~188K GGP)

- IDO sale: 300k USD—225,000 GGP tokens

- Initial Market Cap (excluding liquidity): ~250K USD

Note: The only day 1 circulating tokens, excluding liquidity, will belong to Avalaunch IDO participants.

REGISTRATION SCHEDULE:

Registration Opens: Tuesday, April 18 at 3:00 p.m. (UTC)

Registration Closes: Sunday, April 23 at 6:00 p.m. (UTC)SALE SCHEDULE:

Validator Round Begins: Tuesday, April 25 at 6:00 a.m. (UTC)

Validator Round Closes: Tuesday, April 25 at 3:30 p.m. (UTC)Staking Round Begins: Tuesday, April 25 at 3:30 p.m. (UTC)

Staking Round Closes: Wednesday, April 26 at 6:00 a.m. (UTC)Booster Round Begins: Wednesday, April 26 at 6:00 a.m. (UTC)

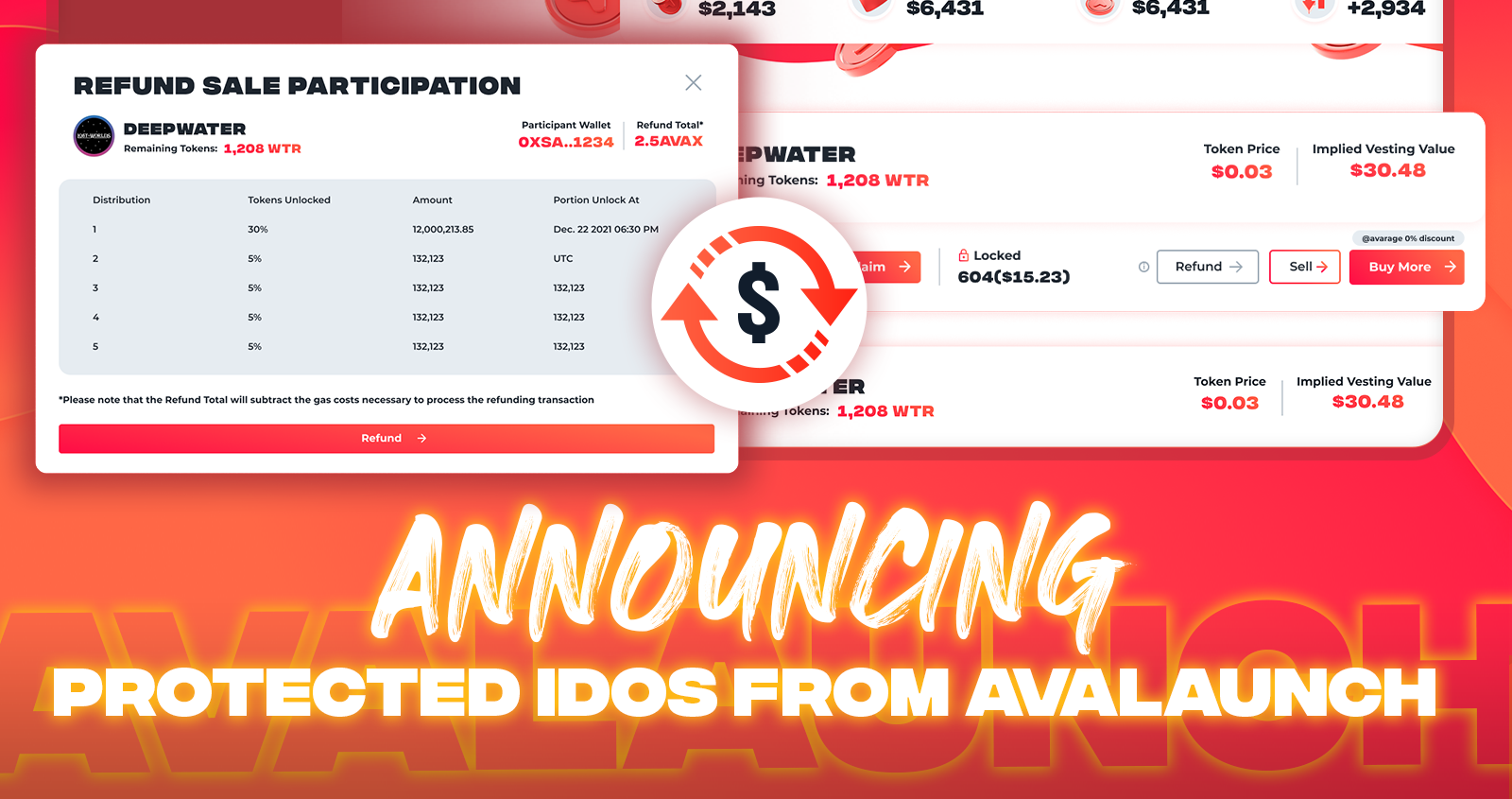

Booster Round Closes: Wednesday, April 26 at 10:30 a.m. (UTC)Introducing Avalaunch Refunds

The upcoming GoGoPool x Avalaunch sale debuts Avalaunch’s innovative refund policy, focusing on safeguarding user participation. This includes a 14-day price performance guarantee, making users with unclaimed tokens eligible for refunds in the event of poor token performance. Refunds can be conveniently processed via the Vesting Marketplace, enabling simple requests and fast completion.

For more detailed information about the refund policy and its requirements, please refer to the main article.

-

The Future of Esports – How BFG Will Shape Web3 Gaming

From wanting to be professional athletes, kids now want to be professional gamers. The competitive spirit that lives and breathes within us always wants to prove its merit. Tournaments, leagues, and Esports events bring millions of fans to watch players compete. Social media is flooded with gaming videos, creators, and the gates have been opened by icons like Dota 2, Fortnite, and CS: GO. Now, Web3 gaming is making its first step, and it’s ready to pack a punch. Enter Battle For Giostone, the game that encompasses the future of gaming and the future of Esports.

The Rise of Battle For Giostone

From a concept to a fully playable game, it has taken Battle For Giostone a little over a year to turn a dream into reality. Founded by experts and lifelong gamers Mile Gramatikov, and Theeban Siva (1437), it quickly amassed a community of dedicated and competitive gamers. The MOBA genre walked so that Battle For Giostone could run. Building on the main weak point of current Web3 games, Battle For Giostone is actually fun to play. You can check that out for yourself and play for free.

The unique mechanics make it different from titles like League of Legends, Dota 2, and Smite. Players get to forge their Heroes out of six Hero Classes and 72 Abilities. Not only that, but the duration of matches will be limited to 30 minutes and include Battle Royale elements. The Giostone mechanics make it incredibly fast-paced. Last but not least, players can trade their assets and get rewarded.

The Impact of Battle For Giostone on Web3 Gaming

Gaming is a multi-dimensional niche. Some people look at it as a method of relaxation. Others look at it as a place to compete. And then there are those who want to make a living out of it, either through esports, in-game earning, or creating content.

Battle For Giostone hits on the key points of each player persona. You can play solo or as a team in 5vs5 matches and choose whether you want to play casually or compete. The free-to-play aspect allows everyone to test out the waters and see if they love MOBAs. Easy to learn and hard to master immediately brings in a community of people who want to explore every crevice and emerge victorious through skill and effort.

Here’s what a Community Game Night looks like:

The Future of Battle For Giostone in Esports

As Battle For Giostone continues to grow and evolve, the future in Esports will look brighter than ever. The game is becoming more popular by the day, and the continuous game nights, tournaments, as well as the Primal Giostone League have a snowball effect when it comes to interest.

There are countless possibilities for how new technologies can push the boundaries of competitive gaming. With a fully equipped production studio, the team hosts and casts events and creates content to remain fresh and exciting for both players and spectators alike.

The ongoing development ensures the game remains fair and balanced, making it incredibly lucrative for gamers who want to compete and showcase their skills. Ultimately, the future of Battle For Giostone is intertwined with the future of Esports. It’s well on its way to becoming a leading force in the industry in the following years.

Here’s a tournament that was hosted recently:

How Battle For Giostone Will Shape Web3 Gaming

The Web3 space is evolving rapidly, and new trends are constantly popping up. But one thing has always been true of the world. People always want to know who is the best. Whether that’s the Olympic Games, the World Cup, the Superbowl, the International, or the Primal Giostone League, there’s always a question of who will win.

With a heavy focus on skill, teamwork, and strategy, Battle For Giostone can capture the minds of millions and evolve proactively. Whether you’re a die-hard fan of MOBAs already or a complete newbie makes no difference. There’s never been a better time to start playing, become a part of the community, and experience the thrill and excitement of competing!

-

Introducing Avalaunch IDO Protection & Refund Policy

Introduction

The rapidly evolving world of crypto has given rise to innovation and opportunity along with the volatility that accompanies genuine disruption. Among these opportunities, IDOs have become a popular method for launching new tokens and raising capital for promising projects. Avalaunch is committed to providing a secure and transparent environment for users to participate in token sales and IDOs. Because investing in this dynamic landscape can be challenging and unpredictable at times, Avalaunch has established a comprehensive refund policy designed to address specific situations to better safeguard our users’ interests.

The Importance of a Refund Policy

A well-defined refund policy not only instills trust and confidence but also serves as a protective measure against unforeseen market fluctuations and project shortcomings. By outlining clear eligibility criteria and a streamlined process on a per sale basis, Avalaunch ensures that users can make informed decisions when participating in token sales and IDOs, while also having a safety net in place should the need arise.

Our Next Sale Policy

Given that each sale is unique with varying terms and vesting periods, Avalaunch will provide a bespoke solution on a per sale basis to best serve our users. Avalaunch focuses on price protection in three primary ways:

- Liquidity—Teams must believe in their pricing and must provide a tradable environment for their token. Initial liquidity provision should be roughly equal to the value of the circulating supply at IDO price.

- Price Uniformity—Retail buyers often have the luxury of unlocked tokens while private investors are subject to vesting but may receive tokens at a heavily discounted price along with a percentage of their allocation at TGE. This substantially lowers the cost basis of circulating tokens, creating misaligned incentives.

- Price Protection—teams must provide a period where the tokens remain at or above the IDO price.

Price Protection For Our Next Sale:

- 100% unlocked at TGE so there are no vesting considerations

- 14 Days of price performance guarantee

- Token must remain at or above IDO price for 85% of the time in aggregate and must not fall below IDO for a consecutive period of more than 24 hours

- Users who have not claimed their tokens will be eligible for a refund

Please note that the price protection policy for subsequent sales will likely have tweaks and modifications to best optimize the user experience.

Refund Eligibility Criteria

To be eligible for a refund under our policy, users must fulfill the following conditions related to the specific sale in question:

- No Prior Token Claims or Vesting Marketplace Interaction: Users must not have claimed any tokens from the sale or interacted with the Vesting Marketplace for that particular sale before requesting a refund. By claiming tokens or engaging with the Vesting Marketplace for the sale, users are deemed to have accepted the associated risks and rewards, making them ineligible for a refund.

- Token Price Criteria: Refunds can be claimed and activated only when the token’s value falls below the IDO price, as defined above, within a 14-day refund window. This refund window begins on the date the token is listed on its first supported exchange, decentralized and other. Should the listing project not meet the price protection criteria, eligible users may submit a refund request which will be made available on the Vesting Marketplace.

Refund Process

As part of the newly launched Vesting Marketplace rollout, Avalaunch has designed a straightforward refund experience for eligible users.

To request a refund, simply follow these steps:

- Connect your wallet to the Avalaunch app and navigate to the Vesting Dashboard.

- Locate the relevant project and click the “refund” button.

- Review and accept the refund terms and conditions.

- Submit your refund request, and our team will process it—please allow up to 48 hours for the refund to be processed.

- Any fees associated with the original transaction, such as gas fees, may not be refunded.

- Additionally, please note that users provide collateral for their purchase in AVAX and will be refunded in AVAX.

Support and Assistance

We understand that navigating the complex world of crypto investments can be daunting. Should you encounter any issues or have any questions regarding the refund process, please do not hesitate to contact administrators in the official Avalaunch Telegram channel for any assistance.

Conclusion

In the fast-paced and often unpredictable world of cryptocurrencies, having a comprehensive refund policy in place is vital for both investors, projects and platforms alike. By offering clear eligibility criteria and a streamlined refund process, the Avalanche ecosystem can continue to thrive as its community confidently navigates the ever-evolving world of digital assets.

-

Understanding Tokenomics – Models, Systems & Sustainability

To build on the overview on web3 gaming from last month, we wanted to explore the basics of web3 tokenomics. GameFi is still a nascent sector, but it has already crossed $14 billion in global value, with some studies indicating future growth upwards of $50 billion by 2025. However, for this to succeed there needs to be continued refinement on how game tokenomics is structured to ensure sustainability.

Nearly every week, we see new crypto games released, but very few of them survive more than a few months. One of the main causes of this is poorly established tokenomics. Now this could be by design as we saw in late 2021-2022 with many DeFi clone type projects spiraling to zero. The more promising projects suffered from just not having a well-thought-out long-term strategy.

One of the core components of every blockchain-based project, including games, is tokenomics. This is especially true when it comes to investors who pay close attention to those sections of a project’s whitepaper to evaluate the game based on its tokenomics architecture.

So what are tokenomics and what are some key things to look for when evaluating a game? Let’s explore.

Tokenomics Overview

Tokenomics encompasses a variety of concepts, including playing, staking, trading, governance, and other mechanisms designed by the game’s development team. By implementing these concepts effectively, game developers can create a self-sustaining ecosystem that rewards players for their involvement.

One of the key benefits of a well-designed tokenomics system is the creation of a self-sustaining loop. This means that players are rewarded for their contributions, which encourages further engagement and creates a strong community around the game. This community can be a critical factor in a game’s success, as it can help to promote the game, attract new players, and provide valuable feedback to the development team.

To ensure the success of a game’s tokenomics system, it’s essential to carefully consider the various economic principles at play and how they interact with each other. This includes factors such as token supply, inflation, and distribution, among others. By understanding these principles, game developers can create a sustainable and fair system that benefits both players and the game.

Tokenomics Models

There are essentially two main models we have seen projects build their tokenomics around, deflationary and inflationary.

Deflationary models will typically involve a fixed token supply, where the issuance of new tokens will decrease gradually over time. The decreasing supply usually pushes prices higher as tokens become scarcer. Bitcoin is the best example of a deflationary model.

Alternatively, an inflationary tokenomics model can be implemented which involves an unlimited cap of tokens. With this model, the token supply will only increase over time, but certain mechanisms can be implemented to limit inflation or potentially shift to create a deflationary system. A great example of this on Avalanche was the Treasure Under the Sea (TUS) token that was inflationary. The team put mechanisms in place to attempt to slow the inflation at various times through introducing different burning mechanisms for TUS.

Choosing between an inflationary or deflationary tokenomics model is an important decision for game developers as it can significantly impact the long-term sustainability of the game. Both models have their advantages and drawbacks, and game developers need to carefully consider the needs of their specific game and audience when designing tokenomics.

Inside of each of these models, there are two primary ways a team can approach slowing inflation. Throughout the last 18 months we have seen examples of all of these models and we would expect we continue to see teams incorporate these ideas into innovative ways to sustain a game economy.

- Buybacks: Periodically a team will purchase tokens from the market and burn them. This will remove a certain percentage of the supply and attempt to bring a better balance to supply and demand.

- Transaction Tax: Each transaction of a buy or sell would have a certain tax associated with the transaction. This tax would then be burned similar to the buyback model but occurs constantly.

Two-Token Systems

Outside of the inflationary/deflationary models we witnessed the rise of the two (or even three) token system in numerous games over the last year. The two-token system aims to distinguish between a utility token and a governance token. For example, Crabada implemented this model with TUS as the in-game token and CRA as the utility token.

However, this system has faced some challenges. Both investors and players may struggle to grasp the advantages of holding one token over the other, and how they can benefit from the overall gameplay experience.

It’s crucial to educate users about the unique roles each token plays in the ecosystem. The utility token serves as a means of exchange for goods and services within the game, while the governance token represents voting power for decisions that impact the ecosystem’s future. By clearly defining these roles, users can make informed decisions on which token best suits their needs and goals.

It’s also essential to consider the potential risks associated with the two-token system, such as the possibility of the governance token becoming overvalued and negatively impacting the overall ecosystem. As a result, it’s important to carefully monitor and balance the distribution and use of both tokens.

Web3 games need to be easy to understand and play without the average player becoming confused or frustrated.

Sustainability (or lack thereof)

Designing and choosing the right tokenomics is not an easy task, and can easily distract a team by focusing more on how to value the token(s) instead of developing a fun and engaging game.

Developing an engaging and fun game is the primary goal, and it’s essential to prioritize this over simply focusing on token values. If the game fails to attract and retain players, it doesn’t matter how well-designed the tokenomics are. Therefore, it’s vital to focus on the gameplay experience and make sure it’s easy to understand and enjoyable for players.

While tokenomics play a crucial role in incentivizing player engagement, solely focusing on how much players can earn may attract a player base only interested in extracting value. This approach can lead to a death spiral for the token, as we’ve seen in some cases over the past few years.

To avoid this, game developers should design tokenomics that encourage engagement and reward players for their contributions to the ecosystem. This can be achieved by carefully balancing factors such as token supply, inflation, distribution, and other economic principles to create a fair and sustainable system.

Conclusion

In addition to basic tokenomics and sustainability, there are other factors that need to be examined before investing in a web3 gaming project. Some of these topics include evaluating the tokenomics distribution, token sale pricing and unlock schedule, a clearly defined governance model, more detailed utility examples, and reading and understanding the whitepaper. These topics are extremely important to evaluate as both a player and investor. In future articles we will take a look at each of these and how you can use the information to help guide your decision making process before investing or playing a new game.

-

Why Web3 is the Future of Gaming

What is GameFi and Why is it Important?

GameFi is a term used to describe the fusion of finance and gaming. Combining the power of blockchain technology and the massive gaming industry will revolutionize the way we play, invest, and earn money doing something that so many people across the globe already do. GameFi does not just mean video games, but also includes other popular sectors such as sports betting, casino games, and even virtual real estate.

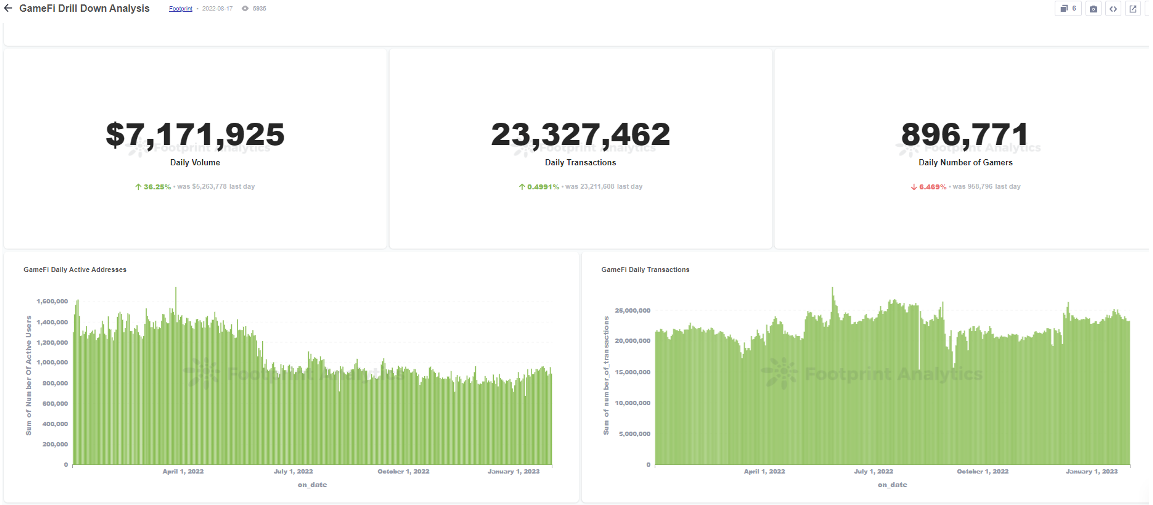

There has been an unprecedented growth rate in the gaming industry. Blockchain technology and Web3 are about to transform it in a dramatic way. The gaming industry has always been lucrative, with billions of dollars in revenue generated every year. However, gamers have always had limited ways of monetizing their skills and achievements. GameFi offers a solution to this problem by allowing gamers to own, trade, create, and monetize their in-game assets and achievements. This not only provides a new source of revenue for gamers, but also creates a new market for investors who can invest in these assets. You can take a closer look at the GameFi analytics dashboard at footprint.network below for a detailed breakdown by chain activity.

The importance of owning Web3 assets like non-fungible tokens (NFTs) is becoming increasingly apparent, and it’s time to pay attention to them. Here’s why owning Web3 assets is crucial for GameFi and how it’s going to change the way we play.

Why is ownership of Web3 Assets Important for GameFi?

There are a variety of reasons that ownership of assets will change the face of how we look at gaming, but from my perspective you can combine a majority of the benefits into a few main topics.

- True Ownership

- Interoperability

- Scarcity

- Transparency

True Ownership

This is probably one of the single largest benefits of web3 gaming. Unlike traditional in-game assets, Web3 assets are stored on a decentralized blockchain, and the owner holds the private key to access and transfer the asset. This means that the owner has complete control over the asset and can sell it, trade it, or even gift it to someone else. Traditional in-game assets, which are under the control of the game developers and studios do not allow for any trading, selling, or management of anything by the players. They simply collect your money through microtransactions and move on. For instance, in Call of Duty, players frequently buy skins, weapon blueprints, and attachments. Once purchased they are bound to that account in that version of the game. In 12-24 months when the next Call of Duty comes out, those purchased items are no longer usable and basically dead money. That player will now have to buy more skins or weapons in the current version. In web3, those assets should be able to be brought into the next version of the game or sold throughout the existence of the old version to other players to recoup some or all of the original cost. Rare, limited time skins could become valuable based on what the community wants and is not dictated by the gaming studio. Players can take advantage of all the potential given in this new GameFi environment and have full control over their Web3 assets.

Interoperability

Another advantage of Web3 assets is interoperability, which goes hand in hand with ownership. These assets can be used across multiple games, platforms, and even outside of the gaming world. The possibility to take these NFTs and use them across multiple games opens possibilities that we have not even begun to scratch the surface of when it comes to gaming. This interoperability creates a new level of freedom and flexibility for gamers as well as creators and developers who can put their skills to work to bring numerous communities together.

Scarcity

Scarcity is another factor that makes Web3 assets valuable. Unlike traditional in-game assets, Web3 assets have limited supply, and their value is determined by the market demand as opposed to pricing by the game studio. A gaming studio rarely ever releases a limited amount of anything because this would cap how much they can make off the items so eventually, if the item is good, everyone will have it and it is just a requirement to stay competitive. With third party developers having the ability to create NFTs for a game, they can set the number of items for release. If the number is set low and the community loves the release or has a major impact on the game, this scarcity will make the assets more valuable, and this can provide an opportunity for gamers to invest and make money. The scarcity of these assets creates a market for collectors and investors, who are willing to pay premium prices for rare and unique assets.

On the flip side of this however, this could potentially open game breaking releases. For example, if a skin was released by a developer that would blend into the background of an environment making them almost impossible to see, this could send the community into an outrage if the number of NFTs made it impossible to obtain. Since these assets are owned by the player they cannot be easily patched or removed as we have seen down in web2 games. How these situations are navigated will be extremely important as the web3 space develops.

Transparency

A key part of web3 is transparency. Blockchain technology’s decentralized nature ensures that every transaction is recorded on a public ledger, making it transparent and auditable at any time. With this, gamers can track their assets and history more easily, and creators can see the price history of popular assets so they can improve on or rework them for future releases.

Web3 is Poised for the Future

With the right resources in place and the billions of gamers around the globe, web3 gaming is poised to take the place of traditional web2 gaming. There is still plenty of work to be done with ensuring each game has a sustainable economy, the appropriate security measures in place to avoid exploitation, and can seamlessly onboard traditional gamers who may have a negative opinion about crypto and web3 gaming. That being said, with industry titans like Epic Games, Amazon, and more entering the market, it’s clear they’ve done their research and realize the potential that web3 has to completely change how we have looked at gaming during the last 3 decades.

-

Introducing: The Avalaunch Vesting Marketplace

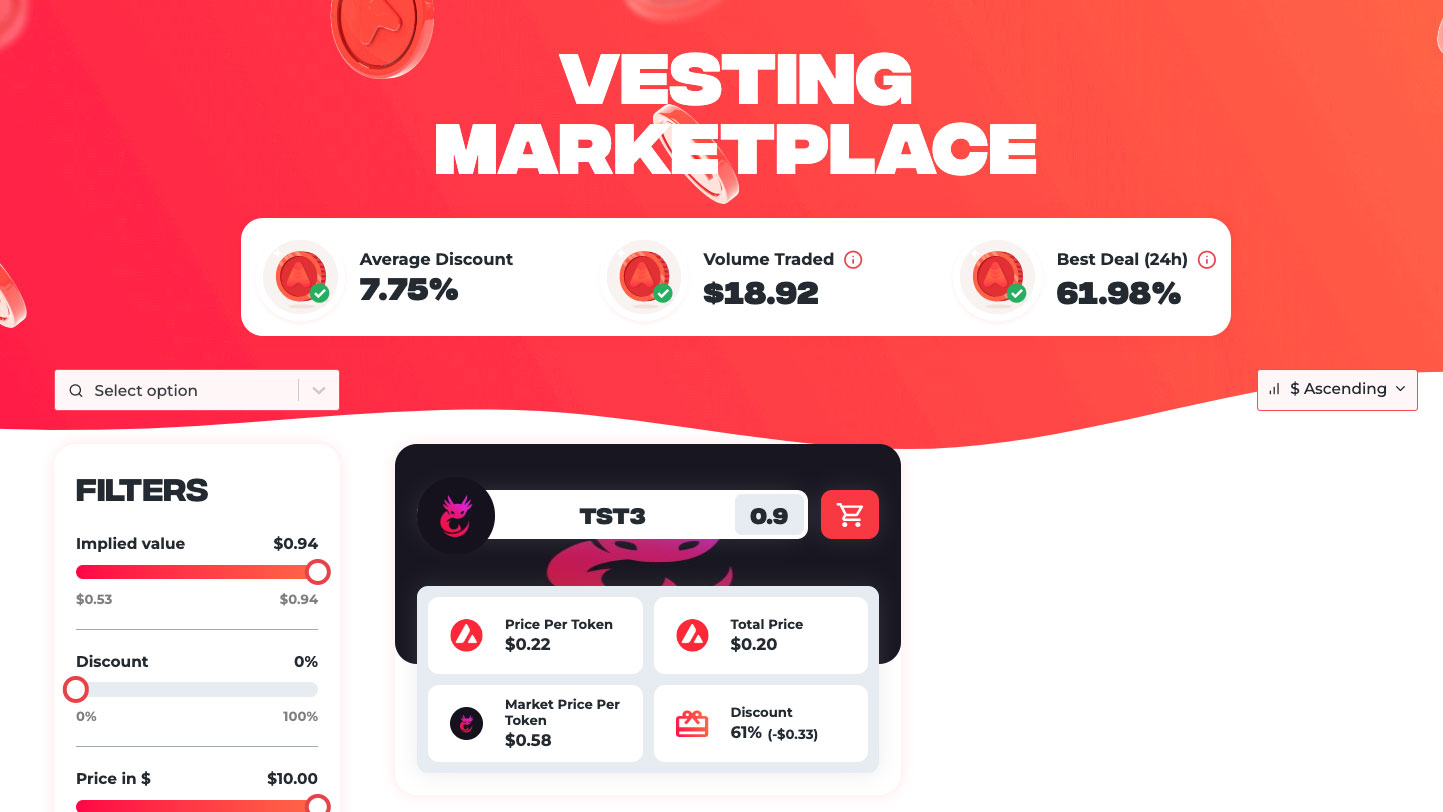

Avalaunch has been busy and in the coming months will release a number of new features and products in an effort to expand as well as optimize its native offerings. Avalanche is evolving and we have every intention of growing right alongside it.

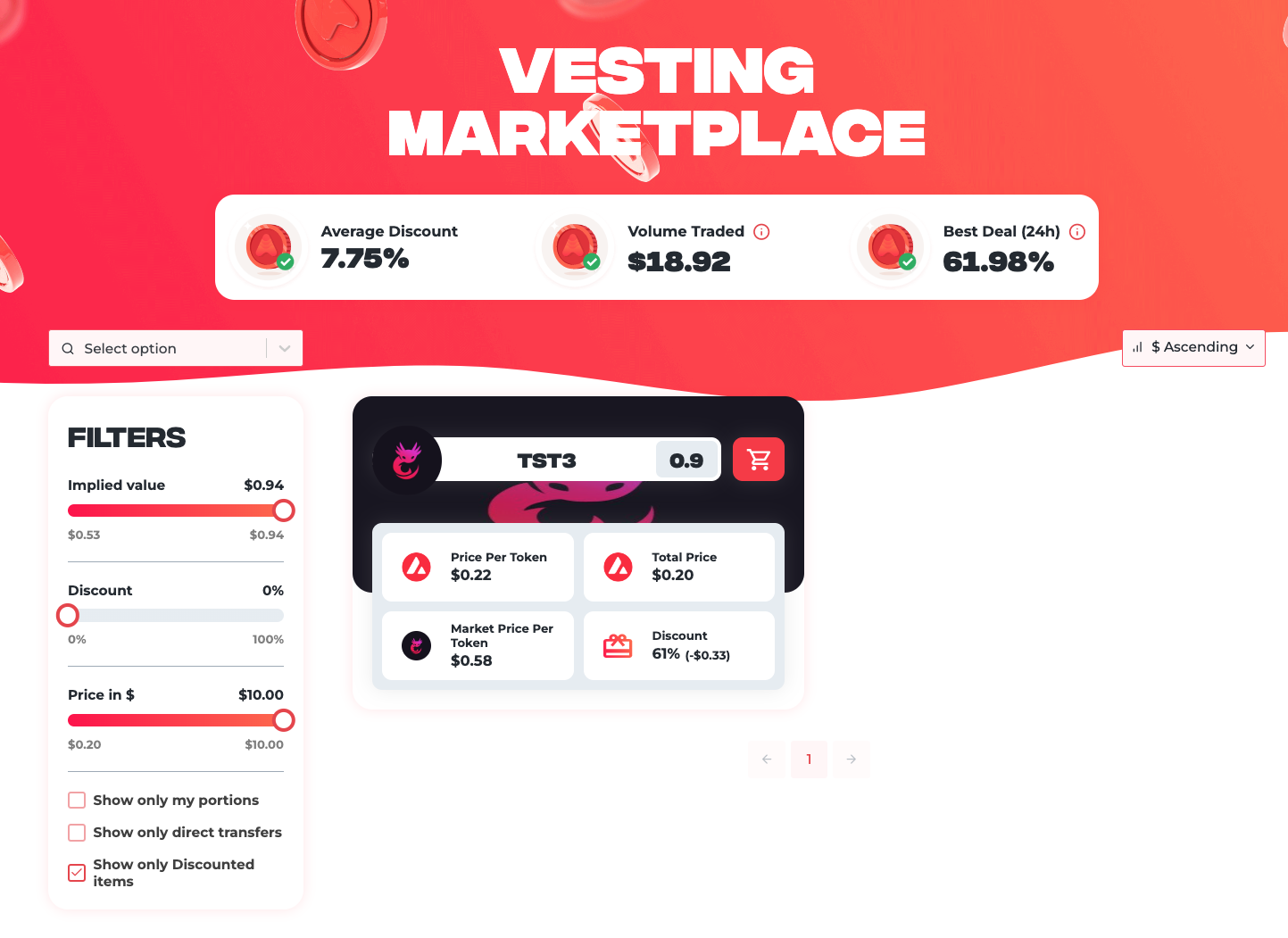

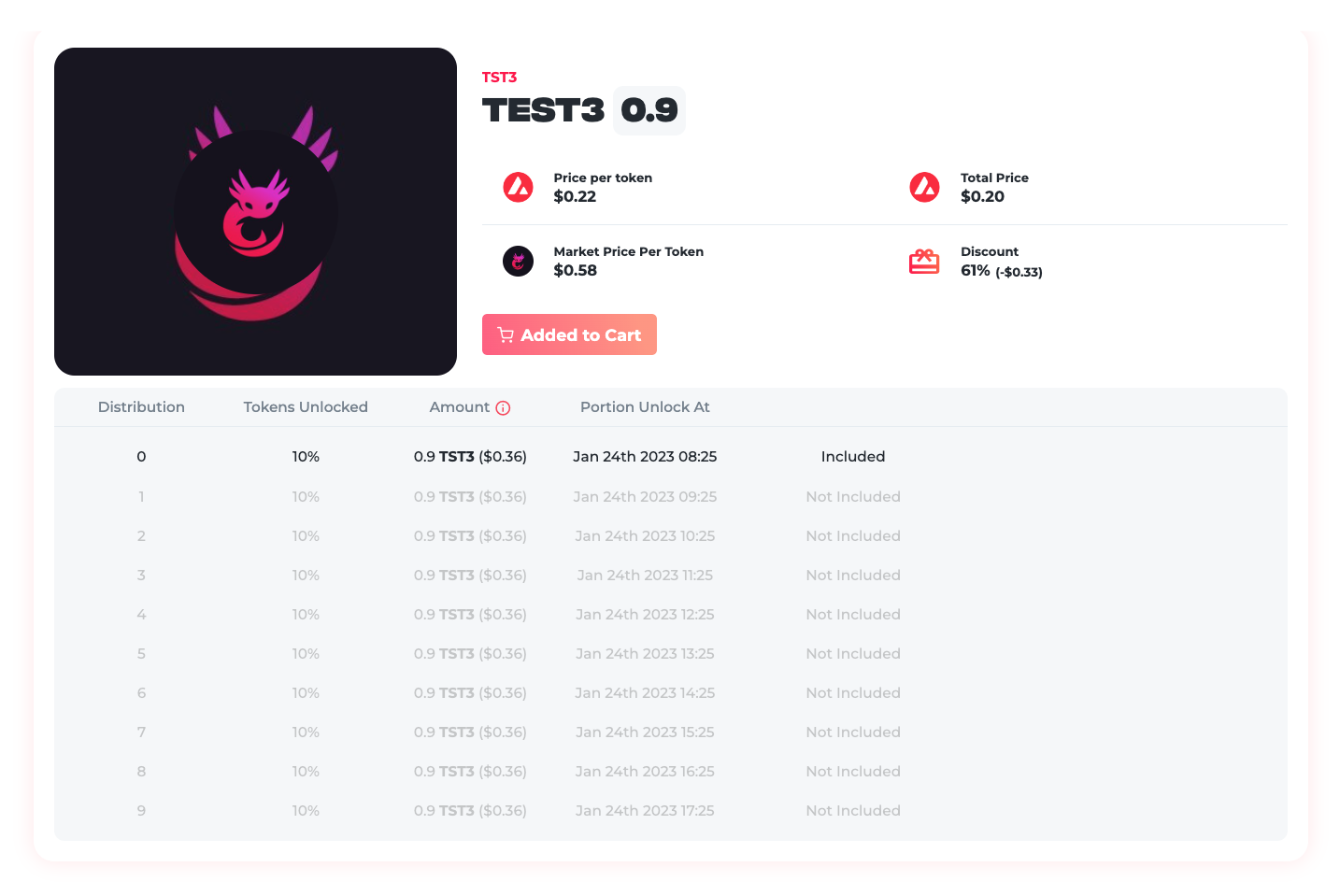

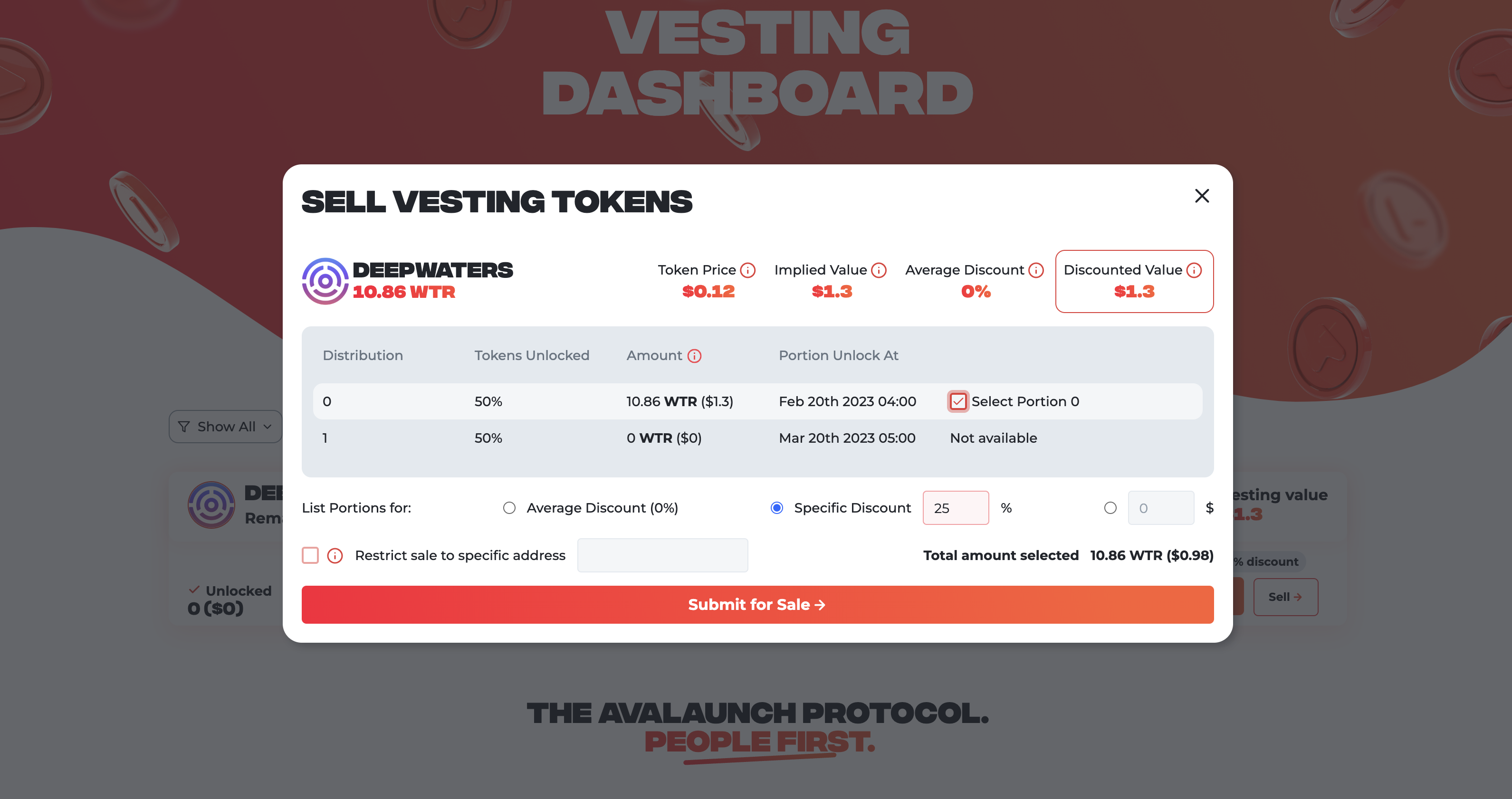

Stressing utility and flexibility for XAVA holders is a priority and initially, the team is excited to release its vesting marketplace and token dashboard. Beginning with the Deepwaters IDO, this new offering will enable IDO participants to trade their locked/vesting tokens with other users in an open marketplace inside of an experience optimized for flexibility and usability. In other words, buyers can acquire the right to claim tokens when they unlock as if they had participated in the IDO regardless of whether they actually did or not.

The Avalaunch Vesting Marketplace introduces several fundamental shifts for both users of the platform and the projects launching on it:

- IDO participants can now deploy more sophisticated strategies that involve retaining select portions of their locked tokens, while offering others up for sale on the marketplace — oftentimes at a discount to the buyer.

- The vesting marketplace is of tremendous value to projects launching on Avalaunch as it allows buyer and seller to transact off the order books and without an impact to price. Additionally, these locked tokens can now be transferred to holders who presumably have a longer-term interest in the project. Prior to the marketplace, a user might sell these tokens as soon as the unlock simply because it was the only option. Now, they can trade them well before the unlock, freeing up capital while simultaneously putting the tokens into the hands of holders with an extended time horizon on the project. This is a win-win-win for buyer, seller and the project.

- The IDO occurs at the very beginning of a project and doesn’t allow future supporters an opportunity to participate. The marketplace affords projects a brand new ability to engage and excite fresh users well after the IDO and a platform for these users to acquire a position in the earliest opportunity available, well after it has occurred.

- IDO participants are only offered a limited allocation based on sale size and registration numbers. Now, if they are especially bullish on a particular project they can acquire additional discounted tokens.

The Vesting Marketplace is a first for all of crypto, giving way to new market dynamics that benefit both project and user while allowing Avalaunch to continue to establish itself as a market leader with respect to functionality and usability.

Token Vesting, Liquidity & Market Dynamics

Crypto is a space where early stage companies are traded; giving rise to great speculation and volatility versus traditional markets where far more mature assets comprise a given exchange’s tradable assets. Risk tolerance among individuals varies greatly and crypto, generally speaking, is an ongoing fight for liquidity where moving in and out of positions can materially impact price and sentiment. Vesting tokens are often released in relative bulk, often creating chaos at the moment of release causing unlocks to often be bearish events.

Ideally, token distribution schedules should be timed with anticipated demand, however, investors require firm dates where they can expect to receive tokens. The result is quite challenging for projects as they hope to offset inflation with fundamental developments.

Token vesting, in essence, is a process by which tokens are released gradually over time instead of being issued all at once. This mechanism is intended to align the interests of issuers and investors by ensuring that tokens are distributed in a controlled and strategic manner.

Ideally, token vesting is meant to encourage long-term engagement and prevent market saturation, however, this is often not the case. A token vesting marketplace can redistribute tokens into the hands of longer-term participants before tokens are “in the wild.” Avalaunch has developed a platform that allows token holders to buy and sell token vesting schedules, enabling them to trade the right to receive tokens in the future.

Avalaunch’s vesting marketplace is a tool to incentivize long-term engagement that enables token holders to trade their vested tokens, which can result in a more liquid and efficient market. For projects, these marketplaces offer a new way to engage and attract supporters by incentivizing long-term investment.

For token holders, a crypto token vesting marketplace offers a new opportunity to trade their vested tokens to mitigate against risk, free up capital or realize returns in favorable market conditions. For supporters seeking to take a position, they are too often forced to bid up the market with high slippage or negotiate risky OTC deals with prohibitive fees.

For launching projects, offering a fully audited, cost free, state-of-the-art vesting tool and claim portal can be as advantageous to launching projects as it is to users. The Avalaunch marketplaces aims to add market efficiency for launched projects and broader token support. It can prevent supply shock, add liquid flexibility for holders and offer new opportunities for those with longer investment horizons. Avalaunch believes that a trading marketplace for vested tokens can ultimately take the sting out of a growing circulating supply while offering participants a novel way to unlock value.

Avalaunch Vesting Marketplace: Understanding the Features and Functionalities

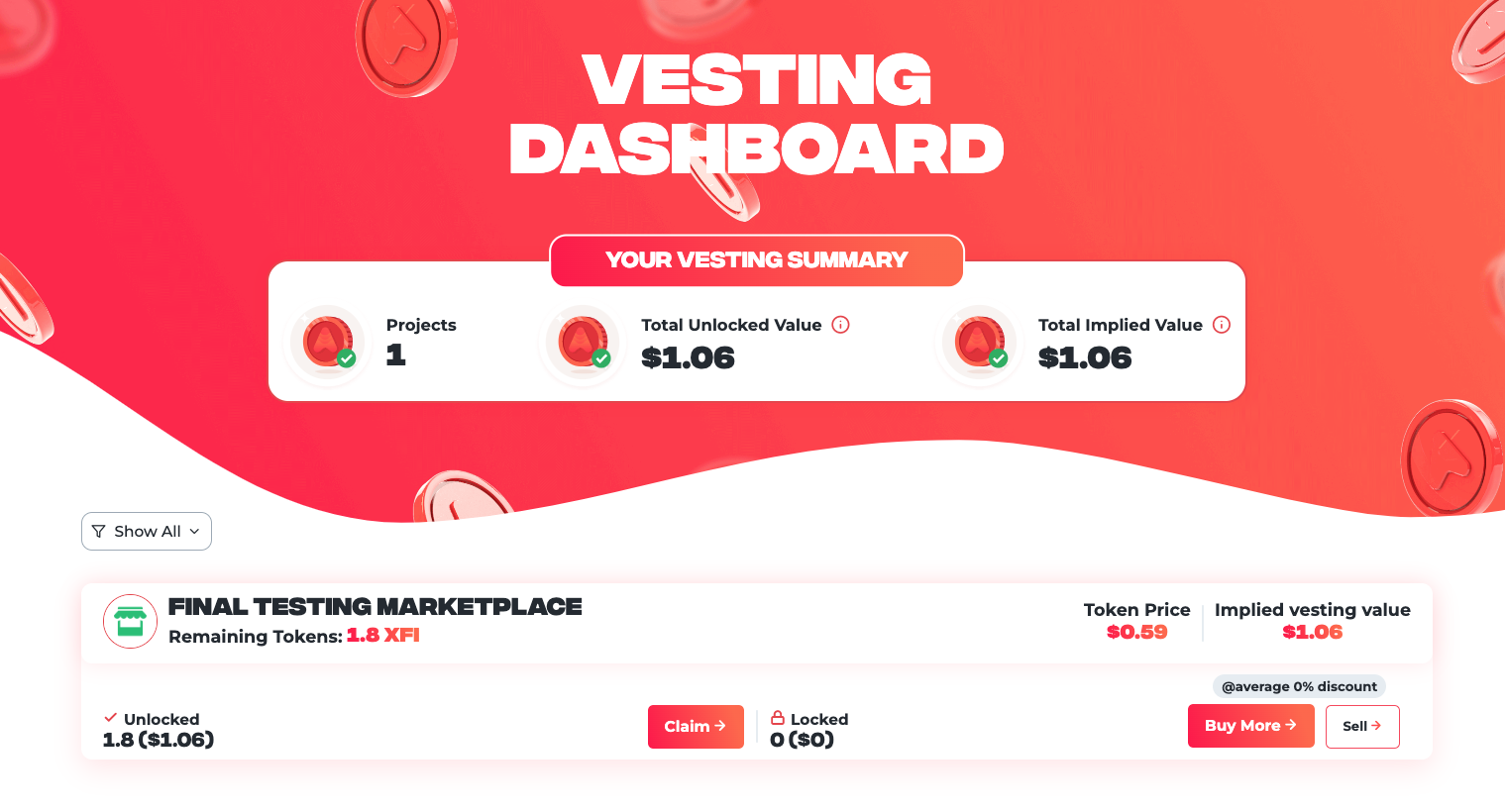

Avalaunch presents a public-facing dashboard for users to realize value from their vesting positions that allows token holders to buy and sell token vesting schedules, offering them a way to trade the right to receive tokens in the future.

Here are some of the key features and functionalities:

- Token vesting schedules: The dashboard displays the IDO token vesting schedules available for trade, including:

- Unlocked Value—tokens which have been or are currently claimable

- Implied Value—the total value of an allocation, both claimable and vesting.

- The duration of the vesting period and the release schedule.

- Total Token Position—both unlocked and vesting

- Trading functionality: a user-friendly platform for buying and selling vested tokens in real-time with order matching and settlement.

- Price discovery: The marketplace will not use algorithms to determine price but user supply and demand to ensure fairness and efficiency.

- Transparency: The Avalaunch marketplace provides users with a clear and transparent view of their balances and positions in order to make informed decisions.

Let’s use a practical example to tie it all together.

A user participates in an IDO that vests over a period of 1 month, with two unlocks (one at TGE and one 30 days later), creating 2 vesting portions. They decide that they want to participate in the first unlock, but would like to put the remaining portion up on the marketplace. Because the unlock occur in the future and not having immediate access to the tokens creates additional risk, the claim to these tokens should be offered at some discount to make it attractive to potential buyers.

At this point, anyone can come to the marketplace and purchase these tokens, or more specifically, the right to claim them once they unlock in 30 days. Buyers on the marketplace do not need to KYC or have participated in the IDO. Once they acquire the tokens on the marketplace, they will show up in their token dashboard, available to claim at unlock, as if they had participated in the IDO. In this example there were only 2 vested portions, however if there were more, they could offer up any combination of future unlocks to fit their specific strategy.

Wrapping Up

The above was a simple introduction to the Vesting Marketplace, it’s features and implications for projects and users. We have released user guides for step-by-step instructions and will be talking more about it in the coming days and weeks.

With a user-friendly interface, demand based price discovery and secure trading functionality, a token vesting marketplace is an essential tool for Avalaunch for launching projects and participants. Beginning with Deepwaters, Avalaunch believes that the functionality of a marketplace and the convenience of a robust dashboard will slowly become a staple in a growing list of forthcoming products and services. Avalaunch looks forward to sharing more detailed instructions and information as the launch date draws nearer.

User Guide: Video Tutorial

-

How to Use the Vesting Marketplace

Watch this video to learn how to claim, buy and sell vesting portions on the Avalaunch Vesting Dashboard & Vesting Marketplace.

Importnat Note:

All sales previous to the Deepwaters IDO in February 2023 will not have Vesting Marketplace support. In other words, you will not be able to buy or sell vesting positions on the vesting marketplace for any sale before Deepwaters.

-

Deepwaters AMA #2 – Technical Deep Dive (Recap)

On 02/09/2023 at 6:00 p.m. (PST), an AMA session was held on Avalaunch Telegram with Zorrik Voldman (CEO), Michael Callahan (VP of Marketing), and Greg Barnes (CTO) to cover the technical underpinnings of the project. The focus of this AMA will be the underlying tech development and roadmap.

Below we present to you an excerpt from AMA with questions and answers.

Dave | Avalaunch

Hello again Avalaunch Community and welcome to the sequel AMA with Deepwaters. In part II we will be doing more of a technical deep dive on the project and bringing us some no joke Deepwaters excellence are @zscape0 CEO and Architect, CTO extraordinaire @gregkbarnes and their Market Director, the venerable @mscallahan . Thank you for joining us. How are you all doing today?

And, for an additional cameo we will have their Chief of Staff, @CarltonHoyt

Greg | Deepwaters

Excited to be here and generally not sleeping: getting ever so close to our launch.

Dave | Avalaunch

Can you please tell us a little bit about yourself? Where were you before you started working on Deepwaters?

Greg | Deepwaters

We definitely have a diverse set of backgrounds:

For me: I actually discovered Bitcoin in a past life, when I played poker professionally. From there, it led me into starting a mining operation in Washington State (cheap hydro power) and then into Ethereum, defi and beyond.

Zorrik | Deepwaters

Deepwaters actually pulled me out of early retirement. I was in Kauai , surfing and dreaming of the next best thing, when the idea hit me.

Carlton | Deepwaters

Mid 2021? Deep in covid quarantine.

Jokes aside, I have a background in life science marketing and once upon a time I got a PhD in neuroscience.

Dave | Avalaunch

I have mixed feelings about you leaving that set up but I’m glad you did nonetheless.

Well you put your grey matter to good use. Cheers.

Zorrik | Deepwaters

In past life I started a few fintech companies, sold some to public companies, ran a hedge fund as a quant and created a military communication system that a few countries around the world are using

Dave | Avalaunch

This is a well qualified group to be sure.

Considering the collapse of FTX and how the narrative is to keep away from custodial parties, how does Deepwaters as a hybrid architecture of finance and blockchain position itself as a cryptocurrency exchange, one in which customers can trust and use?

Zorrik | Deepwaters

Couldn’t be happier. This is the most exciting project I have ever worked on.

Simply put, we are a marketplace whose priority #1 is to remove any potential of privileged operations from all parties, including Deepwaters. Beyond custody, and equally important, is order flow protection, which is our main thesis.

Dave | Avalaunch

Excellent. Thank you for that. What are some of the strategies that Deepwater will use to stay above this competitive environment, particularly what options will you provide for onboarding the first wave of users and ensuring their retention?

Zorrik | Deepwaters

What has proven effective so far is staying true to our mission. You would be surprised how many very profitable ways there are to dilute the uncompromising stand on custody and orderflow. If we continue to demonstrate a competitive market place, we will remain competitive. The direct measures we are taking are not unlike the strategy that PayPal employed: reward participation and referral of new participating clients.

Carlton | Deepwaters

We also just announced a really cool promo where everyone who signs up by the end of the day on our launch day (the 14th) gets max VIP tier for one year.

Dave | Avalaunch

Can you explain in more detail how Deepwaters aims to circumvent the impermanent loss (IL) problem ubiquitous to the LP mechanism?

Greg | Deepwaters

Deepwaters is a pure order book. As such it does not have an Automatic Market Maker based LP mechanism. However, we are looking at allowing clients to participate in the liquidity provision and profit sharing through market makers that are going to be trading on Deepwaters. The big difference here is instead of naive buy high and sell low implementation of AMM LP, your money is being used by an intelligent and experienced market maker.

Note, MMs do not have privileged rights or access on Deepwaters but they are protected from the exchange trading against them. Potentially, this will have a positive effect on ultimate profitability.

Dave | Avalaunch

That’s smart and has been notably problematic in crypto.

Greg | Deepwaters

Not for long 😉

Dave | Avalaunch

Amen.

Greg | Deepwaters

Building an exchange the RIGHT way should be simple. Focus on transparency, fairness for all players, and make it provable!

Dave | Avalaunch

Simple is not always easy so kudos to you. Which legislation will Deepwaters be operating under? Any counties that will be excluded from accessing the platform? Do you envision any difficulties in expanding the services to other countries?

Carlton | Deepwaters

Deepwaters is operating under the laws of the Czech Republic, and therefore also the European Union. We’ll have to exclude countries with broad financial sanctions:

• Cuba, some occupied parts of Ukraine, Iran, Afghanistan, Russia, Syria, and North Korea.

We’re also excluding some non-EU jurisdictions with very well-defined regulatory regimes:

• United States, Canada, United Kingdom, Switzerland, United Arab Emirates, Singapore, Japan, Australia.Greg | Deepwaters

All of those we plan to get licensure for, in time. Doing things the ‘right way’ and remaining compliant take time and resources. We are devoted to this cause.

Dave | Avalaunch

Well let’s hope the governing bodies can stay out of the way of progress.

How will the initial liquidity be provided, will there be looping in of liquidity from other CEXs and DEXs?

Zorrik | Deepwaters

The initial liquidity will be provided by the market makers, which is a superior way to create liquidity with the best spread and depth. We are working with aggregators for backstop, as well.

Dave | Avalaunch

Who will be your KYC/AML provider, and how much customer data will you store and for how long? Do you have your own server for data storage, and who will have access to this data?

Carlton | Deepwaters

We’re working with Fractal for KYC/AML. We are required to keep records safely on EU servers, since we’re based there. Access is limited to personnel with a need to be able to access it for compliance or technical purposes.

Dave | Avalaunch

Will Deepwaters be accepting fiat? If so, which currencies do you expect to be supporting and what system will you be using for providing this?

Greg | Deepwaters

Soon! Day one, crypto only. But we will integrate fiat rails and make announcements around supported currencies in the near future. We’re not 100% certain what provider we’ll be using for fiat rails, but we’re currently leaning towards BCB.

Carlton | Deepwaters

FYI, BCB is a super crpyto-friendly bank in the UK.

Dave | Avalaunch

Let’s hope it stays that way. 😁

What’s the hierarchical structure for users to gain access to the platform? What are the main functions non-KYC’ed vs a KYC’ed users will be able to access?Zorrik | Deepwaters

Only KYC’d users can trade. Users, who go through source of funds declaration will have much higher deposit and withdrawal limits, but it won’t be required.

Dave | Avalaunch

What security measures does Deepwaters have in place? Will there be proof of reserve available? What about 2FA?

Greg | Deepwaters

That’s a good question and something we’re particularly proud of.

Deepwaters Beta uses EIP-712-based transaction signing. We require you to sign actions (trades, withdrawals, etc.) with your private key using your favorite web3 wallet. Customer funds are trackable in Deepwaters’ PositionManager smart contracts.

In the coming months we will be expanding our offering and integration with best-in-class custodians (Fireblocks and Qredo).

Dave | Avalaunch

That’s a good answer. You’re on top of this stuff and are looking ahead which is particularly important in the current landscape.

How will withdrawals work? Do you have wallet whitelisting functionality?

Greg | Deepwaters

That’s correct.

In Beta, withdrawals work by using your own wallet signature and broadcasting the tx on-chain yourself.

Carlton | Deepwaters

Your wallet is your remote control for your funds on Deepwaters!

Dave | Avalaunch

That definitely works.

Can you tell us more about the structure of the different wallets and deposit options? How do you ensure that customer funds/deposits are not commingled with company funds? Will there be any transparency in this regard?

Greg | Deepwaters

The PositionManager that we mentioned before leaves a on-chain trail of all deposits and withdrawals.

The best way to deal with this is transparency combined with legal structures and auditing that provide oversight.

Our PositionManager smart contracts hold strictly customer assets and are responsible for deposits, withdrawals, and settlement between customers.

We’ve got big plans around auditing and transparency (the sexiest topic). This starts with 3rd party audits and extends to including Deepwaters validators in on the auditing process.

Dave | Avalaunch

Nothing sexier than a good audit.

Zorrik | Deepwaters

Maybe slow audit

Dave | Avalaunch

And a final question before we move on to the Twitter/Community portion of the program — Are there any other points you’d like to tell us more about to better understand the platform?

Carlton | Deepwaters

If you look at almost all of the big implosions in crypto in 2022, they weren’t because of external bad actors or hacks. They were essentially inside jobs. The operators of the platforms were doing things they shouldn’t have. You can easily create a set of rules which would prevent any and all of those things, while making trading more fair to everyone at the same time. You can solve all these problems with technology, and that is precisely what we are aiming to do.

Join us on our mission, everyone! We welcome you to sign up at https://app.deepwaters.xyz/

Things only change if you vote with your wallet (so to speak).

Dave | Avalaunch

Absolutely. A decentralized protocol is most vulnerable to its own creators. Well said.

Good link to check out.

Community Questions

Dave | Avalaunch

So first up from our community is a virtual assasin. @bookieassassin asks — If I want to participate in governance, is it the WTR token or the ZRB token I need to hold?

Carlton | Deepwaters

WTR. ZRB will act like an ETF. It’s a really cool product but it won’t be ready for a while.

Dave | Avalaunch

Understood. Next up comes from @AguedaShank1998 — Who are the ideal target users for Deepwaters?

Carlton | Deepwaters

Are we allowed to say everyone?

Dave | Avalaunch

You have clearance from the FCC on this, yes.

Zorrik | Deepwaters

Anyone who cares about the best price discovery and execution. And yes, that would include market makers who once in a while have to go flat on their risk.

This includes: retail traders, quants (who would love viable market orders, 100% price improvement and low adverse selection) and institutionals.

Dave | Avalaunch

Good looking out for retail traders. They’ve been through enough.

A common question that gets asked. @spanser77 During the creation of your project, do you consider community feedback or requests to further expand new ideas for the project?

Greg | Deepwaters

1,000% — Yes. We have gotten great feedback and support from our time in testnet. We look forward to listening and learning from our community.

Michael | Deepwaters

300k+Carlton | Deepwaters

King of context right here.

Dave | Avalaunch

and you have a massive community that can attest to this. Prop.

Zorrik | Deepwaters