-

Castle of Blackwater x Avalaunch: IDO Announcement

Castle of Blackwater is a thrilling social deduction game on Beam, merging a mysterious world of trust and betrayal, with powerful Web3 features that rewards players for their skill and engagement. It elevates the social deduction genre by intertwining innovative gameplay with an ownership-driven social experience, allowing players to deeply engage and form a passionate community around the intrigue and magic of Blackwater Town.

Trust or Treachery: The Battle Within Blackwater Castle

Set in the perilous confines of Blackwater Castle, up to 15 players are cast into one of three distinct factions, each offering unique play styles and strategies for victory. Players must navigate alliances and deception in a high-stakes battle between good and evil, with only one side emerging victorious.

Each containing a set of diverse characters, the factions are:

- The Protectors: Emblematic of teamwork, compassion, and trust, this faction embodies the forces of good. Their goal is to collaboratively complete tasks assigned by the castle.

- The Satanic: A group of malevolent scholars intent on overthrowing and ruling through sabotage and blood sacrifice. Their tactics revolve around gaining the castle’s favor by deceiving the other factions.

- The Forgotten: These are the most selfish individuals of the party, made up of scholars on the brink of madness due to information overload, losing loved ones to the castle or social alienation. They navigate the game by manipulating both allies and enemies, embodying a wildcard element in the gameplay.

In Castle of Blackwater, players must leverage their faction’s strengths and exploit their opponents’ weaknesses, using deduction and strategy to survive and escape with their lives intact.

The game progresses through a series of recurring cycles, made up of a day cycle, a night cycle, and a voting round. During the day, players must choose from an endless list of tasks, presenting an extensive array of challenges. As nightfall envelopes the castle, shadows lengthen and darkness creeps into every corner, rendering visibility almost nonexistent. In this veil of obscurity, the castle becomes a Satanic playground, allowing for unseen forces to eliminate victims with chilling precision. Finally, in the voting round, accusations fly and fates are sealed. Those deemed guilty are mercilessly executed by the castle.

Crafting the Optimal Web3 Economy

Castle of Blackwater integrates Web3 features to deepen player engagement and establish ownership over in-game items and the economy, to allow for aligned incentives. By leveraging Beam, Castle of Blackwater provides a frictionless introduction to these Web3 features for fans of the social deduction genre.

The game represents an evolution of the Play-to-Earn (P2E) model that has significantly impacted Web3 gaming. It aims to develop a sustainable economy across diverse game modes to appeal to all players, whether they are just playing for fun or wish to maximize their earnings. By offering both casual and ranked modes, Castle of Blackwater is able to cater to a wide spectrum of player types. Each game mode is designed with its own economic framework and balancing mechanisms, to ensure that Castle of Blackwater can accommodate player growth whilst maintaining a healthy economy.

For competitive players, ranked mode introduces a dual-token system, consisting of the COBS utility token and COBE, the value accrual token. This intricately designed Web3 economy carefully balances value creation and extraction, strategically finding an equilibrium between the two.

By separating the two tokens, Castle of Blackwater is able to implement specialized balancing mechanisms to ensure the game’s scalability and sustainability. This approach also aligns players more closely with the game’s growth and differentiates speculative activities from genuine in-game utility. Castle of Blackwater’s deep focus on its rewards and utility system showcases their pioneering efforts in establishing a sustainable economic model for Web3 games to flourish.

COBE Utility

- Earned through official tournaments and community events – players are rewarded for their skill, with increasing incentives for high-skilled players. This approach fosters long-lasting player relationships and ensures rewards cannot be farmed.

- Buying premium assets such as ranked characters and cosmetics.

- Buying future exclusive land plots and living spaces in Blackwater Town.

- Governance voting rights on topics such as product development priorities and the allocation of COBE collected from marketplace sales.

Team

Partners & Backers

“Remo and Jojo are entrepreneurs pur-sang. I haven’t met many people who can get so much done with such limited resources. They have domain expertise in so many areas due to sheer willpower and the ability to pick up new skills very quickly.

It’s incredible how much passion they have for this project and for the game they are building. I am confident they will grind for as long as its needed to make this a success.

They have also built a great team around them in the past year. Displaying both good leadership and management skills. In part because the resources were initially limited, they positively selected people who have a passion for the project & game itself, without sacrificing skill or competence.

Rarely do we see teams with the web3 know-how and the actual game-building know-how combined across the team. CoB has this. They have already proven they can harness web3 elements successfully and foster a web3 community. While they are now also proving they can build a comprehensive game and integrate the two worlds into each other.

Social deduction is an underserved genre in our opinion, one that can be very suited for web3 mechanics.

At Merit Circle we are very excited to have entered into a very close partnership with CoB. We have big expectations for the project and we will do our part in making it a success.”

— Tommy Quite, Merit Circle

Official Links

Website | Game | Twitter | Discord | Youtube

Castle of Blackwater: Avalaunch IDO

Castle of Blackwater team on working with Avalaunch:

“Since our very first meeting, the Avalaunch team have been nothing but professional, supportive and friendly. Their understanding of the AVAX ecosystem, and how to run a successful IDO campaign, is both admirable and reassuring. We look forward to our continued collaboration.”

Funding Numbers

- Seed Round – 750K USD – 10M COBE at 0.075 USD

- Strategic Round – 1M USD – 10M COBE at 0.1 USD

- Private Round – 600K USD – 4M COBE at 0.15 USD

- Public Round* – 1.3M USD – 6.5M COBE at 0.2 USD

Total Raise: 3.65M USD

*Avalaunch IDO – 400K USD - 2M COBE at 0.2 USD per token

Supply Breakdown

Total Supply: 100,000,000 (COBE)

- Community Initial Distribution: 1M COBE (1%)

- Creator/Builder Fund: 5M COBE (5%)

- Tournaments: 5M COBE (5%)

- Marketing: 5M COBE (5%)

- Player incentives/rewards: 16.5M COBE (16.5%)

- Treasury: 10M COBE (10%)

- Team: 15M COBE (15%)

- Advisors: 5M COBE (5%)

- Seed Round (Incubation): 10M COBE (10%)

- Strategic Round: 10M COBE (10%)

- Private Round (Holders): 4M COBE (4%)

- Public Round: 6.5M COBE (6.5%)

- Liquidity: 7M COBE (7%)

Note: COBE tokens allocated for the Creator/Builder Fund, Tournaments, Marketing, Player Incentives and the Treasury will not necessarily be brought into circulation at once when they reach their respective unlocks, as these tokens will only be utilized to benefit the game when relevant.

Vesting Following TGE

- Community Initial Distribution: 100% unlocked at TGE

- Creator/Builder fund: 12 months cliff, 12 months linear vesting

- Tournaments: 12 months cliff, 24 months linear vesting

- Marketing: 36 months linear vesting

- Player incentives/rewards: 60 months exponential vesting increasing with 1.6% monthly until fully vested

- Treasury: 12 months cliff, 36 months linear vesting

- Team: 12 months cliff, 36 months linear vesting

- Advisors: 12 months cliff, 36 months linear vesting

- Seed Round (Incubation): 6% unlocked at TGE, 6 months cliff, 20 months linear vesting

- Strategic Round: 8% unlocked at TGE, 6 months cliff, 18 months linear vesting

- Private Round (Holders): 15% unlocked at TGE, 4 months cliff, 8 months linear vesting

- Public Round: 20% unlocked at TGE, 1 month cliff, 7 months linear vesting

- Liquidity: 50% unlocked at TGE, 6 months cliff, 4 months linear vesting

Other Info

- Initial Liquidity: 200K USD and COBE

- Initial Circulating Supply: 4.30%

- Initial Market Cap: $860,000 (excluding liquidity)

- Avalaunch IDO: 400K USD - 2M COBE at 0.2 USD per token

Castle of Blackwater IDO Schedule

Registration Schedule

Registration Opens: Tuesday, March 19 at 3:00 p.m. (UTC)

Registration Closes: Sunday, March 24 at 6:00 p.m. (UTC)Sale Schedule

Validator Round Begins: Tuesday, March 26 at 6:00 a.m. (UTC)

Validator Round Closes: Tuesday, March 26 at 3:30 p.m. (UTC)Staking Round Begins: Tuesday, March 26 at 3:30 p.m. (UTC)

Staking Round Closes: Wednesday, March 27 at 6:00 a.m. (UTC)Booster Round Begins: Wednesday, March 27 at 6:00 a.m. (UTC)

Booster Round Closes: Wednesday, March 27 at 10:30 a.m. (UTC)How to Participate

To participate in Avalaunch sales, users will have to:

- Complete their KYC Registration | Tutorial

- Stake XAVA to secure their allocation | Tutorial

- Register for the sale when Registration opens | Tutorial

About Castle of Blackwater

At its core, Castle of Blackwater is a next-generation social deduction game, where players are caught in a magical castle of mystery and deception. With its thrillingly suspenseful gameplay, and innovative blockchain-powered game economics, Castle of Blackwater seeks to prove how web3 technologies can best be applied in the world of social gaming.

About Avalaunch

Avalaunch is a launchpad powered by the Avalanche platform, allowing new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With its values deeply rooted in the early Avalanche community, we are able to offer projects confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem. Leveraging Avalanche’s scalable, high-throughput, and low-latency platform, Avalaunch is built by users, for teams, to help grow strong communities.

-

Avalaunch Licensed Fork Program: Enter Seijin!

Avalaunch is proud to announce the launch of its highly anticipated Licensed Fork Program, beginning with its reach to the SEI blockchain and the first native launchpad, Seijin. This strategic move underscores Avalaunch’s commitment to fostering a more interconnected and robust digital asset ecosystem and exposing XAVA holders to it.

Ultimately, Avalaunch believes chains will be interoperable and there are certainly synergies to be explored with some of the most innovative blockchains that have been engineered to enable new types of applications to be built. As its core, the Licensed Fork program is designed to allow the Avalaunch team to continue its efforts on Avalanche while extending the our ethos, community and unique style of collaboration to growing blockchains.

Parallel EVMs : The Biggest Narrative Of 2024

At the heart of the SEI blockchain is parallelized Ethereum Virtual Machine (EVM), an approach that can enhance transaction throughput and efficiency, allowing for multiple transactions to be processed in parallel, rather than sequentially. This can reduce bottlenecks and improve the scalability of the network and with this design, solve one of the limitations of the EVM. The parallelized EVM enables decentralized applications (dApps) to perform at greater speeds, making the SEI blockchain highly responsive and scalable for dApps. SEI aims to set a new standard for performance and usability in the ecosystem as the next generation of Layer 1 blockchains improve upon their predecessors.

Airdrops: Much More Than A Reward

As outlined within the core tenets of the Licensed Fork Program, XAVA stakers will receive an exclusive token airdrop of the Seijin token, marking a significant milestone in the Avalaunch journey. The specific details will be released soon, but both teams are committed to making sure the history and value of the original Avalaunch community is recognized.

This partnership between Avalaunch and SEI represents a commitment to sharing value and exposure across ecosystems. We want this to stand as a powerful model of cooperation over competition with the clear understanding that a shared audience of educated users holds far more sway than an isolated one.

The airdrop itself represents more than a reward. It is an invitation to pass through a gateway that encourages and supports the launch of groundbreaking projects on the SEI blockchain as well as Avalaunch.

Foundation & Ecosystem Support

As with Avalaunch, it’s important that any expansion into other chains is underpinned by a strong relationship to the community and culture. Therefore, we want to thank the SEI Foundation for being so receptive to this collaboration as they stepped up with robust support for this initiative, underscoring their broader commitment to fostering innovation and growth. Avalaunch is honored to be able to garner this trust and use our technology and expertise to play a part in their growth.

This unprecedented collaboration paves the way for XAVA holders to be at the forefront of the SEI blockchain’s evolution, offering them a unique opportunity to contribute to and benefit from our collective successes.

Avalaunch Licensed Fork Program: Bridging Gaps, Building Futures

Avalaunch’s Licensed Fork Program has been meticulously designed to empower project creators, offering them a robust suite of tools and resources to launch their projects successfully. This program not only provides a secure and transparent platform for fundraising but also ensures compliance and governance standards are met, fostering trust and reliability within the ecosystem. To quote from the original article on who can qualify for a fork:

“Avalaunch’s brand represents a commitment to nurturing innovation and empowering teams as well as communities to directly contribute to the growth of the industry.

- Teams who are granted a license will be expected to:

- Understand and commit to Avalaunch’s principles.

- Recognize that in addition to forking any technological solutions, they will also be adopting Avalaunch’s philosophical and cultural ethos.

It is essential to ensure that the integrity of this vision is preserved. Therefore, licenses will only be granted to teams demonstrating deep alignment with Avalaunch’s values.”

Avalaunch has every confidence that the team is up to the task and committed to be the premier launchpad on the SEI blockchain. By extending this program, Avalaunch is inviting a new wave of innovation and creativity. Developers on the SEI blockchain can now leverage Avalaunch’s proven launchpad mechanisms, tailored support, and extensive network to amplify their reach and impact.

What’s Next?

As we embark on this exciting journey, Seijin is dedicated to supporting the vibrant community of developers, creators, and users on the SEI blockchain. We are excited to see the innovative projects and groundbreaking ideas that will emerge from this collaboration.

Stay tuned for further updates, including detailed guides on how to participate in the Licensed Fork Program and how this new project will reward Avalaunch token stakers! Avalaunch looks forward to introducing the Seijin team and to making waves with a number of already slated launches.

For the SEI incumbents fret not as we look forward to a collaborative announcement with the first native DEX on SEI—Dragon Swap.

About Avalaunch

Avalaunch is a leading blockchain platform dedicated to accelerating the growth of innovative projects in the digital asset space. Through its Licensed Fork Program and other initiatives, Avalaunch provides the tools, resources, and community support necessary for successful project launches.

Website | Twitter | Telegram | YouTube | Announcements | Blog

- Teams who are granted a license will be expected to:

-

Upcoming IDOs in March

With March underway, we are excited to present the next 2 upcoming IDOs on Avalaunch! Our commitment lies in introducing the highest quality projects to the Avalaunch community — projects at the forefront of innovation and creativity within the Web3 space. These upcoming IDOs represent some of the best work being done across DeFi and Web3 gaming in the Avalanche ecosystem and we are thrilled to be able to share them with our community.

Castle of Blackwater

Castle of Blackwater is building one of the most high-anticipated games in the Beam ecosystem. This enchanting social deduction game blends traditional gameplay with powerful Web3 features, fostering a community-driven social experience where players have true ownership of their in-game assets.

In a thrilling game of trust and betrayal, players will find themselves trapped in a perilous castle, filled with danger and deception. You have one mission – do anything in your power to make it out alive. Whether this requires you to form strategic alliances or deceive your friends – you must prioritize your own survival above all else.

Focused on creating a sustainable economy, Castle of Blackwater caters to a wide range of players. Whether engaging casually for entertainment or aiming to optimize earnings, the game’s meticulously designed economy ensures balance and inclusivity. Castle of Blackwater is playing an instrumental role in advancing the Web3 gaming movement, delving into the economic models initiated by the play-to-earn concept. Being deeply committed to sharing its success with a dedicated player base, this is an opportunity to be part of one of the most exciting games coming to market.

Are you prepared to navigate the treachery, deceit and secret alliances that lie deep within the castle’s walls?

Arrow Markets

Natively building on Avalanche since 2021, Arrow Markets is dedicated to revolutionizing the options trading market. At its core, Arrow is focused on creating a highly streamlined user experience. In doing so, Arrow Markets aims to make options trading accessible to a broad audience. It empowers users to learn and develop their own trading strategies, thus lowering the entry barrier for beginners while also catering to the sophisticated demands of professional traders.

By operating on-chain and eliminating the need for any intermediaries, Arrow is able to offer a trustless platform for options trading, ensuring that value is directly returned to its users and liquidity providers. This approach positions Arrow as the most cost-efficient platform in the industry for options trading, providing users with the best possible prices in the market. As a foundational layer in the DeFi space, Arrow paves the way for the creation of innovative derivatives and structured products.

With the upcoming launch of Arrow V2, users can look forward to experiencing the enhancements brought about by its RFQ (Request for Quote) system. Arrow Markets has chosen to deploy on Avalanche due to its high throughput, robust security and low transaction fees, aiming to explore new opportunities in options trading and further enriching the DeFi ecosystem.

IDO Dates

Castle of Blackwater

Registration: 3/19/24 – 3/24/24

IDO: 3/26/24 – 3/27/24

Arrow Markets

ℹ️ Please note that the Arrow Markets team have decided to reschedule their IDO to a date in April – we will make an official announcement when dates have been finalized.

Registration: TBD

IDO: TBD

Stay tuned for the release of full IDO details for each project, including detailed IDO schedules and funding information.

-

Aether Games Sale: wAEG sent

Last week, Aether Games completed their Strategic Sale on Avalaunch:

- Raised: $300,000

- Participants: 3922

The purchased wAEG has now been sent and participants of Aether Games’ sale just have to wait until the TGE (March 7) to unwrap their wAEG and unlock the full utility of their AEG tokens.

In this article, we will break down how to check your wAEG balance and the next steps for sale participants.

✅ wAEG sent

⏰ Aether Games TGE on March 7wAEG Sent

📩 Participants who successfully registered and purchased their allocations have now been sent their purchased wAEG to the wallet used to participate in the sale.

Please note – This has taken place on the Polygon network. This is because Aether Games will be migrating to Avalanche but their token was originally minted on Polygon before determining that Avalanche is a better fit.

To check your wAEG balance,

- Simply add Polygon network to your wallet

- Import the wAEG contract address – 0xd31E99B72455dC526b56654B254EA07e3F889ed2

Adding Polygon Network to Metamask:

To add Polygon to Metamask please go here for simple instructions.

You can also manually add Polygon with the information below:

- Network Name: Polygon Mainnet

- New RPC URL: https://polygon-rpc.com

- Chain ID: 137

- Currency Symbol: MATIC

- Block Explorer URL: https://polygonscan.com

Adding wAEG as an asset:

You can visit Polygon’s Metamask guide and scroll to “Adding Assets” or follow the instructions below:

- Select Polygon Matic network

- Click “Import token”

- Paste in the wrapped AEG contract address: 0xd31E99B72455dC526b56654B254EA07e3F889ed2

- To see your wAEG balance, please visit here to see balance on the Polygon Scan explorer

This works for Metamask, Trust Wallet or any other wallet (on desktop and mobile).

Aether Games TGE

During the TGE on March 7, Aether Games will open up a dedicated Claim Portal for a hassle-free unwrapping process.

Since this will take place on Polygon and requires MATIC as a gas fee, participants have been airdropped 0.2 MATIC to streamline the unwrapping process.

In the Claim Portal, Avalaunch’s Strategic Sale participants will be able to swap their wAEG for AEG in accordance to the vesting schedule. Once your AEG is unwrapped, it will become freely traded and utilized in the Aether universe.

For any questions, please join our Avalaunch Telegram group and our support team will be ready to assist!

-

Aether Games AMA: Project Overview (Recap)

On Friday, January 19 at 0:00 a.m. (UTC), we hosted an AMA on the Avalaunch Telegram group with Dreadsong from the Aether Games team. We learnt about their grand vision and what sets them apart from the competition in the Web3 gaming space. This was also an opportunity for the Avalaunch to ask their questions – congratulations to those who were selected!

Below you can read our AMA session with Aether Games:

Aether Games x Avalaunch AMA

Avalaunch

Ladies and Gentlemen, esteemed guests, and passionate gamers from around the world, welcome to this exclusive and exhilarating AMA brought to you by Avalaunch. Today, we are beyond thrilled to have the unique opportunity to delve deep into the world of gaming with the brilliant minds behind Aether Games.

Today we have an esteemed part of the Aether team, @DreadsongAEG

@DreadsongAEG how are you today?

Dreadsong | Aether Games

Pretty good overall

A bit awkward on the timezone though as it’s currently 1am

So hopefully I don’t do any blunders in text due to the late time on my end haha

Avalaunch

Let’s delve right in then as it’s later than is ideal. Blunders will be promptly forgiven. Can you give us a brief intro of yourself and how you became involved with Aether Games?

Dreadsong | Aether Games

Absolutely

Hello everyone — Dreadsong here, BD and AMA host of AetherGames; I’ve joined the crypto space back in the bullrun of 2021, interested primarily in the tech and the overall aggressive growth of the industry. Been involved with all branches of the crypto market since then — DeFi sector, GameFi or NFTs, I’ve worked in each sector and know each of them quite well. Besides this, I have a background of having worked at EA Games and Bioware for a few years, specifically on titles like FIFA, Need for Speed and Anthem. Graduated Foreign Languages, philology branch, with a major in Slavistics and a minor in English.

As for my involvement with Aether; I have been with the company since essentially day 0. Aether launched their community back in November 2021 and I joined a day after server launch on the back of one of the communities I was a part of. Ever since then, I stayed with the company, and at this stage, have literally been with them through good and the absolute worst (this bear was a headache and a half)

Not quite brief but hey — gotta keep it spiced up

Avalaunch

Welcome Class of 2021! Always good to see survivors who have been forged in the crucible of a long bear market. Makes for more resilient teams. Appreciate the answer. Can you give our audience an overview of the vision at Aether Games and what the team has built so far?

Dreadsong | Aether Games

Definitely — for starters;

To give a general introduction on what AetherGames is, we’re a Web2.5 transmedia development studio focused on gaming and entertainment. Currently, we specifically focus on blending traditional and blockchain gaming, aiming at merging fantasy narratives with blockchain technology.

As a transmedia company, we are currently engaged in two major ventures: the gaming industry which we’ve tapped into with our gaming title, Aether TCG — this being our card game which doubles down as an IP platform utilizing a Gaming as a service model, and our forthcoming endeavor in the entertainment industry with our series, the Aether Saga, which we’ve actually teased on the 14th of December, with a bit of the starting sequence from the first episode

From a team perspective, we have a team that boasts both heavy gaming AND entertainment experience, who’ve been involved in the production of a number of very popular AAA titles such as the latest 2023 Game of the Year-winning Baldur’s Gate 3, and other titles such as Hearthstone, FarCry6, God of War, Raid: Shadowlegends and plenty others

Our CGI director has also been involved in the making of 2 very popular Love, Death & Robots episodes, specifically Snow in the Desert and Beyond the Aquila Rift

Besides these, we’ve also been the Golden Reel Awards Judge since 2016, with 2023 included.

Avalaunch

This is an impressive set of resumes to be sure and web2.5 is coinable if that wasn’t you. Great work on the fundamentals which looks like it could be a great driver for the token which brings me to…

Registration for the Aether Games strategic sale is now open, users can get their hands on AEG — the token powering the Aether universe. Can you talk about the utility of AEG and what built-in mechanics you have to ensure it accrues value and can support sustainable long-term growth?

Dreadsong | Aether Games

Let’s dive into the above more in-depth:

Currently, in our ecosystem, there’s🥇and ❄️

🥇is not a token but simply a game currency to purchase any asset (not NFT). This ranges from cards, pets, heroes, maps, emotes, cosmetics and campaign mode content.

It cannot be sold and is locked to your game account.

❄️ is the token and is used as a crafting material

Simply put: cards + ❄️ = NFT

This counts for any asset.

NFTs are traded and sold among each other and purchased later on through our marketplace using ❄️ as the currency, and along the way as our gas fee also.Rewards that are given are mostly 🥇 , non-NFT assets and crafting materials (dragon tooth, demon eye etc.)

When there’s a reward we give from events it’s always in USDT or assets.

Assets that are NFT can be disenchanted later on and you receive about 40–60% back based on the rarity of the card. For example a legendary card costs $10 fixed in ❄️ to convert, but when disenchanted you get $4–6 back albeit along with valuable crafting materials.

Legendary cards sell for $100–300 so there’s very little incentive to disenchant these, allowing for many tokens to be nested inside assets, and contributing towards a higher token price.

Avalaunch

I appreciate the stable coin part as well. This is pretty robust utlity and again, having to endure that headache and a half of a bear does help with ingenuity. Can you share details for the TGE and what plans you have for liquidity?

Dreadsong | Aether Games

Absolutely — TGE is currently planned for the end of February, after Chinese New Year. We’ll be listing on a Tier 1 exchange first and for a clean launch we will add liquidity on DEXs slightly after listing, in order to prevent any sort of snipers. We add more liquidity over time as the price discovers itself. However, we will not reveal the exact amount in the liquidity pool just yet, but it will obviously be a hefty amount.

Avalaunch

I could tell easily enough so we’re good. Moving on — Aether Games has some of the most talented team members from the gaming, entertainment and CGI industries. Can you share more about the team behind Aether? How does this unique blend of expertise help to set you apart from other studios?

Dreadsong | Aether Games

I covered this slightly in a previous answer, but to go further in-depth:

We have a strong founding team of 5 members, which includes the creator of Primal Carnage, an Esports celebrities manager, a Hollywood audio director, and a 6-year Unit Image CG Generalist veteran.

Essentially, what heavily sets us apart is that our in-house game development is on par with Blizzard, Ubisoft, and Riot Games. Our team encompasses CGI Hollywood-level producers, composers, and financial managers with accomplished projects for Netflix, Hulu, and HBO, that have worked on over 400 projects (games, series, movies)

Some of the previous titles worked on:

— SMITE

— Vikings: War of Clans

— Star Wars: Battlefront 2

— Hearthstone

— Raid: Shadowlegends

— Honor of Kings

— Primal Carnage (created by Aether Founding Member)

— Love, Death & RobotsAvalaunch

Appreciate the added detail and it’s good to emphasize the pedigree of this team and their work, so onto the game…The beta version of Aether’s Trading Card Game is currently live on the Epic Games Store. Could you share some details about the TCG? Additionally, what are the next steps on the Aether roadmap that the community can look forward to?

Dreadsong | Aether Games

You can look at us as essentially the Magic The Gathering of Web3 — we plan to utilize our game as a platform that houses a plethora of different IPs, with focus being set on Web2 IPs. We already have an extremely strong multi-billion dollar company signed in with us which will bring its own IP in for us to utilize in-game — this will later on be followed by other massive Web2 names.

This would cover both the game aspect and the roadmap: we are currently in talks with a multitude of entities and franchises such as Lord of the Rings, Game of Thrones, The Boys and are in very deep discussions with Warner Brothers, which would unlock us access to other major titles such as Mortal Kombat etc.

The above would be a pretty good vision into what our roadmap could look like over the coming months and years, with focus being on implementation of different franchises into our title and universe, and essentially, actively tapping into these massive Web2 fanbases.

Community Questions

Avalaunch

I’m sensing you’ve been asked these type of questions before 😃so let’s get a wild card into the mix and move right into the community portion of the program where things get weird and prizes are on the line.

Our friendly neighborhood @Fil936 asks — Do you plan to launch other games in addition to Aether TGC?

Dreadsong | Aether Games

Yes. Our plan is to launch a second game, albeit timeline on it is TBD, and as production on it has been paused (it was in active development prior to the release of our TCG) I cannot give too many details on it. Plans were originally for it to be an AR Pokemon-GO-type game, but we scrapped that idea and are now exploring other genres for it to release under

Avalaunch

That’s exciting stuff. @BGerbera wants to know — Why did Aether Games embrace both fiat currency and cryptocurrency for in-game purchase

Dreadsong | Aether Games

Ease of accessibility for both Web2 and Web3 audiences;

FIAT currency in-game purchases make it extremely easy for the average traditional gamer to jump into the game and purchase assets at his convenience, whilst the crypto purchases are optimal for the average Web3 user

Avalaunch

It’s that web2.5 thing. I think it’s smart. Anything to make that transition seamless and garner both audiences is a must at this point. Here’s @RopLen with a 2-parter — What reasons are there to continue playing for a player accustomed to this type of game? There are several card games out there, why should he choose Aether Games?

Dreadsong | Aether Games

We believe that from a quality perspective, we stand out quite heavily in comparison to our competitors.

There’s only a very specific title in the market currently that we would consider being on par with our level of quality, but they are very different from us so I wouldn’t say they’re direct competition.

At the end of the day, many card games in the market currently have the tendency to take their own spin to the genre, making it so that players have the liberty to choose which one fits their interests the best; be it Sci-Fi, Fantasy or more modern takes on TCGs

But for a more direct answer, our tournament systems definitely bring a motivational factor into play

Avalaunch

Yeah. There’s not a lot of discernment from crypto people when it comes to assessing offerings like this and yet, it makes all the difference. This team’s experience and development to date confers a lot of advantages.

Well done. How can I trade or sell my cards or characters with other players? What platform or marketplace should I use, and what commissions or taxes apply? From @SenaidHughes

Dreadsong | Aether Games

Cards are currently tradeable through the main popular Web3 marketplaces, such as OpenSea and Magic Eden, albeit we plan to introduce our own marketplace in the near future to maximize ease of access for this feature, essentially, at current stage.

You can utilize 3rd party platforms for the trading options — but soon enough everything will be possible to be done directly through our platform.

Avalaunch

An NFT platform is a project by itself so the comprehensiveness of what you’re building is impressive. Our very own @EvissFord_BTC has a question — One major fundamental weakness for many gaming and blockchain projects is an unsustainable fee vs reward model. How unique is the revenue model of Aether Games that enables it to remain sustainable for the long term?

Dreadsong | Aether Games

We are not a P2E game.

By default, this removes the unsustainability vs reward feature from the get-go.

The player reward system comes in through more of a skill 4 earn system (not exactly an official term in the markets, more like something I coined on the go lol), and it primarily rewards users through the tokenisation of assets functionality and participation into tournaments, giving us a heavy Esports setting from very early on.

As for the revenue part — we utilize a much more traditional Web2 approach, which is partially based on in-game purchases, but also on usage of our token.

Avalaunch

The irreverent @zenobiapollard72 believes in you all and wants to know how she can become an ambassador for Aether Games? Does Aether Games have any plans for building local communities, especially in non-English-speaking countries?

Dreadsong | Aether Games

We don’t currently have an ambassador program the type Web2 games do, and this is primarily due to our early development stage — however, we do indeed plan to aggressively extend throughout different sectors of the globe, and house local communities of different localizations; even now, we house quite a large Slavic player base.

Avalaunch

Well you have a request then. There is some good visibility for you all and Avalanche wants you all on a subnet but all in due course. Do the token holders have the right to participate in the governance of Aether Games? What kind of decisions can they vote on about Aether Games? What are the benefits of holding Aether Games tokens? Question brought to you by @Concutrangxoa

Dreadsong | Aether Games

Parts of this were briefly answered on the question regarding token utility — on the other end; we do have plans to organize a potential DAO, but it is still in the works; I cannot give an exact answer to the governance question as the system isn’t yet fully polished.

Avalaunch

Fair enough. Tell us a little bit about security at Aether Games. Have you done an audit of the platform? Are the smart contracts error-free? What are the test results? This is from none other than @EzequielMarrero

Dreadsong | Aether Games

We have done multiple audits which came back with near-perfect results, showcasing the overall stability and safety of the platform

Pretty straight-forward answer here

Avalaunch

That’s always good to hear, particularly the results as so many audits have to be dragged out for myriad reasons. Coming down to the final couple of questions Sir.

Anticipation is building Will you consider to hold game tournament or interactive community events that can make Aether Games community more solid in the future? @badu_crypto

Dreadsong | Aether Games

Over the past months, we’ve held a variety of different tournaments with major cash prize pools, most of them with pools worth $10.000

We have the tendency to host one of these every few months, and we also host smaller community-gated tournaments for different guilds

So the answer is yes, and it has been a practice for a good while now, even pre game release from an in-community standpoint.

Avalaunch

That’s a good size pool for sure. You have nearly run the gauntlet and your answers have been both pithy and poignant. Much appreciated. To close the show @DreadsongAEG let’s ask something game-related from @JohnMartial1 I am so, curious to know about these 10 ADVENTURERS so, can you give detailed information about these ?

Dreadsong | Aether Games

Absolutely –

We have a range of Adventurer cards which essentially function as hero cards; each of them comes with its unique trait and interacts differently with the multiple factions available in the game

Aisha for example is a tempo-enhancing Adventurer, as she decreases the resource-cost of cards in your hand by 1

Aurelia on the other hand is the exact opposite of Aisha, instead increasing the opponent’s resource-cost of cards

Then we have Adventurers like Dona which provide healing based on the amount of unspent resource at the end of your turn

And on the opposite side, the Revenger who deals damage to your opponent’s Adventurer based on the amount of unspent resource

There’s definitely an Adventurer for everyone’s playstyle, and there’s a major difference between the playstyle of each of them.

Avalaunch

Thank you! It’s been a pleasure having you with us and this is an AMA that will make for a good read as well. We’ll have it transcribed and posted to our blog for good measure. We wish you continued success leading up to your launch and look forward to hosting the strategic sale with us. Onward and upward. 🤝

Dreadsong | Aether Games

Thank you for having me, was definitely an enjoyable AMA — I wish everyone a good night (considering it’s past midnight on my end lol) and to take care

Avalaunch

Take care and thanks again.

-

Welcoming Minipool Operators to Avalaunch

We’re delighted to announce that GoGoPool Minipool Operators are now eligible to participate in our Validator Round for upcoming sales on Avalaunch! This opportunity allows Minipool Operators to easily verify the ownership of their Minipool during the KYC process, which must be completed before registering for a sale.

With the mission of accelerating Subnet adoption through organic decentralization, GoGoPool enables users to setup an Avalanche Validator node at half the cost, whilst benefitting from a triple incentive reward structure. With their user-friendly one-click Minipool launcher, users can setup their Minipool in minutes.

How to Participate

- Sign up & KYC

- Connect and register with the wallet address associated with your Minipool

- Register for upcoming sales when Registration Opens

Minipool Operators do not need to stake or hold XAVA. Upon successful KYC registration, Minipool Operators will receive a guaranteed allocation in the Validator Round, alongside the Avalanche Network Validators.

A Collaborative Approach to Shaping the Future Avalanche

The inclusion of GoGoPool Minipool Operators in our Validator Round reflects our ongoing commitment to launching projects that we can collaborate with to strengthen the Avalanche ecosystem. Other examples of our collaborations include:

- Working with Dexalot Discovery to ensure safer AMM listings post-IDO, which protects users and provides them with a fair price discovery process.

- Colony’s addition of the $XAVA token in their Avalanche ecosystem index.

- Bloom – the result of a year-long research effort with GoGoPool, to provide a solution to decentralize and accelerate Subnet growth.

At Avalaunch, our commitment to collaboration and innovation is at the heart of our vision as we continue to build a stronger, more interconnected Avalanche community.

About GoGoPool

Since their Avalaunch IDO in April of 2023, GoGoPool (GGP) has established itself as a critical pillar of the Avalanche community via its decentralized and inclusive infrastructure. GGP lowers barriers to entry for validation by providing a faster, more convenient alternative through their liquid staked AVAX product. The GGP token and protocol has firmly rooted itself inside the security and ever-expanding economics of the growing Avalanche network.

-

Aether Games x Avalaunch: Strategic Sale Announcement

Introduction to Aether Games

Aether Games is a pioneering transmedia studio focused on creating an immersive gaming and entertainment franchise for both Web2 and Web3 audiences. Its vision is to build out an interconnected ecosystem of games which allow players to use their gaming assets across multiple titles in the Aether universe. This element of game design has simply not been possible in traditional gaming and will be key to unlocking a whole new realm of experiences.

By seamlessly combining blockchain-enabled features, Aether Games is not only enhancing the gaming experience, but is also empowering players in a way that is also inclusive of traditional gamers. This approach ensures that Aether is accessible and enjoyable for everyone.

Aether Games: A Multi-Platform Universe

What makes Aether Games truly stand out is its commitment to creating experiences that spans various forms of media. Alongside a rich gaming ecosystem, Aether is also developing a cinematic series which aims to captivate audiences across multiple platforms and merge multiple experiences into a unified realm. By taking this innovative approach, Aether Games is able to immerse audiences in a deeper way whilst drawing more players to its games, resulting in an interconnected and diverse entertainment experience.

The Aether realm so far consists of:

- Aether: Trading Card Game – The beta version is currently live on Epic Games.

- Aether Saga – To enhance the universe and deepen player engagement, Aether Games is working on an interactive short story series which allows players to uncover the secrets of the world of Aether.

Aether: Trading Card Game

Set in a dark fantasy universe, Aether: Trading Card Game (TCG) is a captivating collectible card game that showcases stunning visuals and cinematic artwork. Players engage in strategic battles using a mix of Adventurers, Creatures and Cards, which each have their own unique mechanics. Leveraging the expansive array of stats and abilities, players can customize their decks and cards to fit their individual playstyles. Aether’s TCG combines the element of card collecting with deck building to allow players to engage in real-time online battles to earn valuable in-game rewards.

Utilizing Web3 features, Aether’s TCG greatly enhances the collectible card game genre by using NFTs to represent in-game assets, granting players true ownership in a genre where ownership is crucial. By unlocking this feature, players can then freely trade these assets in a player-driven economy.

The beta version is available to download on the Epic Games Store.

AEG: Powering the Aether Universe

AEG is the native token of Aether Games and facilitates all activities in the Aether universe, enabling a seamlessly integrated economy. AEG will be a multi-chain token and its utility includes:

- Crafting – In Aether: Trading Card Game, players can use AEG to transform their plain cards into an NFT, granting players true ownership of their assets.

- Nesting Heirlooms – Heirlooms are cross-game dynamic NFTs in the Aether universe. By nesting AEG within Heirlooms, players can adjust the level of their Heirloom to enable faster in-game progression. This feature also allows players to rent out their upgraded Heirlooms to other players.

- Gas Usage – AEG will be used as the native gas token once the Aether Subnet goes live.

- Transacting in Aether’s Marketplace – AEG will be used for all trading activity within the Aether universe and its upcoming marketplace.

Aether Games – Official Links

Website | Game | Twitter | Discord | Telegram | Youtube

Aether Games Team

The Aether Games team brings a wealth of experience and expertise, with many years of experience in the game development, esports, entertainment, and CGI industries. They have collectively contributed to more than 500 media titles, including notable games like God of War, Far Cry 6 and Baldur’s Gate 3. Additionally, their expertise extends to the television industry, with team members having worked on innovative Netflix shows like Love, Death & Robots. This diverse team background enables Aether Games to build a high quality franchise, further accelerated by their extensive network across multiple industries.

Partners & Backers

“Our investment in Aether Games, coupled with the opening up of opportunities at Excelsior, is a clear indicator of our belief in the transformative power of GameFi. Aether Games is not just a strategic success; it is a visionary step that aligns with our objectives and offers a glimpse into a future ripe with possibilities.”

Founder and general partner of EnigmaFund

Aether Games: Strategic Sale on Avalaunch

The Aether Games sale on Avalaunch represents a unique and strategic opportunity, distinct from a typical Initial DEX Offering (IDO). Unlike an IDO, the strategic sale is aimed at participants who see the potential in Aether games. The highlight of this sale is the offering price of $0.032 per token, which presents a significantly better value proposition compared to the upcoming public sale price of $0.045.

Aether has conviction in the broad distribution of the token and thus, has conducted some smaller private/public sales for this purpose, most significantly on TrustSwap this past December, with the large majority of this round sold privately. The Avalaunch offering comes closer to the Token Generation Event (TGE) while providing early access at a more advantageous price. Again, this opportunity precedes the public sale and serves not just as a means of raising funds, rather, its primary goal is to strengthen communities, increase visibility and to promote token decentralization prior to their official launch.

Participants in the Aether Games sale on Avalaunch will receive a portion of their tokens at the TGE, which is scheduled to occur on March 7. Therefore, the turnaround time from the point of sale to the receipt of tokens is appealing and contrasts with private rounds where initial distribution is typically many months away.

Overall, the Aether Games strategic offering on Avalaunch stands out for its reduced pricing and relatively swift token distribution post-sale, thereby aligning the interests of early supporters with the long-term success of the project.

Aether Games team on working with Avalaunch:

“Working with Avalaunch has been a highly positive experience. Their expertise, expansive network, and consistent support have significantly contributed to the success of our project. Working with Avalaunch has been characterized by a blend of professionalism and collaboration, making it a truly valuable partnership.”

FUNDING NUMBERS:

Total Supply: 1,000,000,000 AEG Tokens

- Equity Holders – 350K USD – 28M AEG at 0.0125 USD

- Seed Investors – 3M USD – 150M AEG at 0.020 USD

- Strategic & Avalaunch* – 4.48M USD – 140M AEG at 0.032 USD

- KOL Rounds – 1.4M USD – 40M AEG at 0.035 USD

- Advance Round – 3.08M USD – 77M AEG at 0.040 USD

- Public IDO – 810K USD – 18M AEG at 0.045 USD

Note: Numbers are rounded slightly.

Total Raise: 13.12M USD

*Avalaunch IDO – 300K USD – 9.375M AEG at 0.032 USD

SUPPLY BREAKDOWN & VESTING

Total Supply: 1B AEG

- Player Rewards: 170M AEG (17%)

- Seed: 150M AEG (15%)

- Strategic & Avalaunch: 140M AEG (14%)

- CEX & Market Liquidity : 120M AEG (12%)

- Advance Round: 77M AEG (7.7%)

- Treasury: 70M AEG (7%)

- Team: 70M AEG (7%)

- Marketing: 70M AEG (7%)

- Advisors: 35M AEG (3.5%)

- Equity Holders: 28M AEG (2.8%)

- KOL Round: 40M AEG (4%)

- Public IDO: 18M AEG (1.8%)

- Initial Liquidity: 12M AEG (1.2%)

VESTING FOLLOWING TGE:

- Player Rewards*: Contingent upon revenue benchmarks

- Seed: 5% at TGE, 6 month cliff, 18 months linear vesting

- Strategic & Avalaunch: 10% at TGE, 4 month cliff, 12 months linear vesting

- DEX & CEX Liquidity: Discretionary unlock upon listings.

- Treasury: 1 year cliff, 48 months linear vesting

- Team: 1 year cliff, 60 months linear vesting

- Marketing: 5% at TGE, 6 month cliff, 36 months linear vesting

- Advisors: 1 year cliff, 48 months linear vesting

- Equity Holders: 1 year cliff, 36 months linear vesting

- Advance Round: 20% at TGE, 3 month cliff, 9 months linear vesting.

- KOL Round: 25% at TGE, 3 month cliff, 9 months linear vesting.

- Public IDO: 25% at TGE, linear release for 5 months.

- Initial Liquidity: 100% at TGE

*The unlocking process of the rewards pool is not tied to a specific date but rather triggered by a certain profit level. To elaborate, every AEG spent in the ecosystem goes to a pool which are allocated for rewards, burning, liquidity and further development.

It is essential to note it will not be inflationary, as unlocks from the rewards will always be less than what is being burned.

Other Info:

- Initial Liquidity: 540K USD

- Initial Circulating Supply: 55M AEG

- Initial Market Cap: 2.47M USD

- Avalaunch Strategic Sale : 300K USD - 9.375M AEG at 0.032 USD

Aether Games: Strategic Sale Schedule

Registration Schedule

Registration Opens: Wednesday, January 17 at 3:00 p.m. (UTC)

Registration Closes: Monday, January 22 at 6:00 p.m. (UTC)Sale Schedule

Validator Round Begins: Wednesday, January 24 at 6:00 a.m. (UTC)

Validator Round Closes: Wednesday, January 24 at 3:30 p.m. (UTC)Staking Round Begins: Wednesday, January 24 at 3:30 p.m. (UTC)

Staking Round Closes: Thursday, January 25 at 6:00 a.m. (UTC)Booster Round Begins: Thursday, January 25 at 6:00 a.m. (UTC)

Booster Round Closes: Thursday, January 25 at 10:30 a.m. (UTC)How to Participate

To participate in Avalaunch sales, users will have to:

- Complete their KYC Registration | Tutorial

- Stake XAVA to secure their allocation | Tutorial

- Register for the sale when Registration opens | Tutorial

About Aether Games

Aether Games: A transcendent blend of traditional and blockchain gaming, Aether Games merges the realms of high-fantasy narratives with the innovative technologies of the blockchain. This innovative transmedia development studio creates immersive gaming and entertainment experiences for both web2 and web3 audiences.

About Avalaunch

Avalaunch is a launchpad powered by the Avalanche platform, allowing new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With its values deeply rooted in the early Avalanche community, we are able to offer projects confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem. Leveraging Avalanche’s scalable, high-throughput, and low-latency platform, Avalaunch is built by users, for teams, to help grow strong communities.

-

Avalanche’s Snowman Consensus Protocol

Avalanche’s Snowman Consensus protocol is the fundamental mechanism powering the Avalanche network and is crucial for its remarkable speed and security. In this report, we’ll break down the role of consensus protocols in the blockchain validation process and delve into what makes Snowman such a revolutionary breakthrough. By looking at the inner workings of Snowman, we can have a deeper understanding of the impact it has on Avalanche and the future of blockchain technology.

The Role of the Validator

To understand the role of a validator in the functioning and security of blockchains, we first need to break down the definition of a blockchain. To put it very simply, blocks make up the core components of the blockchain and contain a group of transactions or any other type of relevant information. As a literal chain of blocks, each block cryptographically stores the information of the previous block, meaning that every block is unique and the information inside cannot be changed.

Blocks can contain a range of information such as:

- Financial transaction data

- Smart contract executions

- Data storage requests

Blockchains are distributed systems, meaning that they operate across a network of computers (nodes) located around the world. This distributed nature underpins the decentralized character of blockchain technology, where control and decision-making are spread across many nodes rather than being controlled by a single entity. By having a network of nodes maintaining and validating a shared ledger, this structure provides transparency, security and resilience against centralized parties.

At the heart of this decentralized structure is the network of Validators, who are responsible for determining the validity of transactions before including them in the next block. The consensus protocol provides validators with a set of rules to ensure that they can reach a majority agreement on the current state of the network.

On Avalanche, validator nodes, queried as part of the consensus process, play a key role in influencing the network. To earn this influence, they must stake AVAX, with the quantity of AVAX bonded by a node increasing the frequency at which it is queried by others. Validators are incentivized to participate and be responsive, as they are rewarded for their honesty and active engagement in the consensus process.

The purpose of consensus is to enable validators to collectively establish a single source of truth across the network. The effectiveness of validators and the consensus protocol they follow is crucial for ensuring the network’s speed, security, and scalability.

A Brief History of Consensus Mechanisms

“How do we achieve agreement between a set of machines?”

This was the question asked by computer scientists Leslie Lamport and Barbara Liskov in the 1970s, which resulted in their pioneering research paper: The Byzantine Generals Problem. The challenge of reaching consensus is explained through the following analogy:

A group of Byzantine Generals must agree on a unified plan to attack a city, communicating only through messengers, with the possibility that some generals may be traitors who are trying to sabotage the plan. The central problem is how the loyal generals can ensure that consensus can be achieved when there is uncertainty about the loyalty of others. This problem is fundamental in understanding and designing algorithms for distributed systems where network nodes must agree on a state.

The paper demonstrates that consensus can be achieved as long as two thirds of the generals are loyal. This concept has formed the basis for various fault-tolerant distributed systems.

Classical Consensus

The first solution to the consensus problem was Classical Consensus, designed by Lamport and Liskov. It involves a key property which is all-to-all voting – meaning that every validator node must vote on whether they would like to accept or reject a transaction. As long as the number of participating nodes is small, transactions are confirmed very quickly. However, as the network grows, each node must communicate with an increasing number of other nodes, making scalability challenging. Classical Consensus also requires that each node has knowledge of every other participating node; a characteristic which limits its usability in open, permissionless networks.

Nakamoto Consensus

The next major development in consensus protocols was introduced by Satoshi Nakamoto in the Bitcoin Whitepaper. This new approach, known as Nakamoto Consensus, operates under a fundamentally different principle where nodes do not need to identify other nodes to achieve consensus. It is built on probabilistic safety guarantees which means that nodes send the same number of messages regardless of the network’s size.

Nakamoto Consensus offers a significant advantage in decentralized environments, due to its ability to achieve consensus without requiring knowledge of all participants. However, this approach has its drawbacks. These protocols are very slow, with transactions taking up to 1 hour to be finalized. Nodes must solve complex cryptographic puzzles in order to produce the next block, requiring heavy computational power which makes it very energy-intensive to run.

Despite these challenges, Nakamoto Consensus represents a pivotal shift in enabling trustless digital systems.

Avalanche Consensus

The Avalanche Consensus family combines the strongest elements of the Classical and Nakamoto designs to redefine the capabilities of consensus protocols. Inspired by gossip algorithms, its probabilistic nature enables it to be a lightweight protocol that doesn’t compromise on speed, scalability or security. Rather than asking every single node to vote on a transaction, Avalanche Consensus uses repeated random subsampling of a small set of nodes – the number of messages each node has to handle doesn’t change, even as more nodes join the network. This innovation allows for lightning-fast consensus to be achieved without the need for intensive computational work.

The Snowman Consensus is an implementation of the Avalanche Consensus, specially tailored for blockchains which require linear, ordered consensus – such as those built for smart contract execution.

Avalanche Consensus is a groundbreaking milestone in the evolution of consensus protocols and has paved the way for a new generation of blockchain networks.

For a deeper look into Avalanche Consensus, read the full whitepaper here.

Breaking Down the Snowman Consensus Protocol

The distinguishing feature of Snowman Consensus, setting it apart from its predecessors, lies in the use of a sub-sampled voting process. This decision-making process is enabled by the Snowball consensus algorithm, which has pre-determined parameters to efficiently achieve consensus:

- The number of participants in the network

- Sample size – the number of nodes queried by the validator

- Quorum size – the number required to reach a majority reply

- Decision threshold – the number of times a majority must be received consecutively in order to come to a final decision

The Validation Process

The process of achieving consensus on Avalanche When a validator receives a broadcasted transaction, it must first determine the validity of a transaction before beginning consensus.

Example: Alice has 2 AVAX in her wallet. She tries to send 5 AVAX to Bob – this transaction is clearly invalid as Alice doesn’t have enough AVAX in her wallet.

Once a transaction is determined to be valid, the consensus process can begin.

To determine whether a transaction should be accepted, the node asks a small set of randomly selected validator nodes on their preference. Each queried node then replies with their preferred transaction, with the quorum size determining the majority reply. In order to come to a final decision, the subsampling process is repeated with different sets of nodes until a majority reply is received for a pre-determined number of consecutive rounds.

Transactions can be finalized quickly if there are no conflicts. In the case of conflicts, honest validators quickly gather around the conflicting transactions. This creates a reinforced feedback loop, where each round of consensus increasingly aligns their preferences, until everyone reaches an agreement.

It’s important to note that the sub-sampling performed by nodes is not entirely random – selection is weighted by stake amount, meaning that nodes with more staked AVAX are more likely to be queried.

Through the sub-sampling process, validators actively adjust their own preference to guide the network towards a unified, collective decision.

See here for an excellent visual demo of the Snowman Consensus in action.

Benefits of Snowman Consensus

Scalability – Enabled by its subsampling process, Snowman Consensus ensures that the number of messages each node sends remains the same, whether the network is made up of 100 or 100,000 nodes.

Speed – Without the need to query every single node on the network, Snowman achieves an extremely lightweight design that can rapidly process and confirm transactions. This efficiency is amplified by the fact that the Avalanche Consensus protocol guarantees that if an honest validator accepts a transaction, all other honest validators will inevitably reach the same conclusion.

Security – Snowman’s probabilistic approach, where each node repeatedly queries a random subset of nodes, greatly reduces the chances of malicious nodes consistently influencing the network, thus maintaining the integrity of the network’s decision-making.

Decentralization – The performance of the network is unaffected by the number of nodes, promoting an open and permissionless environment where any node can contribute to securing the network.

Efficiency – Instead of operating on fixed slot times, like other consensus protocols, Snowman adopts a dynamic approach to block production based on the activity of the network. This versatility ensures a more responsive and efficient block generation, tailored to the current state of the network.

Conclusion

The Snowman Consensus, as a key component of the Avalanche Consensus family, represents a significant evolution in distributed systems. By addressing the limitations of previous consensus mechanisms, Snowman introduces a more scalable, swift, secure, and decentralized approach to blockchain consensus. Its innovative subsampling and probabilistic methods, coupled with dynamic block production, mark a notable advancement in ensuring faster transaction processing, robust security, and efficient network operation without compromising on decentralization. This makes Snowman Consensus a crucial element in the development of more resilient and adaptable blockchain networks, paving the way for a new era of distributed digital systems.

-

Introducing Bloom

An Open Framework to Safely Decentralize Avalanche Subnets

Avalaunch and GoGoPool are excited to introduce Bloom, an open framework allowing Subnet builders to programmatically attract validators and delegators to decentralize their networks.

Bloom accelerates the growth of the Avalanche Network by utilizing the XAVA and GGP tokens as a platform for decentralization. This framework addresses the common challenges faced by various stakeholders in the Web3 ecosystem, from Subnet teams to validators and crypto users.

The Problem with Decentralizing Blockchain Networks

The process of decentralizing blockchain networks presents numerous challenges, leading to delays in network launches and expansions. The three key stakeholders – Subnet teams, validators and crypto users – each face unique difficulties:

- Subnet Teams – Achieving decentralization before reaching product-market fit can be costly. Many teams, often from a Web2 background, grapple with the implications of decentralization, such as counterparty identification, KYC requirements, hardware specifications, and the necessity of a token.

- Validators – Validators seek sustainable business models that thrive in both bear and bull markets. They need efficient ways to connect with Subnet teams, understand opportunities and demonstrate their unique value in a competitive space.

- Crypto Users – Users look for ways to support their preferred Subnets through delegation or staking, participate in DeFi activities, and contribute to the growth of the Avalanche Network and the broader Web3 ecosystem.

Bloom: The Solution for Safe Decentralization

Bloom is a permissionless, secure, and adaptable framework: the result of a year-long comprehensive research effort by Avalaunch and GoGoPool. It offers a structured yet flexible approach for Subnet teams to grow through decentralization and minimize counterparty risks.

The framework has a few goals:

- Maximize value accrual to the blockchain network

- Allow teams to have an ROI-positive way to decentralize

- Address unique challenges and create new opportunities for each stakeholder

This gives Subnet Teams and Developers a way to programmatically:

- Attract stakers for enhanced network security via liquid staking

- Engage and incentivise diverse node operators

- Iteratively decentralize and grow their networks

Validator Node Operators can:

- Gain early and exclusive access to networks

- Develop sustainable business models

- Earn higher yields through hardware provisioning and maintenance

Delegators and Crypto Users can:

- Participate in Subnet ownership

- Earn yields on the C-Chain and participate in DeFi

- Actively contribute to the growth and decentralization of Subnets

Value Accrual for XAVA & GGP

Some of the value accrual for XAVA and GGP holders are as follows:

- Delegation Pool: Representing the underlying assets of the liquid staking vault which accrues rewards and fees back to delegators.

- Operator Pool: A 50/50 split of Operator Pool profits between GoGoPool and Avalaunch, distributed to token stakers.

- Matching Pool: A Subnet-determined pool of native staking tokens that are used to launch validators.

- Matching Queue: Node operators will be able to enter into the Matching Queue via the GoGoPool protocol and earn a Node Operator Commission on matched funds from the Delegation Pool.

Why Bloom? Why Now?

With the increasing number of teams exploring and experimenting with Subnets, there is a clear demand for a realistic and secure path to decentralization. Bloom aims to set the foundation for this journey, allowing the ecosystem to build and expand upon it.

So, What Happens Next?

Bloom is going to be an open and permissionless framework. Our teams will share further information about Bloom’s technical architecture, how GGP and XAVA token holders will benefit, provide clarity for launch timelines, as well as making the testnet framework accessible.

Avalaunch & GoGoPool

Avalaunch was always driven to be more than a static launchpad. Today, a partnership with GoGoPool represents the beginning of an endgame where support and benefit from the Avalanche ecosystem goes beyond launching projects. While token sales will always remain central to the mission and a core competency, the XAVA token will now be able to help Subnets grow past their IDO and benefit stakers accordingly.

Since their Avalaunch IDO in April of 2023, GoGoPool (GGP) has established itself as a critical pillar of the Avalanche community via its decentralized and inclusive infrastructure. GGP lowers barriers to entry for validation by providing a faster, more convenient alternative through their liquid staked AVAX product. The GGP token and protocol has firmly rooted itself inside the security and ever-expanding economics of the growing Avalanche network.

-

Upcoming IDOs on Avalaunch: A Sneak Peek

Over the past two years, Avalanche has emerged as a truly global platform, realizing its vision of establishing an interconnected ecosystem of high-performing blockchains. Avalanche’s powerful framework has unleashed a surge of innovation across various sectors – from gaming to the tokenization of RWAs and household e-commerce brands.

At Avalaunch, we are grateful to have played a core role in nurturing the growth of the Avalanche ecosystem and forging deep partnerships that enable the next generation of game changing products. While we typically avoid teasing our community without specific timelines in place, we wanted to share our excitement with the Avalaunch community for the journey that lies ahead.

We have been working closely with some of the most innovative projects on Avalanche and we can finally reveal a sneak peek of some of the upcoming IDOs on Avalaunch. These are projects that have persevered and evolved through challenging market conditions while staying true to their original vision.

It’s important to note that this is by no means a complete list. There are others in the fold. The projects we are working with are at various stages of their strategic planning. This ranges from finalizing the tokenomic design to navigating through investment rounds. As such, we are unable to disclose every project preparing for an Avalaunch IDO.

In line with our philosophy at Avalaunch, we are committed to providing XAVA holders with the highest quality projects and also empowering our community to directly contribute to the growth of the ecosystem.

While specific timelines are TBA and the projects below are not listed in any particular order, we can ensure that there is a lot to look forward to with things kicking off in January.

DeltaPrime

DeltaPrime is building a gateway into an interconnected DeFi ecosystem. By enabling users to borrow up to 5x their collateral, DeltaPrime’s innovative design empowers users to maximize the potential of their portfolio. With a Prime Account, users can securely use their collateral and borrowed assets to create custom strategies using whitelisted blue-chip DeFi protocols. DeltaPrime puts a strong emphasis on security, ensuring trustless lending and borrowing while upholding platform stability with a secure liquidation approach that protects both depositors and borrowers.

With $21.5M TVL already deposited on the platform, DeltaPrime has successfully unlocked $17.2M in liquidity. As the project continues to grow, further protocols will be integrated, giving users even more flexibility in their DeFi strategies.

Website: deltaprime.io

Socials: twitter.com/DeltaPrimeDefi

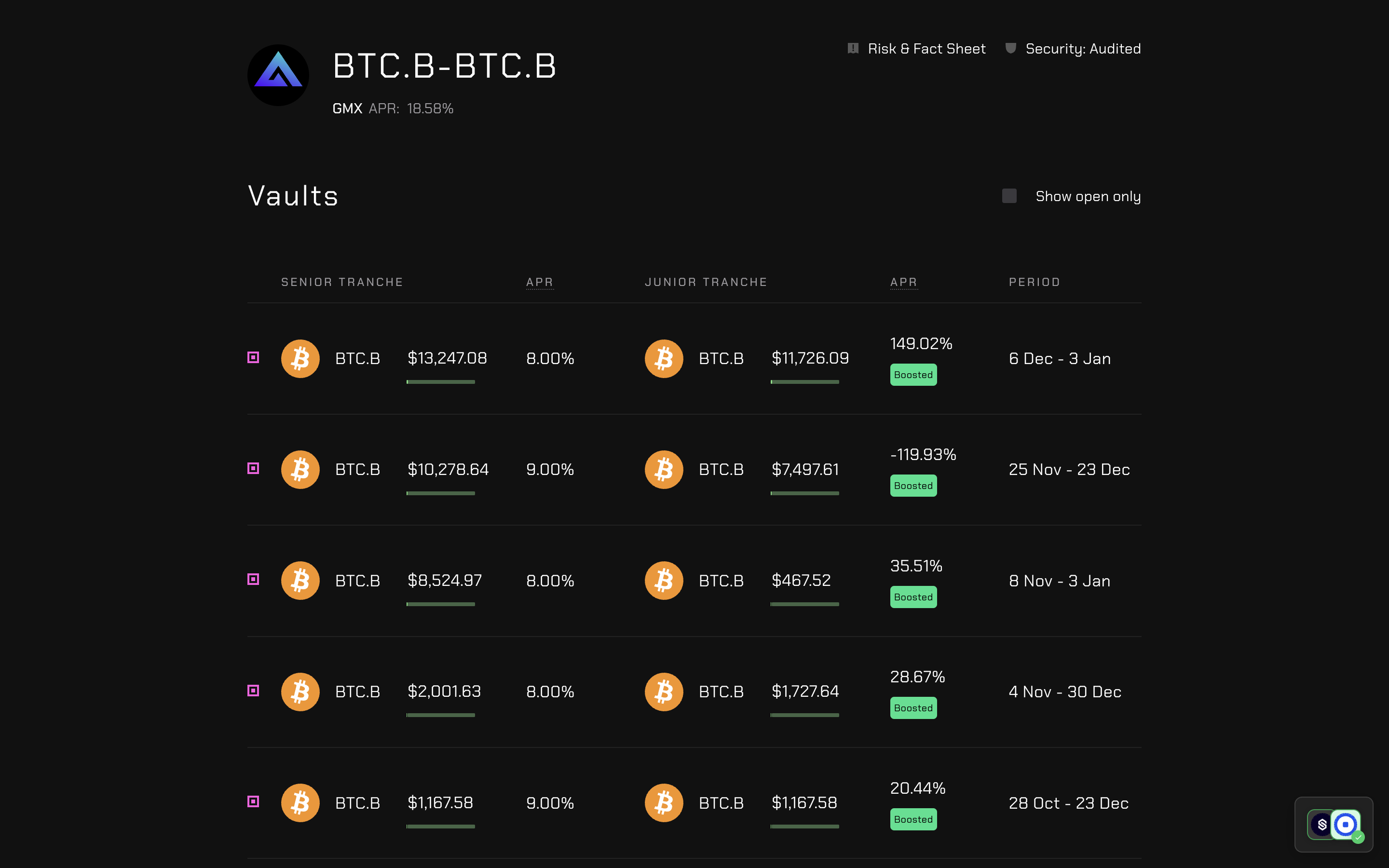

Struct

Struct is democratizing access to sophisticated structured financial products through its tranched interest rate vaults. Designed for simplicity, it caters to both institutional and retail users, offering a range of products for various risk profiles. Its decentralized interest vaults offers users stable returns (fixed rate) or the option to leverage their position at an increased exposure (variable rate). This process, known as tranching, is achieved by repackaging riskier assets into tiered assets with varying returns. In doing so, it redistributes the risk and diversifies investment options. The vaults are made up of yield-bearing positions which are strategically directed to blue-chip DeFi protocols, making Struct a core liquidity provider in the DeFi ecosystem. By offering vaults tailored to varying risk preferences, Struct is able to attract more users which inherently deepens liquidity and greatly enhances capital efficiency.

Users can already deposit into a range of interest rate vaults built on top of GMX, with structured auto-pool vaults leveraging Trader Joe’s Liquidity Book coming soon.

Website: struct.fi

Socials: twitter.com/StructFinance

Movement

Movement is building an open modular framework to enable the next-generation of Move-based blockchains. Their goal is to drive the adoption of the Move language and its built-in security features, to create a safer environment for innovative products to reach mass adoption. Leveraging Avalanche Subnet customizability, it has launched M1, which is powered by the Snowman Consensus mechanism. M1 will serve as a decentralized sequencing layer for M2 – the first Move-based L2 on Ethereum. Forming deep partnerships with the industry’s leading infrastructure protocols, Movement is emerging as pioneers in the modular blockchain landscape.

Website: movementlabs.xyz

Socials: twitter.com/movementlabsxyz

Levr Bet

Sports betting is an $80B+ industry and Levr Bet is building a decentralized platform to revolutionize this rapidly growing market. Enabled by blockchain technology, Levr Bet is the first protocol to allows users to trade their sports betting positions with up to 5x leverage. Built on top of a powerful on-chain orderbook, Levr Bet merges with a DeFi framework to provide users with a transparent and secure way to wage bets on major sports markets. With the platform’s full launch in 2024, users can now sign up for Levr Bet’s upcoming beta testing phase to earn activity points which count towards a future airdrop. Blockchain features will be a game changer for the betting industry and Levr Bet is set to lead this movement with industry firsts.

Website: levr.bet

Socials: twitter.com/LEVR_bet

Aether Games

Aether Games introduces its flagship Trading Card Game (TCG) which unlocks true digital ownership within this immensely popular genre. Leveraging blockchain’s transparency and open economies, players can freely trade and sell their collectible cards. Aether Game’s TCG is set in a dark fantasy world, where players strategically build card decks to defeat their opponents in thrilling and competitive gameplay. With the TCG genre boasting an audience of 10M+ in the US alone, Aether is focused on providing a gaming experience that welcomes all competitive gamers – whether they prefer F2P or P2E styles. It also places a strong emphasis on attracting traditional players by seamlessly integrating blockchain features to enhance the overall experience.

By using NFTs to reward early supporters and deepen player engagement, Aether is building an organic community while establishing a thriving hub for the TCG genre on the Avalanche platform. The early access version of Aether’s TCG is now live on both Beam and Steam, aligning closely with Beam’s player-centric philosophy.

Website: aethergames.io

Socials: twitter.com/AetherGamesInc

Pulsar

Explore, Build, Mine, Survive.

Created by gaming industry veterans, Pulsar is a Sci-Fi MMO-RTS which seamlessly combines the stunning visuals of RTS games with the community-driven layer of MMOs. The game is set in an expansive open world, where players must manage plots of land, build bases and extract valuable resources to grow their empire. With PLSR as the native currency, players are empowered to trade freely within Web3’s open economy, thereby facilitating a more immersive MMO experience which cannot be replicated in traditional game design. In-game assets, such as land plots and buildings take the form of NFTs, introducing the concept of ownership and serving as a foundation for stronger player involvement.

The Pulsar team recognized the groundbreaking capabilities of Avalanche Subnets, leveraging their high throughput and customizable parameters. Pulsar recently surpassed 100M+ transactions, providing us with a glimpse into the journey ahead.

Website: pulsar.game

Socials: twitter.com/PulsarGame

Arcade Galaxy

As part of the Beam ecosystem, Arcade Galaxy is bringing a fun, retro-inspired racing game to the Web3 gaming landscape. Players can compete in exhilarating races on crazy obstacle courses to earn rewards and personalize their racing cub with unique skins – this is a game that will appeal to all kinds of players. Arcade Galaxy empowers content creators by enabling them to design their own custom tracks to share with the community. These minigames can be hosted on customizable planets, which players can own to generate real world value.

Arcade Galaxy has recently hosted the finale of its Grand Map Challenge, where map creators submitted their designs to compete for exclusive prizes.

Website: arcadegalaxy.space

Socials: twitter.com/arcadegalaxy_